Summary:

- The share price of Berkshire Hathaway has fallen 50% multiple times – so, Amazon’s 50% share price decrease in 2022 has laudable historical company.

- Investors are concerned with four key issues.

- We expect a gradual improvement in operating efficiencies as Amazon beds down the massive expansion in its fulfillment and logistics network over the past few years.

- We still expect robust growth by AWS, but the business is not macro immune and will also be impacted by a slowdown from customers in the technology sector, particularly less established businesses.

- Our analysis suggests Amazon is making significant losses on initiatives that are not core to Amazon’s existing operations.

David Ryder

The following segment was excerpted from this fund letter.

Amazon.com – so what is going on?

“You shouldn’t own common stocks if a 50% decrease in their value in a short period of time would cause you acute distress.”

– Warren Buffett

Easier said than done, Mr. Buffett! The share price of Berkshire Hathaway (BRK.A, BRK.B – Buffett’s investment group) has fallen 50% multiple times. So Amazon’s (NASDAQ:AMZN) 50% share price decrease in 2022 has laudable historical company. Nor is this the first time Amazon’s share price has fallen over 50% since its public listing. It doesn’t make the situation feel any better.

So, what is going on? Why has Amazon’s share price halved over the past 12 months and under-performed weak equity markets?

Investors are concerned with four key issues:

- Macroeconomic pressures on consumer ecommerce spending,

- Elevated costs impacting both Amazon’s ecommerce business and Amazon Web Services,

- Slowing in the growth of Amazon Web Services (AWS), and

- Shift away from higher growth technology businesses.

Macroeconomic environment

There is no denying the macroeconomic environment has deteriorated during 2022 and Amazon faces more challenging operating conditions, as do most businesses. Amazon is the leading ecommerce business in the U.S. and many international markets, excluding China, generating well over $400 billion of revenue, excluding AWS. A slowing in consumer (and business) spending will naturally flow through to Amazon. Amazon is also cycling elevated activity caused by COVID-19. As the world continues to normalise, consumers are returning to physical shops and ecommerce penetration of retail sales is adjusting back to historical trends at a faster rate than expected. Amazon’s growth rates will also slow because of the law of large numbers. We have allowed for realistic growth in our base case and see upside if the economic environment improves.

Elevated costs

Anyone who has run a business will tell you it is usually better to have a costs problem than a revenue problem. From our perspective, Amazon’s revenue growth has not been particularly disappointing, but the growth in costs and resultant pressure on margins has been greater than our expectations. Cost pressures are evident at many levels – higher cost of goods impacting gross margins, increased fuel and energy costs, infrastructure inefficiencies following a period of rapid expansion and increasing labour costs which impacts all aspects of Amazon’s integrated operations.

Employees and employee costs

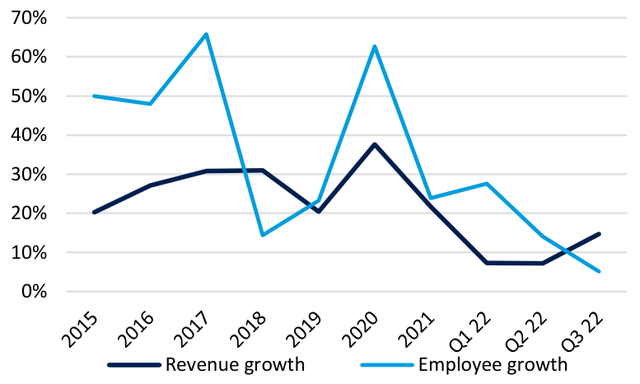

Over the past 7 years, Amazon’s total revenue has increased from around $100 billion to around $500 billion, a staggering 25% cumulative average rate of growth (CAGR) for some very large numbers. Employee numbers have increased even faster, from 230,000 to over 1.5 million, equating to a 31% CAGR (see figure below).

Changes to Amazon’s minimum wages

Source: Amazon and L1 Capital International.

Amazon added 500,000 employees in 2020 and a further 300,000 employees in 2021 as it scaled up to meet rapid growth during the pandemic and to support international expansion. In recent times Amazon’s revenue growth has slowed off a very high base, with revenue from sale of goods online essentially flat. In short, Amazon over-hired and is progressively adjusting its employee base to increase productivity. Recently, Amazon confirmed 18,000 redundancies concentrated in its Amazon Stores and People, Experience and Technology divisions.

While we do not expect redundancies in the people-intensive warehouse and transportation areas, we do expect thoughtful replacement of natural attrition and ongoing productivity efficiencies. There are already early signs of tangible action with total employee numbers drifting down in 2022.

Amazon’s labour practices are far from perfect. That said, Amazon has been at the forefront of increasing minimum wages in the U.S. As illustrated in the table below, Amazon has supported a minimum starting salary of $15/hour since 2018, and its current average starting salary for warehouse and transportation workers is around $19/hour. The U.S. Federal Minimum Wage is still stuck at 2009 levels of $7.25/hour.

Changes to Amazon’s minimum wages

|

Date |

Action |

|

Oct 18 |

Announces minimum $15/hr starting salary – benefitting 250,000 permanent and 100,000 temporary employees. |

|

May 21 |

Average starting salary $17/hr, sign on bonuses and intends to hire an additional 75,000 warehouse and transportation workers. |

|

Sep 21 |

Average starting salary increases to $18/hr and intends to hire an additional 125,000 warehouse and transportation workers. |

|

Sep 22 |

Average starting salary increases to $19/hr. $1 billion investment in additional frontline employee benefits. |

|

Source: Amazon. |

Share-based compensation

Share-based compensation and SBC as a % of revenue

Source: Amazon and L1 Capital International.

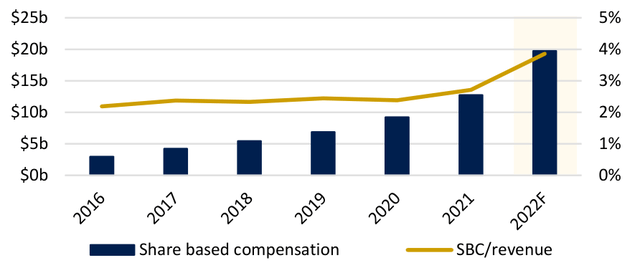

The growth in Amazon’s share-based compensation has materially exceeded our expectations and has been a major disappointment, meaningfully lowering our valuation of Amazon. We recognise Amazon needs to pay competitively to attract and retain the best talent, particularly in the Amazon Web Services division, and that Amazon’s share- based compensation structure had some particular quirks which led to adjustments in 2022. However, the increase in share-based compensation by an estimated $7 billion in 2022, rising to around 4% of total revenue compared to the low 2s in the past substantially lowered our near-termearnings expectations for Amazon and our valuation of the business. With almost daily announcements of layoffs by technology companies, including Amazon, it is highly likely we are past the immediate peak in technology employment costs. We do not expect Amazon’s SBC expense to reverse, but we do expect stability going forward.

Shipping and fulfilment costs

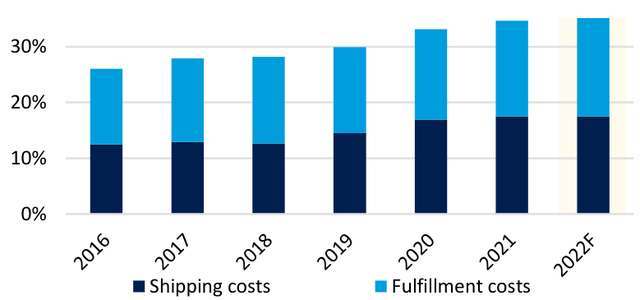

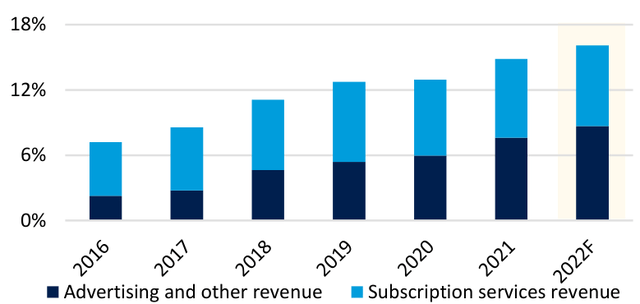

Higher fuel, freight and employee costs, operating efficiencies and increasing service levels have been reflected in an increase in Amazon’s shipping and fulfillment costs. These costs as a percentage of Amazon’s total revenue, excluding AWS, have increased from around 26% of revenue to 35% of revenue over the past few years, despite sustained outsized growth in advertising and subscription revenue which have no shipping or fulfillment costs (see figures below).

Shipping and fulfilment costs as a % of total Amazon revenue, ex AWS

Source: Amazon and L1 Capital International. Source: Amazon and L1 Capital International.

Subscription services (including Prime), advertising and other revenue as a % of total Amazon revenue, ex AWS

Source: Amazon and L1 Capital International. Source: Amazon and L1 Capital International.

We estimate Amazon’s cost to fulfil and ship an online unit has increased over 40%, despite a nearly five-fold increase in volume of units fulfilled over this period. We expect a gradual improvement in operating efficiencies as Amazon beds down the massive expansion in its fulfillment and logistics network over the past few years.

Specifically, Amazon management has commented that 2022 capital investments are expected to be around $60 billion, similar to 2021. This allows for a reduction in fulfillment and transportation capital investments of approximately $10 billion compared to 2021 to better align expansion projects with demand, offset by an approximately $10 billion year-over-year increase in technology infrastructure, primarily to support the growth of AWS.

Amazon Web Services (AWS)

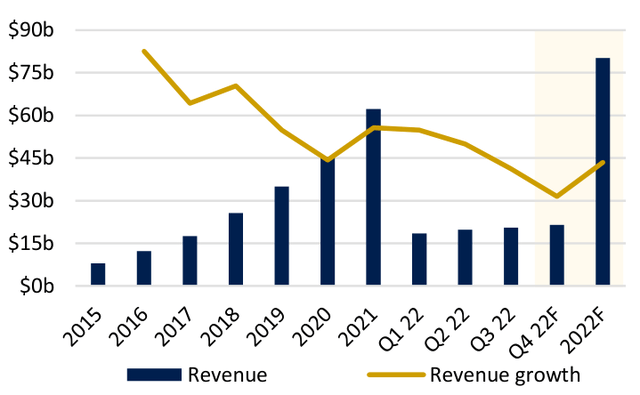

AWS is one of the highest quality businesses in the world. In less than 10 years, AWS has developed into a business generating revenue of $80 billion and operating profit of around $23 billion. Outside of China, only Microsoft (MSFT) through Azure, and to a lesser extent Alphabet’s (GOOG, GOOGL) Google Cloud Platform are the only credible competitors. Technology, scale and capital requirements are strengthening barriers to competition, while cloud computing has an extensive runway for further growth.

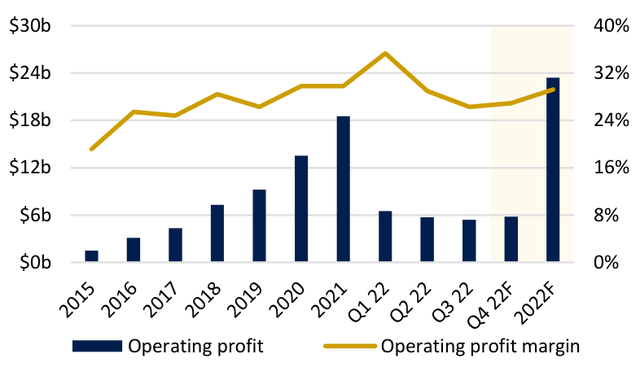

2021 was an exceptional year of growth for AWS. Despite an ever-increasing base, AWS increased revenue by $17 billion or 37% to $62 billion, and maintained operating margins at around 30%.

We still expect robust growth by AWS, but the business is not macro immune and will also be impacted by a slowdown from customers in the technology sector, particularly less established businesses. Amazon is likely to exit 2022 with a growth rate around 20%, still exceptional, but a slowdown from recent levels and a further tapering of growth rates is likely over time.

Operating margins are a more complicated discussion. Amazon (along with its peers) has increased the useful life of equipment in its data centres, lowering depreciation and increasing operating profit. This contributed to operating margins spiking to 35% in Q1 2022. Subsequently Amazon increased share-based compensation, which was particularly targeted at AWS, reducing operating margins below 30%. Q3 2022 operating margins were further impacted by a softening in operating conditions and increased energy costs. We expect AWS’s operating margins to gradually increase from current levels, which is moderately below our prior expectations.

While AWS’s operating performance is only modestly below our prior expectations, some analysts and investors had, in our view, unrealistically high expectations. Negative revisions to expectations have contributed to negative sentiment impacting Amazon’s share price.

AWS revenue and revenue growth

Source: Amazon and L1 Capital International.

AWS operating profit and operating profit margins

Source: Amazon and L1 Capital International.

Missing profitability

Excluding AWS, Amazon will report an operating loss in 2022. Notwithstanding the cost pressures outlined and likely substantial losses in less mature international operations, our analysis suggests Amazon is making significant losses on initiatives that are not core to Amazon’s existing operations – initiatives like Project Kuiper (satellites), Zoox (autonomous vehicles), Health, Alexa- related AI projects and video games. Experimentation and side developments are core to Amazon’s culture and have led to AWS and other significant businesses. However, we believe investors would benefit from Amazon disclosing the size of investments in these initiatives and increasing cost discipline, a process that has likely already commenced.

Summary

Amazon is an immense and complicated group of integrated businesses, generating around $500 billion of revenue and employing over 1.5 million people. Yet, fundamentally, it is powered by two key drivers – ecommerce and cloud computing. Amazon and AWS are both global leaders in ecommerce and cloud computing, respectively, and are increasing their barriers to competition. Amazon is facing cost pressures and the macroeconomic environment has worsened. Interest rates have increased dramatically which does lower the value of future earnings. Accordingly, we have reduced our valuation assessment of Amazon in 2022, but not enough to justify a 50% fall in Amazon’s share price.

We do not expect any silver bullet or quick fix to drive a rapid recovery in Amazon’s profitability, and future expectations need to be set at realistic levels. We remain confident in Amazon’s management and note meaningful actions have already been taken to improve operating efficiencies and enhance longer term shareholder value. In our view, Amazon’s share price has been oversold and offers compelling value. So far in January 2023, at the time of finalising this report, Amazon’s share price has increased by 17%. There is substantial further upside before Amazon’s share price approaches fair value.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Additional disclosure: Copyright © L1 Capital