Summary:

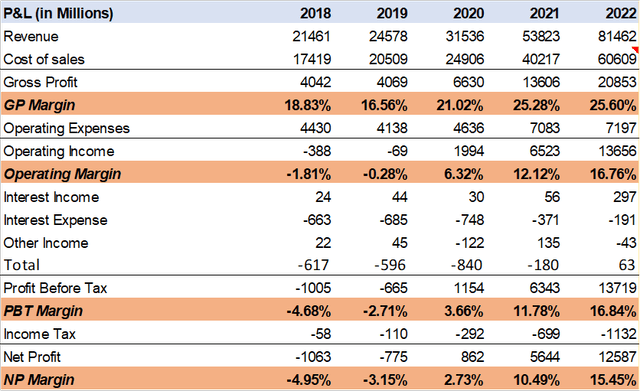

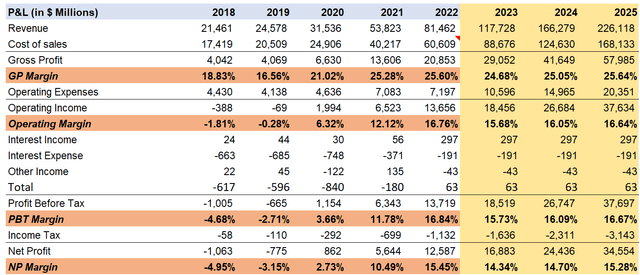

- Tesla had a record-breaking 2022. Its revenue grew 51% year-on-year to $81.4 billion in 2022.

- Tesla’s operating margins have risen well above that of its competitors. The company is able to consistently reduce its per-unit cost of sales and operating expenses over time.

- Assuming a 50% CAGR increase in sales year-on-year, the stock’s price-to-sales ratio will fall to much more reasonable levels.

JasonDoiy

Investment thesis

Tesla’s (NASDAQ:TSLA) stock price is up by 63% in 2023. This indicates that the price cuts that the company implemented on its cars this year are keeping investors pleased. The stock has given tremendous returns to investors since its listing. The company is generating strong financial results, but its declining market share remains a concern for investors. Despite that, improvement in technology, strong operating margin, scaling of production, and introduction of new models are some factors that make the stock attractive.

About Tesla

Tesla is a global electric vehicle company headquartered in Austin, Texas. It manufactures and sells fully electric vehicles, solar panels, and energy storage systems.

It has four electric vehicle models available in the market currently – Model S, Model X, Model 3, and Model Y. It has also recently started deliveries for its first electric truck Semi. The truck outperforms diesel trucks in terms of power and has several safety features. It also plans to launch two new electric vehicles in the future- the Cybertruck and the new Roadster.

It has seven manufacturing facilities located worldwide – Fremont, Shanghai, Berlin-Brandenburg, Texas, Nevada, New York, and California. Its main markets are the United States, China, and Europe.

Financial Results

Tesla had a record-breaking 2022. Its revenue grew 51% year-on-year to $81.4 billion in 2022. The revenue growth was driven by growth in vehicle deliveries and other parts of the business during the year. Its operating income doubled during the year and stood at $13.6 billion with an operating margin of 16.8%. Its margins were the highest among any other car maker globally. Its net income also more than doubled to $12.6 billion compared to the previous year.

Tesla delivered 1.3 million vehicles, 40% higher compared to FY21. It deployed 348 MW of solar energy and 6,541 MWh of solar storage in 2022. Its operating lease vehicle count grew 17% year on year. It installed over 4,678 Supercharging stations and 42,419 supercharging connectors during the year.

Performance against competitors

Global Deliveries

|

Market Share |

2018 |

2019 |

2020 |

2021 |

2022 |

|

Tesla |

16% |

22% |

22% |

19% |

17% |

|

BYD |

7% |

9% |

6% |

7% |

12% |

|

VW |

0.0% |

0.0% |

10.2% |

9.4% |

7.4% |

Source: EV Volumes, Companies.

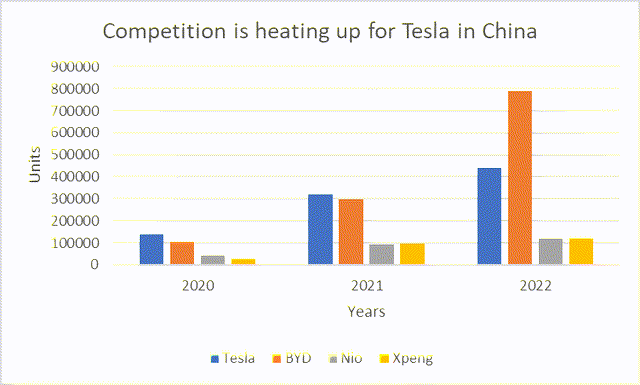

Tesla holds the highest share of the global EV market. BYD is one of the strongest competitors to Tesla. Although BYD deliveries are less than Tesla, its delivery growth is strong. BYD deliveries have doubled every year after 2020. In 2022, its deliveries grew by over 184%. A year before that it grew by 145%. As the above table shows, even though EV delivery numbers for each of the three top EV players – Tesla, BYD, and Volkswagen – are growing, BYD’s numbers are growing the fastest in a growing market. Its market share continues to rise, even when that of Tesla and Volkswagen (OTCPK:VWAGY) is falling.

In terms of global market share, Tesla’s market share is the highest. In 2022, its global EV market share was 17%. Its market share has been declining globally since 2019. This is because new players like Li Auto (LI), XPeng (XPEV), and NIO (NIO) have entered the market. Also, legacy companies like Ford (F), General Motors (GM), Toyota (TM), and Volkswagen have boosted their EV production. Thus, this has increased competition in the EV market.

China

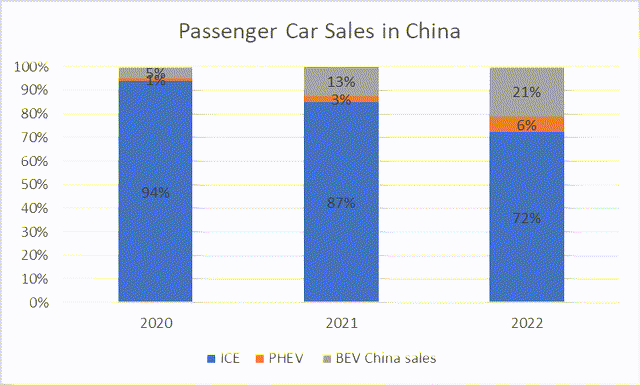

China had a tough 2022 due to a rise in Covid-19 cases. Irrespective of this, the total car sales volume was strong. According to China Automotive Association, car sales increased by 24% in 2022.

The transition from fossil fuel cars to EVs is happening at a faster pace in China. Since 2020, the proportion of BEV to total car sales have increased from 5% to 17%. PHEV sales have also picked up during this period. However, ICE passenger cars as a proportion of total sales have declined to 78% in 2022.

BEV sales in China remained strong in 2022. China sold over 5 million BEVs during the year. BYD delivered the highest number of electric vehicles in China. For the first time, it surpassed the deliveries by Tesla. Its deliveries more than doubled to 789,244 units. In contrast, Tesla deliveries grew by only 37% to 441,697 units.

Additionally, BYD also surpassed Tesla in terms of market share. In 2022, BYD held 16% of the market share. Tesla’s market share has declined in China. This is again because of new competition in the market. In order to gain back market share, Tesla cut prices for Model 3 and Model Y in China. Based on Reuters’ calculation, Tesla slashed prices by 6% to 20% in early 2023 (between 6% and 13.5% in China). This has also encouraged its competitors to do the same.

|

Market Share in China |

2020 |

2021 |

2022 |

|

Tesla |

14% |

12% |

9% |

|

BYD |

10% |

11% |

16% |

|

NIO |

4% |

3% |

2% |

|

XPeng |

3% |

4% |

2% |

Europe

European Automobile Manufacturers’ Association

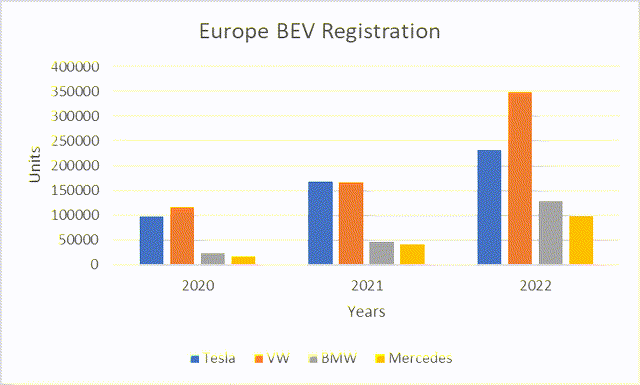

According to the European Automobile Manufacturers’ Association, Europe is also transitioning to carbon neutrality at a fast pace. Even though the use of petrol and diesel cars have declined, people have not moved entirely to fully electric. In 2022, only 12% of cars registered in the Europe Union were fully electric. People in Europe are more inclined towards using hybrid electric cars. Hybrid cars registered in 2022 stood at 22.6%.

Source – Volkswagen led the European electric vehicle market in 2022 – JATO ; In 2021, Battery Electric Vehicles made up one in ten new cars registered in Europe – JATO

Volkswagen’s presence in Europe stays strong. According to JATO, EV registrations for all German automakers doubled in 2022. Volkswagen, BMW, and Mercedes Benz EV registrations grew by 110%, 184%, and 136%, respectively, in 2022. Over 349,147 Volkswagen EVs, 129,109, BMW EVs, and 97,567 Mercedes Benz EVs were registered that year. On the other hand, Tesla’s registrations grew by only 38% in 2022.

United States

Bureau of Transportation Statistic

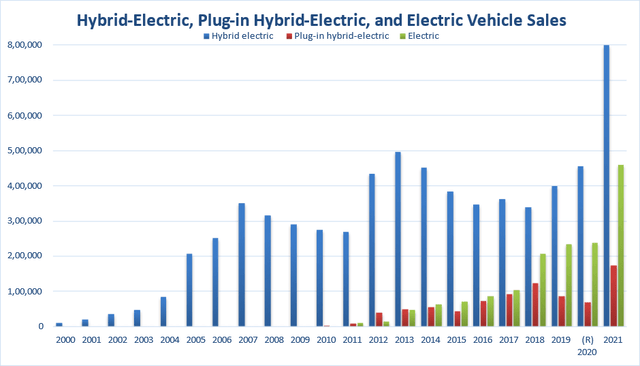

Electric Vehicle sales in United States are growing rapidly. In the last five years, it has grown at a CAGR of 34%. On the other hand, sales of Hybrid Electric and PHEV have grown by CAGR of 17% and 14%, respectively, over the five-year period.

Tesla is the top-selling Electric Vehicle brand in the U.S. However, its market share is dropping since 2020. According to data from S&P Global Mobility, Tesla’s market share was down from 70.5% in 2021 to 63.5% in 2022. This is because new affordable options have arrived.

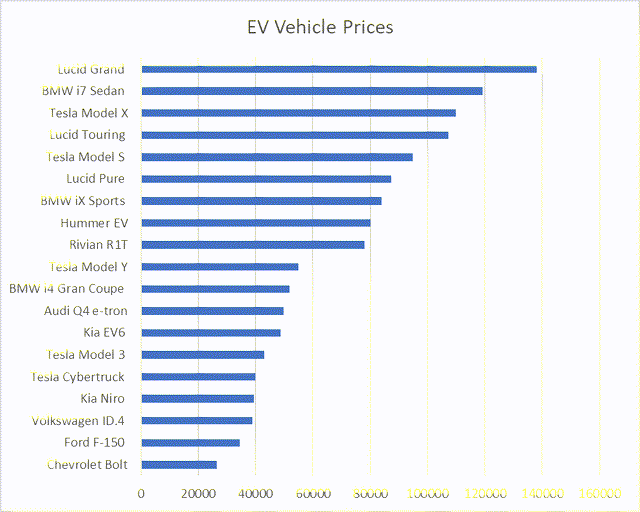

Tesla’s Model 3 is the cheapest Tesla car to date. The base model 3 is available in the market for $42,990. The company’s upcoming Cybertruck was initially expected to be around $40,000, but the latest pricing details are not yet available. There are other EV vehicles like Ford F-150 and Volkswagen ID.4 available at cheaper price points.

Ford F-150 could be a key competitor for Tesla’s Cybertruck. Although F-150 is available at a lower price point, it is way behind Cybertruck in terms of mileage. Cybertruck base model is expected to have an EPA range of 250 miles on its battery, 20 miles more than the comparable F-150. However, the $7,500 tax credit is not available on this Tesla model. This could result in lower growth in deliveries in the initial years.

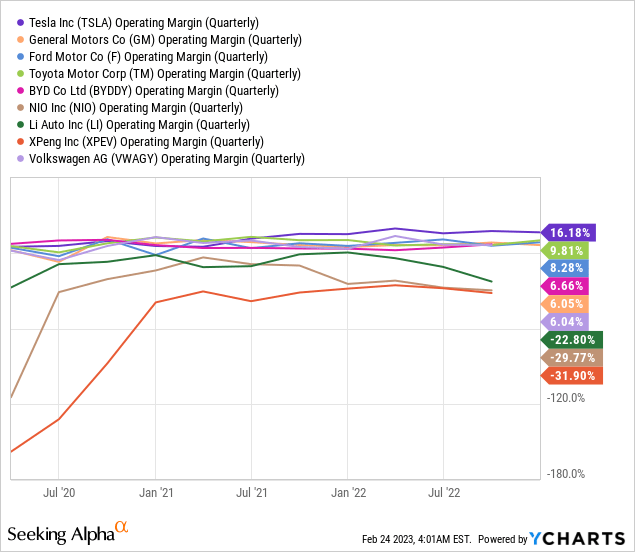

Operating Margin versus Competitors

Tesla’s operating margins have risen well above that of its competitors. This is because the company is able to consistently reduce its cost of sales and operating expenses over time. The reason for its lower cost of sales is higher vehicle production over a single platform. This has helped the company lower its long-run output cost. Its Selling, General and Administration expenditure has also reduced over time due to a decrease in employee and labor costs.

|

P&L |

2018 |

2019 |

2020 |

2021 |

2022 |

|

Revenue |

100% |

100% |

100% |

100% |

100% |

|

Cost of sales |

81% |

83% |

79% |

75% |

74% |

|

Gross Profit |

18.83% |

16.56% |

21.02% |

25.28% |

25.60% |

|

Operating Expenses |

21% |

17% |

15% |

13% |

9% |

|

Operating Income |

-2% |

0% |

6% |

12% |

17% |

The operating margins of legacy automakers like Ford, General Motors, Volkswagen, and Toyota are usually well below 10%. On the other hand, the operating margins of new EV makers like NIO, XPeng, and Li Auto are negative currently.

Technology Could Continue to be the Key Differentiator

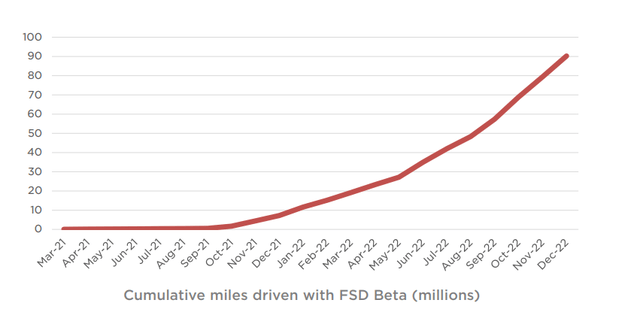

Tesla’s Autopilot and Full-Self-Driving (“FSD”) may give it a competitive advantage over other automakers. It has been ahead in autonomy research since its inception. The company has recently released FSD Beta to all customers in US and Canada. Approximately 400,000 customers have bought FSD to date. Also, the cumulative miles driven with FSD Beta are increasing. It reached over 90 million miles by end of 2022.

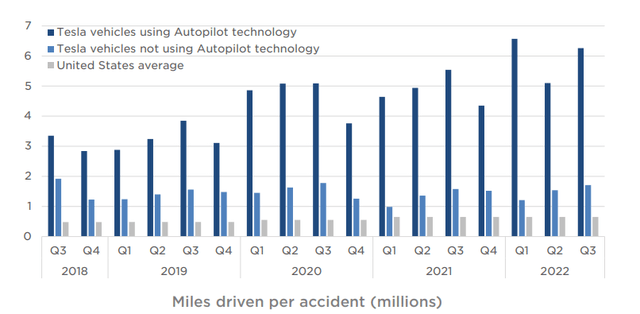

Tesla has been working towards Autopilot technology since the beginning. Its goal is to level up this technology where Autopilot function will not require intervention and active driver supervision. It suggests its customers to use Autopilot technology as it believes that the technology reduces the risk of accidents.

On average, in the U.S., an accident happens every half a million miles. According to data gathered by Tesla, a customer using Tesla without Autopilot technology is prone to meet with an accident in every 2 million miles, on an average. In contrast, in Autopilot technology, the chances of accidents are reduced. Over time Tesla has become better with its autopilot technology. Back in 2018, the miles driven per accident with Autopilot technology were 3 million miles. Since then, it has increased to over 6.5 million miles.

Although the data set for Tesla Autopilot is much smaller compared to the U.S. average and is therefore not conclusive, it at least looks directionally positive.

Notably, the company recently recalled 362,758 vehicles due to the risk that its full self-driving beta software could cause a crash. Tesla did not agree with the National Highway Safety Traffic Administration’s analysis of the risk. This isn’t the first time the company’s FSD technology’s safety has been called under question. However, the company keeps on improving it. In the meantime, Mercedes-Benz received certification in Nevada to bring Level 3 autonomy on U.S. roads — the first carmaker to have received it.

Until a company successfully makes FSD a reality, it would be difficult to decide who’s leading the race. However, Tesla has ample test data that it has been collecting over the years towards this technology. As with other things about Tesla, there are as many supporters of Tesla being ahead in FSD, as opposers. From what we’ve understood (and we are not technology experts), Tesla is among the leaders, if not at the top, in autonomous driving. With the financial resources, years of work in this direction, and a history of innovation, we would lean toward it coming to a position to immensely benefit from this technology in the future.

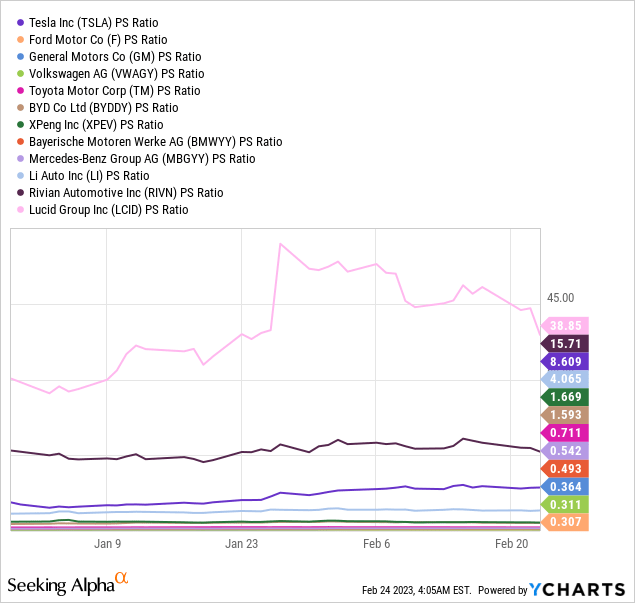

Valuation

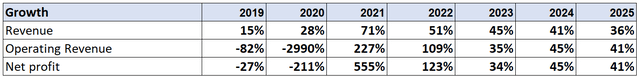

Tesla’s Price to sales ratio is one of the highest amongst automobile makers. However, assuming 50% CAGR increase in sales year-on-year based on its current automotive demand, introduction of new models, and improvement in technology, the ratio may fall to much reasonable levels. On the other hand, if the ratio is maintained, the stock price has enormous upside potential.

Tesla, author’s estimates Tesla, author’s estimates

Risks

Although Tesla enjoys the highest market share in EVs globally, its market share declined in 2022. This forced the company to cut its prices globally to regain its share. The company experiences fierce competition from BYD, BMW, Mercedes Benz, Ford, VW, and General Motors, as well as from newer EV companies. In China, BYD is gaining popularity. It has even outpaced Tesla in terms of market share. In Europe, Tesla’s registration numbers stay strong but its growth in EV registrations has declined since 2020. Also in the U.S., Tesla fears competition from legacy and premium automakers like Ford, General Motors, and Toyota.

Conclusion

Despite higher interest rates, lockdown in China, and delivery challenges, Tesla delivered an excellent performance in 2022. Its operating margins were the highest in the entire automotive industry. Tesla is well known for its technology. Its Autopilot and Full-Self Driving technology gives it a competitive advantage over its peers. Automakers like Ford, General Motors, Volkswagen, BMW, and Mercedes Benz are far behind on this front. Tesla’s biggest strength is its robotic manufacturing units. This has helped the company to ramp up production quickly over time, while bringing down costs. The company has seven manufacturing facilities, and can continue ramping-up its production.

Tesla’s strategy to cut down prices for its cars has worked well and the stock remains up 63% year-to-date. The company has the highest industry operating margin and global market share. If the stock’s PS ratio is maintained at the current levels, there is an enormous upside potential in the next 3 years. Even if the PS ratio corrects, there is still scope for substantial upside in the coming years. In the long-term, Tesla’s FSD may provide it an unbeatable edge over the competition.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.