Summary:

- Rivian Automotive, Inc. submitted its Q4 2022 earnings sheet yesterday, which caused the stock to skid 10%.

- Rivian expects a production volume of 50 thousand electric vehicles in FY 2023, which fell short of Wall Street’s expectations.

- Falling revenue estimates may be a problem in the short term, and the EV maker’s valuation is already high.

Mario Tama

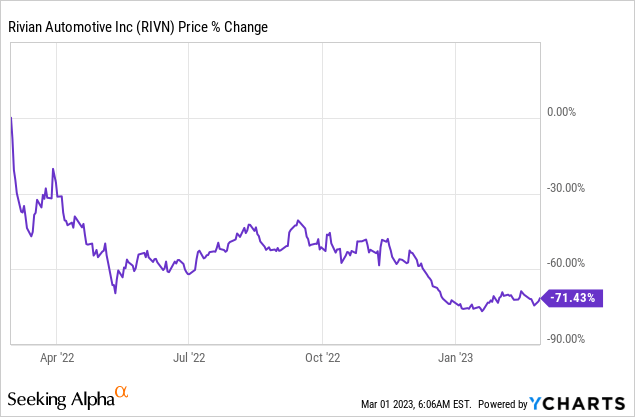

Shares of Rivian Automotive, Inc. (NASDAQ:RIVN) dropped 10% in extended trading on Tuesday after the electric vehicle company submitted its earnings sheet for the fourth-quarter. Rivian missed consensus expectations regarding revenues and presented a disappointing production outlook for FY 2023. Rivian said that it expects to produce 50 thousand electric vehicles in FY 2023, which implies an approximate doubling of factory output compared to last year. Considering Rivian’s high valuation based off of revenues, I believe that the electric vehicle (“EV”) maker has an unattractive risk profile after the company under-performed the Street’s production expectations. Revenue estimates are now at risk, and Rivian may retest its 1-year low!

Rivian’s Q4 performance and FY 2023 production outlook

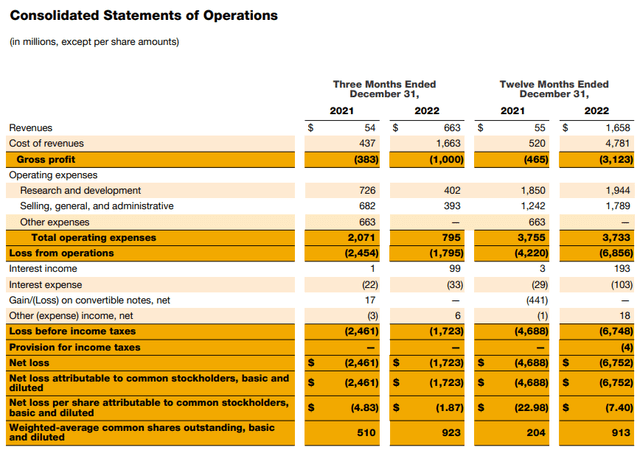

Rivian achieved $663M in quarterly revenues in the December quarter, which fell short of expectations of $717.3M. Rivian also reported adjusted EPS of $(1.73) compared to an average estimate of $(1.86), so earnings results were slightly better than expected. However, the revenue miss combined with the light outlook for FY 2023 hurt the stock in extended trading.

Rivian aggressively ramped up production in FY 2022, especially in the second half of the year. Yet, the EV maker still fell short of its FY 2022 production target of 25 thousand electric vehicles. Due to supply chain challenges, Rivian produced 24,337 electric vehicles in FY 2022, which is the reason why the EV company didn’t see as much revenue growth as investors had hoped.

The EV maker generated $663M in revenues in Q4’22, showing a factor increase of 12.3 X year over year. Still, Rivian continued to lose a ton of money in the fourth-quarter as well as in FY 2022: the EV company reported a loss from operations of $1.8B for Q4’22 and $6.9B for FY 2022.

Turning to Rivian’s outlook for FY 2023, which was the most important piece of information.

Rivian estimates that it can produce 50 thousand electric vehicles this year, which essentially represents Rivian’s initial production forecast from the beginning of last year. Rivian produced 24,337 electric vehicles in FY 2022, so the EV company could be on track to double production this year. However, the forecast fell short of Wall Street’s expectations, which assumed a production volume between 60-65 thousand units. Because Rivian underperformed the Wall Street estimate regarding factory output, I believe there is a risk for revenue estimate revisions in the short term. Rivian also said that it will spend $2.0B in CapEx in FY 2023 and that it expects to remain EBITDA negative to the tune of $(4.3)B.

The forecasts of other EV companies were mixed. Lucid Group, Inc. (LCID) projected a FY 2023 production volume of 10,000-14,000 electric vehicles, which represents 39% and 95% year over year growth. One of the best production targets presented this earnings season came from electric vehicle start-up Fisker Inc. (FSR), which is seeing a total output volume of 42,400 electric vehicles despite the company only commencing with customer deliveries in March.

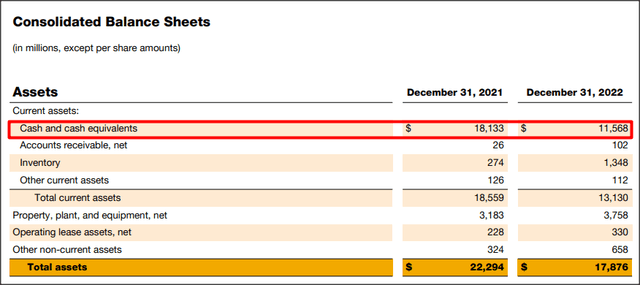

Balance sheet is an asset

Rivian’s biggest asset is the balance sheet. The EV firm’s balance sheet showed $11.6B in cash and cash equivalents at the end of FY 2022, which gives Rivian more than enough liquidity to finance the ramp of the R1T and R1S. I estimate that Rivian’s current cash position gives the company a two-year liquidity runway, meaning the financing of the production ramp is all but ensured even without a major ramp in revenues.

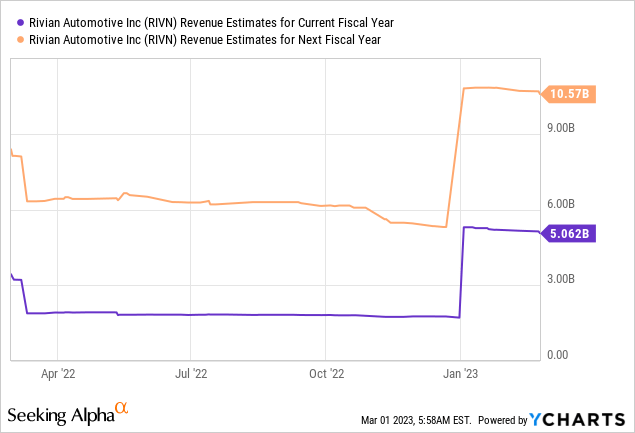

Rivian’s valuation and estimate risk

The production outlook for FY 2023 was disappointing in the eyes of Wall Street, and so was the revenue miss. As a result, Rivian’s shares sold off and declined 10% in extended trading on Tuesday. I believe it is likely that revenue estimates for Rivian are now going to correct to the downside, which could put additional pressure on Rivian’s valuation.

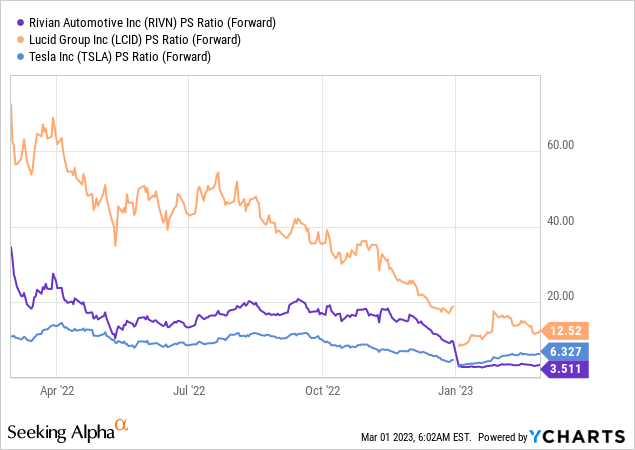

Rivian is projected to generate 195% revenue growth this year and 109% growth next year. The price-to-sales ratio for FY 2023 is 3.5 X which makes he the stock quite expensive in my opinion considering that Rivian is clearly not growing production as fast as initially though. Both Lucid and Tesla, Inc. (TSLA) trade at higher valuation multipliers, but that doesn’t mean Rivian is necessarily a buy.

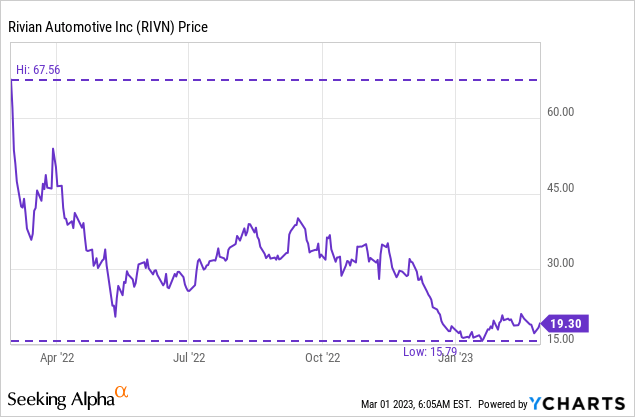

Considering that the outlook for FY 2023 has created new negative sentiment for Rivian, I am expecting RIVN stock to re-test its 1-year low at $15.79.

Risks with Rivian

There is a risk that Rivian and other electric vehicle start-ups could see slowing growth in their top lines going forward, not because of supply issues, but because of moderating demand for EV products. The electric vehicle field is now crowded, with many companies offering increasingly dense EV product portfolios. Tesla recently lowered its EV prices in a bid to spur demand, which may indicate that pricing pressure in the industry is growing going forward. These headwinds could potentially delay Rivian’s profitability and could negatively impact its valuation factor. Another risk for Rivian is that the company just announced yet another recall due to an airbag problem. The recall could affect up to 12,700 electric vehicles… and is yet another issue that has created negative sentiment.

Final thoughts

Rivian Automotive, Inc.’s outlook for FY 2023 was widely perceived as disappointing. It indicates that the EV manufacturer is not growing as quickly as initially thought… which is putting even more pressure on Rivian’s valuation. Rivian’s shares have declined 71% in the last year, not counting yesterday’s selloff in extended trading.

While the Rivian Automotive, Inc. balance sheet is a huge asset for the EV firm, slowing growth is likely going to be reflected in a falling revenue estimates and potentially in a lower valuation multiplier. Since the market reacted very harshly yesterday, I believe Rivian Automotive, Inc. is set to re-test its 1-year low at $15.79 in the short term!

Disclosure: I/we have a beneficial long position in the shares of LCID, FSR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.