Summary:

- Apple’s excessive reliance on China for manufacturing and any disruptions due to a lack of components or geopolitical tensions will severely impair its ability to meet demand.

- The valuation appears elevated if treated as a tech company but close to being in line if considered a consumer name.

- Apple is a solid company with limited upside potential from current levels, earning the sell rating.

Scott Olson

Investment Thesis

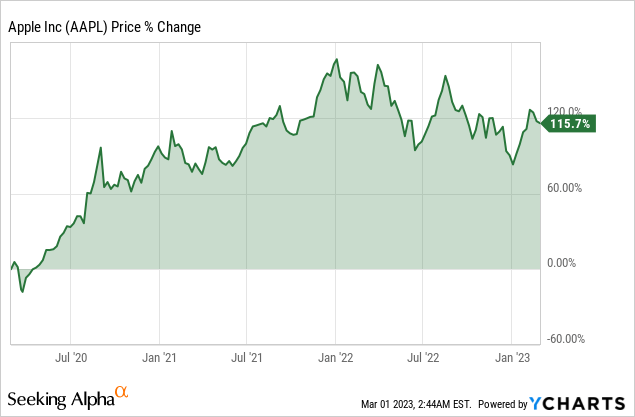

Over the past three years, Apple Inc. (NASDAQ:AAPL) has provided a decent return to investors of 116%. However, considering the current macro environment and AAPL’s valuation, there is limited upside from current levels. A potential valuation headwind in the coming years, given that the shares are currently selling at around 25 times forward earnings, is a probable scenario, and investors might consider taking profits. However, any positive surprise following its conservative guidance in the next quarter can boost shares in the short run.

Outlook For The Second Quarter

Apple guided Q2 2023 gross margin to be between 43.5% and 44.5%, up from 43% in Q1 2023, considering the weakening US dollar and favorable component pricing. Management also indicated that the supply chain issues had been resolved and that supply output had returned to desired levels to meet consumer demand.

Management indicated that sales from China declined by 7% in Q1 2023 but grew on a constant currency basis despite supply constraints and COVID restrictions. Apple said it saw a significant change in store traffic compared to November, when China eased its COVID restrictions in December 2022.

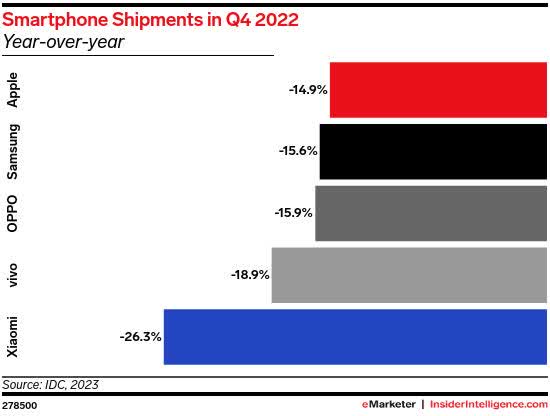

Lastly, Apple also conveyed its bullishness on India. On top of diversifying its supply chain to the country, it is also opening physical retail stores there and working on financing options. In addition, trade-in offers to make the products more affordable for local consumers. Nevertheless, in Q4, Apple had the least YoY drop in smartphone shipments, indicating its resilience during challenging times.

www.insiderintelligence.com

Conservative Guide Provides Upside Ground

The guidance for the upcoming quarter’s revenue decline has left investors underwhelmed. The conservative guide for the second quarter reflects a deeper downturn in consumer hardware, specifically in the smartphone and PC markets. This viewpoint is supported by weaker guidance from Qualcomm, a key smartphone chip supplier. However, it’s important to note that Apple’s guidance may be overly conservative.

This is due to the incremental challenges posed by recent COVID spikes in China. As a result, the company may set a lower bar about the guide, which could lead to upside potential if the situation improves sooner than expected. Overall, while the previous quarter’s revenue fell short of expectations and the upcoming quarter’s guidance is lower, the outlook for the shares may be more favorable than before due to more significant de-risking of investor expectations.

Apple’s medium-term revenue growth appears poised to remain in the mid-single digits, spurred by product refresh cycles and sales of additional services to its installed base of more than two billion active devices. In addition, high inflation and a weakening global economy, especially in China and Europe, which collectively account for more than 40% of total sales, could extend the iPhone-refresh cycle. Lastly, Apple’s overexposure to China for manufacturing is a significant concern, and any disruptions due to either parts shortages or geopolitical issues could seriously hinder its ability to fulfill demand.

Continued Expansion Of Installed Devices

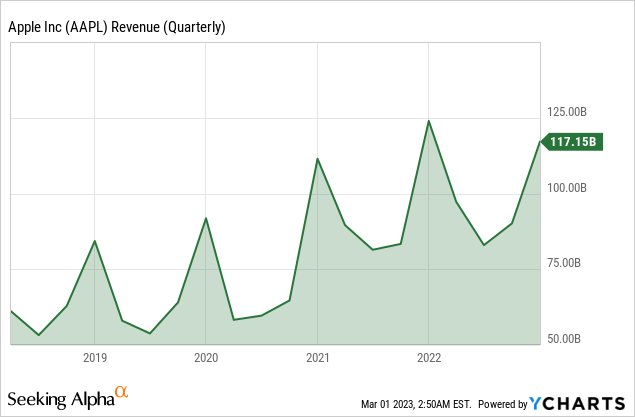

As Apple had warned during previous months, its sales performance in the first quarter of its fiscal year 2023 was significantly weaker than in recent quarters. Several transient factors, such as the strengthening of the US dollar, supply bottlenecks due to lockdowns in China, and a weakening macroeconomic environment, hit the results. Even as the situation in China has become more favorable in the current quarter, the other two factors will continue to impact the results. Management hinted at a similar sales performance as in the reported quarter, though no concrete guidance was provided.

Including 8% of currency headwind, the reported sales in the first fiscal quarter came in at $117 billion or 5.5% lower than in the year-ago quarter. This marks the first sales drop since the second quarter of the fiscal year 2019 and a substantial slowdown. Lower sales were generated at the iPhone, Mac, Wearables, Home, and Accessories units. On the other hand, iPad delivered almost 30% sales growth, mainly due to the favorable comparison base, since iPad revenues had suffered a 14% decline in the first quarter of the prior fiscal year. Lastly, a double-digit decline is projected for both Mac and iPad, offsetting an expected improvement in iPhone sales.

In November and December 2022, Apple needed help to fully capture the demand for its latest flagship phones, iPhone 14 Pro and Pro Max. As a result, iPhone revenue remained flat on a constant currency basis and declined by 8% on a reported base of $65.8 billion. In addition, lockdowns in China disrupted the supply of its products, increasing customer waiting times.

Before this disruption, Apple had been working to diversify its supply chain, prompted by the trade tensions between the US and China. As a result, it has made some progress in shifting production to India and Vietnam. However, most of its products are still produced and assembled in China, implying that the recurrence of disruptions remains a risk in the foreseeable future. However, the firm’s strong financial position and highly loyal user base give it solid ground to manage such challenges.

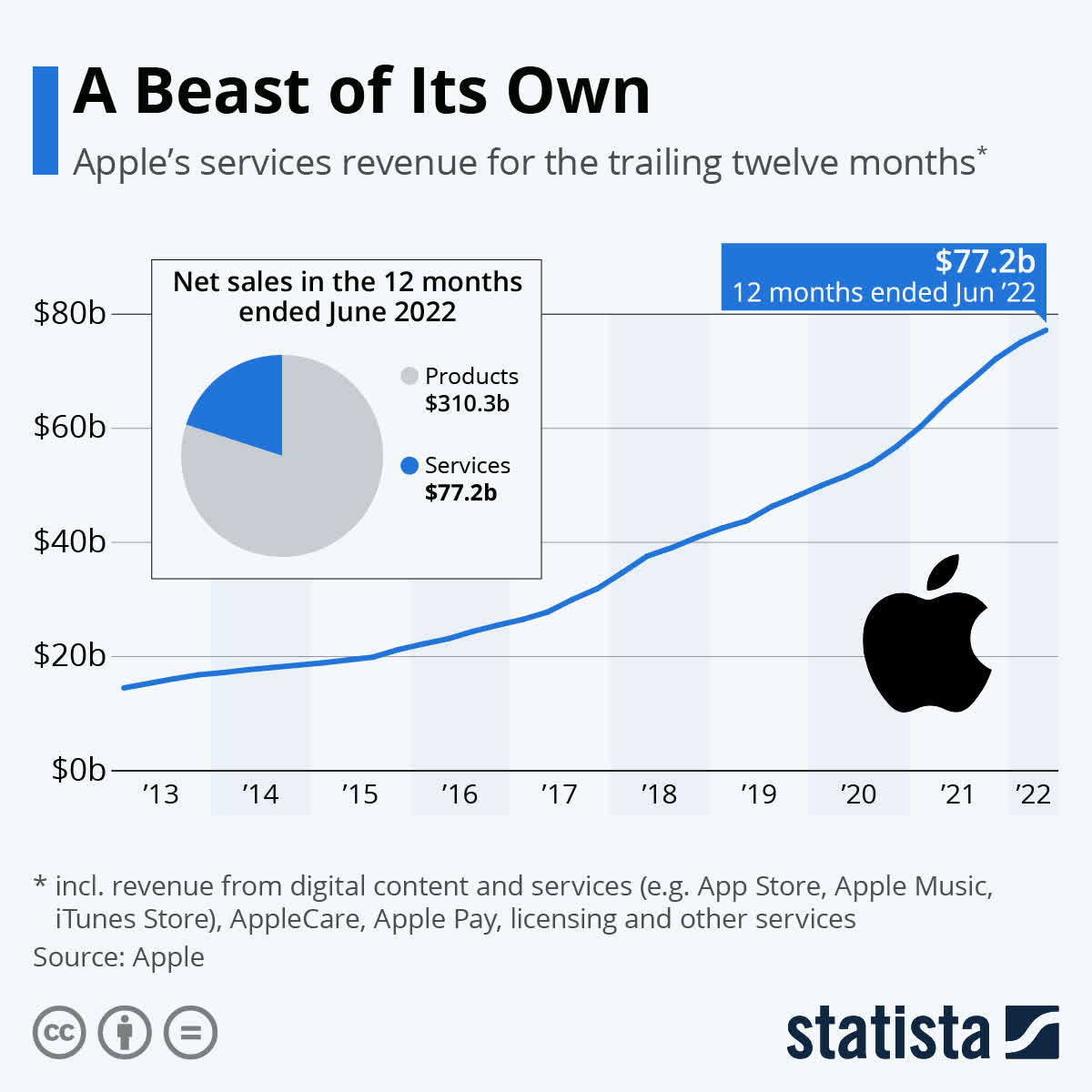

In the reported quarter, the installed base of active Apple devices crossed two billion, up from 1.8 billion a year ago. This expanding base has helped the firm to create a robust services business, which has become the second largest source of revenue after the iPhone. Services sales are generated through a wide variety of offerings, including third-party app commissions but increasingly also Apple’s digital services, such as music and video streaming and gaming subscriptions.

The number of paid subscriptions, including third-party offerings, has consistently risen quarterly. At the end of the reported quarter, the firm had 935 million paid subscriptions, a year-on-year increase of almost 20%. As a result, services (21% of sales) have gross profitability twice that of products. The critical long-term sales and margin expansion driver is Apple’s ability to shift its revenue mix to services. At the same time, buybacks may support the bottom line amid supply-chain constraints.

statista.com

Apple Antitrust Pressure In The US Persists

US antitrust threats to Apple’s business model will continue through 2023, even though the passage of intrusive new laws has become less likely given the gridlock in Congress. Antitrust pressure on Apple in the US is intense, as criticisms of its “walled garden” iOS device model increase, including the Biden administration.

While the iPhone maker has thus far succeeded in avoiding a legal defeat and new regulations, antitrust challenges are expected to increase for the company, which may risk some business model changes, whether forced or voluntary. Apple has the upper hand in ongoing lawsuits by app developers and consumers, but the Justice Department is likely to sue, extending the overhang for years. In addition, momentum for new laws regulating app stores has stalled with a GOP-led House, but court wins by Apple could change that.

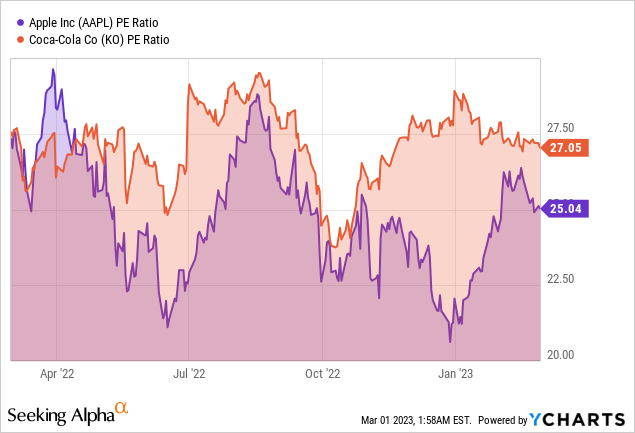

Relative Valuation Depends On AAPL’s Categorization

Amid slowing sales, a big topic of discussion is whether Apple’s valuation is too high. The valuation appears elevated if treated as a tech company but close to in line if considered a consumer name. Moreover, volatile product sales don’t indicate Apple’s stable business model and predictable revenue stream.

The company’s valuation is close to being in line if considered a consumer company such as Coca-Cola, Costco, or Hershey. Given the longevity of these businesses compared with the technology sector, investors usually pay a much higher multiple despite their low growth.

Costco trades at a forward P/E of around 34x, with three-year sales-growth expectations of roughly 6% and an EPS increase of 10%. Apple will remain a household brand even a couple of decades from now and can be grouped with consumer companies.

Takeaway

Apple’s solid brand name has somewhat protected its sales, reporting the slightest drop in smartphone shipments among its competitors. However, under the current environment, there is no clear catalyst for AAPL, and I would instead rotate profits to more attractive candidates with higher risk/reward profiles.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Author of Yiazou Capital Research

Unlock your investment potential through deep business analysis.

I am the founder of Yiazou Capital Research, a stock-market research platform designed to elevate your due diligence process through in-depth analysis of businesses.

I have previously worked for Deloitte and KPMG in external auditing, internal auditing, and consulting.

I am a Chartered Certified Accountant and an ACCA Global member, and I hold BSc and MSc degrees from leading UK business schools.

In addition to my research platform, I am also the founder of a private business.