Summary:

- Lucid’s stock has been battered, dropping by about 90% from peak to trough in recent years.

- However, Lucid’s stock likely hit a long-term bottom around $6 and will probably go much higher.

- While there are some production and demand concerns, the PIF owns about 66% of Lucid shares, implying that Lucid can grow revenues substantially in the coming years.

- As the company advances and becomes more efficient, it should become increasingly profitable, driving its shares much higher in future years.

jetcityimage

Lucid’s (NASDAQ:LCID) stock has been on a wild rollercoaster ride since the SPAC began trading several years ago. Let’s face it. Lucid will not become profitable anytime soon. However, if the company can eventually reach a level where it effectively competes with Tesla, it doesn’t matter.

Lucid’s vehicle line-up is versatile, ranging from around $87,000 to about $250,000. Therefore, there is a Lucid for essentially “everyone.” The company should ramp up production capacity significantly in the coming years.

Also, Lucid has a unique design, branding, and performance similar to high-end Teslas. Thus, if another 100% EV producer will test Tesla’s supremacy in future years, my money is on Lucid to do so. Furthermore, there’s been some concerns about Lucid missing production estimates, yet, we saw a similar phenomenon with Tesla years back.

Moreover, much of Lucid (roughly 66% of all shares) is owned by the PIF, a Saudi Arabian wealth fund, which increased its stake last quarter. We also have a report of a possible buyout coming from the Saudi Nation soon.

Regardless if the Saudis buy out Lucid entirely or not, the company is highly capable of boosting production, predicting to deliver around 10,000-14,000 vehicles this year. Moreover, 2024 production should improve drastically, driving the company’s share price much higher in the coming years.

Analysts appear asleep at the wheel, as their rock-bottom revenue and EPS estimates could be surpassed. Therefore, I am doubling my Lucid position here before this stock surges again soon.

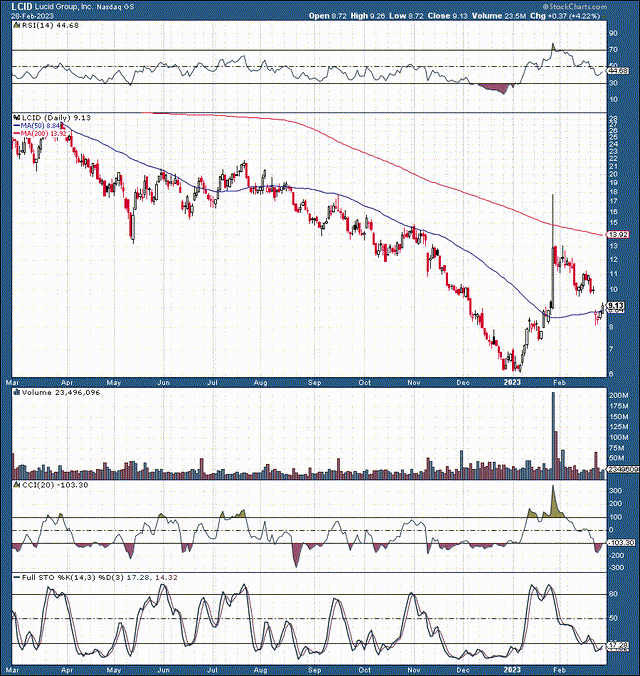

The Technical Image – The Bottom is in

LCID (StockCharts.com)

Lucid’s stock has been decimated in the recent bear market — however, the declines began well before then. From peak to trough Lucid dropped by approximately 90% from its ATH in early 2021 to its recent low at the start of 2023. Technically, Lucid got extremely oversold into year-end before getting a long-awaited rebound. More recently, we received notice of PIF’s increased position in Lucid and a possible buyout of the company soon. Shares skyrocketed, and I took profits on my position around the highs, recently reopening my position around $11 and doubling down on it in the $8-$9 range.

From here, Lucid should close the gap at $10 and move higher. Lucid’s stock has the potential to move substantially higher in future years, and it is likely to be bought out by the Saudis at a substantial premium to its current share price. Therefore, the downside is likely limited in Lucid shares, but upside potential remains significant, and this stock should move much higher in the intermediate and long term.

Let Me Tell You a Little About The Air Vehicle

One of the reasons I am optimistic about Lucid is its extremely high quality and capable luxury vehicles that are 100% EVs and offer some of the best performance out of any EV company. Lucid’s cars are so capable performance-wise that they can effectively compete with Tesla on many levels. For instance, Lucid’s Air Grand Touring model gives drivers up to 1,050 hp with a range of 516 miles. While the starting price of this vehicle is around $138,000, its performance capabilities are on par or better than many far more expensive vehicles. Moreover, Lucid also offers the Air Sapphire, which recently outperformed Tesla’s Model S Plaid, the Bugatti Chiron, and even the latest Ducati motorcycle, smashing the quarter mile in just 9.1 seconds.

Therefore, we see that Lucid possesses some of the most advanced technologies in the EV world and can effectively compete with Tesla for dominance in the market in future years. Of course, only some people are willing to dish out $250K for an Air Sapphire or even $87K for the starting Air Pure version. Nevertheless, as the company progresses, it will likely adopt a similar strategy to Tesla, providing mass-market lower-cost vehicles to capture more market share in the 100% pure EV market.

The PIF – Where Saudi Arabia Gets Innovation

The “PIF” is an exciting organization. Moreover, it is also one of the world’s most significant sovereign wealth funds. This Saudi Arabian wealth fund owns about 66% of Lucid shares, now worth around $10.5 billion. We also know that the PIF increased its stake in Lucid last quarter. Therefore, it is likely that the Saudis want to be in the EV game, and since the country doesn’t have a booming EV sector, the kingdom (or the PIF) could buy Lucid instead. Thus, having the PIF as a majority holder and a major backer of Lucid is highly beneficial as there is plenty of capital in the fund, implying Lucid has an extremely long runway to improve production efficiency, increase revenues and become profitable.

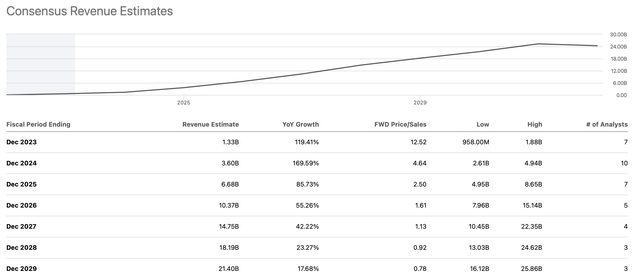

Revenue Estimates – Too Low to Ignore

Revenues (SeekingAlpha.com )

This year’s consensus revenue estimates are $1.33 billion. However, Lucid expects to deliver 10,000 – 14,000 cars this year. If we take the mid-range of these estimates (12,000) vehicles and apply an average selling price “ASP” of approximately $140,000, we arrive at a revenue figure of about $1.68 billion for 2023. Moreover, as Lucid ramps production capacity, its deliveries should increase dramatically, leading to a massive revenue jump in 2024. Naturally, we want to own the stock well before then, and now may be the perfect time to buy.

Here is what Lucid’s financials could look like in future years:

| Year | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue Bs | $1.7 | $4.5 | $8 | $14 | $20 | $24.5 | $30 | $36 |

| Revenue growth | 183% | 165% | 78% | 75% | 43% | 23% | 22% | 20% |

| Forward P/S ratio | 3.8 | 5 | 6 | 7 | 7 | 6 | 6 | 5 |

| Market cap $ | 17b | 75b | 110b | 184b | 212b | 303b | 363b | 417b |

| Price | $9 | $40 | $84 | $140 | $172 | $180 | $260 | $300 |

Source: The Financial Prophet

If Lucid proves to the market that it can increase production and deliveries substantially in the next few years, the company should command a higher P/S multiple. I am applying a modest seven times sales as a peak valuation, and we still see that the price can move up substantially in the coming years. Moreover, due to PIF backing, Lucid can remain in an ultra-growth mode without delivering substantial profits for years. Thus, I see little downside potential in Lucid’s stock, while the upside potential is essentially limitless.

Risks to Lucid

While I am bullish on Lucid, risks exist. Lucid may run into production issues slowing the trajectory of its revenue growth. Moreover, the company can remain profitless for longer than expected, leading to lower multiples. Additionally, there is increased competition from Tesla and other automakers. Therefore, Lucid may run into demand issues due to the relatively high cost of its vehicles. The downturn could also impact sales, and the stock could be in for more volatility in the short term. Investors should examine these and other risks before committing to an investment in Lucid.

Disclosure: I/we have a beneficial long position in the shares of LCID either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am long a diversified portfolio with hedges.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2022 17% return), and achieve optimal results in any market.

- Our Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement our Covered Call Dividend Plan and earn an extra 40-60% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Don’t Wait! Unlock Your Own Financial Prophet!

Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now, and start beating the market for less than $1 a day!