Summary:

- Exxon Mobil has executed brilliantly by expanding its production output counter-cyclically, allowing it to fully benefit from the favorable oil/gas spot prices in 2022.

- The company also returned much value to its existing shareholders, mostly with its share repurchase programs with more pledged over the next two years.

- However, we wonder if it warrants the ~20% premium from the declining WTI crude oil and natural gas prices over the past six months.

- Prudent investors may consider locking in some gains here, with China likely to rely more on Russian oil post-reopening cadence.

- There is no harm in rebalancing the portfolio at this time of peak recessionary fears in our view.

Aslan Alphan

XOM Executed Brilliantly In Our View – But Is It Worth The Disconnect Premium?

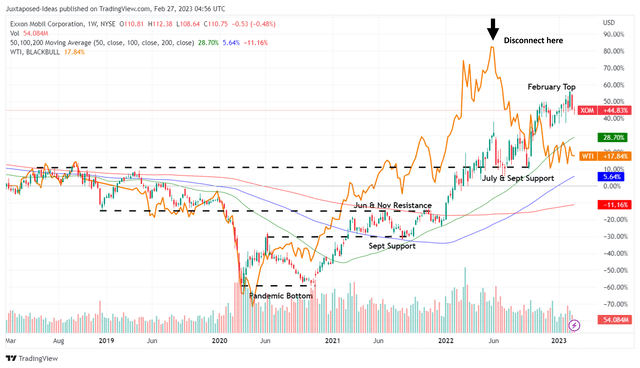

XOM 5Y Stock Price

Exxon Mobil (NYSE:XOM) has had an impressive recovery over the past few years. Despite the drastic decline in 2020, the stock had rallied by +238.9% to $110.75, since the hyper-pandemic bottom levels of $32.67 in October 2020, well exceeding its 2019 stock prices of $70s.

This was unsurprising, due to the tremendous rise (and fall) in oil/gas prices in 2022. The rise in prices contributed to XOM’s excellent top line performance of $402.21B (+44.2% YoY) and bottom line numbers of $55.74B (+141.9% YoY) in the latest fiscal year. Its balance sheet had also significantly improved to net debts of $9.53B (-72.6% YoY) by FQ4’22, against $33.99B in FQ2’20, particularly attributed to its cash/ equivalents of $29.64B (+335.8% YoY).

While shareholders did not enjoy a tremendous rise in dividends paid out (at $14.93B, inline YoY) in FY2022, the management embarked on an aggressive share repurchase program worth $15.15B (+9677% YoY) instead. Subsequently, the company was able to retire 137M shares or the equivalent of -3.2% in the latest fiscal year, returning significant value to its existing shareholders.

On top of that, XOM had set aside another $35B for repurchase programs, suggesting a potential total reduction of -10.5% in its share count to 3.82B by 2024 from 4.27B in 2021, based on the current stock prices. This was impressive indeed, despite the sustained focus on expanding production through 2027 with a guided capital expenditure of up to $25B (+35.8% YoY) in FY2023.

In addition, the company proved highly competent in investing in its forward execution “counter-cyclically,” as it had done pre-pandemic. This strategy had allowed the company to fully benefit from the favorable oil/gas market conditions in 2022, when spot prices rallied to 10Y highs.

Particularly, the XOM management guided a prudent 2023 Guyana output of 360 bbl/day (inline YoY or +200% from FQ2’20 levels of 120K bbl/day) and Permian output of 600K boe/day (+7.1% YoY or +104.7% from FQ3’19 levels of 293K boe/day).

However, we may potentially see an upper range of up to 650K boe/day (+16.1% YoY) from the Permian, attributed to its consistent 90K boe/day expansion YoY over the past two years.

The optimism is further fueled by the company’s ambitious 2027 guidance of 1.2M bbl/day from Guyana and 1M boe/day from the Permian. These numbers suggest a tremendous expansion by 233% and 78.5% from FY2022 levels of 360K bbl/day and 560K boe/day, respectively.

Perhaps this is why market analysts have optimistically projected FY2024 EPS of $9.97, against FY2019 levels of $2.25 and FY2022 levels of $14.06, despite the notable normalization in WTI crude oil and natural gas spot prices by -36.5% and -73.6% since their peaks.

As a result, XOM’s expanded investments may help temper some of the ongoing macroeconomic and demand headwinds moving forward.

So, Is XOM Stock A Buy, Sell, or Hold?

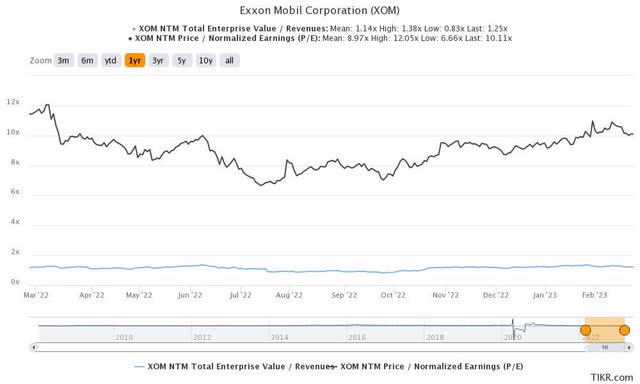

XOM 1Y EV/Revenue and P/E Valuations

XOM is currently trading at an EV/NTM Revenue of 1.25x and NTM P/E of 10.11x, lower than its 3Y pre-pandemic mean of 1.30x and 18.35x, respectively. Otherwise, it is higher than its 1Y mean of 1.14x and 8.97x, respectively.

Based on its projected FY2024 EPS of $9.97 and current P/E valuations, we are looking at a moderate price target of $100.79, suggesting minimal upside potential from current levels.

Furthermore, we must also highlight that the oil/gas sector may remain volatile over the next few months, attributed to China’s uncertain demand and the Russian price cap/ban. If anything, based on recent trends, we reckon China may likely continue importing Russian oil, as India and Turkey have been doing for the past few months, to meet its growing demand during its post reopening cadence.

In addition, adding at these current levels, based on the projected FY2024 dividend of $3.84, means a lower forward dividend yield of 3.46%, against its 4Y average of 5.62% and sector median of 4.30%.

Conversely, we are uncertain how long XOM may sustain these arguably optimistic levels, especially due to the widening gap in its rallying stock prices and declining WTI crude prices over the past six months, as highlighted in the chart mentioned earlier in the article.

Therefore, while the oil/gas industry remains highly important for the foreseeable future, we reckon that it may be wise to lock in any gains here and possibly re-enter at the previous October support levels in the $80s.

We believe there is no harm in rebalancing the portfolio at a time of peak recessionary fears, especially due to XOM’s forward focus on share repurchases instead of dividend growth.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.