Summary:

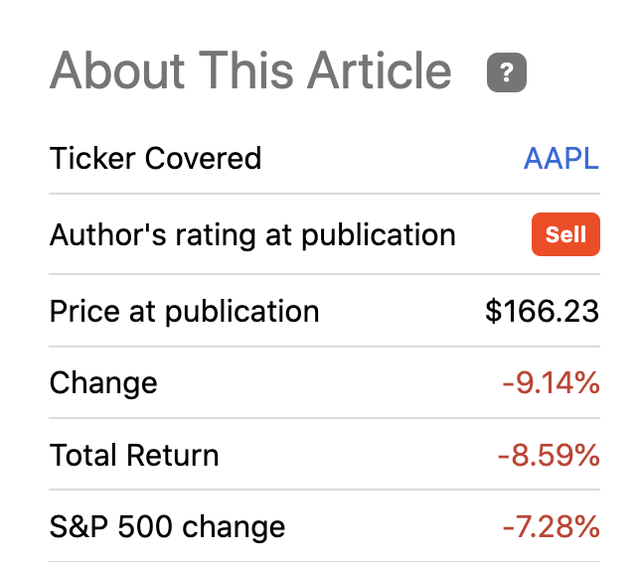

- Apple has fallen 9% in the first year since the 4-year dead money call made in March 2022.

- The company has seen EPS estimates fall in the year due to weak demand for tech products.

- Analysts continue to promote aggressive price targets keeping the stock inflated at the current price of $150.

- Based on updated FY26 EPS targets, Apple has a maximum March 2026 valuation similar to the current price using a possibly aggressive P/E multiple of 20x.

glegorly/iStock via Getty Images

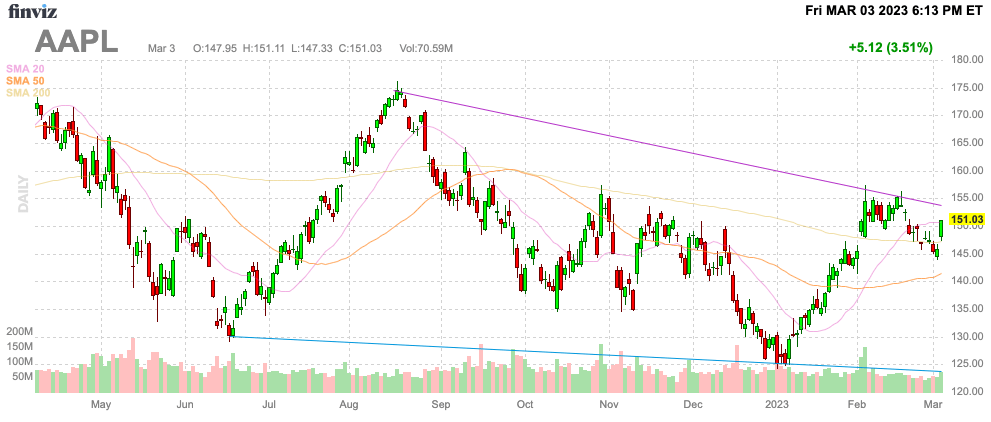

Exactly a year ago, Stone Fox Capital made the prediction that Apple (NASDAQ:AAPL) would trade flat to down for the next 4 years. The tech giant had rallied above $160 on new product hype and analyst projections of much higher prices. My investment thesis remains Bearish on the stock even after a nearly 10% dip in the last year, especially with a leading research firm again out promoting a massive gain from already elevated levels.

Source: Finviz

A Year Later

Our proclamation on March 3, 2022, got over 700 comments with the vast majority of commenters disagreeing with the view Apple wouldn’t rally in the next 4 years. The bearish call was made when the stock traded above $166 and Apple fell 9% during the first year of the bearish call.

In all fairness, the S&P 500 fell 7% during the year. Apple declined generally in line with the benchmark index in a slightly positive nod to shareholders that at least the stock didn’t vastly underperform the market.

Clearly, the call was made to signal that Apple would underperform the market during the 4 year period. If anything, this indicates how bulls haven’t disengaged from owning the tech giant despite Apple just reporting a quarter where revenues fell 5.5%.

A year later, the stock isn’t in any better position to warrant a change in the prediction Apple won’t top $166 by March 3, 2026. If anything, the FY25 EPS estimates have fallen from $7.32 to only $7.04 per share now warranting an original prediction for a stock decline over the 4 years period, not just dead money.

The company has seen the AR/VR device pushed out with signs Apple won’t release the second version until a couple of years later in 2025, at the earliest. After all the tech giant still hasn’t released the first version and the first quarter of 2023 is almost over already.

The Apple Car shows no signs of heading towards an official product release. The most recent news pushed out the launch of a self-driving EV until 2026 and Apple hasn’t lined up any partners for a project that could takes years to ramp up.

In both cases, Apple won’t come close to hitting the original product targets. The investor hype that drove the stock to $166 and above in early 2022 was misplaced with Apple failing to provide any indication of these products becoming meaningful revenue producers by 2026 now, if ever.

Prominent Bull Call

My original warning of 4 years of pain focused on overly bullish analysts driving the stock to irrational levels. Apple is a great company and the above products along with turning the Watch into a medical device could drive growth for decades ahead, but investors were accepting too much risk for the potential return in the next few years.

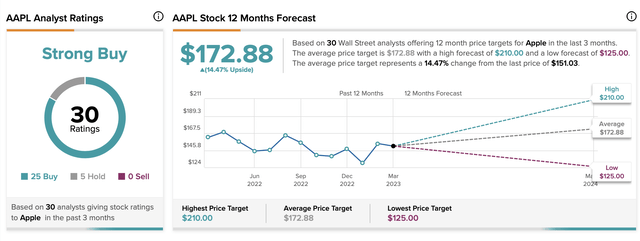

Over the last year, analysts have cut the price target by over $20 to $173. The group still remains as bullish on the stock with now 25 Buy ratings and 0 Sell rating despite the obviously stretched valuation.

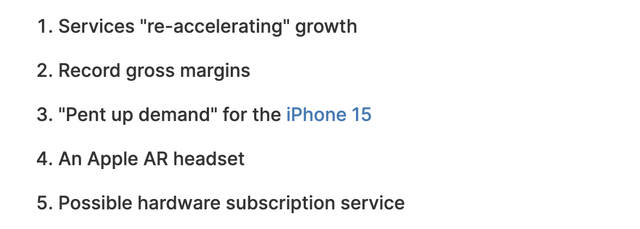

The new Morgan Stanley analyst was kind enough to highlight this overly bullish view on the anniversary of the dead money call. Analyst Erik Woodring increased the price target on Apple by $5 to $180 due to five “underappreciated” catalysts as follows:

While the debate should be whether Apple is expensive at the current price of $146 prior to this bullish call, Morgan Stanley predicted a $34 increase in the stock price leading to a $5 gain on Friday. Based on the current $6 EPS target for FY23, this bull call alone adds 6 points to the P/E multiple.

It’s one thing to argue whether Apple is expensive at 24x FY23 EPS targets, but an entirely different story to make the suggestion the stock should trade at 30x those EPS estimates. In fact, one can argue the catalysts outlined by Morgan Stanley are reasons for Apple to reach around the current price of $150.

If the tech giant does have pent-up demand for the iPhone 15 (not sure why) and the business produces record gross margins, Apple could be worth $150 in a year. The company would actually produce EPS growth at or above the 10% targeted growth for FY24 and similar or higher growth in FY25.

The biggest part of the bull call appears to be the suggestion Apple is worth up to $230 based on an hardware subscription service. The benefits of the subscription service have been debunked on numerous occasions due to consumers already having plenty of options to buy a Mac or iPhone via a monthly payment.

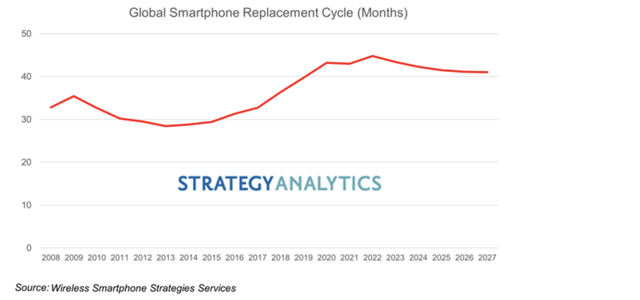

Morgan Stanley predicts the current iPhone replacement cycle will extend to 4.4 years to reach a new record high. A shift to a longer replacement cycle is a detriment to revenues. Apple would definitely see a big boost to revenues from a subscription service that somehow collected monthly revenues from consumers versus a current system where one pays a monthly fee for only 2 years until the phone is paid off.

According to Strategy Analytics, the global smartphone replacement cycle was 43 months (3.6 years) in 2022. While the research firm predicts the cycle to shorten through 2027, smartphones are likely to face lengthening cycles in the years ahead as consumers acquire phones with 5G speeds and less innovation each yearly cycle reducing the need for a new phone.

In the case of Apple, the recent push of consumers towards the iPhone 14 Pro Max with a starting cost of $1,099 likely lengthened that cycle. The prime way to justify a smartphone costing as much as a computer is to keep the device for 4+ years similar to a computer.

Takeaway

The key investor takeaway is that Apple trading below the price from last year is no surprise here. AAPL stock remains dead money for at least 3 more years. The catalysts provided by Morgan Stanley offer a path to how Apple could be worth the current stock price in a year, but the new analyst wants investors to overpay for the tech giant similar to his protege Katy Huberty.

Investors need to understand that Apple is a great company with slow growth in the years ahead. The best way to generate strong returns is to buy shares at the correct price and sell into the hype where a company with over $400 billion in annual revenues can miraculously grow at rates to warrant a forward P/E multiple of 30x.

Based on an aggressive 20x multiple for the FY26 EPS targets of nearly $7.50, Apple would have a max valuation at the start of 2026 of ~$150 and below the original dead money call at $166. One can easily argue the tech giant could see the P/E multiple contract closer to 15x in a high interest rate environment.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market heading into a 2023 Fed pause, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the out sized risk of high flying stocks.