Summary:

- Tesla Master Plan 3: accelerate the world’s transition to sustainable energy via a vertically integrated company producing vehicles, batteries, and Solar Panels.

- Tesla’s vision of driving “improved affordability” and “unprecedented scale” reinforced its priority in cutting price while building better products.

- Tesla might be able to hold profitability intact despite price cut.

Tesla Investor Day 2023 Robert Way/iStock Editorial via Getty Images

On Mar. 1st 2023 Tesla, Inc. (NASDAQ:TSLA) featured one of major EV events of the year – Tesla Investor Day 2023.The company’s leadership team did a very comprehensive 360-degree presentation about the future world we will be embracing. I enjoyed watching the Investor Day presentation and Q&A, and wanted to share a couple of thoughts about Tesla.

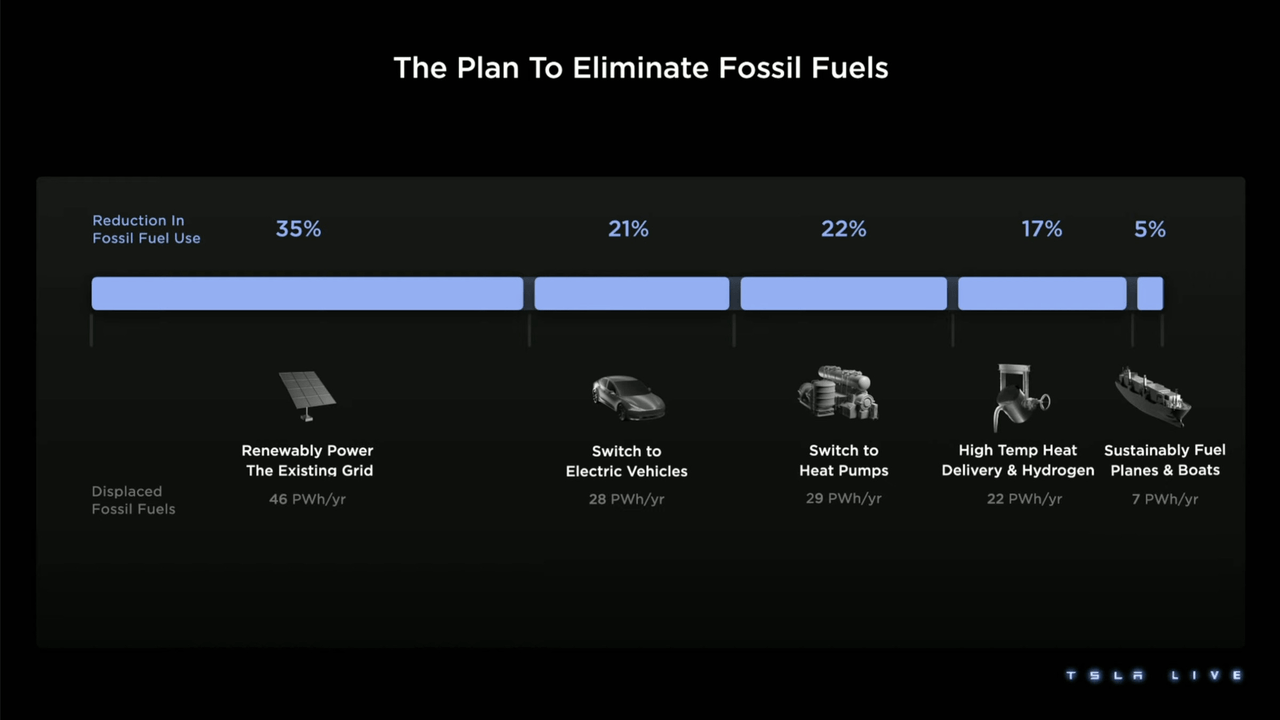

Tesla’s Master Plan 3 – Embarking on path to a fully sustainable energy for Earth

Tesla’s mission has never changed. Tesla envisions itself to lead the path for the earth to a fully sustainable energy in the long run. EV has meaningfully penetrated the auto industry thanks to Tesla and other EV manufactures efforts in building affordable products for consumers. As discussed in my previous article, Tesla’s 2023 Path Forward, Tesla brought sustainable energy to the industrial market. “Tesla Semi outperforms both diesel and electric truck competition, and its first 100 vehicles will go to PepsiCo (PEP) before mass production in 2023.” According to Master Plan 3, I think it means Tesla is embarking on a path to a fully sustainable energy for the earth. As shown in the following slide from Investor Day shows Solar Panel has a 1.5x addressable market size vs EV.

Tesla

Tesla is a pioneer in Solar energy, providing solar energy storage solutions (Solar Roof, Solar Panel, Powerwall, and Megapack) for our homes and lives. Solar products have not taken off yet primarily due to its economics (~8-year payback for Solar Roof). According to an article on Forbes, “a two-story, 2,000-square foot home with an 11.28-kW solar roof can cost a little more than $55,300 before tax incentives and credits. “A Tesla Solar Roof comes with significant initial costs and can rise if you’re replacing your existing roof. It takes a little more than eight years, on average, for home solar will pay for itself.”

I am positive about Tesla’s capability of reducing unit cost for solar products. From 2017 to 2022, EV unit cost decreased from $84k to $36k (-57%). What if Tesla is able to replicate its cost optimization success from Model 3 to Solar products, and meaningfully penetrate a 1.5x as large market as EV?

Tesla’s vision of driving “improved affordability” and “unprecedented scale”

A company can always have its targeted customer segment, and build perfect products for that customer cohort. It is very common that a company lets go customers outside its targeted segment considering price elasticity of demand. However that is not what Tesla wants to do. Tesla wants to eliminate fossil energy usage, which means ultimately it pursues 100% penetration rate across all customer segments on the earth. To get there Tesla will have to provide affordable rates and also great products for customers to be willing to spend, and to afford buying. To me this is Tesla’s commitment of cutting price while building better products.

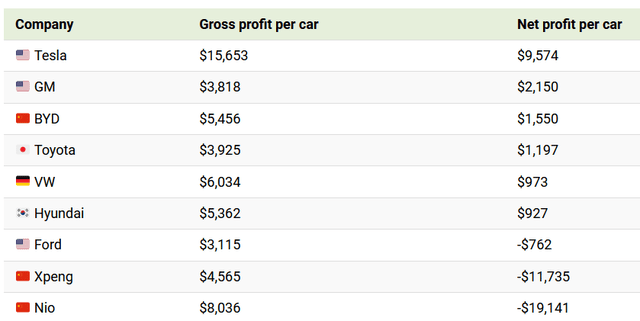

As the company said, it would be hard to do both at the same time. But I am optimistic considering Tesla as a distant leader in EV profitability, which implies much larger room for Tesla to optimize pricing based on consumer elasticity. The following figure shows that Tesla’s net profit is more than 4x of the No.2 company, and Tesla’s competitors in China currently lose $12k to $19k by selling one EV. Pricing reduction will also be a powerful weapon for Tesla to defeat other competitors in China. Recall that Tesla once said “an EV would sit around the $25,000 price point.”

Tesla might be able to hold its profitability intact while continuing to cut prices

Microeconomics tell us the relationship between price and volume. Admittedly pricing cut will enable Tesla to continue to unlock demand. However investors might be worried about its profitability, and its capability of creating shareholder value. My point of view is that Tesla might be able to hold its profitability intact when cutting prices. In other words, price cut and cost cut might likely offset each other, so Tesla maintains its profitability levels.

The company cited a variety of cost saving levers across SG&A, productivity, automation, etc. I would consider three major cost-saving drivers as follow.

1. Battery Improvement

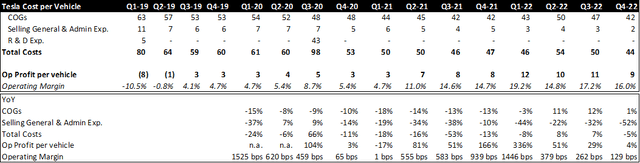

The following figure shows Tesla’s cost per vehicle, and how each line as changed YoY in the last 16 quarters. Tesla’s SGA costs have been significantly decreased benefiting from economies of scale, while COGs per vehicle has been trending upward in 2022.

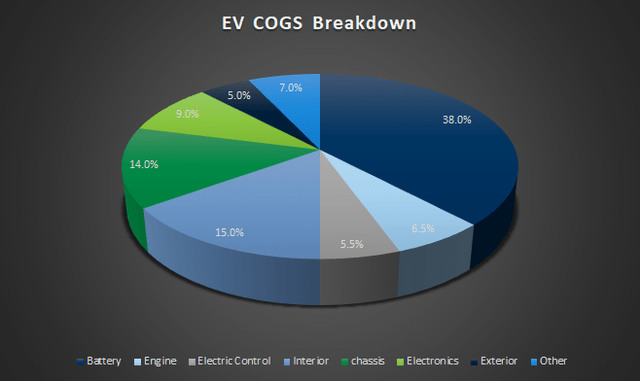

As shown in the following figure, 38% of total EV COGs come from Battery, the area that Tesla has been doubling down in innovation. According to Patent Cloud, among ~1000 patents from Tesla, over 900 are invention patents around Battery thermal management, electric machine, and battery charging.

There have not been a lot being quantitatively disclosed yet. But I expect Battery Improvement to be a major contributor to Tesla’s cost reduction.

2. Tesla’s Vehicle Platform

In the Investor Day, the company candidly shared how challenging it was to automate Model 3’s manual manufacturing process. With its past learning and pace of innovation, Tesla’s new EV platform will bring in material improvement. According to the company, “The platform is expected to bring a step change in vehicle cost (cut it in half).” “EVs based on the new platform would be produced at a volume higher than all other vehicles combined.”

Conclusion

Tesla presented a spectacular picture about how it is going to lead the path to sustainable energy for the earth. It sounds compelling and tangible only because IT IS TESLA. I am a big believer for Tesla continuing to lead this space, and I am also optimistic about Tesla’s capability to deliver better performance in both top line and bottom line in the near term.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.