Summary:

- McDonald’s has been in the industry for over 65 years, giving it a competitive advantage. The company has a loyal customer base and is constantly innovating to meet the changing environment.

- The company has a solid financial position, with a healthy balance sheet and wide margins enabling it to generate strong cash flows.

- My valuation exercise together with multiples analysis suggests that the stock is undervalued.

ozgurdonmaz/iStock Unreleased via Getty Images

Investment thesis

McDonald’s (NYSE:MCD) is a globally known company in the fast-food restaurant industry which has a strong success track record, including demonstrating resilience during the Covid-19 pandemic when lots of restaurants suffered and even went out of business. The company continues adapting to the changing environment and customers’ preferences, which will highly likely enable the company to sustain best-in-class margins together with enormous free cash flow conversion rates. My valuation analysis suggests that the stock is 18% undervalued.

Company information

McDonald’s is the world’s largest restaurant chain, with more than 40,000 fast-food restaurants across more than 100 countries. Of the 40,275 McDonald’s restaurants at year-end 2022, approximately 95% were franchised.

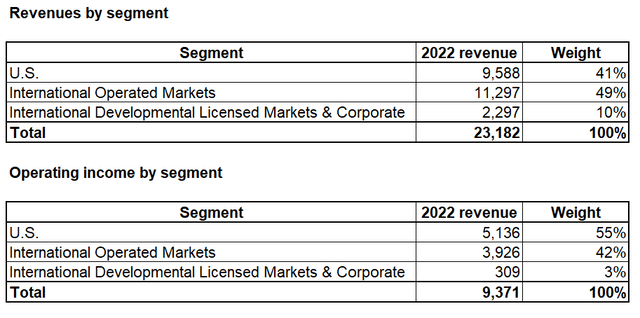

Significant reportable segments include the United States (U.S.) and International Operated Markets. In addition, there is the International Developmental Licensed Markets & Corporate segment, which includes markets in over 80 countries, as well as Corporate activities.

Financials

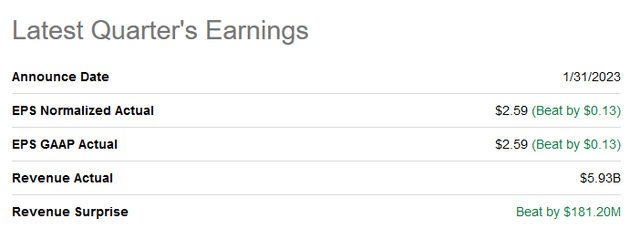

On January 31, 2023, MCD announced its latest quarterly earnings beating consensus estimates on both the topline and from an EPS perspective. EPS demonstrated a 16% increase from the same period a year earlier in spite of the revenue falling 1% YoY.

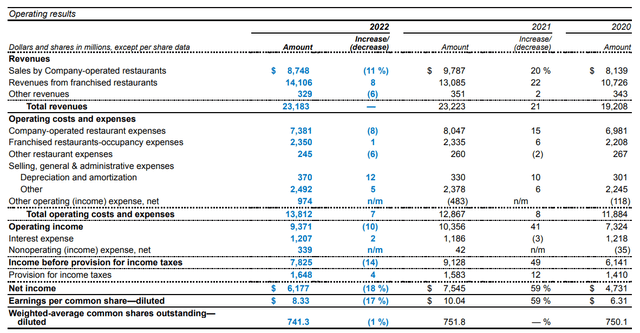

The company filed its latest annual 10-K report on February 24, 2023. Navigating through the challenging environment in 2022, consolidated revenues were flat at $23.2 billion, with operating income decreasing around 10% from the prior year. That means a shrink in operating margin from 44.6% in 2021 to 40.4% in 2022. Narrowing margins adversely impacted the bottom line, with diluted EPS decreasing by 17% and free cash flow (FCF) dropping 23% from the prior year to $5.5 billion.

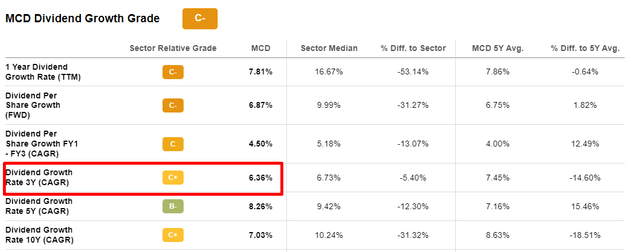

Despite margins narrowing and FCF declining, the company increased its quarterly dividend per share by 10% to $1.52 for the quarter. MCD has a strong Dividend Consistency Grade according to Seeking Alpha’s Quant ratings, largely thanks to 21 consecutive years of dividend growth.

The company’s outlook for FY 2023 is positive, with operating margin remaining robust at around the 45% level and a free cash flow conversion rate greater than 90%. Management seems committed to adapting to the changing environment via its “Accelerating the Arches” strategy by betting on the further enhancement of the company’s growth pillars.

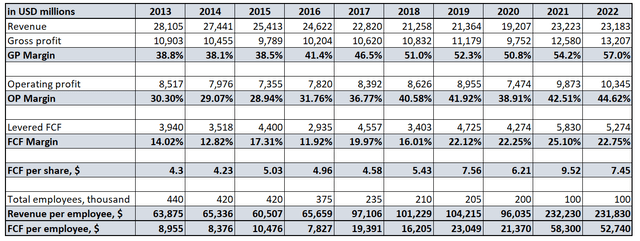

To assess whether a company performs well in the long-run, I usually prefer to zoom out and look at the company’s P&L and some of the cash flow metrics during the last 10 years. We can be misled by an 18% decline in revenue between 2013 and 2022, but the devil is in the details. After we dig down a bit, it becomes obvious financial performance of the company has been stellar.

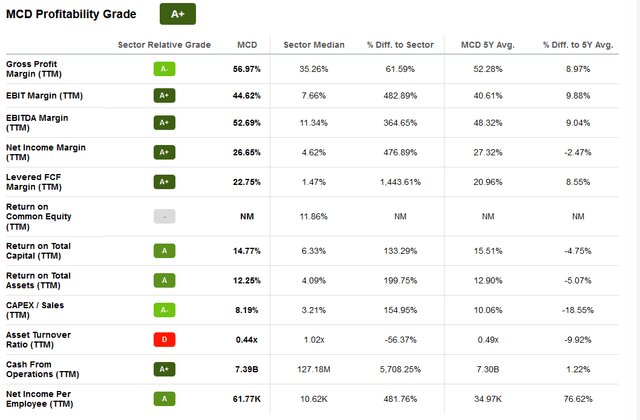

The company was working on improving efficiency and never chased topline growth just for the sake of topline growth. Striving towards efficiency led business margins to significantly expand: in 2022 the company earned 21% more in gross profit in spite of the fact revenues declined 18% which I believe is amazing. Expanded margins led to much stronger cash flows, with free cash flow (FCF) per share almost doubling in the last decade. And two metrics which I like the most here are revenue and FCF per employee, which increased almost four and six times, respectively. The company’s Profitability Grade is the highest possible, which is “A+”.

Overall, I consider MCD’s financial performance as very strong thanks to management’s stellar execution of transformation, which helped enable profitability metrics to skyrocket.

Valuation

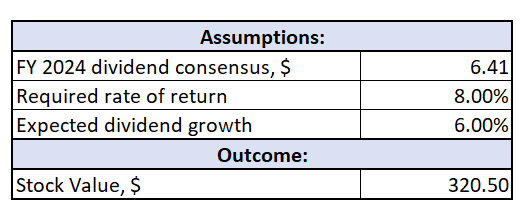

To perform a valuation of MCD stock, I used the dividend discount model (DDM). I need three assumptions which include the required rate of return, current dividend, and expected dividend growth rate. For the required rate of return, I use WACC, which is provided by GuruFocus. MCD WACC is at a 7.13% level, but to be conservative in the current environment of Federal Reserve interest rate hikes, I round it up to 8%. Consensus dividend estimates see the FY2024 dividend at $6.41 per share, and for the dividend growth I use a 3-year dividend growth rate CAGR rounded down to 6%.

Putting together all the assumptions described above, the DDM suggests that MCD stock is undervalued by 18%, with a fair price at about $320 per share.

Author’s calculations

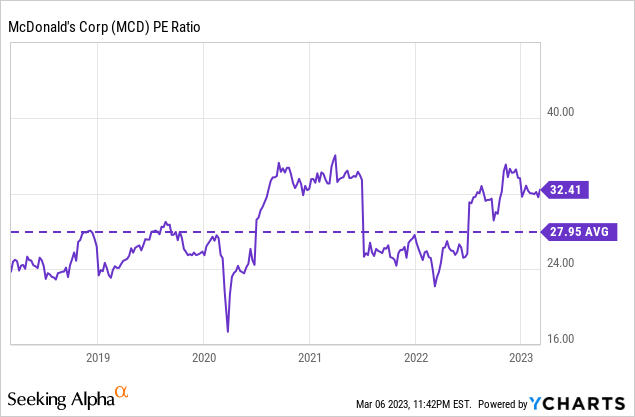

To challenge my calculations, I would also like to analyze valuation multiples and compare them to the company’s historic levels. The company’s last 5-year average P/E is about 28, which gives us a $326 fair price per share if we multiply the average multiple by FY 2024 EPS, which is expected by consensus earnings estimates to be at $11.66.

To sum up, DDM outcomes together with multiples analysis indicate that MCD stock has an upside potential of 18%. Argus Research (sign-in required) is slightly more conservative than me, indicating a 12-month target price for MCD at $306, which represents a 13% upside potential.

Risks to consider

Apart from stellar financials and undervaluation, there are still some risks which investors should consider before buying MCD stock.

First, about 60% of the company’s revenues are generated outside of the U.S., so the financials can be adversely impacted by unfavorable fluctuations in foreign exchange rates.

As a second big risk, I see the intense competition in the fast-food restaurants business, with MCD facing intense competition from any market player offering the public fast food at a cheap price. The company’s market share could deteriorate if it does not keep up with changing preferences of the customers or if competitors offer better deals.

Third, MCD operates in a consumer discretionary sector which is vulnerable to adverse changes to the overall economy’s health. In case of a recession, consumer spending on fast food is highly likely to decline, which will put downward pressure on the company’s earnings.

Fourth, McDonald’s faces a variety of laws and regulations related to its operations which include health regulations, food safety regulations, and labor laws. Changes in these regulations could be unfavorable for the company and lead to increased operating costs.

Bottom line

In conclusion, I believe MCD represents a solid investment opportunity in the fast-food restaurants industry because of its strong brand name, its commitment to adapting to changing environments, and stellar profitability. What I especially like about MCD is that it has proven resilient during the Covid-19 pandemic thanks to the increased drive-thru and delivery sales together with management’s initiatives to control costs. MCD is a buy given the company’s strong success track record together with safe dividends and my DDM calculations suggesting that the stock is currently undervalued.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.