Summary:

- Netflix is one of the world’s leading entertainment services with approx. 230 million paid memberships in over 190 countries.

- Netflix global market share in the video streaming market continues to decline as competition intensifies.

- Despite strong competition, Netflix is in a great position to take advantage of the growing video streaming market set to grow to $137 billion by 2027.

hocus-focus

Business Overview and Investment Thesis

Netflix Inc. (NASDAQ:NFLX) operates one of the largest video streaming subscription-based business models, meaning that the company generates revenue by charging its customers a monthly or annual fee for access to its TV series and films across a wide variety of genres and languages. NFLX is active in over 190 countries offering content to its customers which they can access anytime, anywhere, and on any device with an internet connection. NFLX customers can choose from a variety of subscription plans including its new and cheaper Advertising model which will allow customers access to its platform at a discounted price. With over 230 million paid memberships NFLX is a highly successful company in the growing video streaming market.

Since its market valuation peak in late 2021 when it reached the $300 billion mark, the company has seen a substantial drop to its current market valuation at $140 billion. The market has punished NFLX as a result of a deceleration in subscriber growth rate and intense competition in the space with leading technology companies such as Amazon (AMZN), Disney (DIS), and Warner Bros. Discovery (WBD), etc. making big investments in order to gain market share. Despite these headwinds, NFLX continues to develop its strategies to gain more subscribers and boost revenues, this is visible with the company‘s recent deployment of its advertising revenue model. Furthermore, the projected market size for the streaming services market stands to be ~$137 billion by 2027, which provides NFLX a long runway for growth. This opportunity combined with the significant decrease in valuation has placed NFLX stock in an attractive position for a long-term investment opportunity. Let‘s dive into the company‘s financials.

Financial Overview

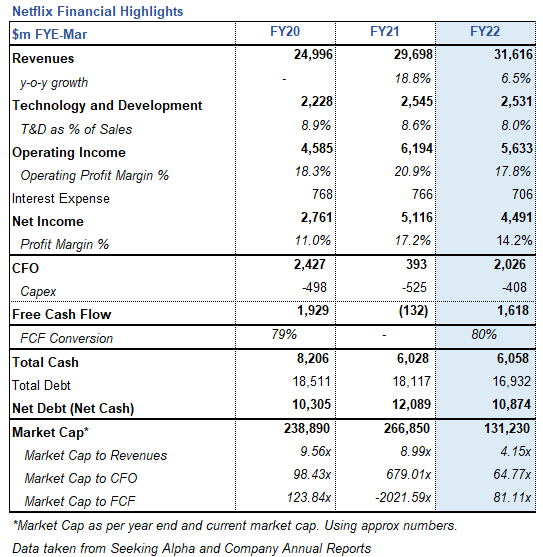

Netflix Financial Highlights (Annual Report and Seeking Alpha Data)

As previously mentioned NFLX generates revenues through its subscription based model, where customers pay a monthly or annual fee for access to its streaming service. During 2022, NFLX increased revenues to $31.6 billion, which amounts to a 6.5% increase compared to the previous year. The revenue increase was largely driven by the addition of approx. 9 million subscribers combined with membership price increases during the year. Despite this increase in revenues, the company‘s operating profit decreased to $5.6 billion compared to $6.2 billion during FYE 2021. This decrease was a result of higher operating expenses led by acquisition, licensing, and production of content expenses. Important to note that most of the market players invested heavily in content during the 2022 year. For example, AMZN made investments to the tune of $7 billion just in Amazon Originals, live sports, and licensed third-party video content during 2022. These results led NFLX to report a profit for the year of $4.5 billion which equates to a profit margin of 14%.

NFLX cash flow from operations during 2022 stood at $2 billion, while its free cash flow totaled $1.6 billion. This is a nice improvement compared to the previous year when the company‘s cash flow from operations was not sufficient to cover capital expenditures. This cash generation helped NFLX bolster its balance sheet by repaying $700 million of debt while at the same time investing $900 million in short term investments. As a result, the company reported a cash and cash equivalents position of $6.1 billion and a decrease in its net debt position to $10.9 billion.

Performance per Geography

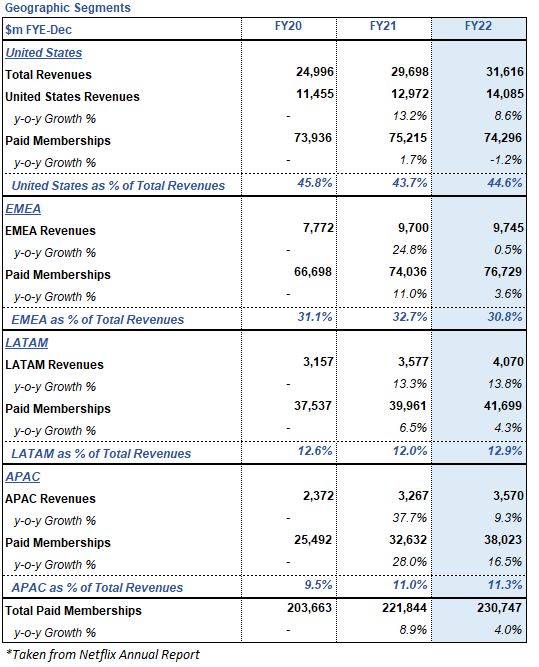

Performance per Geography (Annual Report)

In terms of revenue per geography, the United States accounted for 45% of total revenues, while the rest of the revenues came from EMEA (Europe, Middle East, and Africa) at 31%, LATAM (Latin America) at 13%, and APAC (Asia Pacific) at 11% of total sales during FYE 2022. This geographic diversification helps NFLX mitigate the risk of relying too heavily in one particular region. From the table above, it can be seen that the LATAM and APAC regions saw the highest percentage increases in revenues while paid memberships saw a deceleration across all regions compared to 2021. It will be interesting to see how the new advertising model performs across all regions as NFLX is focusing this initiative on major countries including the United States, Brazil, Mexico, Japan, the United Kingdom, France, Germany, Korea, Spain, Italy, Australia, and Canada.

Competition

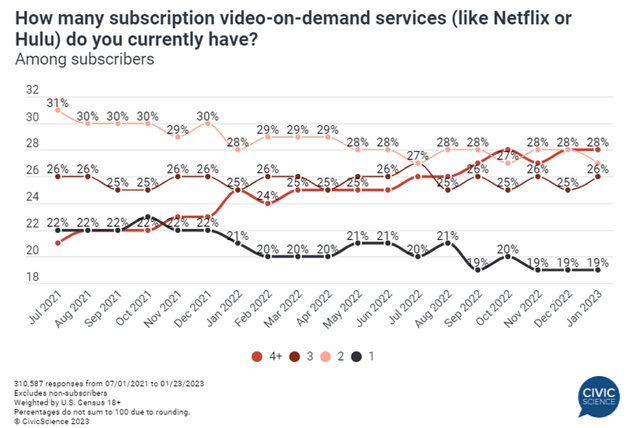

For a long time Netflix was to some extent the only game in town for streaming services, however this has changed in the last few years with the market seeing large cap and well-funded companies enter the market. These companies include Disney, Warner Bros. Discovery, Amazon, Apple (AAPL), Paramount Global (PARA), etc. All these competitors have invested heavily in their platforms and have a lot of experience developing great content. As such we now have a competitive market. However, it should be mentioned that this is not a winner takes all market, there is room for multiple players to compete. For reference a survey by Civic Science has shown that about 81% of subscribers have 2 or more video streaming subscriptions at the same time. Nonetheless, these companies are competing for consumer time and consumer money, so offering great content is of great importance.

Subscription Survey (Civic Science)

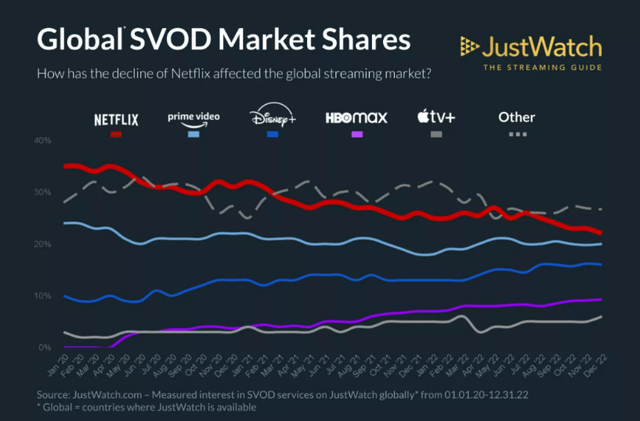

The result of the competition seen during the previous years has led NFLX to lose market share to the various competitors in the space. According to Just Watch, as of December 2022 NFLX is still the most dominant player in the market, however Prime Video and Disney+ are both very close to NFLX and continue to invest heavily in their platforms and content. Furthermore, Disney will also offer an advertising subscription which should help increase its subscribers numbers. In the other hand, Amazon continues to plow money into Amazon Prime with the company investing $7 billion in Amazon Originals, live sports, and licensed third-party video content during 2022.

Global Streaming Video Market Shares (JustWatch)

Video Streaming Market Opportunity

The streaming market is increasing its relevance in various markets. The beauty about video streaming services is that it is a personalized service which leads to a better experience for the customer. As previously mentioned, the streaming video market is highly competitive, and companies are investing heavily in producing original content and acquiring the rights to popular TV shows and movies in order to attract and retain subscribers. However this is not a winner takes all market, the possibility for different companies to thrive at the same time is quite high as people usually want to have more than one subscription at the same time. With the market set to grow to $137 billion by 2027 there is still room for growth for all market players. Further to this, companies are trying new ways to generate revenues such as including advertising for a discounted price. This should help companies bolster revenues as people may see more value for their money.

Valuation

NFLX has experienced substantial volatility during the past two years reaching its peak market valuation at $300 billion in late 2021. The bullishness was shortly lived as the company‘s market valuation dropped by more than 75% to $74 billion within six months. Since this low, the company has seen a market valuation increase of almost 100% to $140 billion. Investors could have gotten caught by the decline or could have taken advantage of the bottom, regardless these fluctuations pose a significant risk to investors.

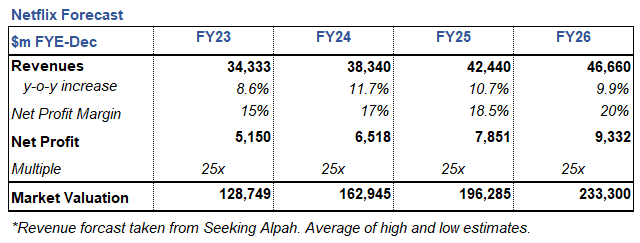

With the current market valuation, the company’s multiples stand at a price to cash flow 66.8x and price to sales of 4.2x. For the valuation of the company, I have used the market multiple method, using future forecasted earnings to a 25x multiple. It should be noted that this is a low multiple compared to what the company has traded historically, as such I believe it is reasonable. I have obtained the analysts’ revenues forecast from Seeking Alpha data and have applied a net profit margin which progressively arrives to 20% by the end of 2026. This should be achievable as the company should be able to get more efficient as it continues to grow. With these numbers I arrive to a market valuation by FYE 2026 of $233 billion. It is important to understand that this is based on estimates and assumptions which can change. The company could in fact return back to its highest valuation, however I always try to be conservative.

Netflix Forecast (Seeking Alpha & Author‘s Estimates)

Risks

Strong Competition

As mentioned across the article, NFLX faces intense competition from other streaming services, such as Amazon Prime Video, Disney+, HBO Max, and others. Increased competition could result in higher operating expenses, a decline in subscriber growth and pricing pressure. All these could have negative impacts on NFLX financial performance.

International expansion will present Challenges

Netflix has been expanding globally to over 190 countries, this presents challenges such as adapting to different cultures, languages, and regulations. Despite this expansion being a possibility to generate higher revenues, it could also lead to higher content costs, currency risks, and operation challenges.

Currency Risks

NFLX generates a significant portion of its revenue from outside the United States with currencies denominated other than the U.S. Dollar accounting for 56% of revenues during 2022. As a result, NFLX is exposed to currency risks, for reference the company reported that revenues would have been approximately $1.8 billion higher had foreign currency exchange rates remained constant compared to 2021. These risks are not only seen in revenues but also in expenses as NFLX is operating in different regions at the same time. Management will need to continue to implement efficient strategies in order to mitigate this risk.

Conclusion

In summary, Netflix generates revenues primarily through its subscription-based model and has shown strong financial performance in terms of revenue growth, cash flow from operations, and free cash flow. The company faces competition from other streaming services but remains one of the top players in the market. Netflix’s strong balance sheet, focus on international expansion, new advertising revenue model and dominant position in the growing video streaming market which is projected to grow to ~$137 billion by 2027 provides a solid foundation for growth. These factors in combination with the decrease in market valuation has put NFLX in an attractive position for a long-term investment opportunity. As such, I believe NFLX stock currently presents a buying opportunity.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.