We Are

The short interest on 23 out of 38 consumer staple stocks—part of the Consumer Staples Select Sector SPDR Fund (NYSEARCA:XLP)—increased in April vs. previous month. The remaining 15 stocks saw a fall in their short interest.

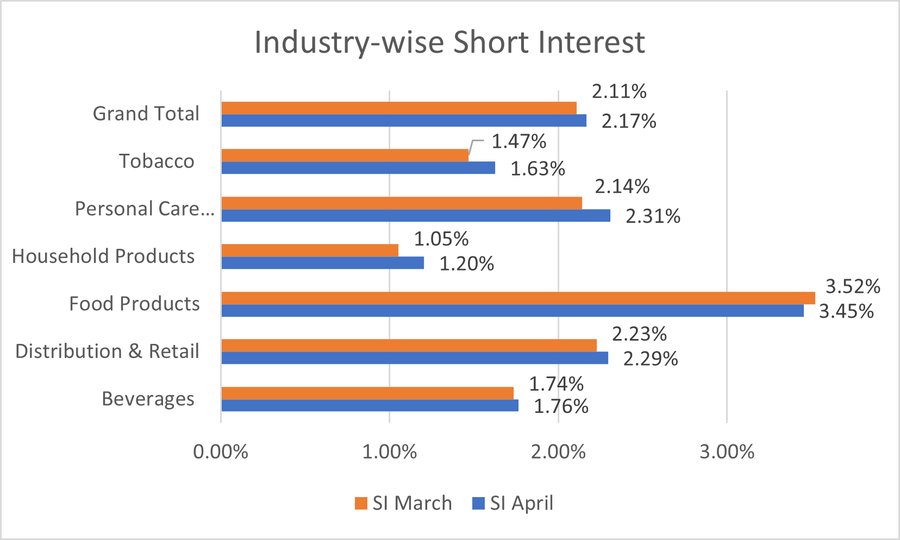

Industry-wise, short interest bets moved higher 4 out of 6 sub-sectors, and the grand total of short interest also increased to 2.17% in April from 2.11% in March.

Industry Analysis:

In the consumer defensive/staples sector, Food Products remained the most shorted industry, like the last few months, with an average short interest of 3.45% vs. the previous month’s 3.52%.

The Personal Care Products industry had the second-highest short interest of 2.31% in April, vs. 2.14% last month.

Short interest in the Household Products segment was lowest at 1.20% vs. 1.05% prior. Beverages was the second-lowest segment, with a short interest of 1.45% vs. 1.85%.

Personal Care Products short interest increased to 2.31% from 2.14%, while that for Tobacco was 1.63% vs. 1.47% prior.

Seeking Alpha

Short interest, which could potentially be an indicator of pessimism, calculates the number of shares sold against the company’s float. (Short Interest % = Number of Shares Sold Short ÷ Stock Float). To note, consumer staples often underperform in rising markets but beat the falls.

Least shorted stocks:

- Procter & Gamble (NYSE:PG): 0.80% vs. 0.73% last month

- Philip Morris International (NYSE:PM): 0.90% vs. 0.58%

- Coca-Cola (NYSE:KO): 0.94% vs. 0.88%

- Walmart (NYSE:WMT): 1.10% vs. 0.85%

- Costco WHolesale (NASDAQ:COST): 1.36% vs. 1.34%

Most shorted stocks:

- Brown-Forman (NYSE:BF.B): 9.81% vs. 9.96%

- Campbell Soup (NASDAQ:CPB): 9.38% vs. 8.95%

- Dollar Tree (NASDAQ:DLTR): 7.78% vs. 7.57%

- Molson Coors Beverage (NYSE:TAP): 6.47% vs. 7.72%

- Hershey Foods (NYSE:HSY): 5.58% vs. 5.84%

The S&P 500’s consumer staples sector ETF (NYSEARCA:XLP) was almost flat in April, up 0.05% compared to a broader S&P 500 ETF Trust (NYSEARCA:SPY) loss of 1.14%. Noting, consumer staples (NYSEARCA:XLP) often get attention in a risk-off scenario.

ETFs to tab consumer staples: (NYSEARCA:VDC), (NYSEARCA:IYK), (NYSEARCA:FSTA), (NYSEARCA:KXI), (NYSEARCA:FXG), (NYSEARCA:RSPS).

More on Consumer Staples

- SPY: How Well Is It Really Understood?

- SPY: Expected Economic Aftershocks Make Me A Bear Right Now

- U.S.-China Trade War: Implications And Market Outlook For 2025

- ‘Volatility is the name of the game’ from now on – MetLife’s chief market strategist

- Wells Fargo: U.S. will avoid recession, maintain exceptionalism amid shifting policies