Summary:

- The company is recovering revenues at a very fast pace driven by restriction lifts after the coronavirus pandemic crisis.

- Both gross profit and EBITDA margins are profoundly depressed due to inflationary pressures, and the company is losing cash at a very fast pace.

- The company is taking too much debt and interest expenses are skyrocketing amidst recessionary concerns.

- Share dilution has damaged shareholders permanently.

- The risk profile of the company is too high, so I consider Carnival a company that should be better avoided.

NAPA74/iStock via Getty Images

Investment thesis

Carnival Corporation (NYSE:CCL) is walking a tightrope. If you read the latest earnings call, you will likely notice high optimism on the part of the management, but it is important to understand that in times as complicated as the current ones for the company, we, as investors, must carefully investigate the company’s balance sheets and operations’ performance as we may not be getting the complete picture from management presentations that point to the positive and optimistic aspects of the short and medium term. Despite strong marketing efforts, revenue per user increase, higher fuel and operating efficiency initiatives, and new program launches, both gross profit and EBITDA margins are profoundly depressed due to inflationary pressures as the balance sheet is deteriorating at a (very) fast pace. The company’s debt levels are increasing at alarming rates, which is creating too high interest expenses that will need to be met at the end of each period. Furthermore, cash from operations remains in negative territory and shares are diluting very fast. At this point, returning to 2019 cash-generating levels will not be enough to cover current interest expenses and CAPEX, so I think it is better not to get carried away by the low price of the shares, especially considering current recessionary risks associated with increasing interest rates by central banks in order to stabilize inflation rates, which would have a direct impact on consumer purchasing power.

As time passes, things keep worsening: more cash losses, more debt, higher interest expenses, more share dilution, and, therefore, fewer chances to turn the ship around.

A brief overview of the company

Carnival Corporation is the largest global cruise company and is among the largest leisure travel companies with a portfolio of world-class cruise lines operating in North America, Australia, Europe, and Asia. The company was incorporated in Panama in 1974, and in England and Wales in 2000, and its market cap currently stands at ~$14 billion, employing around 87,000 workers worldwide. Insiders own 9.89% of the shares outstanding, which means that the management is a direct beneficiary of the good performance of the company’s share price.

Carnival Corporation logo (Carnivalcorp.com)

The company’s portfolio includes AIDA Cruises, Carnival Cruise Line, Costa Cruises, Cunard, Holland America Line, Princess Cruises, P&O Cruises (Australia), P&O Cruises (United Kingdom), and Seabourn.

But despite such a strong portfolio of brands, the company had to cancel its quarterly dividend of $0.50 per share in 2020 due to the coronavirus pandemic outbreak and the profitability issues derived from it. Furthermore, inflationary pressures and recessionary concerns are casting serious doubts on the viability of the company in the long term, and not in vain.

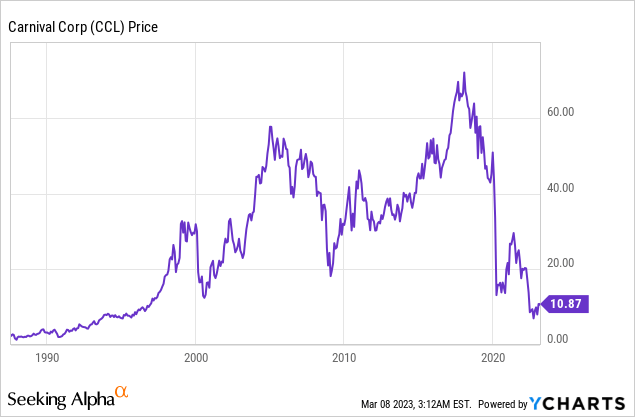

Currently, shares are trading at $10.87, which represents an 83.58% decline from all-time highs of $66.19 on January 29, 2016. Certainly, this is a very precipitous decline in the price of shares that I believe is heavily supported by a deteriorating balance sheet and operations, as well as an increasingly uncertain macroeconomic context as a result of current recessionary risks due to rising interest rates. For this reason, it is very important to consider the risks associated with Carnival before venturing to bet on a turnaround since time is playing against the company and the balance sheet is deteriorating at a dizzying rate.

Lost revenues are recovering very fast

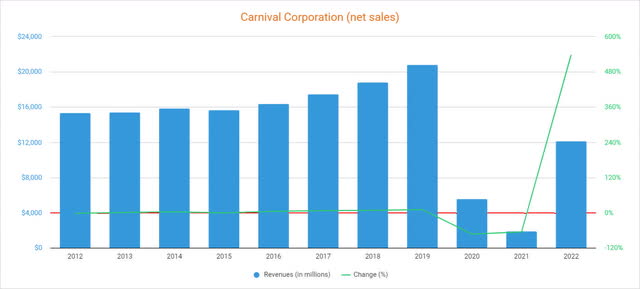

In the 2012-2019 period, the company achieved steady and very acceptable revenue growth rates, which were accompanied by a significant increase in the share price, but in 2020 and 2021, with travel restrictions due to the irruption of the coronavirus pandemic, these have plummeted to very low levels. In this sense, revenues declined by 73.14% in 2020 and by another 65.89% in 2021. Nevertheless, revenues increased by a whopping 537.79% in 2022 (which is still -41.6% compared to 2019).

Using 2022 as a reference, 65% of revenues are generated through operations within North America, whereas 32% take place in Europe, 2.5% from Australia and Asia, and less than 1% from the rest of the world.

Carnival Corporation net sales (10-K filings)

The good news is that revenues are still showing signs of improvement. In this sense, revenues of $3.84 billion during the fourth quarter of 2022 only represent a 19.70% decline compared to the same quarter of 2019, which shows the company is recovering from the pandemic loss of revenues at a quick pace. Furthermore, restriction lifts are to be expected in China sooner or later. Despite this, the share price has only continued to fall, which reflects that the increase in the company’s revenues is not something to be celebrated.

This is so because, despite the increase in revenues, profit margins are still deeply depressed, which is producing large economic losses that are having a direct impact on the company’s balance sheet, and time is, in my opinion, already running out.

Margins are failing to recover

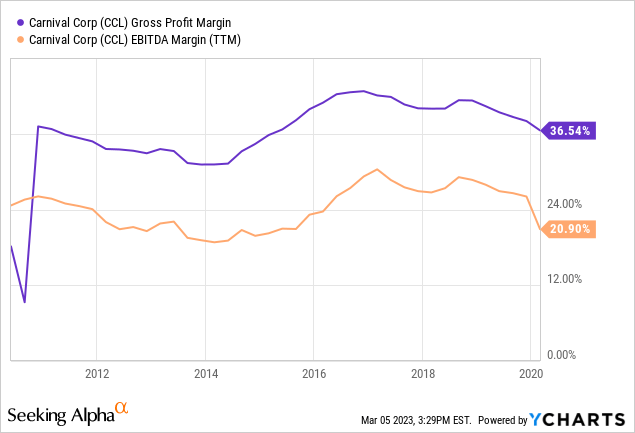

Before the coronavirus pandemic crisis, the company was highly profitable with gross profit margins above 35% and EBITDA margins above 20%, which enabled high cash from operations. This is so because of the nature of the company’s services, which operate in the luxury industry.

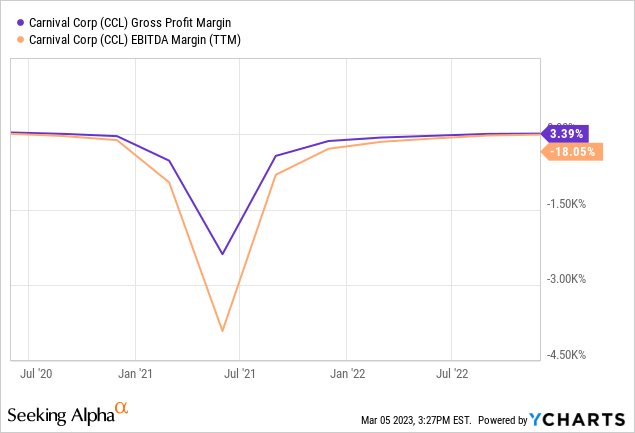

Profitability issues began to take place in 2020 due to restrictions taking place all around the world as a consequence of the coronavirus pandemic outbreak and the subsequent inflationary pressures. Now, the conflict between Russia and Ukraine is making the current economic landscape even more complex. In this sense, the current trailing twelve months’ gross profit margin stands at 3.39% and the EBITDA margin at -18.05% despite an improvement from a 50-point gap in occupancy during the first quarter of 2022 to less than 20 points in the fourth quarter and despite constant dollar revenue per passenger cruise day 2% higher compared to 2019.

Things slightly improved during the past quarter with gross profit margins of 4.53% and EBITDA margins of -15.26%, but these figures are far from making Carnival Corporation a profitable company. Part of the improvement was possible thanks to a year-over-year increase of constant dollar revenue per passenger cruise of 4% per day. Also, the management took an initiative that enabled a 30% reduction in food waste. The problem is that even if the positive profit margins the company was used to are achieved again in the long term, debt levels have shot up to stratospheric levels due to the headwinds that have taken place since the beginning of 2020.

Debt has skyrocketed and interest expenses will be hardly met in the future

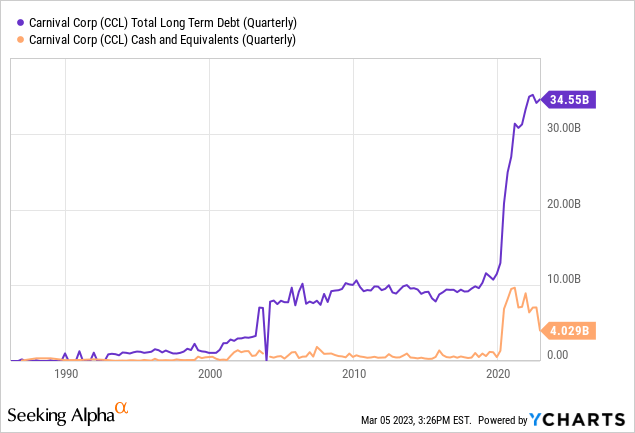

Since the beginning of 2020, the company’s long-term debt has more than tripled from ~$10 billion to $34.6 billion, and current cash and equivalents of $4.03 billion is depleting fast, with which the company could continue to borrow even more.

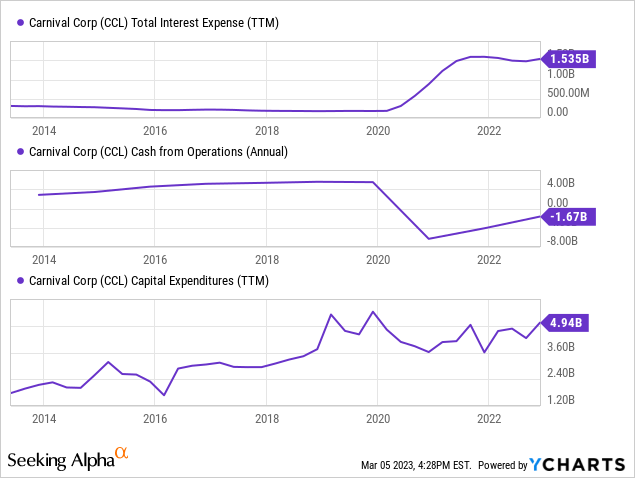

As a consequence of the recent increase in long-term debt, trailing twelve months’ interest expenses skyrocketed to $1.54 billion. Furthermore, interest expenses increased to $408 million during the past quarter, which suggests trailing twelve months’ interest expenses will soon surpass $the $1.6 billion mark. To this, we must add the fact that cash from operations was negative at -$1.67 billion during 2022 while capital expenditures reached $4.94 billion. This means the company is losing cash at a very, very fast pace. Still, cash from operations of -$1.67 billion represents a significant improvement compared to $-4.11 billion during 2021. As for the past quarter, cash from operations was still negative at -$117.0 million (vs. -$368.0 million during the same quarter of 2021).

The company is currently ramping up advertising efforts, but these efforts are being carried out through the use of debt, which carries the risk of not giving overall positive returns. The point here is that reaching past (2019) cash from operations capacity, despite a recent improvement, is something that is clouded by the current recessionary risks due to the rising interest rates by central banks in order to reduce unsustainable inflation rates all around the world. And even if the company recovers profitability levels prior to 2020 (of slightly over $4 billion), those wouldn’t be enough to cover current interest expenses of over $1.6 billion and capital expenditures of almost $5 billion (or even ~$3 billion in more conservative years), which makes the company’s profile risk very high.

Therefore, in my opinion, the company’s operations are (increasingly) unsustainable in the long term.

Risks worth mentioning

As I have mentioned throughout the article, the company’s risk profile is too high at this point, but I would like to underline the ones that I consider most important at this moment.

- Both gross profit and EBITDA margins are very depressed due to high inflationary pressures and lower revenues, which has sunk cash from operations into negative territory.

- The company’s interest expenses are reaching very unsustainable levels due to a very fast-rising debt load. If the company keeps losing cash, it could be forced to take more debt until being not able to keep operating.

- The global economy could experience a (more or less) deep recession as a result of rising interest rates due to high inflation rates stemming from the coronavirus pandemic, the subsequent reopening of economies all around the world, supply chain issues, and the war between Russia and Ukraine.

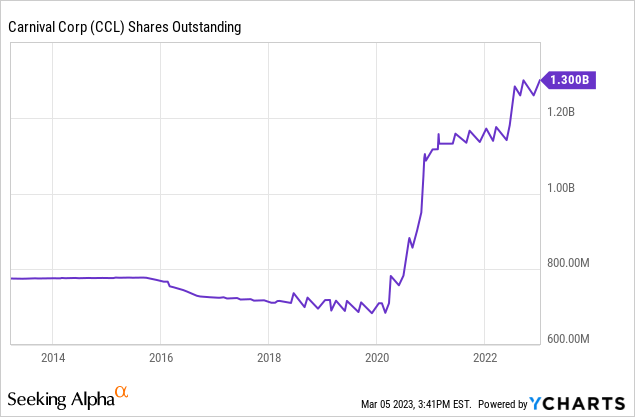

- Share dilution is taking place at the worst time, that is, when prices have fallen sharply in the 2020-2022 period. In this sense, the number of shares outstanding increased by a whopping 111% to 1.11 billion from the beginning of 2020 to the beginning of 2023, whereas shares outstanding of Carnival Plc increased by 2% in the same time-frame.

This means that each share of the company now represents a much smaller slice of the company, and what is worse is that it is very likely that the management will be forced to continue issuing shares to sustain its operations in the short and medium term.

- Lastly, the company’s turnaround is not something impossible to happen. If revenues keep increasing and profit margins begin to enable positive cash from operations, the share price could increase significantly. This could happen especially if inflationary pressures ease and recessionary risks subside.

Conclusion

In my opinion, the current market cap of ~$14 billion is sustained more on the company’s brands and its leading position than in the returns that the shares can offer to shareholders in the short, medium and/or long term. Gone are the days when the company paid a reliable dividend every year (and even repurchased shares).

Share dilution has damaged shareholders permanently in the sense that each share now accounts for a significantly smaller portion of the company, a trend that could continue in the short to medium term as long as profit margins remain negative. And even if the company manages to break into profitable territory, there are now much higher interest expenses that need to be met each year.

Although revenues are recovering, both gross profit and EBITDA margins are far from levels prior to the coronavirus pandemic crisis. Furthermore, recovering profitability levels of 2019 are already just not enough to sustain the company’s current balance sheet due to rising interest expenses, which makes me think that Carnival Corporation is a company that investors should just avoid.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.