ShutterWorx/iStock via Getty Images

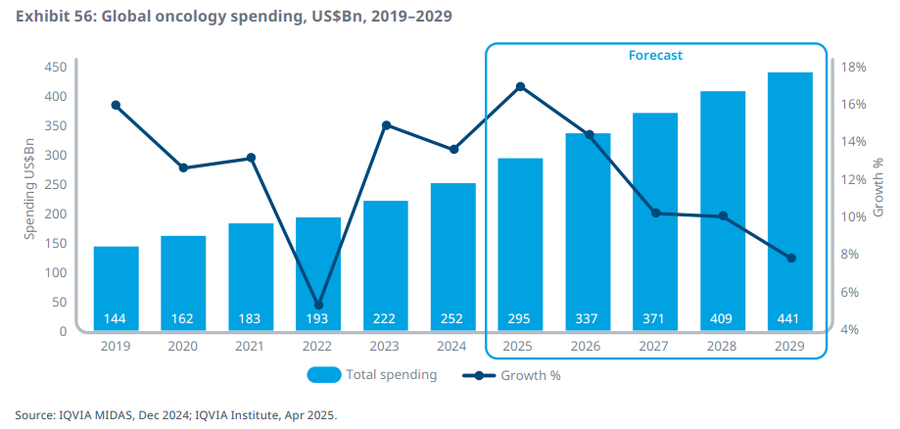

Spending on cancer drugs is expected to reach $441B globally in 2029 despite a slowdown later in the decade as key oncology medicines lose market exclusivity, drug analytics and contract research firm IQVIA (IQV) said in a recent report.

In this year’s edition of its global oncology trends report, IQV’s data analytics unit IQVIA Institute added that spending on cancer medicines expanded 75% over the past five years to reach $252B in 2024.

After averaging 11.9% growth annually from 2020 to 2024, the spending growth is expected to slow from 2027 as some of the key oncology products lose market exclusivity, paving the way for generic and biosimilar competition.

Notable cancer drugs facing patent cliffs include Ibrance from Pfizer (NYSE:PFE) and Xtandi from Pfizer (NYSE:PFE)/Astellas (OTCPK:ALPMF) (OTCPK:ALPMY). Both small molecule drugs lose market exclusivity in 2027.

Meanwhile, PD-1 inhibitors, Keytruda from Merck (NYSE:MRK) and Opdivo from Bristol Myers Squibb (NYSE:BMY), which made up a tenth of global cancer spending in 2024 will no longer enjoy patent protection from 2028 largely impacting oncology spending growth in 2029, IQV said.

However, antibody-drug conjugates, bispecific antibodies, and cell/gene therapies will offset the impact, contributing to roughly 20% of oncology expenditure in 2029, up from 9% and 3% in 2024 and 2019, respectively.

The report noted that major developed markets, led by the U.S., which made up 74% of cancer drug spending in 2024, are expected to witness a slowdown in growth over the next five years, especially in 2028 and 2029, amid generic and biosimilar competition.

Global oncology spending (IQVIA MIDAS, Dec 2024; IQVIA Institute, Apr 2025.)

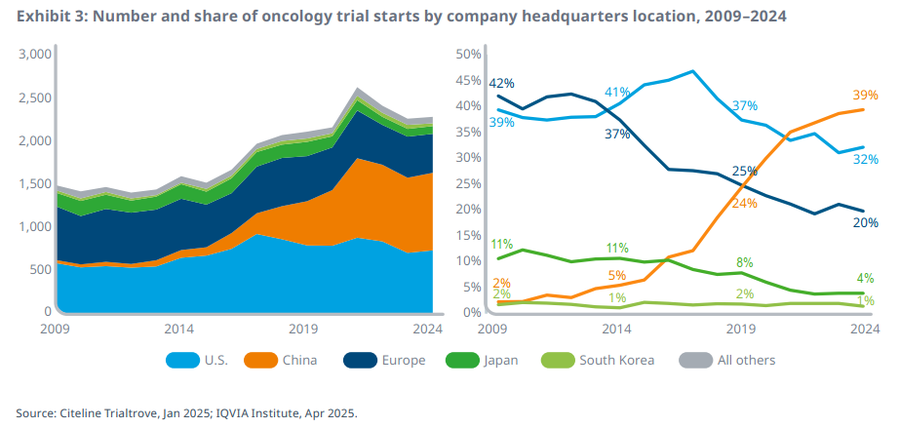

In terms of R&D trends, Iqvia (IQV) said that Chinese companies have led 39% of newly started oncology trials in 2024, up from only 5% a decade ago, with 84% of their trials concentrated locally.

“Trials run by China-headquartered companies have seen significant growth in the last decade, highlighting the important role that companies headquartered there will play in the development of new products globally,” the firm said.

Meanwhile, the U.S. has accounted for 32% of oncology trial starts in 2024, down 5% since 2019, and Europe’s share in new cancer trials has dropped 14% over the past five years to 20%.

Leading cancer drugmakers: Pfizer (NYSE:PFE), Merck (NYSE:MRK), Bristol-Myers Squibb (NYSE:BMY), Eli Lilly (LLY), AstraZeneca (AZN), GSK (GSK), Novartis (NVS) (OTCPK:NVSEF), AbbVie (ABBV), Roche (OTCQX:RHHBF) (OTCQX:RHHBY), Johnson & Johnson (NYSE:JNJ), Amgen (AMGN)

Number and share of oncology trial starts (Citeline Trialtrove, Jan 2025; IQVIA Institute, Apr 2025.)