Summary:

- Tesla, Inc.’s near 60% year-to-date recovery looks set to continue amid the market’s risk-on appetite.

- Although industry consolidation is inevitable, Tesla’s sales growth is yet to revert to a linear distribution, given Tesla’s market share and the exponential growth attached to the EV space.

- Rumors of a lithium mine acquisition and an additional Gigafactory indicate that Tesla is working toward a lower cost base.

- The company’s downstream endeavors could garner assistance from China’s reopening and EV product switching.

- Tesla is relatively undervalued, and its ROE exceeds its CAPM, suggesting that the stock possesses untapped value.

AdrianHancu

It has been a rollercoaster ride for Tesla, Inc. (NASDAQ:TSLA) stock recently, as various market-based and idiosyncratic features coalesced to ramp up the asset’s volatility. With the stock’s recent form in mind, we decided to formulate a long-term vantage point for investors by juxtaposing critical operational features and discussing the security’s valuation prospects.

If the broader financial markets’ risk attribution aligns, we believe Tesla has further room to roam into; here’s why.

Relevant Operational Talking Points

Macroeconomic & Industry-Related Features

Tesla is a giant company, and its stock is frequently traded, meaning it possesses countless influencing variables. However, by using Occam’s razor, we can glean meaningful insights about Tesla’s prospects by looking at the asset parsimoniously.

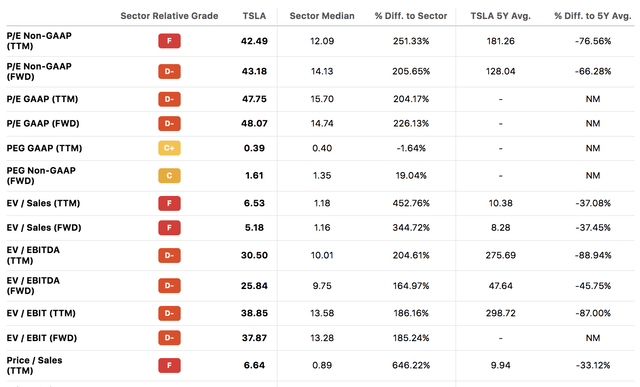

Diagram 1 presents a visual of Tesla’s sales since late 2018-the data’s distribution, coupled with the company’s 5-Y CAGR of 47.27%, tells us that an exponential growth trajectory has unfolded.

Diagram 1 – Tesla Quarterly Sales and Production (Author in NumXL – Data from GuruFocus)

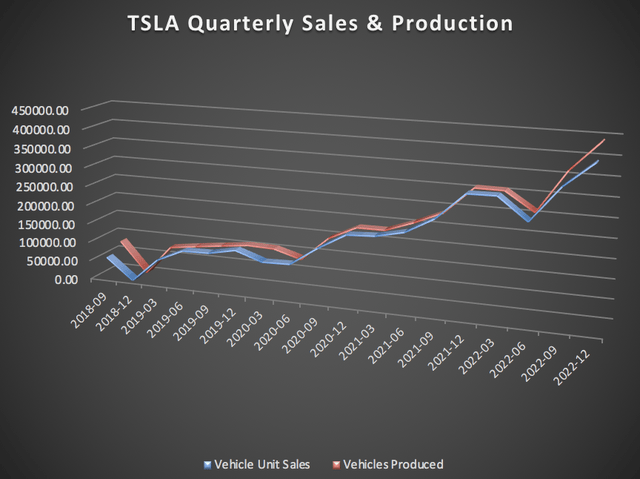

Given the electric vehicle (“EV”) market’s exponential growth (projected at 17.02% CAGR until 2027), Tesla’s sales trajectory shouldn’t be surprising, as it owns approximately 12% of the global passenger EV market and 58% of its domestic EV market.

However, two questions beckon, which are: 1) Will Tesla’s sales sustain given the rise in competition; and 2) What will a temporary macroeconomic drawdown mean for Tesla?

Starting with the prior, Tesla’s market share is anticipated to dip below 20% by 2025, which isn’t surprising as it embodies standard industry evolution. By combining microeconomic and equity valuation theory, it can be stated that unless a firm has a monopoly, it will inevitably lose market share as an industry matures, which will cause its return on equity to subdue. In addition, an industry’s growth rate is expected to retreat to/or below GDP growth as it matures.

Thus, considering the aforementioned, it is likely that Tesla will soon enter a linear growth trajectory instead of resuming its exponential pattern. However, this isn’t necessarily bad news for its stock; instead, it will merely adjust the asset’s risk-return characteristics.

Current EV Registration Breakdown (Electrek)

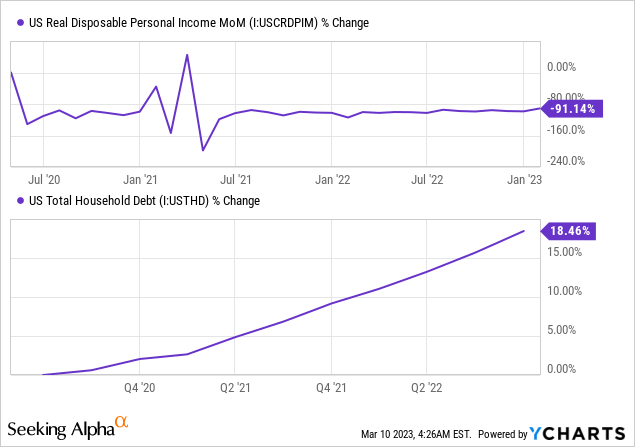

It is perhaps trivial to say this, but I have to reiterate the fact that the nearer-term outlook for Tesla relies on the short-term economic cycle, which is volatile given flimsy monetary policies from leading nations. However, for argument’s sake, let’s discuss a worst-case scenario.

Despite China’s reopening, the U.S. yield curve remains inverted, and uncertainty in the Eurozone lingers. In our opinion, things aren’t as bad as they seem; however, in a worst-case scenario, the U.S. enters a recession, China’s industrial production stagnates even further, and the EMEA region experiences the worst economic period in decades.

If such a scenario unfolded, automotive sales could collapse, as they are inextricably linked to the economic cycle. However, we believe Tesla will survive such a stress test as it owns a significant market share in a secular growth industry. In addition, consider the company’s fourth-quarter production report, which revealed a 40% year-over-year increase in delivered vehicles during a period of heightened recession risk (there’s a fair argument that a recession occurred).

In closing, we are entering a challenging economic environment that could suppress consumers’ appetites for durable goods. However, EVs could be subject to product switching (instead of product upgrades), lending a market leader such as Tesla the opportunity to sustain its sales growth during a period of lackluster household balance sheets.

Idiosyncratic Factors

Upstream Events

Tesla’s average gross margin of 20.62% is not bad. However, it also isn’t optimal, which is why the company is focused on creating downstream value. Tesla is building out a vertically integrated business model, which includes numerous “Gigafactories,” with the latest planned for construction being in Mexico. Furthermore, although denied by Elon Musk, reports suggest that Tesla has explored the possibility of mining its own lithium via the acquisition of Brazilian miner Sigma Lithium Corporation (SGML).

Whether Tesla decides to mine Lithium or not, the intent is clear; the company wants to own its entire value chain to eliminate supply-side bargaining power and deliver more competitively priced products than its peers.

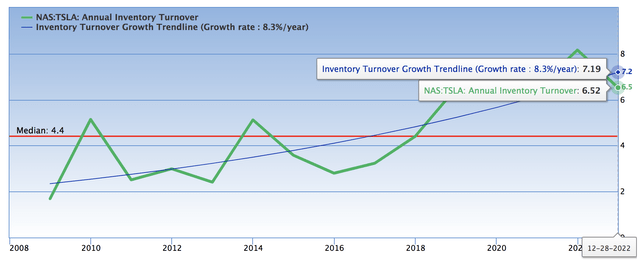

Despite its recent challenges, such as rising input costs and congested supply chains, Tesla has a magnificent inventory turnover ratio (below 10), suggesting that its cost of goods sold relative to average inventory on hand is managed efficiently. In our opinion, this ratio will improve if Tesla executes further up-to-midstream expansion, consequently leading to enhanced shareholder value.

Downstream Considerations

Although Tesla’s downstream prospects were discussed in the opening segment, a few additional features need highlighting.

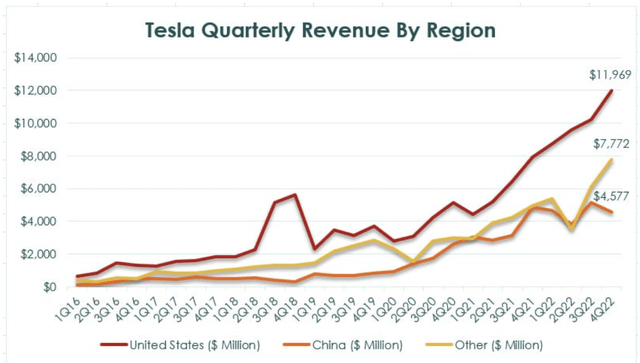

It is well known by now that Tesla plans to extend its geographic footprint by expanding in Asia, which has been challenging given the prolonged covid-19 lockdowns in China. However, a reopening might rejuvenate regional sales and manufacturing, leading to higher growth.

The company has recently achieved tremendous success in Europe, with its market share now exceeding 2%. Although the region’s longer-term economic growth is anticipated to be subdued, Europe’s new-EV uptake is among the highest in the world and continuously exceeds expectations.

Tesla Regional Sales (Stockdividendscreener.com)

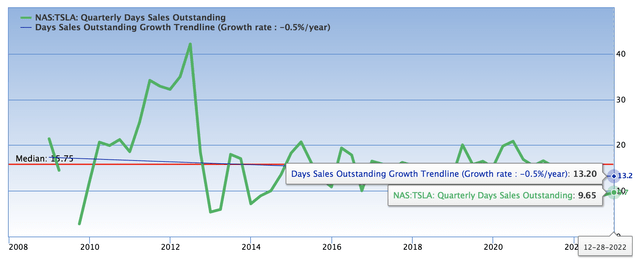

Furthermore, Tesla’s DSO ratio is steadily improving. A low DSO ratio suggests that the company has few loose ends, as little of its revenue is subject to long-dated receivables.

Tesla Days Sales Outstanding (GuruFocus)

Valuation

Sustainable Growth Remains Above Required Returns

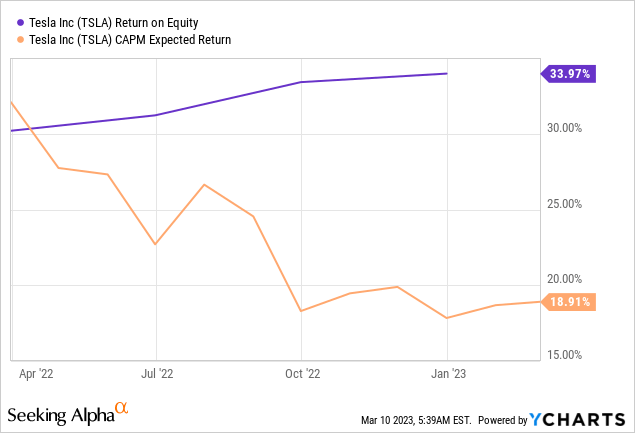

A stock’s expected return can theoretically be reduced to its CAPM (capital asset pricing model), which is a measurement of risk-return attribution. The CAPM can be viewed as the return equity investors demand from an asset for bearing its embedded risks.

Furthermore, Tesla’s ROE (return on equity) is viewed as its sustainable growth rate because the firm does not pay dividends. Therefore, an ROE to CAPM surplus suggests that Tesla is providing its shareholders with excess incremental returns and will theoretically continue to do so until the two metrics converge. In such a scenario, Tesla will likely need to distribute dividends or execute share buybacks to keep investors happy.

However, without straying too far away from the central topic, Tesla looks undervalued based on its stock’s risk-return attribution.

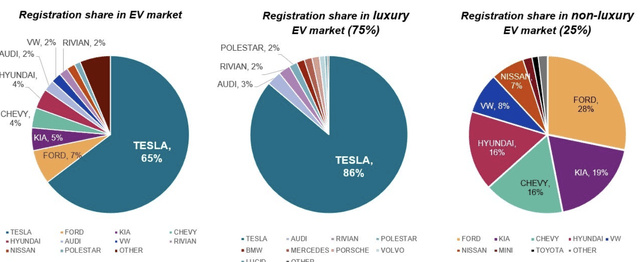

Relative Valuation

In our view, Tesla is best valued on a time series basis. The company’s substantial market share means a peer analysis is of little use, and its volatile sustainable growth rate would cause an absolute valuation to be obsolete.

As visible in the diagram below, all of Tesla’s major stock multiples are beneath their cyclical midpoints. Even after accounting for potential sales compression, the stock seems undervalued after an approximate 40% year-over-year collapse.

Noteworthy Risks

In our opinion, Tesla’s primary risk is market-related. The stock has a beta coefficient of 2.07, meaning it possesses more risk than your average stock. Thus, the stock could slump yet again if 2023 experiences the same risk-off sentiment that occurred in 2022.

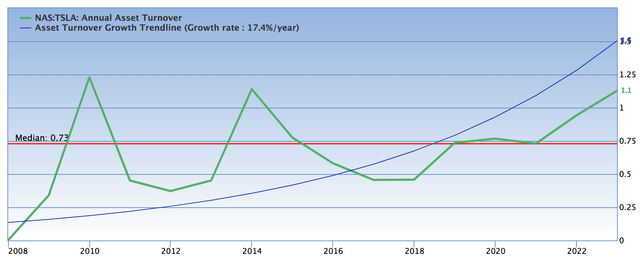

Furthermore, as discussed earlier, Tesla is reinvesting aggressively to consolidate itself as an industry leader. However, the company’s asset turnover ratio implies that it is yet to monetize the bulk of its asset base successfully. Therefore, unwanted industry consolidation and slower sales growth might cause a draw on Tesla’s balance sheet liquidity during its expansion.

Tesla Asset Turnover Ratio (Gurufocus)

Final Word: Is Tesla a Buy, Hold, or Sell?

Tesla, Inc. is trading below its 10-, 100-, and 200-day moving averages and is relatively undervalued, suggesting that its stock presents a good deal. Although risks such as an uncertain economy, industry consolidation, and potential risk-off sentiment exist, Tesla looks in good shape, given its vertically integrated expansion, secular growth, and its stock’s relative discount.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Looking for structured portfolio ideas? Members of The Factor Investing Hub receive access to advanced asset pricing models. Learn More >>>