Summary:

- After a significant downtrend, oil seems to be bottoming out.

- Both companies (XOM and CVX) have a proven track records of consistent dividend growth. In addition, share buybacks could put a stable support under the share prices of both stocks.

- Both companies had an excellent 2022, which gives them a solid war chest to help them get through rough economic conditions if they occur.

imaginima

Introduction

When one wants to invest in the energy sector, the first 2 companies that jump into many people’s minds are Exxon Mobil (NYSE:XOM) and Chevron (NYSE:CVX). Both companies are well-known multinationals with a long history. In this article, we will take a deep dive into both companies to determine which company is the better investment. Furthermore, we will take a look at the industry trend and where the market could be going. In the end, we will decide which company is a better investment at the current price.

Where is The Market Heading?

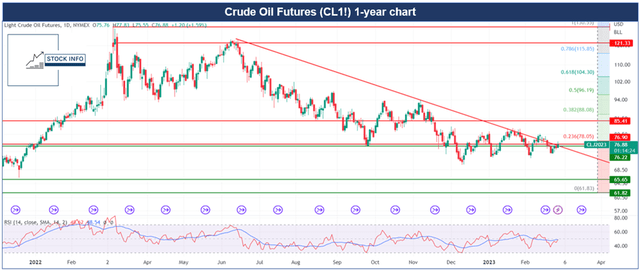

Before we take a look at both businesses, we should take a look at the oil market itself. In the end, the oil and gas market can be considered cyclical. If we take a quick look at the Crude Oil Futures (CL1:COM), we can clearly see that it has been in a downtrend over the last 6 months, with oil prices declining close to 40% since June of 2022. Nevertheless, it looks like it might be forming a solid base as we have been trading in the $70 to $80 range for 3 months now.

If we take a look at EIA’s oil storage numbers, the total liquids stockpile seems to remain low. Nevertheless, the stockpile has been increasing with the YTD total now sitting at 55.321m barrels. We have to be careful with these increases, as this could put downward pressure on the oil price. That said, the market does not seem to believe it. This could be due to the fact that geopolitical tensions are rising lately, which could put a bottom beneath the oil price.

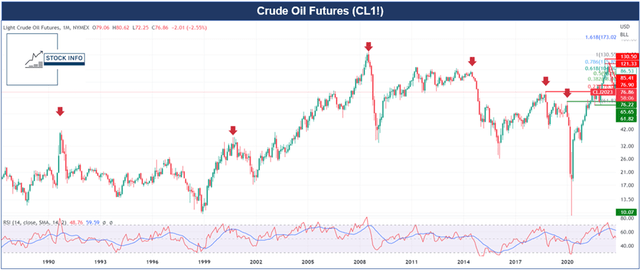

A fun fact one should realize is that after a major peak in oil prices, we often seem to have a recession shortly afterward, this can be seen in the chart below. For example, the recession in the early ’90s, the 2007-2009 financial crisis, and of course the recent Covid-19 crisis.

Exxon Mobil: Recession Resistant or Huge Pullback Incoming?

XOM is a beloved stock for dividend growth investors. The company has steadily increased its dividend over the years. In 2010 the dividend was $0.42 per share, currently, the dividend is $0.91, which is an increase of 117%. In addition, to the stock price appreciation over the last 10 years, shareholders of XOM haven’t had any reason to complain, as the stock is up over 100%.

Nevertheless, XOM is quite richly valued at this moment in time. The stock is up close to 300% since its bottom in 2020. Yes, the company has generated record profits over the last year, but does this justify the current share price? Let us have a look at the fundamentals.

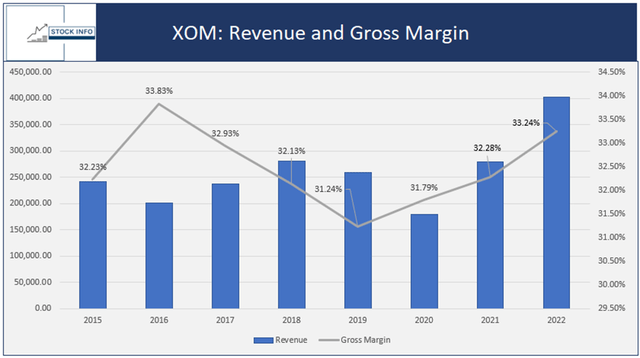

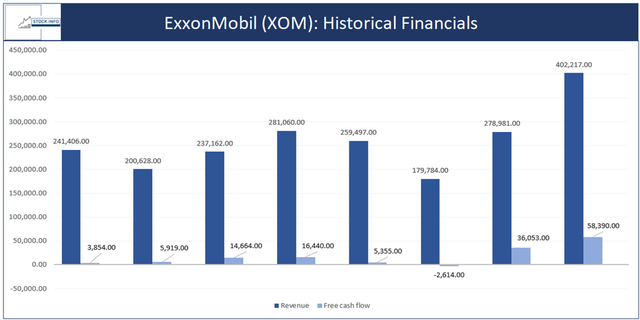

As we can see in the chart above, XOM has been able to generate record revenues in 2022. In addition, they were able to do so with a gross margin of 33.24%, which isn’t bad at all. As you can see, revenue isn’t stable at all, this is due to the cyclicality of the business. It is good to see that XOM is able to have healthy gross margins of around 30% during that time.

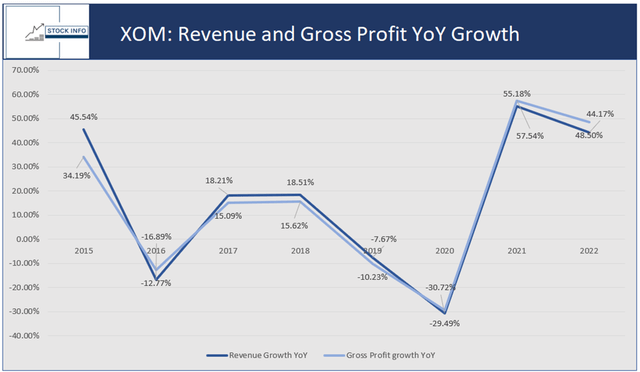

If we take a look at revenue and gross profit growth YoY, we can see that growth is highly volatile, which again is typical for a business operating in a cyclical industry. As mentioned before, XOM has heavily benefited from the boom in oil prices over the last 2 years, 2021 and 2022 have been incredible years for the company due to the energy crisis and supply chain constraints.

In 2021 the company had 55.18% and 57.54% revenue growth and gross profit growth respectively. In addition, 2022 was incredible as well, the company was able to accomplish YoY growth of 44.17% and 48.50% respectively. The most important question now is, is this sustainable?

Well, let us be honest with ourselves. No, this growth isn’t sustainable, but in periods like this, the company has been able to build a significant war chest, which makes it more close to recession-proof.

As can be seen in the chart below, XOM was able to generate $58.39B in free cash flow (‘FCF’). This is a significant number, which we have to keep in mind. In addition, ExxonMobil currently has a FCF Yield of 12.97% at its current valuation, this indicates that the company could buy itself back in less than 8 years.

Furthermore, the company’s 5Y revenue CAGR sits at 7.43%, which is highly impressive due to the cyclicality of the business. It is important to mention that these last 2 years improved this metric significantly. In addition, XOM has a ROIC of 26.48%, indicating that for each $100 it invests in its business it generates an additional $26.48 in operating income.

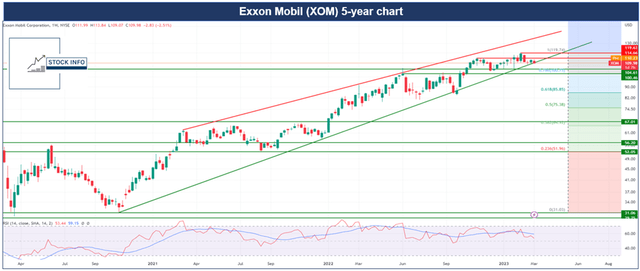

XOM: Technical Analysis

As can be seen in the chart below, XOM has been in a strong uptrend since October 2020, where the stock bottomed out at a similar price as its Covid-19 bottom around $31 per share. The stock is up over 265% since its bottom. In addition, you would have collected a decent amount of dividends along the way. Shareholders have had no reason to complain over the last 3 years.

Nonetheless, the stock is currently down around 9% from its all-time high on the 10th of February. XOM is currently trading above all of its weekly EMA’s, which shows that the stock is still in a strong uptrend. The stock is right at its green trendline support, which should be able to hold. If this level doesn’t hold, one should look for the $100 to $105 zone. The most important resistances are the $115 level and the all-time high at around $120.

Chevron: Raising Share Buybacks

Chevron announced that it will be raising its share buyback outlook to $10B – $20B per year. But, will this help the company in beating XOM as the better investment?

Similar to XOM, CVX is a beloved stock for dividend growth investors. The company has steadily increased its dividend over the years. In 2010 the dividend was $0.68 per share, currently, the dividend is $1.51, which is an increase of 122%. In addition, the stock price has risen by close to 130% over the last 10 years.

Nevertheless, CVX is expensive at this moment in time. The stock is up over 200% since its bottom in 2020. Yes, the company has generated record profits over the last year, but does this justify the current share price? Let us have a look at the fundamentals.

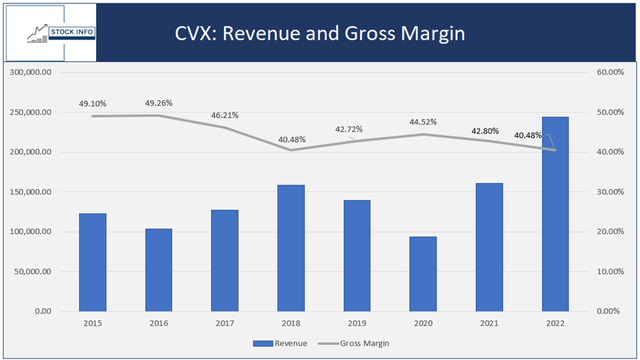

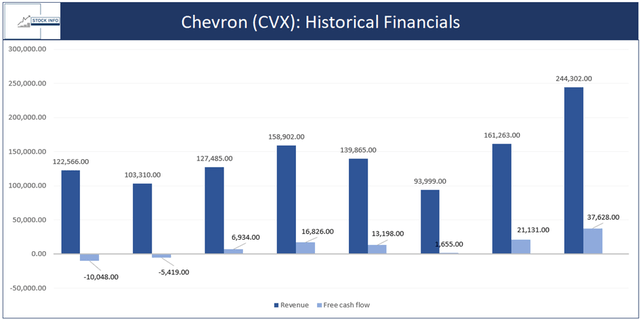

CVX similar to XOM has been able to generate record revenues in 2022. In addition, they were able to do so with a gross margin of 40.48%, which is significantly higher than XOM’s 33.24%. As you can see in the chart above, CVX has been able to operate its business with higher margins compared to XOM. The company hasn’t had gross margins drop below 40%. Purely based on gross margin, we could say that CVX is the better buy, but what do the other metrics say?

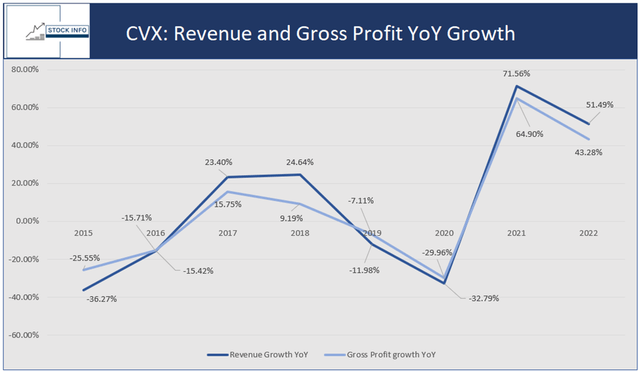

If we take a look at revenue and gross profit growth YoY, we can see that similarly to XOM, growth is highly volatile, which can be expected from businesses operating in the same industry. As mentioned before, CVX has heavily benefited from the boom in oil prices over the last 2 years, 2021 and 2022 have been incredible years for the company.

While XOM has been able to generate positive FCF in every year apart from 2020, due to reasons we are all aware of, CVX struggled a bit in 2015 and 2016, in which the company had negative cash flows for 2 years in a row. However, in 2022 CVX was able to generate $37.63B in free cash flow (‘FCF’). This is a significant number, which is now being used to increase share buybacks, as we mentioned earlier.

In addition, Chevron currently has a FCF Yield of 12.18% at its current valuation, this indicates that the company could buy itself back in a little over 8 years. Furthermore, the company’s 5Y revenue CAGR sits at 8.98%, which is impressive for such a large company. In addition, CVX has a ROIC of 23.93%, indicating that for each $100 it invests in its business it generates an additional $23.93 in operating income.

CVX: Technical Analysis

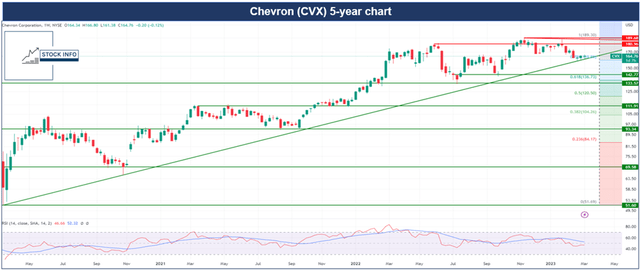

As can be seen in the chart below, CVX has been in a strong uptrend since its Covid-19 bottom back in March of 2020, where the stock bottomed out at between $51 and $52 per share. The stock is up 220% since its bottom. In addition, you would have collected a decent amount of dividends along the way. Shareholders have had no reason to complain over the last 3 years.

Nonetheless, the stock is currently down over 13% since its all-time high in November of last year. CVX is currently trading below its 20-week EMA but above the 50-week EMA, which seems to be providing decent support for the stock. In addition, CVX seems to be able to hold its green trendline support.

The most important resistance level is $180, a break above this level would show strength. While it is a must for CVX bulls that the green trendline support holds. If the stock drops below the green trendline support, we could see $143 again.

Exxon and Chevron: Who to Pick?

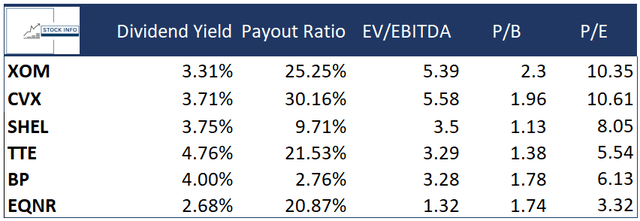

We took a deep dive into both companies and their fundamentals, now let’s take an additional look at how they line up compared to their competitors. The main competitors we will look at are Shell (SHEL), Total Energies (TTE), BP p.l.c. (BP), and Equinor (EQNR).

Exxon is the 2nd largest oil company by market value behind Saudi Aramco (ARMCO). Chevron is in 3rd place right behind Exxon. When we take a look at P/B and EV/EBITDA, both XOM and CVX are on the expensive side. Similarly, they both rank as more expensive than their competitors on both P/E and P/B.

One might ask themselves: Why are they both more expensive? Well, both companies have a long solid track record of growth and dividend consistency. XOM has 20 years of consecutive dividend growth while CVX has 35 years of consecutive dividend growth. Meanwhile, both SHEL, BP, TTE, and EQNR have had to cut their dividends in rough times, such as during the Covid-19 pandemic.

As long as oil does not fall abruptly, both XOM and CVX will be great companies to own for long-term income investors. While the flight into safe haven stocks might have pushed companies like XOM and CVX a lot higher, we believe both companies are well-positioned to weather a recession. Nevertheless, we believe both companies could see further downside in the short term as the stocks aren’t cheap.

That’s why at this moment in time we rate both these companies as a hold. Nonetheless, long-term investors shouldn’t be worried as the companies are very shareholder friendly and provide returns for their investors through dividends and share buybacks. For the people who don’t have a position yet, we would believe it is wise to wait or slowly DCA into one or both of these companies.

Conclusion

Both Exxon Mobil and Chevron are behemoths in the energy space. These companies have proven track records and strong balance sheets, which will help them during difficult times. However, 2022 was an exceptional year and we shouldn’t expect these record cash flows and revenues anytime soon unless some major policy changes occur.

Both companies are perfect for long-term income investors as the companies have an excellent track record of dividend growth. While both of the companies are excellent, we believe they both deserve a hold rating as of now, as they could suffer in the short term.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.