Summary:

- Google has 2 opportunities to show investors that it deserves a higher market valuation.

- Stock buybacks and an advertising rebound are two potential leverage points for Google.

- Google stock may continue to struggle in FY 2023 if the company doesn’t create a catalyst for itself.

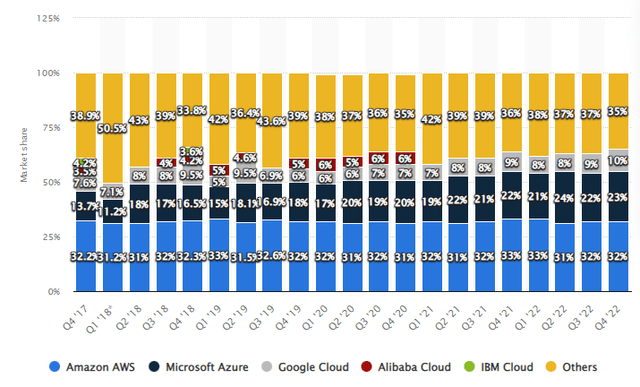

Source: Statista

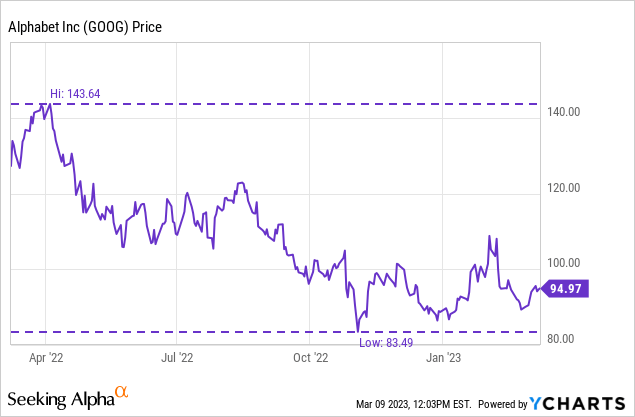

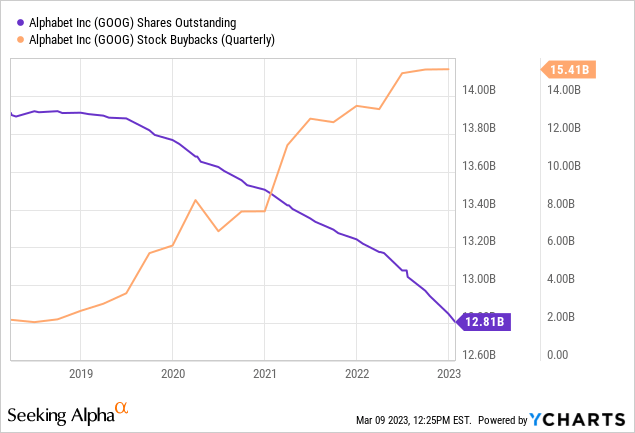

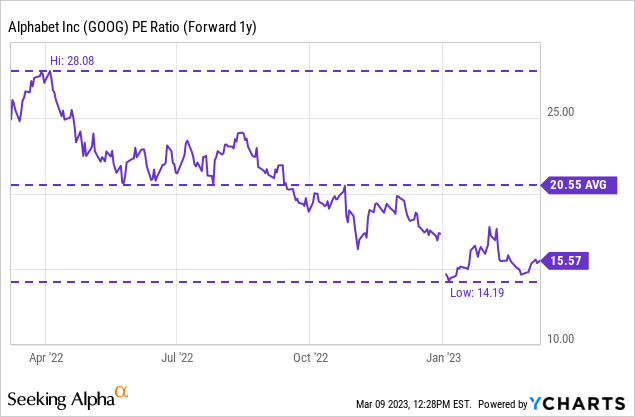

Shares of Google (NASDAQ:GOOG) went into a post-earnings slump lately that lasted from the beginning of February until the end of the month as slowing advertising revenue growth went negative in Q4’22. However, Google could soon announce a new stock buyback, as the current $70B buyback is set to be completed by June (at a current buyback rate of $5B/month). I believe that a new, upsized stock buyback could be a strong catalyst for Google’s struggling shares. At a P/E ratio of 15.6 X, I believe buybacks make a lot of sense for Google and the stock could go into a new up-leg if Google announces a new authorization. While the advertising down-turn is not yet over, Google’s Cloud business could limit the stocks downside potential in FY 2023!

Why stock buybacks are the way to go

Possibly one of the biggest and most powerful catalysts that could drive an upside revaluation of Google’s shares relates to a potential stock buyback. Google announced a $70B stock buyback last year in April and I believe that the technology company, given its free cash flow prowess demonstrated yet again in the fourth quarter, could afford a major upsize in its stock buyback. In Q4’22, Google reported $16.0B in free cash flow and the tech firm repurchased $15.4B of its own shares in the fourth-quarter. In FY 2022, Google repurchased $59.3B of its shares which included the retirement of 61M Class A shares (worth $6.7B) and 469M Class C shares… on which Google spent the majority of its buyback money in FY 2022, $52.6B. Based on a current buyback rate of $5B/month, the buyback program could be completed in May or June.

Google had $28.1B remaining in its stock buyback authorization (including Class A and Class C stock) as of December 31, 2023 and Google has been an aggressive buyer of shares in recent years. I would expect Google to announce a new stock buyback before the current stock buyback program is exhausted… which I expect to be the case within the next three months.

I believe that Google’s stock buybacks make a lot of sense at the current valuation and this is a very good opportunity for the tech firm to double down hard on buybacks… because the stock is cheap. Google currently has the privilege of buying back its own shares at a P/E ratio (FY 2024) of 15.6 X which is 24 % below its 1-year average P/E ratio. Additionally, Google’s shares are currently trading near its 1-year low, so Google would be well advised to be aggressive now with buying back stock.

Google may have a second catalyst in FY 2023

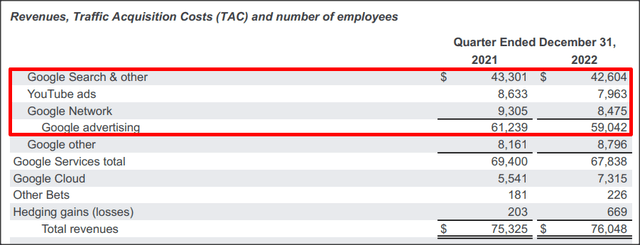

The advertising business is key to Google’s operational and financial success, simply because the company generates the majority of its money from its digital advertising business. Unfortunately, Google saw negative top line growth in its all-important advertising business in the fourth-quarter as marketers continued to pull back on ad spending. Inflation, among other things, had led advertisers to spend less money on digital ad campaigns and it resulted in one of the worst financial reports I have seen from Google in recent memory.

Google Search had a negative top line quarter in Q4’22 with revenues declining 1.6% year over year to $42.6B and the advertising market obviously continued to slow in the fourth-quarter. Google’s total ad revenues skidded 3.6% year over year to $59.0B which resulted in a very meager top line growth rate of just 1%, despite Google Cloud reporting double-digit revenue growth in the fourth-quarter. If it wasn’t for Google Cloud, the tech company may have seen negative growth on a consolidated basis.

A recovery in the ad market is likely to benefit companies like Google or Meta Platforms (META) the most since both companies have unprecedented reach in their digital marketing spheres and could quickly accommodate a return of advertising dollars if marketers have greater confidence in the US economy.

In the meantime, the Cloud business is set to continue to stabilize Google’s financial performance. The Cloud business accounted for 9.6% of Google’s revenues in Q4’22 and I believe Google Cloud could become a $55B to $60B business by FY 2025 and be responsible for a ~15% revenue share in Google’s portfolio of businesses. Two factors could drive gains here: accelerating adoption by enterprise customers aided by an aggressive deployment of AI technology, and growth in market share.

Google’s market share in the Cloud infrastructure market has grown from 7% in Q4’20 to 10% in Q4’22… which is an impressive 3 PP gain in just about two years. Google Cloud also remains the fastest-growing business within Google with a growth rate of 32% year over year in Q4’22.

Risks with Google

The biggest headwind for Google right now remains the slowdown in the advertising market which has weighed on the firm’s valuation as well as on its top line growth. If, in the coming quarters, evidence emerges that advertisers continue to be hesitant to spend money on online ads, then Google’s core business may continue to suffer and shares may go into yet another down-leg.

Final thoughts

Google needs to do more and engineer catalysts in order for the company’s shares to revalue higher. I still believe that Google’s enormous free cash flow prowess could result in a major, new stock buyback authorization which could be a catalyst for the company’s shares in the next few months. Additionally, a rebound in the advertising business would likely be required for investors to see a positive business development and give them a reason to plan with a reacceleration of Google’s top line growth. In the meantime, Google Cloud is stabilizing Google’s business and it could possibly prevent the company from posting negative revenue growth on a consolidated level in Q1’23… if the ad market remains weak. With shares still being cheap and trading near 1-year lows, an aggressive buyback would make a ton of sense for Google right now!

Disclosure: I/we have a beneficial long position in the shares of GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.