Summary:

- Mark Zuckerberg and Facebook have subtly relegated the Metaverse to the strategic back seat.

- The company has exhibited a welcome emphasis on cost discipline and a bloated headcount.

- Several valuation metrics lead us to believe the stock is a bargain at these levels.

Justin Sullivan

Zuck Gets Tough

In some ways, it’s gotta be tough to be Mark Zuckerberg. Despite being a billionaire and CEO of Facebook parent company Meta (NASDAQ:META), every move the man makes is dissected, often viciously. Each misstep invites crows from detractors, and boy, did Zuckerberg provide the detractors with things to crow about over the last year.

Reality Labs, the corporate home of the much-maligned Metaverse, has proven to be a black hole for cash. Promises from Zuckerberg and the company writ large that this virtual world would become a very real part of our working and social lives has fallen pretty flat. Meta’s own employees don’t even like it. The story that dominated 2022 was that Zuckerberg and his pet project were out of touch with the core of the company’s needs and shareholder’s desires.

Despite pleas for Zuckerberg to pivot away from the Metaverse and back to Facebook’s core business, he consistently refused to do so.

With this background in mind, investors suddenly found good news in the CEO’s apparent (yet subtle) shift to AI over the Metaverse in the most recent Q4 earnings call. (Many outlets declared that Zuckerberg had ‘killed the Metaverse,’ but we think perhaps that’s a bit much.) Nonetheless, he did set the stage for a future at Meta in which the Metaverse has a much smaller role to play.

A New Day?

This apparent pivot has caused us to re-evaluate our stance on Facebook. While we tread lightly to say that the days of Facebook setting barrels of cash aflame to develop the Metaverse are behind us, it does seem that the company is setting the stage to put the platform out to pasture.

Consider Zuckerberg’s remarks at the end of his opening statement where he reiterates the company’s go-forward priorities:

So those are the areas we’re focused on, AI, including our discovery engine, ads, business messaging and increasingly generative AI and the future platforms for the metaverse.

The Metaverse doesn’t even get an active-voice mention. How the mighty have fallen.

Instead, the company is looking for more… productive barrels for its cash (to keep the analogy going). The company lowered its 2023 CapEx targets to the $30-33 billion range versus prior guidance of $34-37 billion.

Facebook has also taken a harder look internally than most Silicon Valley companies at its headcount structure, announcing numerous rounds of layoffs with the prospect of still more to come.

This reduction of expenses comes at a time when Facebook is also finding new ways to monetize itself and generate revenue in the midst of an ad-spend slump.

One of the things that excites us most (and which we highlighted in a January article which you can read here) is Facebook’s relatively new Click To Message feature. Click To Message is a particularly sticky form of revenue for the company. Instead of relying on fickle ad dollars, Click To Message is, essentially, a near-required function for any Facebook or Instagram active business to have, because it allows customers to reach out directly to the business in various ways by clicking on the provided link, which is paid for by the business.

In January, we wrote that Click To Message had an annualized $9 billion run rate. The feature, while it excited us, didn’t get much traction from analysts.

On the Q4 call, management announced that the run rate for Click To Message was now $10 billion. For a sequential quarter, that’s serious growth. CFO Susan Li said that serious work was going into the product as well behind the scenes to scale it and find new entry points for businesses, particularly small businesses.

Valuation

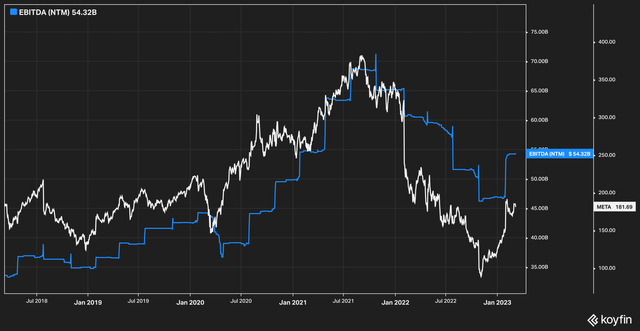

When we overlay Facebook’s stock price against EBITDA, we see an historical pattern emerge.

Facebook typically trades above EBITDA, but the turmoil of the last 18 months has caused the relationship to invert as forecasts for EBITDA have continued to trend down.

When we look at the last few months, however, we see that analyst estimates for EBITDA have suddenly ticked back up. In response to future expectations, the stock has followed suit. Of course, it wasn’t simply lowered EBITDA that made investors turn sour on the stock–it was Zuckerberg’s determination to blow cash on a project the market didn’t understand or believe in. With a little bit of that mystery now resolved, and the market now beginning to believe again that Facebook may be on a more disciplined financial path, we think that the opportunity for the stock to restore its historic relationship to forward EBITDA now exists.

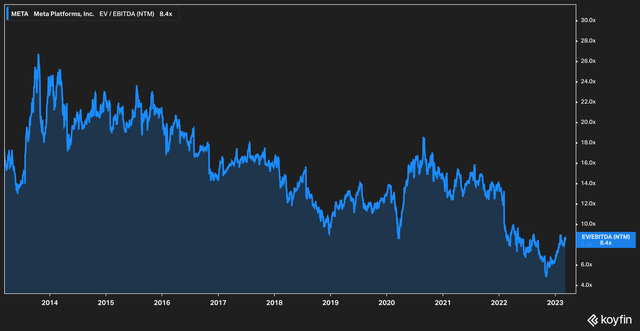

Facebook is also now exceptionally cheap when valued on a forward EV/EBITDA basis.

On this metric, Facebook is currently plumbing ten year lows. The ten year average forward EV/EBITDA valuation for Facebook is 15x–today it trades at almost half that.

We have few other conclusions to make from this that Facebook is indeed quite cheap. Its digital properties remain robust with billions of daily active users, and the company has proven quite adept at confronting challengers to its dominance (Facebook has quite convincingly beat out rival Snap (SNAP) and it has yet to succumb to the influence of TikTok).

The Bottom Line

While we remain cautiously optimistic that the scourge of the Metaverse is more or less behind us, we believe that the next few quarters will dictate how investors should treat it. Given the information we know now, however, we believe that investors of a certain risk tolerance will likely find the stock attractive today.

With single-digit growth to both the top and bottom line in 2023 and a resumption of double-digit growth on the horizon in 2024, we think that Facebook presents a very attractive risk reward scenario at these levels.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Factual errors may exist and will be corrected if identified. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.