Summary:

- Roku got a wake-up call on cash management with nearly $500 million at risk at Silicon Valley Bank.

- The video streaming platform has $1.4 billion in cash not at risk, and the company needs to cut losses to avoid any future cash crunch.

- ROKU stock is cheap on any dip below $60 after previously making a bullish cap at $70+.

Justin Sullivan/Getty Images News

The sudden collapse of SVB Financial Group (SIVB) had some surprise impacts to large tech firms. Roku (NASDAQ:ROKU) shocked the market announcing the company has a large portion of their cash balance held at Silicon Valley Bank. My investment thesis remains bullish on the stock due to any dip from the banking collapse, as the company appears set to re-claim all of their cash.

Source: Finviz

Cash Balance

Roku fell below $60 to end last week and traded down in after-market trading on the announcement of holding a large portion of their cash balance and SVB. The company has a total cash balance of ~$1.9 billion as of March 10 with $487 million held at SVB.

In essence, the SVB collapse placed ~26% of their cash balance at risk with the majority of the cash uninsured. Over the weekend, the Federal Reserve, FDIC and Treasury worked on programs to make all depositors whole at both SVB and Signature Bank (SBNY), another bank closed by regulators on Sunday.

In addition, some research appeared to suggest SVB had enough assets to virtually cover all of the deposits anyway. The statement by the federal banking regulators appears to suggest as much with indications tax payers aren’t on the hook for deposits, though it appears that any losses to the Deposit Insurance Fund will be recovered via a special assessment on banks.

As Roku mentioned in the 8-K filing, the company has ~$1.4 billion in cash deposited at multiple large financial institutions to provide the cash to run daily operations. The company doesn’t have any debt, so the cash possibly at risk wouldn’t cause an impact to the business.

Lack Of Profits

The bank run placing up to $500 million in cash in jeopardy places a huge emphasis on Roku returning to cash flow profits. Any company generating positive cash flows isn’t placed at risk when a portion of bank deposits come under question.

For 2022, Roku burned about $150 million in cash watching the cash balance dip from $2.15 billion at the end of 2021 to the $1.96 billion at the end of the year. The company actually generated nearly $12 million in operating cash flows for the year, but Roku spent $162 million on the purchase of property and equipment.

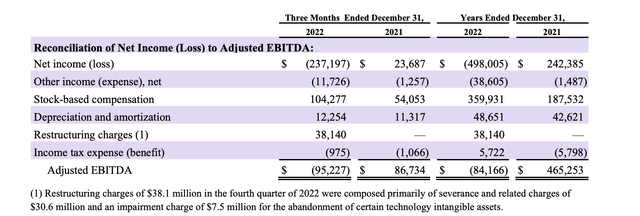

The only problem is that the business deteriorated dramatically during the year. Roku reported a Q4’22 adjusted EBITDA loss of $95 million after reporting a large $58 million gain in Q1’22.

The business got worse every quarter of the year. The losses are only forecast to expand with an adjusted EBITDA loss of $110 million projected for Q1’23.

The market has a lot of debate regarding the use of the adjusted EBITDA metric these days with a shift towards the preference for using GAAP. In the case of Roku, the Q4 adjusted EBITDA mostly excludes stock-based compensation of $104 million and restructuring charges of $38 million. Both non-cash charges are logical to exclude from the profit picture of a company.

Source: Roku Q4’22 shareholder letter

The deprecation charges are real expenses, but the interest income excluded in the Other income section really highlights how the adjusted EBITDA loss is very reflective of the adjusted losses more equivalent to cash flows. After all, Roku produced an $84 million adjusted EBITDA loss in 2022 and still generated positive operating cash flows for the year.

In general though, investors should assume solid cash flow burn rates with the adjusted EBITDA loss at $100+ million a quarter. Roku needs to cut these losses, though a lot of the downfall has occurred with the weakening scatter ad market to end 2022. An improving ad market will solve a lot of the problems with the profit picture at Roku and the company likely still has $1.9 billion worth of cash to fund losses.

Takeaway

The key investor takeaway is that Roku got a wakeup call on cash management. The company will likely implore a higher sense of urgency to return to generating positive cash flows to reduce the risk of eventually being at the mercy of the markets.

ROKU stock remains attractive at these levels due to the long-term growth potential in the streaming video ad market. Investors should use any weakness to load up on Roku as the financial position of the firm doesn’t appear materially impacted by the SVB bank closure.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in ROKU over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market heading into a 2023 Fed pause after several bank closures, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the out sized risk of high flying stocks.