Antoine Bonneau/iStock via Getty Images

National Hamburger Day on May 28 marks the culmination of National Burger Month and is widely considered the unofficial start of the summer grilling season in the United States. While Americans consume over 50 billion burgers annually, making the hamburger one of the most popular foods in the country, fast-food chains have turned even more promotional recently to stoke sales.

Chains offering special deals tied to National Hamburger Day include Burger King (NYSE:QSR), Wendy’s (NASDAQ:WEN), Smashburger, Buffalo Wild Wings, Wayback Burgers, Dairy Queen, Red Robin Gourmet Burgers (RRGB), White Castle, Shake Shack, Sonic, Perkins, Wayback Burgers, and Whataburger. Restaurant insiders have noted that the deals in general are more favorable to the consumer than those seen in 2023 and 2024.

Looking ahead, McDonald’s (NYSE:MCD) extended its $5 Meal Deal, which includes a choice of a McDouble or McChicken sandwich, small fries, 4-piece Chicken McNuggets, and a small soft drink for $5. The promotion, first launched in summer 2024, has been extended through the end of summer. The aggressive stance followed the Chicago-based company reporting its worst U.S. comparable sales tally since 2020 in Q1.

Tale of the tape

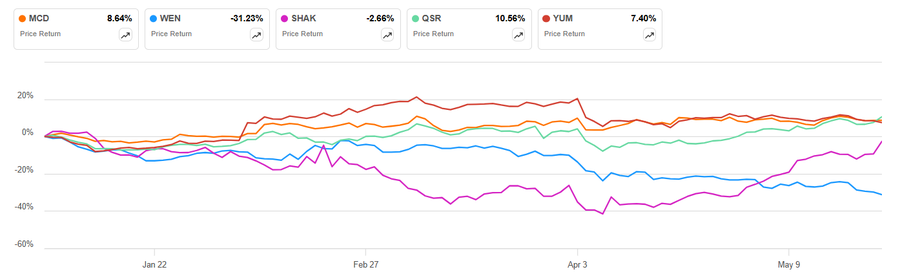

Share price returns for the parent companies of the major hamburger chains have been mixed on a year-to-date basis. In terms of quant ratings, Burger King parent Restaurant Brands International (NYSE:QSR) has the highest quant score.

Seeking Alpha

Eyes on the economy

In a potentially positive development for the restaurant sector, consumer confidence may be on the mend. The U.S. Consumer Confidence Index strengthened to 98.0 in May, topping the 87.3 consensus and rising from 85.7 in April (revised from 86.0), according to data released by The Conference Board on Tuesday. May’s print marked a turnaround after four straight months of declines. “The rebound was already visible before the May 12 US-China trade deal, but gained momentum afterwards,” said Stephanie Guichard, senior economist, Global Indicators, at The Conference Board. “The monthly improvement was largely driven by consumer expectations as all three components of the Expectations Index — business conditions, employment prospects, and future income—rose from their April lows.”

More on McDonald’s

- McDonald’s Slumping Sales May Be A Canary In The Economy

- Wall Street Lunch: Big Macs Vs. Uncertainty

- McDonald’s Valuation Under Scrutiny Amid 4 Poor Quarters (Q1 Earnings Review)

- McDonald’s closing CosMc’s concept, eyes broader beverage rollout

- What is next for McDonald’s as the world’s largest fast-food chain turns 85