Summary:

- Worsening macro conditions may accelerate selling even among strong companies with beaten down stocks.

- Amazon has its own challenges due to outside macro conditions.

- At $75, even AWS by and of itself appears undervalued.

- Consider selling puts at lower strike prices you like but be sure you are cash-secured.

HJBC

I wrote this article on Amazn.com (NASDAQ:AMZN) three months ago when the stock was trading at around $88. Since then, the stock has traded as low as $81 and as high as $112 and is currently back within a hair’s distance of $88. I present this article with a few reasons why I believe the stock is heading lower in the short term and why that is likely to reward long-term investors. Let us get into the details.

Worsening Macro Conditions

This is far beyond Amazon’s control but is likely the most important factor in the short to medium term. Inflation is rearing its ugly head and the market and Fed are caught in a no-win situation in the short to medium term. The Fed cannot afford to be dovish anytime in the near future (year or two at least) if it is to meet its target of 2% inflation. At the same time, extending the terminal rate beyond anything above the expected 6% will send the market on a tailspin. I fully expect political pressure on The Fed should the market drop like a rock. News like the closure of SVB Financial Group (SIVB) don’t help either, although it is highly unlikely that Amazon has any meaningful exposure. However, this is another clear sign of tightening liquidity, which, believe it or not, affects even Amazon with its debt more than doubling since 2020.

As Amazon has matured as a company over the years, the stock’s beta is now almost in line with the market at 1.25. But it still means that for a 1% sell-off in the market, Amazon is expected to lose 1.25%, which can quickly accelerate during a sharp sell off.

Worsening Business Conditions

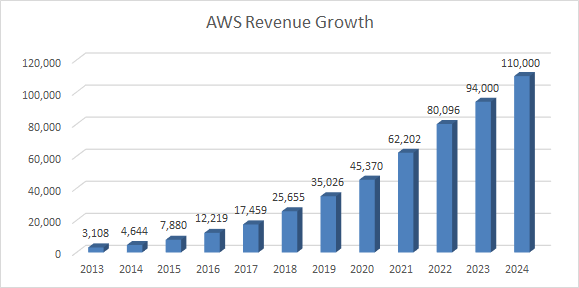

- Almost as a direct consequence of the macro issues mentioned above, Amazon’s golden-child, Amazon Web Services (“AWS”) is facing steeper challenges and slowdown than expected. While the growth rate is still high in the early 20s and is expected to be in mid to high-teens at least this year, the market’s disappointment is understandable after handing the stock such lofty valuations in the past and arguably at present as well.

- Meanwhile, in the retail space, Walmart, Inc. (WMT) continues chipping away at Amazon and is now starting to hit where it might hurt Amazon the most – luring wealthy shoppers away. Walmart+, in line with the Walmart image, has long been seen as the cheaper alternative to Amazon Prime but is now beginning to attract younger customers with higher household income than in the past.

- While news like the pause in HQ2 may seem positive on surface (CAPEX reduction), it is an implicit admission by the company that it expects the tough times to last longer. Newer initiatives like Zoox are facing their own headwinds as well.

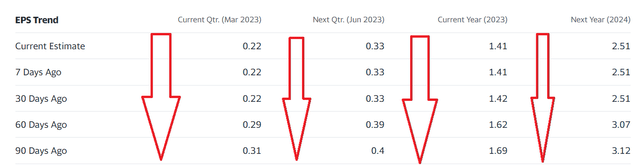

- All these weaknesses have not gone unnoticed as EPS estimates have been steadily falling across the board as shown below. To put some of these numbers into context, the current quarter’s estimate has fallen by almost 30% in the last 90 days.

AMZN Estimates (Yahoo Finance)

Worsening Stock Technicals

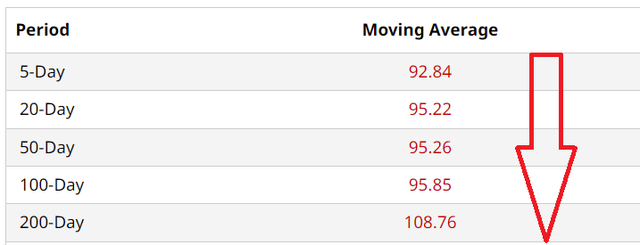

The stock is right now trading below its 5-, 20-, 50-, 100-, and 200-Day moving averages as shown below. The 200-Day moving average is still a good 20% away from the current market price of $90 and while this is concerning, this is also a confirmation that the base has clearly shifted from a technical perspective. The fact that each of these averages are progressively lower indicates that the stock is under more recent pressure as well.

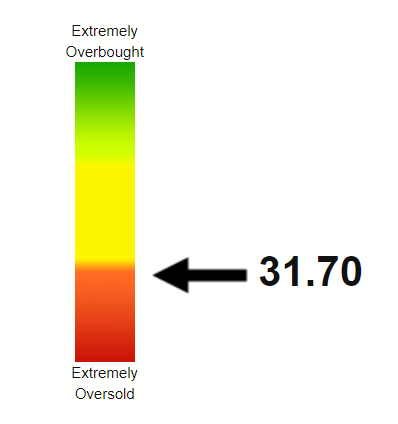

The Relative Strength Index (“RSI”) rating of 32 shows the stock is about to enter the oversold territory (<30). However, just like euphoria overshoots, pessimism tends to get depressing as well, meaning if the current macro conditions persist or get worse, a RSI in early to mid 20s is likely.

AMZN Moving Avgs (Barchart.com) AMZN RSI (Stockrsi.com)

A Potential Trade

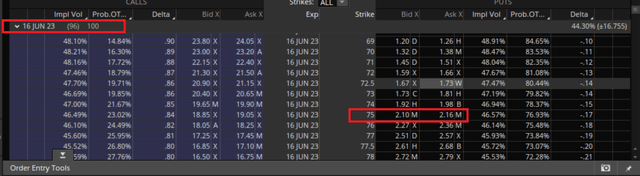

A trade I am looking at executing on further weakness is shown below. In this cash-secured put, the put seller is agreeing to buy 100 shares of Amazon at $75 should the stock trade at or below $75 by the expiration date of June 16th, 2023. In return, the put seller gets an immediate $210 per each contract (of 100 shares), which is about 3% return for 3 months. Not earth shattering but a trade like this presents the best of both worlds by:

- Not going all in when the bottom is likely not in.

- Not staying out of the game entirely.

- Better using the cash reserves that many are urging investors to raise during this uncertain time.

There are some risks with selling puts in general and in this particular chain that readers need to be aware of. When the market sells off violently, your strike price may be reached quicker than anticipated. So, before executing this trade or anything of similar nature, be sure you’d like to own the underlying stock at that price irrespective of short-term noise. In addition, Amazon is expected to report earnings around April 28th. While the option chain expires a good month and a half after that, please be aware that if the numbers disappoint, the stock may fall through your strike price quicker than you could react.

Why $75 Is Enticing?

- At $75, Amazon will be trading at a forward multiple of less than 30 based on 2024’s estimate of $2.51 per share. That is a reasonable premium for Amazon’s clout considering the fact that the market on average is currently trading at a multiple of nearly 21.

- At $75, Amazon will be trading at lows not seen since December 2018, an almost 5-year low as shown below. A large part of the current market downturn (since end of January) has to do with questions around inflation and Fed policies, just like in December 2018 and December 2021. However, this time is a little different since we are much closer to the terminal rate now than at any time in 2018 or 2021. The Fed has a long way to go before reaching its 2% inflation target but no matter what the recent inflation reports say, the bulk of the bad news is out of the way for investors.

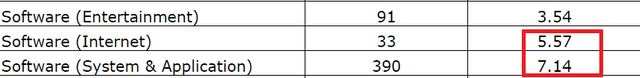

- In spite of “slowing” growth, AWS is still growing and revenue is on track to reach $94 Billion in FY 2023 and $110 Billion in FY 2024. At $75, Amazon’s market cap will be about $780 Billion. Putting those two numbers together, at $75, Amazon’s stock would be trading at an AWS sales multiple of 7 based on AWS’s 2024 revenue. If you think that is overvalued, consider the numbers below.

- While Amazon is still categorized under the “Consumer Discretionary” primarily due to its E-Commerce history, it is a technological disruptor. According to a recent study by NY Stern University, the average revenue multiple (as of January 2023) for software stocks in Internet and System/Application is 6.3. Surely, Amazon is better than the “average” stock?

- As an outside comparison, NVIDIA Corporation (NVDA) is currently trading at a multiple of nearly 20 based on 2024’s revenue.

- Amazon is not just AWS as explained below.

AWS Revenue (Compiled by Author, data from Statista.com) Revenue Multiply by Sector Jan 2023 (pages.stern.nyu.edu/)

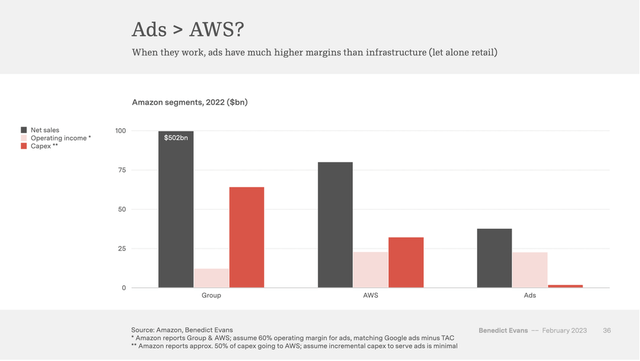

- Besides AWS (which almost by and of itself makes Amazon undervalued at $75), Amazon’s revenue from other segments should mean something in the long run. In specific, Amazon’s advertising segment is growing at such scorching pace that it likely is already larger than Amazon Prime’s revenue with a 2022 revenue of $38 Billion. It is also being reported that this segment may already be more profitable than AWS with a 50% operating margin. Amazon’s integrated ecosystem makes it harder to calculate individual profitability by segment but it is not out of the realm to think advertising is already as profitable as AWS due to the following reasons:

- Advertising has much lower CAPEX, enhancing profit margins

- Advertising can and does actually leverage all aspects of Amazon’s business

Conclusion

I am in the camp that believes the market is headed lower in the first half of the year with a recovery in the second half. My primary reason for this is that it takes at least 6 to 9 months for the Fed’s monetary policies to show up in the official numbers meaningfully. Hence, I am comfortable picking a strike price that is more than 15% from the current market price. If you believe Amazon may never reach $75, please feel free to adjust your strike price accordingly. In the longer term though, I believe buying at either $75 or $90 is likely to reward shareholders based on the strengths explained above.

Disclosure: I/we have a beneficial long position in the shares of AMZN, NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.