Summary:

- Investors who followed my last calls on GOOG could top their return at over 18% profit in just a couple of weeks.

- GOOG has completed its corrective sequence and has fallen back into a new downtrend, while support levels have now again turned into significant resistance.

- In this technical article, I discuss important price levels and metrics that investors could consider to gain an overview of the stock’s likely price action.

- By considering multiple outcomes and setting up an adequate contingency plan, investors are less inclined to act driven by emotions, as this could come at a higher cost.

- The relevant industry groups seem to hint at further weakness, and despite discussing also a positive scenario, the observed elements lead me to downgrade GOOG to a hold position.

lindsay_imagery

Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) has returned over 18% to investors who followed my last call, as I expected the stock to form the last leg of its corrective wave formation. The stock has successively dropped in a new downtrend and is heading into more weakness also confirmed by its most relevant industries and benchmarks. In this article, I discuss technical elements that underscore the increasingly high chances of seeing the stock performing poorly, while I also discuss the possibility of a more positive outcome. All elements considered lead me to qualify the stock as a hold position, while I would certainly not enter or add exposure in GOOG.

A quick look at the big picture

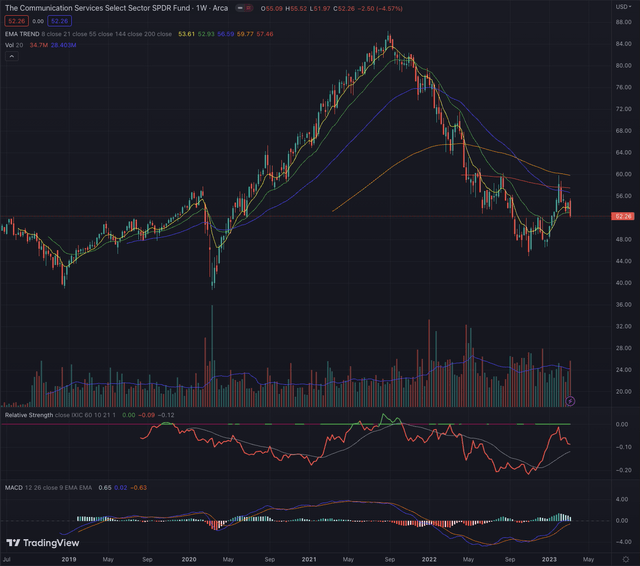

The US communication services sector continues to be the worst performer in the past year, and the technology sector after a short reversal attempt is now heading again into weakness while still being among the laggards yearly. Information technology services providers have particularly suffered during the sell-off in the past month, while companies active in the internet content and information industry, despite not being the worst performers of the sector, couldn’t escape the negative trend and have also significantly lost in valuation.

The Communication Services Select Sector SPDR Fund (XLC) after breaking out from its most significant trailing resistance, could rally until shortly overcoming its EMA55 and even its EMA200, before being rejected at its EMA144 and projected back into the downtrend. The industry reference has since built up relative weakness, when compared to the broader technology market, the Nasdaq Composite (IXIC), or more narrowly the Nasdaq-100 tracked by the Invesco QQQ ETF (QQQ), and its positive momentum seems giving signs of exhaustion, as hinted by the MACD. The past week has seen a breakdown under the EMA21 on significant volume, which could now act again as trailing resistance as it has been since the beginning of the benchmark’s downtrend.

Where are we now?

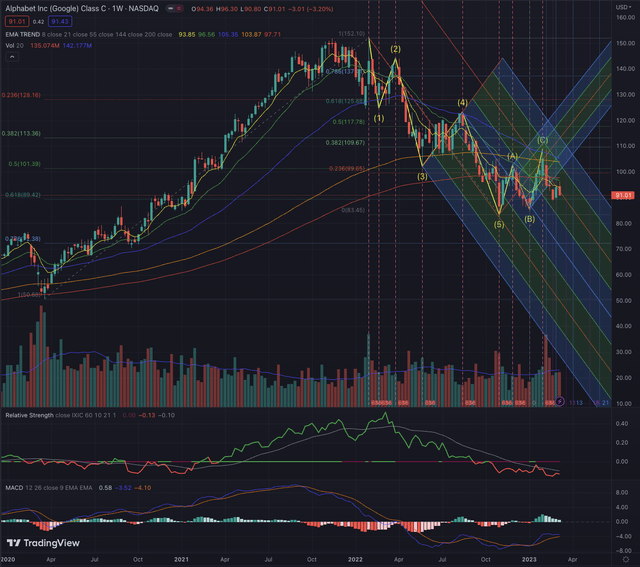

In my article Google: Fundamentally Undervalued With Contrarian Opportunity, published on January 18, 2023, I suggested the stock forming a corrective wave sequence, with waves A and B already formed, and the last leg formation ongoing. I, therefore, rated the stock as a buy position also in a short-term perspective, hinting at prices most likely breaking over $97.40 and reaching $112. While the stock effectively broke out from its overhead resistance, it peaked at $108.82 while forming its C wave, still allowing investors who followed my call, to generate a profit of over 18% over a couple of weeks.

GOOG has been rejected at the EMA55 in its weekly chart with a massive surge in sell-side volume, while successively breaking under the EMA200, where it tried to recover but finally broke even under the ascending trend channel that was forming.

The stock is now hovering along the central part of the downtrend channel in search of a bottom, as it broke under all most significant supports while reporting increasingly relative weakness and its short-lived positive momentum seems to end its expansion. GOOG has fallen back into stage four and could face an extended period of weakness. The major issue in this stage is the massive technical, but also psychological, overhead resistance that the stock has to overcome before possibly setting up for a new uptrend. GOOG will need to build up significant relative strength for a consistent reversal, and this should be reflected also in the XLC, as the company’s ponderation is above 11.50% in the benchmark’s holdings.

What is coming next?

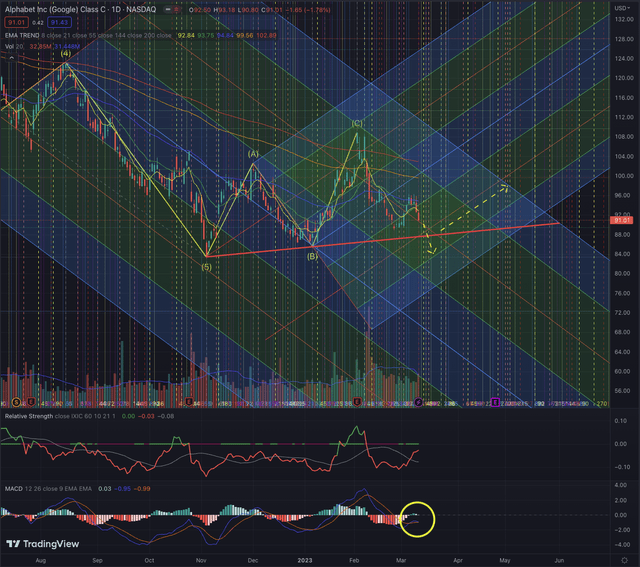

To discuss my contingency plan and my assumptions of likely outcomes for the price action in the coming weeks, I consider GOOG’s daily chart, where we can observe the massive distribution days that lead to the stock’s breakdown after having shortly surged above the EMA200. More recently, the stock formed an attempt to break out from the EMA55 but got again rejected on increasing sell-side volume. While on the daily chart, it is slightly improving in terms of relative strength compared to the broader technology market, the Nasdaq Composite (IXIC), GOOG will need much more conviction and sequentially improving accumulation days, to consistently break out from its downtrend.

The actual situation is hinting at two major likely outcomes. If we consider the movement after the completion of the corrective wave formation, GOOG seems to head into more weakness with a continuation of the downtrend in a new Elliott downward impulse sequence. I would not want to be invested in GOOG if this hypothesis is confirmed, and I, therefore, raise my formerly defined stop loss to slightly under the price levels traced by the red trend line. Investors who want to give the stock more tolerance could keep the formerly suggested stop-loss levels between the two bottoms at $83.50 and 85.50, but as now the corrective wave sequence has formed, and the stock is oriented in a new downtrend, I would cut my losses short, while always being able to enter the stock in case of a reversal.

The second scenario I consider is more optimistic. Investors might want to consider the up-trending channel as their reference and observe the price action close to the discussed trend line. GOOG could find support and form a reversal around this price level and follow the up-trending channel while breaking out from its short-term resistances toward its EMA200. Here, it’s important to remember that GOOG is in stage 4, and without significant accumulation days, the stock will most likely continue to suffer under weakness. It’s therefore of utmost importance to observe the trading volume and possibly see the stock building relative strength, as we saw that Alphabet’s most relevant industries are under significant selling pressure. Investors may also want to confirm the price levels on different time frames, where the weekly chart has proven to be a valid tool for spotting important price levels and major changes in the trend.

I would certainly not add any new exposure in GOOG, as the odds are currently clearly unfavorable and despite some short rebounds that cannot be excluded, these types of movements are unlikely to affect materially any potential gain, as what we look for is a defined trend supported by conviction and strong positive momentum.

All the discussed elements lead me to downgrade GOOG to a hold position. I would certainly not try my luck at bottom fishing as this could lead to significant losses or investors could be trapped for an extended time into weakness, while I would continue to closely observe the stock and unconditionally act by following my contingency plan.

The bottom line

Technical analysis is not an absolute instrument, but a way to increase investors’ success probabilities and a tool allowing them to be oriented in whatever security is listed on the markets. One would not drive towards an unknown destination without consulting a map or using a GPS. I believe the same should be true when making investment decisions. I consider techniques based on the Elliott Wave Theory, as well as likely outcomes based on Fibonacci’s principles, by confirming the likelihood of an outcome contingent on time-based probabilities. The purpose of my technical analysis is to confirm or reject an entry point in the stock, by observing its sector and industry, and most of all its price action. I then analyze the situation of that stock and calculate likely outcomes based on the mentioned theories.

Both the information technology services industry and the internet content and information industry are struggling to significantly recover from their steep losses, while macroeconomic headwinds and rising interest rates are continuing to put pressure on the companies’ valuations. GOOG has completed its corrective wave sequence and has since crashed into a new downtrend confirming the stock is in stage four. I lower my risk tolerance and tighten up my stop losses, because of seeing higher chances of an extended downward movement, during which I would not want to be exposed. GOOG will offer many more chances to investors to make significant profits, while it’s equally important to define risk and sometimes wait on the sidelines for a better setup. The observed elements lead me to downgrade GOOG to a hold position.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: All of my articles are a matter of opinion and must be treated as such. All opinions and estimates reflect my best judgment on selected aspects of a potential investment in securities of the mentioned company or underlying, as of the date of publication. Any opinions or estimates are subject to change without notice, and I am under no circumstance obliged to update or correct any information presented in my analyses. I am not acting in an investment adviser capacity, and this article is not financial advice. This article contains independent commentary to be used for informational and educational purposes only. I invite every investor to do their research and due diligence before making an independent investment decision based on their particular investment objectives, financial situation, and risk tolerance. I take no responsibility for your investment decisions but wish you great success.