4kodiak/iStock Unreleased via Getty Images

Which robotics and robotics-related stocks should be on investors’ radars this year?

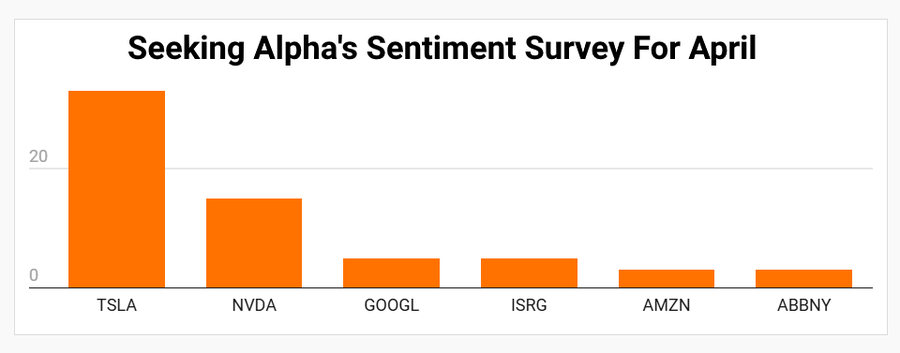

In April, Seeking Alpha asked readers which stocks they thought were the best picks for 2025 to gain exposure to the space. Of the 393 respondents, 33% chose Tesla (NASDAQ:TSLA), while 15% named Nvidia (NASDAQ:NVDA). Alphabet (NASDAQ:GOOG) and medtech developer Intuitive Surgical (NASDAQ:ISRG) both received 5%, while Amazon (NASDAQ:AMZN) and ABB (OTCPK:ABBNY) each got 3%.

Seeking Alpha

We asked Seeking Alpha analysts Michael Del Monte and Louis Stevens which stocks they thought investors should check out and why.

SA: Which stocks do you see as the top robotics stocks for investors in 2025?

Michael Del Monte: My top industrial automation picks are Rockwell Automation (NYSE:ROK) and Emerson Electric (NYSE:EMR). Each company had previously mitigated tariff risk in 2028, providing minimal exposure to margin compression. These organizations will benefit most from manufacturing re-shoring and migration.

In terms of AI-enabled robotics, Cognex (NASDAQ:CGNX) is my top pick given the growth outlook for transportation (warehouse/distribution) automation.

Louis Stevens: I have not personally come across compelling pure play robotics companies; however, I do like “bare metal” plays such as chip and networking stocks.

SA: What do you think of NVDA, TSLA, GOOG, AMZN or ABBNY for exposure to the space? Do you think they’re good robotics plays, or would you invest elsewhere?

Michael Del Monte: Nvidia (NASDAQ:NVDA) is building out its automation orchestration capabilities along with Microsoft (NASDAQ:MSFT), Palantir (NASDAQ:PLTR) and Blackberry (NYSE:BB). Amazon (NASDAQ:AMZN) may benefit most from the adoption of robotics at its distribution centers, augmenting labor and potentially improving margins as a result.

Tesla’s (NASDAQ:TSLA) Optimus humanoid robots can potentially augment labor in traditional factories without the need for retrofitting facilities, posing a huge benefit to manufacturers that seek to minimize capital investments.

Louis Stevens: I think the SA audience has a good grasp here.

Tesla (NASDAQ:TSLA) has made it explicitly clear that they plan to launch a robotics product, and, while the timelines on which Tesla (NASDAQ:TSLA) has brought products to market in the past have been lengthier than often billed, I do believe they will eventually field a compelling robotics product in Optimus. Unit economics are totally unknowable today. That said, we can be sure that robotics will help make Tesla’s (TSLA) existing products more profitable by reducing labor costs.

I like Nvidia (NASDAQ:NVDA) for its AI chips that will power the intelligence in each robot. I like Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG) for its $45B robotaxi vehicle (most recent valuation).

I’m also a really, really big fan of Intuitive Surgical (NASDAQ:ISRG) and have been for over a half decade now. I believe it’s one of the most important robotics companies of the 21st century.

SA: Which robotics and/or robotics-related stocks should people keep an eye on in 2025?

Michael Del Monte: Symbotic (NASDAQ:SYM) may be a high-catalyst company to watch for as it develops its prototype warehouses for Walmart (WMT). The organization is also building out its GreenBox “Warehouse-as-a-Service” offering, potentially augmenting the need for warehouse capacity without the large capital investments required for enterprises.

Louis Stevens: I would say one of my favorite robotics plays is what I call MACS, which stands for MercadoLibre (NASDAQ:MELI), Amazon (NASDAQ:AMZN), Coupang (NYSE:CPNG) and Sea Ltd (NYSE:SE).

Each of these businesses is building “machine warehousing and logistics networks,” such that these logistics networks become one embodiment of machine intelligence: routing packages without the need for human labor costs, with the only technicians and engineers servicing the at-scale machine intelligence. Their scale, requiring tens of billions in capital expenditures, and efficiency, with robotics imbued into them, make them extremely difficult to replicate, creating formidable economic moats.

Ecommerce players Amazon (NASDAQ:AMZN) and Sea Ltd (NYSE:SE) are two of my favorite robotics plays that aren’t immediately evident as robotics plays.

Regarding pure plays that are up and coming, I would say certain chip names, such as Astera Labs (NASDAQ:ALAB), which provides chip connectivity solutions (tech that connects GPUs to compute resources and memory, as well as other GPUs), are interesting. These up and comers are always quite risky for one reason or another, though, and that is the case for Astera (NASDAQ:ALAB).

- Top Electrical Components/Equipment Stocks

- Top Semiconductors Stocks

- Top Broadline Retail Stocks

- Top Automobile Manufacturers Stocks

- Top Industrial Machinery/Supplies/Components Stocks

- Top Healthcare Equipment Stocks

- Top Interactive Media/Services Stocks

More on Amazon, BlackBerry Limited, etc.

- Microsoft Corporation Continues To Be The Story Nobody’s Talking About

- BlackBerry Limited (BB) Baird 2025 Global Consumer, Technology & Services Conference (Transcript)

- Astera Labs: Poised To Retest April Lows (Technical Analysis, Downgrade)

- Nvidia tops Microsoft to reclaim crown of most valuable company

- Microsoft Bing under fire in France over issues with search results: report