Summary:

- Amazon is facing a challenging year in terms of consumer spending and inflation.

- The SVB problem could translate to bigger headwinds for Amazon and the market as a whole.

- I will consider buying Amazon in the discussed price and valuation range.

HJBC

Amazon (NASDAQ:AMZN) could see a major re-test of its 1-year low in the very short term as the U.S. economy may have seen the beginning of a new stress period in the financial system last week. A major bank, Silicon Valley Bank, which was owned by Silicon Valley Financial Group (SIVB), was taken over by the Federal Deposit Insurance Corporation on Friday. The commercial bank was the 16th largest bank in the U.S. by deposits and it was the 2nd largest bank failure in U.S. What this likely means for investors is that the stock market will see new spikes of volatility in the coming days and weeks and it is possible that other regional banks will see the same fate as Silicon Valley Bank. While I don’t recommend Amazon now, for reasons discussed here, I am open to changing my recommendation and buy the stock if the stock price drops low enough!

Macro picture deteriorated, SVB collapse could lead to major market slide and headwinds for consumer spending

The U.S. financial system has seen a major bank collapse last week, the first since 2008, and it could impact investor confidence despite the Fed stepping in over the weekend and giving the market assurance that it will safeguard consumer and business deposits. However, the bank failure could nonetheless do real damage to the economy, fundamentally weigh on investor sentiment and lead to selling pressure even for Amazon investors.

Although the Fed has taken decisive control of the situation over the weekend, the macro picture has deteriorated and general market risks have risen significantly. In the best case, the Federal Deposit Insurance Corporation will quickly find a buyer for SVB. In the worst case scenario, the market may soon find its next target for a bank run in the regional commercial banking market which could translate to major headwinds for the entire U.S. financial system. In the absolute worst case, SVB and other mid-sized bank failures may lead to such a loss of confidence that lenders curtail lending altogether… which is what we have seen in 2008.

Deteriorating macro picture compounds Amazon’s existing problems

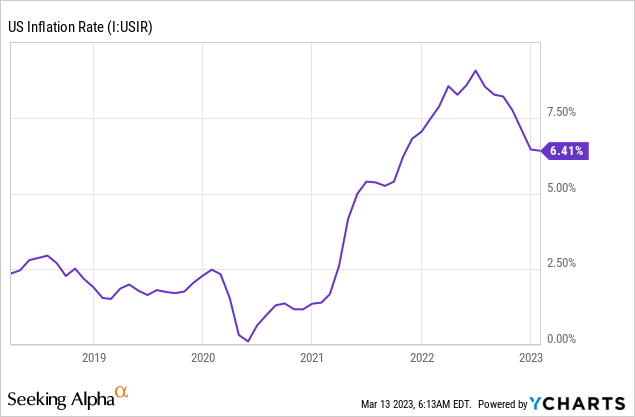

These macro issues compound Amazon’s existing problems which include weak top line growth, slowing traction in Amazon Web Services and a light outlook for Q1’23 (Amazon guided for only 4-8% quarter over quarter growth in the first-quarter). Inflation will remain a challenge for Amazon as well as inflation directly impacts consumers’ ability and willingness to spend money. Inflation slowed to 6.4% in February, but inflation is undoubtedly still very high and a strain on Amazon’s e-Commerce revenues. As long as consumers’ budgets are under pressure from rising prices, I believe the near term prospects for a reinvigoration of Amazon’s top line growth are very slim.

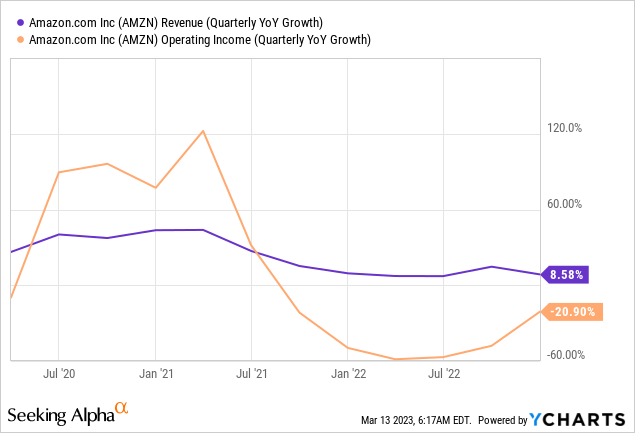

Amazon posted revenue growth of 9% in Q4’22 which, for Amazon, is a poor result. Amazon’s consolidated top line growth has seriously deteriorated in FY 2022 as post-pandemic growth slowed and inflation/interest rates weighed on consumer spending. Amazon’s revenue growth has come down to the single digits and there are also increasing operating income headwinds that could affect Amazon’s core operating performance negatively in FY 2023. Amazon’s operating income declined 51% in FY 2022 and if the collapse of SVB impacts consumer spending, investors may have to expect further declines.

In the near term, there are no real catalysts that could change this trajectory to the upside. However, last week’s SVB shock, despite Fed intervention, may create new uncertainty in the stock market and in the financial industry that results in a broad cutback in consumer spending.

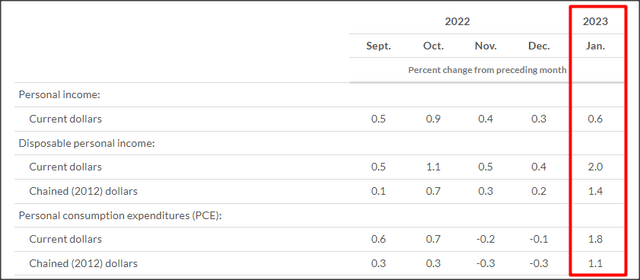

Personal consumption expenditures, according to the Bureau of Economic Analysis, increased 1.8% in January which was the first month since October that consumer spending saw positive growth. However, with inflation remaining high and new uncertainty getting inserted into the macro picture, it is likely that Amazon’s consumer-focused e-Commerce business will continue to struggle.

Source: Bureau of Economic Analysis

Here’s is at what price I will consider buying Amazon

I believe the collapse of SVB could set off further problems in the banking industry as analysts and investors will likely identify other targets that have weak balance sheets and made ill-timed bets on bonds. The reason why SVB went under relates chiefly to misguided investments in mortgage-backed securities. Due to the sharp increase in key rates last year, mortgage-backed securities have lost in value… and SVB was forced to sell assets to cover withdrawals. Other banks likely made the same mistake and we will see in the next few days how serious the problems really is.

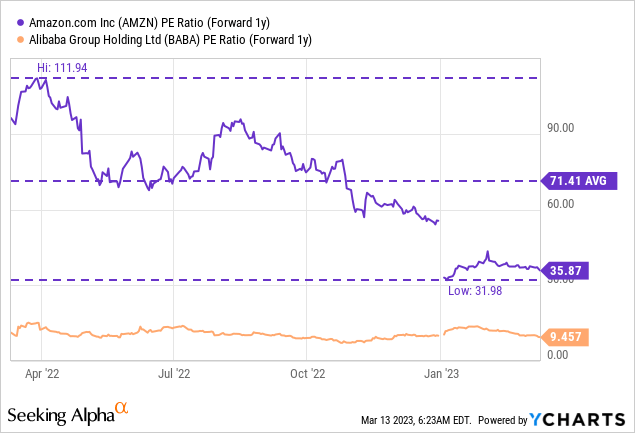

Amazon is currently valued at a P/E ratio of 35.9 X which is well below the stock’s 1-year average P/E ratio of 71.4 X. However, it is still premium territory for me and Amazon is not yet at a level where I would consider the stock a buy, or even a hold. Compared against large-scale, consumer-focused retailer Alibaba (BABA), Amazon actually appears quite overvalued. Alibaba only has a P/E ratio of 9.5 X and has considerable free cash flow that allows for major stock buybacks. I recently changed my outlook on Alibaba and upgraded the stock to buy.

Given that the SVB saga is just developing, I believe Amazon could definitely retest its 1-year low at $81.43 in the short term. To challenge its last low, Amazon would have to decline only 10% from a current share price of $90.73.

More interesting is at what price the stock should be really attractive to long term investors. I will consider buying Amazon at a P/E ratio of ~23-25 X which, based off of a FY 2024 EPS estimate of $2.53, implies a potential buy range of $58-63 per-share, implying approximately 30-36% downside. I am not saying that Amazon’s stock price could reach this level tomorrow, but looking at the current macro picture which reveals sticky inflation, headwinds to consumer spending, and now potentially a new financial crisis, I believe Amazon is not going to be able to go on a bull run any time soon.

Risks with Amazon

Amazon’s biggest commercial risk is that the retailer will continue to suffer from a decline in fundamentals in its e-Commerce business and therefore see slowing or negative consolidated top line growth in FY 2023. What would change my mind about Amazon is if the company saw a rebound in revenue growth and higher operating income margins. Going forward, I expect down-side pressure to build, however, as the SVB saga will likely make larger waves.

My conclusion

Last week’s bank run on Silicon Valley Bank resulted in market upheaval which has impacted the macro picture profoundly and created new uncertainty and anxieties. While I believe that Amazon is currently not a great deal and that shares are likely to re-test their low at $81.43 in the short term, I would buy Amazon if the stock corrects materially to the down-side. I believe the price range of $58-63 is attractive for investors (implied price-to-earnings ratio of 22-25 X) that are looking for a much better risk-reward relationship!

Disclosure: I/we have a beneficial long position in the shares of BABA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.