Summary:

- We continue to be buy-rated on PayPal; we see favorable entry points for long-term investors at current levels.

- We’re more constructive on PayPal growing meaningfully toward 2H23 after the company took steps to rightsize its cost structure.

- We expect PayPal to continue experiencing inflationary pressures, causing a weaker spending environment in the near term.

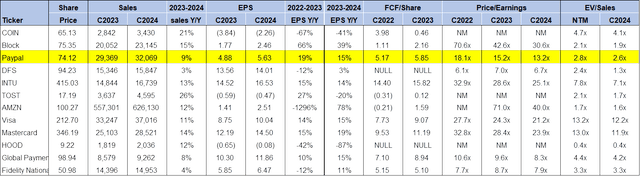

- We believe PayPal is a value stock, trading at 2.6x EV/C2024 sales versus the peer group average of 4.2x.

- The stock price remains volatile in the near term, but we recommend investors take advantage of the pullback and buy the stock at current levels.

Justin Sullivan/Getty Images News

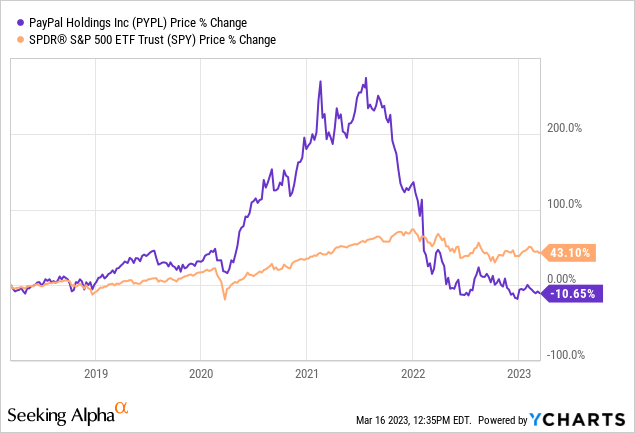

We remain bullish on PayPal (NASDAQ:PYPL). We expect the fintech company is on the right track to maneuver macroeconomic headwinds pressuring consumer spending and digital transactions after rightsizing cost structures earlier this year. PayPal announced it’d be cutting 7% of its workforce, around 2,000 employees, as it adapts to the challenging macroeconomic environment. PayPal is a TechStockPros favorite in the fintech space; the company’s shares jumped nearly 150% during the pandemic. Things have been grimmer in the post-pandemic environment, with the company dropping almost 62% in 2022 alone. Our bullish sentiment is driven by our belief that PayPal is a value stock. We see a more profitable FY2023 as the company reduces costs and grows its top line. While the stock price remains volatile in the near term, we believe investors buying the stock at current levels will be well rewarded in the mid-to-long term.

The following graph outlines the stock’s performance over the past five years.

YCharts

Rightsizing cost structures

We’re seeing the tech layoffs continue into the first half of 2023, with PayPal announcing it’ll lay off 2,000 workers. The company’s layoffs are just one round in the larger job cuts taking over the tech industry; in January alone, Alphabet (GOOG) (GOOGL) cut more than 12,000 employees, and Microsoft (MSFT) has laid off 10,000 more. We believe PayPal is working to reduce costs as the e-commerce market growth slows due to inflationary pressures. In the 4Q22 earnings call, CEO Daniel Schulman outlined the company’s plan for FY2023, identifying “an incremental $600M cost savings on top of the $1.3B of cost savings previously identified.” The company also expressed it would be reducing its external vendor spend and real estate footprint. We believe PayPal is on the right path to decrease its non-transaction-related operating expense line for FY2023 and continue to invest its growth initiatives into FY2023, such as PayPal Complete Payments (PPCP) among others.

We’re constructive about PayPal’s cost reductions amid a worsening macroeconomic condition. We believe the move strengthens investor confidence that the company has a strategy to maneuver macro challenges in FY2023 and is learning from 2022. We previously wrote on PayPal back in November with a bullish sentiment driven by our expectation that 1. The company is well-positioned to grow once macro headwinds ease, and 2. Our expectation is that PayPal would experience demand tailwinds from users’ ability to use the service on Amazon (AMZN). We now continue to expect PayPal to experience demand tailwinds once consumer spending picks up, but we don’t see this happening before the end of the year. Our current investment thesis on PayPal is based on our belief that the company is better positioned to grow from its 2022 levels due to its efforts to reduce costs and address macro challenges directly.

4Q22 earnings results and what to expect in FY2023

PayPal’s 4Q22 earnings report beat bottom and top-line estimates but warned of pressure from weak discretionary spending. Revenue for the quarter came in at $7.4B, up 7% Y/Y, and Non-GAAP EPS was $1.24, with a $0.04 beat. The company expects revenue in 1Q23 to grow ~9% FXN to ~$6.97B. Another takeaway from this quarter was Schulman announcing his plan to retire at the end of the year.

In the first half of FY2023, we expect PayPal stock price to be volatile amid market uncertainty. We see weaker discretionary spending persisting this year but expect PayPal to be better equipped to handle the pressure. Although we believe PayPal’s cost cuts position it well to maneuver the macro challenges, we expect the stock price to be impacted by market volatility and hard-to-predict consumer behavior. Consumer spending in January rebounded from a decline in December, making analysts think the US consumer was more resilient than expected. But, in February, American consumers pulled back on spending, and retail sales fell 0.4% from a month earlier. In the near term, we expect consumer spending to slow down significantly as inflation edges higher, major layoffs continue, and the macro condition worsens. The stock price is volatile, but we see a favorable risk-reward scenario for the long-term investor to buy the stock at current levels.

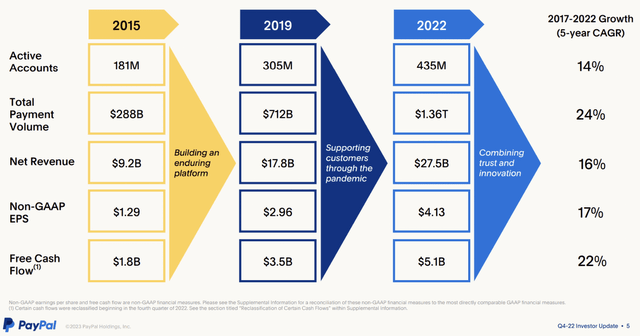

The following graph outlines the company’s 2017-2022 growth.

PayPal 4Q22 earnings presentation

Does the banking mess apply to fintech?

The collapse of Silicon Valley Bank sent chills through the global payment system, with bank stocks suffering heavy losses earlier this week. PayPal is not a bank; it’s a digital platform allowing customers to transfer money and actively make money by taking transaction fees. Still, this does not mean the stock was not impacted by the news, with the fintech stock dropping nearly 3% in the past five days. However, we don’t expect the SVB collapse to have a material impact on PayPal aside from its general implications for the U.S. consumer and global economy.

Valuation

We believe PayPal is relatively inexpensive, trading at 13.2x C2024 EPS $5.63 compared to the peer group average of 19.47x. The stock is trading at 2.6x EV/C2024 sales versus the peer group average of 4.2x. We recommend investors buy the stock as we expect PayPal to be better positioned now to outperform the peer group and expectations.

The following table outlines PayPal’s valuation.

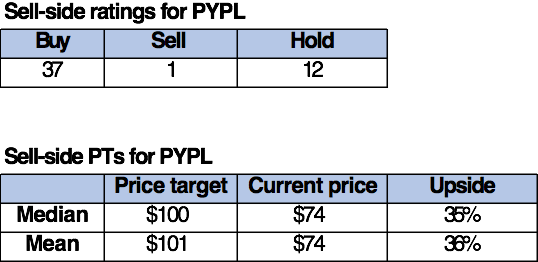

Word on Wall Street

Wall Street is also bullish on the stock, for the most part. Of the 50 analysts covering the stock, 37 are buy-rated, 12 are hold-rated, and the remaining are sell-rated. The stock is currently trading at $74 per share. The median sell-side price target is $100, while the mean is $101, with a potential 35-36% upside.

The following tables outline the company’s sell-side ratings and price targets.

TechStockPros

What to do with the stock

We continue to be bullish on PayPal. We’re more constructive on PayPal stock recovering toward the end of the year after management’s efforts to restructure costs and prioritize spending. We like PayPal’s position within the fintech space and expect the company to grow meaningfully in the mid-to-long run. The stock is relatively cheap, trading nearly 40% lower than its 52-week-high of $122.92. We believe the stock provides an attractive entry point and expect investors buying the stock at current levels will be well-rewarded in the longer run.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.