Tara Moore

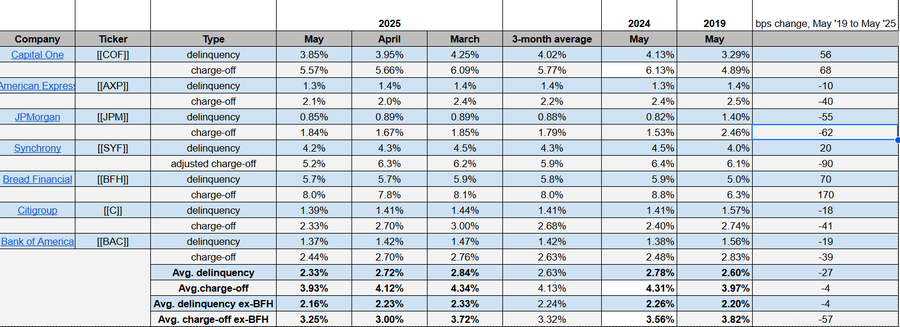

U.S. credit card delinquencies and net charge-offs pulled back further in May, although pre-pandemic comparisons were mixed.

The average delinquency rate dropped to 2.33% from 2.82% in April and 2.89% in May 2024, according to Seeking Alpha’s compilation of credit card metrics. That compares with 2.57% in April 2019, before the Covid-19 pandemic hit.

Similarly, the average April net charge-off rate of 3.93% retreated from 4.23% in the previous month and 4.44% a year ago. But it edged up from 3.91% in April 2019.

Delinquencies occur when people fall behind on payments, while net charge-offs are unpaid debts that the lender writes off as a loss.

Excluding Bread Financial’s (NYSE:BFH) outsized delinquency and charge-off rates, the average delinquency rate also fell to 2.16% from 2.41% in April and 2.46% in May 2024, vs. the 2.22% mark five years before.

Ex-BFH average net charge-off rate of 3.25% compared with 3.26% in the earlier month, 3.82% in April 2024 and 3.77% in April 2019.

Card results for Discover Financial Services — which is now part of Capital One Financial (NYSE:COF) — were not disclosed at the time of writing. Capital One did not immediately respond to Seeking Alpha’s request.

May 2025 credit card delinquencies, net charge-offs (Company filings, press releases)

More on Capital One Financial, American Express, etc.

- Synchrony Financial: Sticking With The 7.65% Yielding Series A Preferred Shares

- Bank of America Corporation (BAC) Presents at Morgan Stanley US Financials, Payments & CRE Conference Transcript

- American Express Company (AXP) Presents at Morgan Stanley US Financials Conference Transcript

- Citigroup announces cash redemption of $650M floating rate notes

- Citi credit card delinquencies, charge-offs improve in May