Summary:

- Despite Carnival Corporation’s huge improvement in financials during the last financial year and its attractive valuations, challenges persist for it.

- The company’s debts still stay high, which does not sit well particularly against expectations of a poor macroeconomic environment in 2023.

- There may still have been a short-term upside to it if the stock markets were more buoyant, but that’s not the case either. I maintain a Hold rating on it.

alzay/iStock via Getty Images

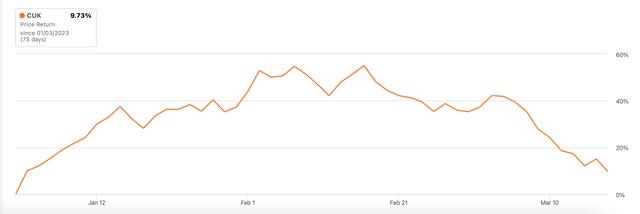

Cruise provider Carnival Corporation (NYSE:CUK) has had a good run at the stock markets in 2023 so far. It is up by almost 10% year-to-date [YTD]. But this obscures the fact that much of the rise was during the first two months of the year. For the past month, it has been falling fast, in fact it is down by 24% since. It can be argued, of course, that this is in line with the performance of the S&P 500 (SP500) index, which has declined over the past month as well. And since CUK is a cyclical stock, it is likely to react more to a general slump in the markets.

Macro challenges persist

So is this a time to stock up on CUK or is it a sign of things to come? When I last wrote about the company over six months ago, it still looked like a risky investment option. This was for two reasons. The first was he macroeconomic situation and the other was its debts. Much of the company’s revenues come from North America, projections for which for 2023 show that a recession is coming. This is not good news.

Already, the company has underperformed compared to expectations. Half a year ago, it was expected to end the financial year (year ending November 30, 2021) with USD 13.5 billion of revenues. It has instead posted a USD 12.2 billion figure. To be fair this is still a significant improvement of around 6x over its 2021 performance, which was riddled with coronavirus related challenges, just not quite what was expected.

In its recent annual report, CUK says that “The uneven opening of cruise travel around the world following the effects of COVID-19 and the impact the invasion of Ukraine has had on European countries have had a material impact on our results of operations”. In other words, the company is still very tangibly affected by coronavirus in terms of its revenues. And is also susceptible to geopolitical stresses.

High debt

That the company’s debts had mounted because of the pandemic, though was better known. Its continued to rise last year, by around 4% from the financial year 2021. This basically means that it remains substantial, having risen by over 3x since 2019, the last pre-pandemic year. To be fair, the company’s debt ratio at 0.6x is not too bad though. And if it continues to progress in bringing revenue back up to pre-pandemic levels in 2023, it would probably not look as overwhelming as it does now.

Favourable valuations

But as noted earlier, 2023 might not exactly be a great year of progress. To this extent, when considering its valuations, the company’s enterprise value-to-sales (EV/S) is a good ratio to consider, since it takes debt into account. The trailing twelve months [TTM] ratio for the company stands at 3.5x, which is significantly higher than the 1.1x for the consumer discretionary sector. This is to be expected, since travel related companies have been among the worst impacted by COVD-19.

But how does it compare to peers? Not badly at all, actually. Both Norwegian Cruise Line Holdings (NCLH) and Royal Caribbean Cruises (RCL) have higher ratios at 3.8x and 4.4x respectively compared to Carnival Corporation. Even its price-to-sales (P/S) figure looks attractive compared to peers. At 0.9x, it is the only one among the three to have a sub 1x, with NCLH at 1.1x and RCL at 1.9x.

Positive outlook

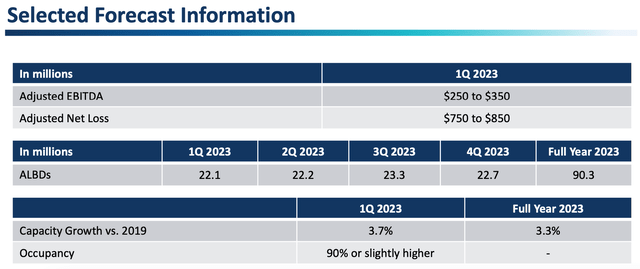

There is more to like about the company than just its valuations. First, its adjusted EBITDA figure came close to break even for the final quarter of its financial year 2022. This is encouraging because it indicates that the company could be relatively close to getting profitable again. In fact, it expects that to happen from the next quarter itself (see chart below). It also sees a reduction in net loss from the USD 1.1 billion in the last quarter. Some slowing down of sequential cost increases also indicates a greater likelihood of getting closer to profits.

Further, its 2023 bookings also look good. It says that the advance position is “higher than its historical average at higher prices in constant currency”. This does mean that an adverse currency effect, as has been witnessed recently by it, could lower the actual booking amounts. Nevertheless, it does signal improvement.

I am also encouraged by the fact that the worst of winters has gone by without substantial return of any coronavirus variants. The pandemic may well be behind us now. We can never say for sure, but that is the positive indication.

What next?

In sum, we have here a company that has undoubtedly suffered in the past years. Its balance sheet is still challenged by a huge debt. However, seen in context, these numbers are contained. Also, its income statement is improving. Revenues have grown significantly since 2021, a year marred by the pandemic. Notably its adjusted EBITDA figure for the latest quarter is also substantially reduced, giving hopes of profitability in the near future.

The big risk I see this year is the macro situation, which does not look good. It is encouraging that the company’s forward bookings look robust. But how the situation actually plays out remains to be seen. If nothing else, a macro slump would be bad for the stock markets and stocks like Carnival Corporation are likely to react more than others.

If the markets were favourably placed, I think there could have been short-term upside to the stock going by its attractive valuations compared to peers. That is not the case now, however. From a medium to long-term perspective, I would like to see the company return to profits before buying it. It is getting closer, but is not quite there yet. I maintain a Hold rating on it.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

—