Summary:

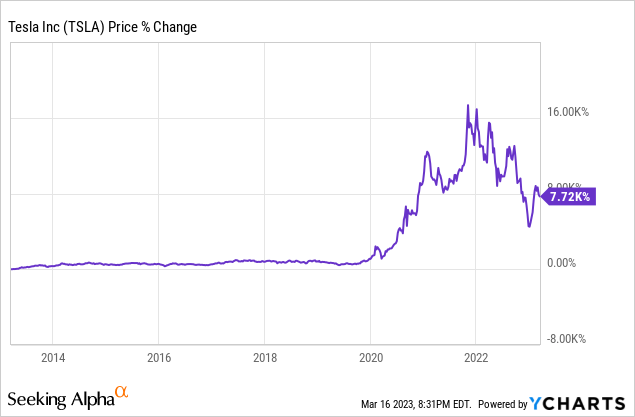

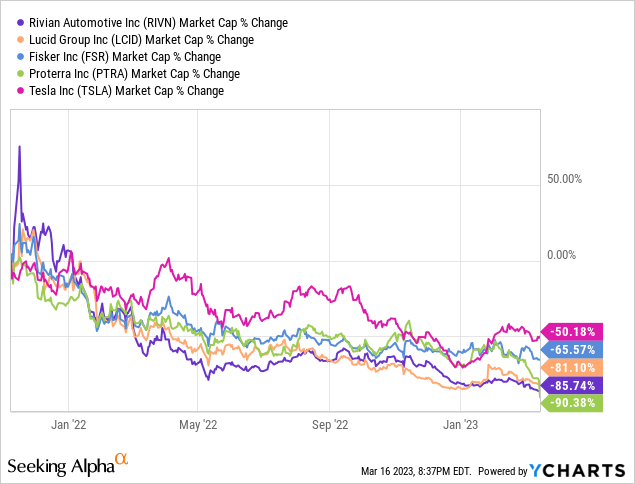

- A catastrophic sell-off in EV stocks in 2022 has left previously high-flying names like Tesla, Inc. and Rivian Automotive, Inc. trading at seemingly attractive levels.

- While Tesla looks fairly valued at $180 per share, Rivian is priced for bankruptcy with the stock trading close to its net cash levels.

- In this note, we shall perform a comparative analysis to choose the better buy between Tesla and Rivian.

- From a long-term risk/reward standpoint, I strongly prefer buying Tesla over Rivian at current levels despite the latter having far greater upside potential. Read on to find out why.

RoschetzkyIstockPhoto/iStock Editorial via Getty Images

Introduction

Tesla, Inc. (NASDAQ:TSLA) and Rivian Automotive, Inc. (NASDAQ:RIVN) are two of the most prominent electric vehicle (EV) manufacturers in the market today. While Tesla is the “800–pound gorilla” in EVs, Rivian is seen as an emerging player in the space. As you may know, the world’s transition to EVs represents a gargantuan market opportunity, and the resounding success of Tesla (the company and the stock) has unleashed a flurry of investor interest in this space, with a wild hunt for the “next Tesla!“

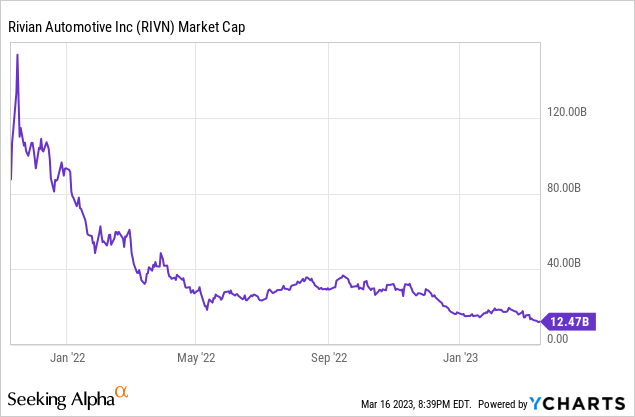

During the liquidity boom of 2020-21, several EV companies went public at lofty valuations, and Rivian is a poster child of those euphoric times. After IPO’ing at an eye-watering $66B valuation, Rivian’s stock reached a market capitalization of ~$153.3B at its zenith in late-2021.

However, the FED’s pivot to quantitative tightening has popped the EV stock bubble with most of these previously high-flying stocks down ~50-90%+ from their respective highs.

While Tesla’s stock is down roughly 50% from its all-time highs, Rivian’s market cap has compressed by ~92% from $150B to $12.5B. With the transition to EVs seemingly inevitable, the catastrophic sell-off in this space could be a generational buying opportunity.

As an investor, I like to evaluate investments from a long-term risk/reward perspective. And in this note, we shall compare Tesla and Rivian to find the better buy from these two names. As a starting point for this comparative analysis, I would like you to refer to my recent research coverage on Tesla:

- Tesla Q4: Mixed Quarter, Stock Jumps As Musk Dismisses Inventory Concerns

- Tesla Stock: Q4 Delivery Disappointment, Reverse DCF Analysis, Technical Typhoon, And More

- Tesla Stock: An Asymmetric Buying Opportunity Arises Out Of Insider Selling, Demand Concerns, And A Scary Recession Playbook.

As of today, I believe that Tesla is fairly valued at ~$180 per share, and the risk/reward for long-term investors is still attractive, with TSLA offering ~15% CAGR returns on a 5-year investment.

For more detailed coverage on Tesla: Ahan Vashi’s SA research on Tesla.

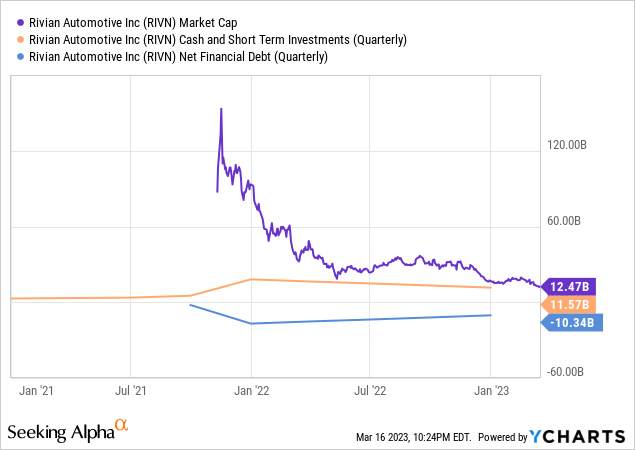

While Tesla is likely to be a secular compounder for the next several years, it is hard to imagine a $6T market cap for an auto company, which is what Tesla is right now. Hence, Tesla is not likely to be a ~10x in 10 years investment from here. On the other hand, Rivian is priced for bankruptcy, with the stock trading extremely close to its [net] cash balance!

We will look at the factors driving Rivian’s stock in just a moment, but please note that Rivian’s relatively small size (~$12.5B) and depressed valuation means that it could turn out to be a ~10x (or even ~20x) investment over the long term given the business scales up successfully and becomes profitable [like Tesla].

Is Tesla A Direct Competitor To Rivian?

From a market standpoint, Tesla is a direct competitor to Rivian in the electric vehicle market; however, there are some key differences between the two companies. While bears may disagree, Tesla is not just an EV manufacturer. As I see it, Tesla is a battery, energy storage, AI/robotics, and software company that happens to make electric vehicles [sedans, SUVs, sports cars, semi trucks, and pickup trucks (Cybertruck)].

On the other hand, Rivian is focused on developing adventure-oriented electric vehicles [pickup trucks and SUVs] for consumers. Additionally, Rivian is building electric delivery vans for Amazon, which is also a strategic investor in Rivian with a ~20%+ stake.

While there is certainly some overlap between Tesla and Rivian products, the two companies have very different strategic focuses and target customers. Nonetheless, they are both competitors in the broader market for electric vehicles, and a comparative analysis makes sense.

RIVN and TSLA Stock Key Metrics

Both Tesla and Rivian are mission-driven EV manufacturers with a deep focus on sustainability, innovation, and cutting-edge technology. However, when it comes to their financials, these businesses are poles apart.

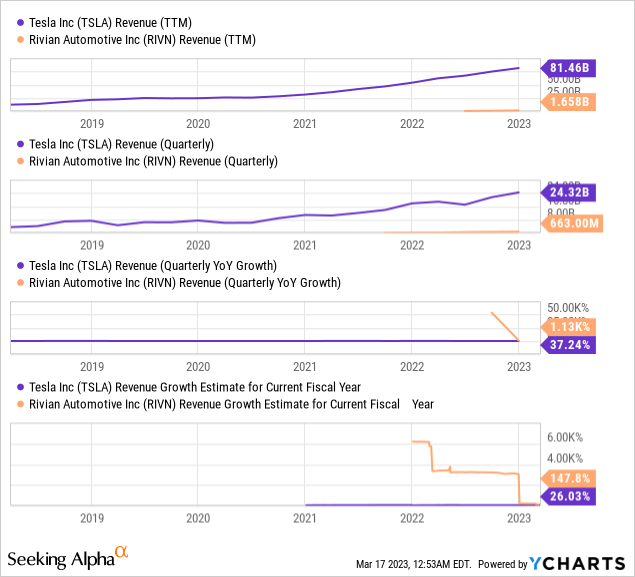

Under the charismatic leadership of Elon Musk, Tesla has become a household name and the undisputed leader in the EV industry. Despite facing the prospect of bankruptcy for many years, Tesla managed to scale up production, and by extension, revenues. In 2022, Tesla recorded a mammoth revenue of $81.46B (production: 1.4M vehicles), with Q4 revenue growing at ~37.24% y/y to $24.32B.

As a weak macroeconomic environment continues to threaten consumer demand, Tesla has been cutting prices on its vehicles in recent weeks. Consequently, TSLA’s revenue growth is now projected to slow down to 25% y/y in 2023. In my view, Tesla’s sales growth will re-accelerate to 30-35%+ once the macro conditions improve; however, considering Tesla’s scale, the hypergrowth days at Tesla are probably numbered.

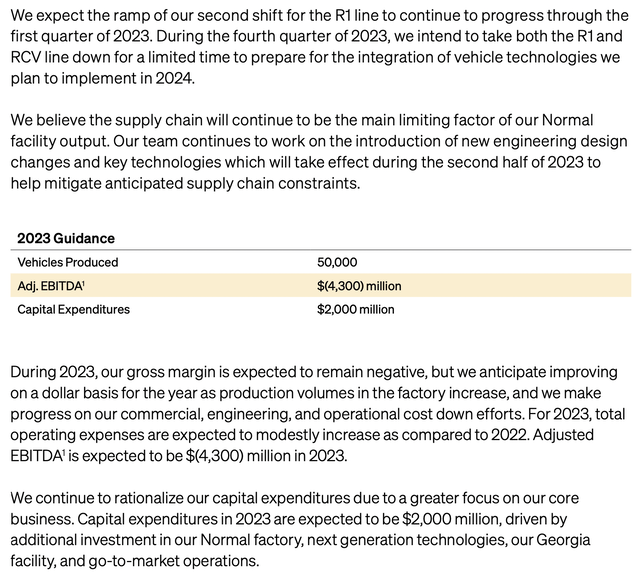

On the other hand, Rivian is a relatively new player in the EV industry, with its 2022 production coming in at just 24K vehicles (TTM revenue of $1.65B). Rivian’s adventure-oriented (off-road-capable) consumer EV lineup of SUVs and trucks along with commercial EV vans represent an incredibly large TAM opportunity. For 2023, Rivian’s management has set forth a production goal of 50K vehicles, which would represent y/y growth of more than 100%. Clearly, Rivian is growing much faster than Tesla, albeit from a much smaller base.

Now, let’s understand the wide disparity between the valuations of Tesla and Rivian. As we discussed, Tesla currently boasts a healthy valuation, whereas Rivian is priced for imminent bankruptcy (trading close to its net cash balance) despite showing hypergrowth.

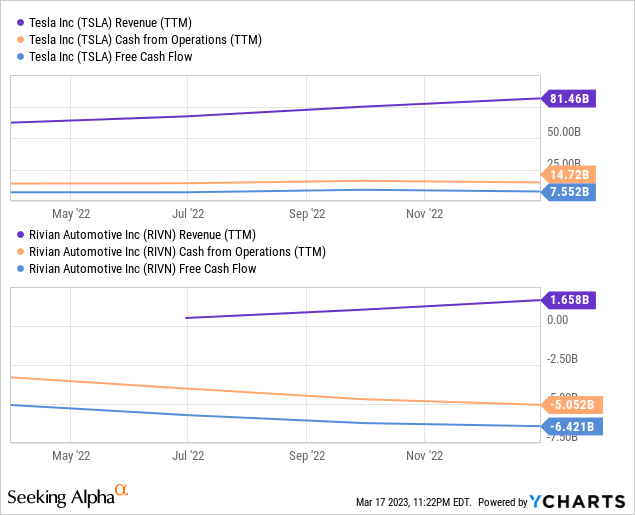

The primary reason for Rivian’s depressed valuation is the amount of money it is burning right now. In 2022, Rivian delivered revenues of $1.65B; however, whilst generating these sales, it burned through $6.4B of cash! Even if we adjust for CAPEX spending, Rivian’s operating cash flow was -$5B.

Now, negative free cash flows are not uncommon for early-stage growth companies. And Rivian’s case is quite unique because it is scaling up production and investing heavily in R&D and infrastructure (manufacturing plants & distribution network).

Can Rivian Pull Off A Tesla And Stave Off Bankruptcy?

Before it turned into a free cash flow machine, Tesla always seemed to be on the verge of bankruptcy [right from its early years up until 2018] as it burned through billions of dollars during its production scale-up. Now, any investor looking to take a long bet on Rivian is hoping that it can emulate Tesla, i.e., scale up production rapidly and turn into an incredibly profitable company.

To get to positive free cash flow (and to avoid bankruptcy), Rivian has roughly ~$12B of cash at its disposal. However, Rivian’s stock price suggests that Mr. Market seems extremely pessimistic about its prospects of avoiding bankruptcy, and I see a good reason for it.

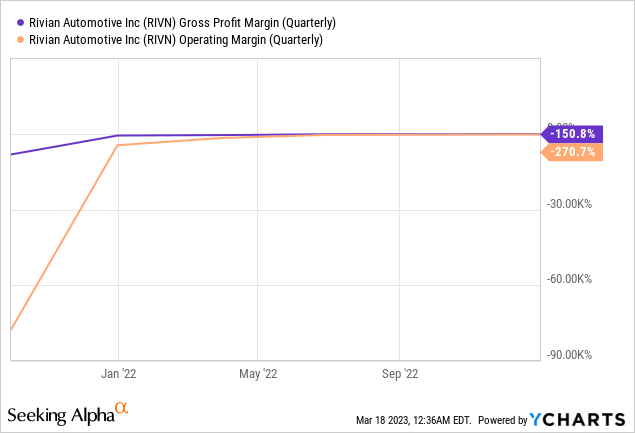

While burning cash is fine, Rivian has deeply negative gross margins. In Q4, Rivian reported a gross margin of -150%, which means that the company’s COGS far exceeded its revenue.

Tesla escaping bankruptcy was miraculous; however, Rivian is going to need to pull off an even greater miracle to have any chance of survival. For 2023, Rivian is targeting the production of 50K vehicles, and even at that scale, management is expecting gross margins to remain deeply negative.

Rivian Q4 2022 Earnings Release

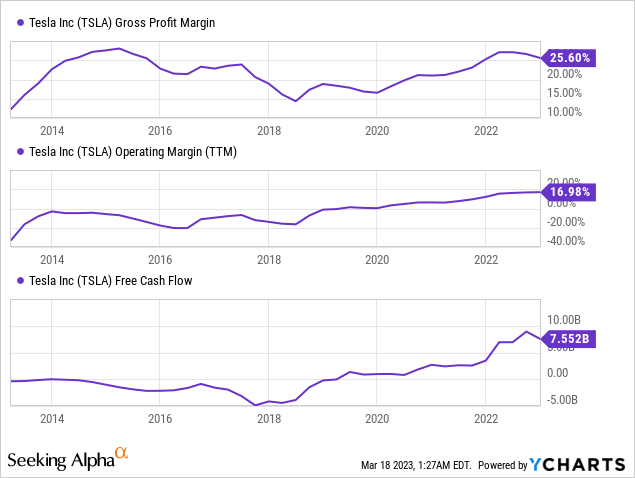

Comparing Rivian to Tesla in its current form doesn’t make much sense due to vastly different levels of production, and so we should look at Tesla from 2014-15 when it was making ~50K vehicles per year. As you can see, despite having deeply negative operating margins (negative FCF) at Rivian’s current scale, Tesla had a positive gross margin of 20%+.

According to Morgan Stanley analyst Adam Jonas:

Rivian Automotive’s inefficiencies are weighing on margins. When Tesla crossed the 50k unit milestone (2015) it earned a positive 21.3% gross margin (ex credits). Rivian targets 50k units of production this year, but we estimate a negative 68% gross margin with nearly 2x the capex + opex spend. Rivian’s use of its plants is more inefficient than that of Tesla at a comparable stage. Namely, the Normal, Illinois plant utilized by Rivian is designed to reach a production capacity of 150,000 units versus Rivian’s target of just 50,000 vehicles in 2023.

Furthermore, a sudden surge in lithium prices adds to headaches for Rivian versus Tesla’s starting point. That is due in large part to significant competition in the EV market, which is also a factor augmenting Rivian’s current position vis-a-vis Tesla at a similar stage in the Elon Musk-led automaker’s growth.

Source: Morgan Stanley highlights margin concerns for Rivian.

As Rivian scales up production and realizes economies of scale, it is expected that its gross margins will improve. However, based on Rivian’s guidance for 2023, I think we are likely to see a little more than half of Rivian’s $12B cash balance evaporate by the end of this year. While Rivian’s management has expressed belief in achieving positive gross margins by 2024, it may prove to be too little too late! With the macroeconomic environment getting worse amid a banking crisis, Rivian’s chances of raising fresh capital look quite slim. As I see it, Rivian will likely burn through its cash in the next 18-24 months, and in the absence of external funding, Rivian can easily end up in bankruptcy.

Concluding Thoughts: Is TSLA or RIVN Stock A Better Long-Term Buy?

In conclusion, Tesla and Rivian are two of the most exciting and innovative players in the EV industry. While Tesla has an established presence and a robust margin profile, Rivian is still in the early stages of scaling up and investing heavily in R&D and infrastructure.

As we noted in today’s article, Rivian & Tesla’s product lineups have little overlap, and both of these companies can co-exist in the massive auto market. Now, Tesla is unlikely to be a ~10x investment from current levels in the next decade; however, investors buying in here at ~$180 per share could conservatively expect a 5-year CAGR return of ~15% from TSLA stock.

On the other hand, Rivian could be a ~10x or ~20x investment from current levels if it avoids bankruptcy and scales up production successfully. However, given the competitive environment and macro conditions being vastly different in 2023, Rivian’s chances of emulating Tesla [of 2015] do not look great to me. Plus, Rivian is starting from a much worse-off position due to its deeply negative gross margins. With its current cash burn rate, I see Rivian burning through its cash balance in the next 18-24 months. And if RIVN fails to raise additional funding in what will be much tighter financial conditions, it may easily end up in bankruptcy!

The macroeconomic environment is highly uncertain, and this is not the time to be a hero. Given the long-term risk/reward on offer, I strongly prefer buying Tesla, Inc. over Rivian Automotive, Inc. right now.

Key Takeaway: I rate Tesla stock a “Buy” at ~$180 per share and Rivian an “Avoid” at ~$13 per share.

Thanks for reading, and happy investing. Please share your thoughts, concerns, and/or questions in the comments section below.

Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Are you looking to upgrade your investing operations?

Your investing journey is unique, and so are your investment goals and risk tolerance levels. This is precisely why we designed our marketplace service – “The Quantamental Investor” – to help you build a robust investing operation that can fulfill (and exceed) your long-term financial goals.

We have recently reduced our subscription prices to make our community more accessible. TQI’s annual membership now costs only $480 (or $50 per month). New users can also avail of a special introductory pricing deal!