emptyclouds/iStock via Getty Images

Jefferies took up coverage of the tobacco sector on Wednesday, with three Buy ratings, one Hold rating, and one Underperform rating. Overall, analyst Andrei Andon-Ionita and his team think the sector sits in the sweet spot of consumer staples through attractive growth, a defensive nature, rich cash returns, and still-attractive valuation

The firm initiated coverage on Philip Morris International (NYSE:PM) with a Buy rating. “We believe the company will continue to lead growth in Heated Tobacco and Oral Nicotine Pouches, which is likely to drive sustainable +HSD EBIT expansion in the medium term,” wrote Andon-Ionita. While PMI is seen trading at a premium to tobacco peers, sharesw ere not seen as expensive relative to food and household product blue chips and were noted to offer superior top- and bottom-line growth and elevated shareholder cash returns.

Meanwhile, Altria (NYSE:MO) was started off with an Underperform rating and a price target of $50. “We see risk to the US Combustibles business due to accelerated -HSD volume declines and incremental, downtrading-driven pressure. Moreover, Altria’s market-leading position in declining Traditional Oral is offsetting Modern Oral growth,” warned the analyst team.

Jefferies started off coverage on Imperial Brands (OTCQX:IMBBY) (OTCQX:IMBBF) with a Buy rating. “Following a management overhaul in 2020, the combustibles business has steadily gained share in key markets, and the company’s Smoke-Free Products strategy is starting to show signs of success, particularly in US Modern Oral,” updated Andon-Ionita. Despite a fortress balance sheet and rich cash returns, Imperial Brands (OTCQX:IMBBY) was highlighted as trading at a tobacco-wide valuation trough.

Japan Tobacco (OTCPK:JAPAF) (OTCPK:JAPAY) was initiated with a Hold rating. “The company’s global volume share gains, which we attribute to the skew towards attractive Emerging Markets, suggest the core combustible business is in good shape. Additionally, Global Flagship Brands appear in good health, having gained market share in key DMs, and the recently-acquired US discount brands are outperforming the wider market,” updated Jefferies.

Buy-rated British American Tobacco (BTI) is Jefferies top overall tobacco sector pick (read more about the Jefferies call on BTI).

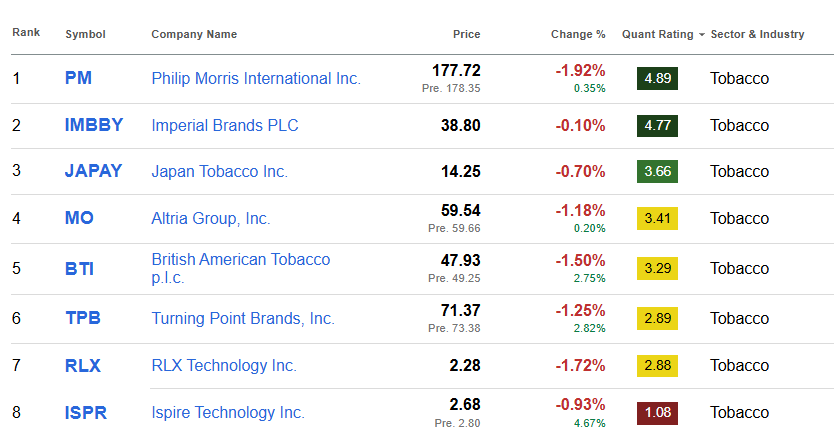

On a quantitative analysis basis, Philip Morris International (NYSE:PM) has the highest Seeking Alpha quant score.

Seeking Alpha