Summary:

- The digital payments market will continue to grow at a solid pace.

- Although competition is fierce, PayPal has its target audience and further strong market share erosion is unlikely.

- The company’s cost-cutting policy is already starting to pay off, and further saving of labour will increase margin.

- It is fair to say that PayPal is already a mature business. The company has an established target audience, no need for large capital investments, and a high FCF generation capacity. Further payouts in the form of buybacks bode well for attractive returns.

- The market is still fundamentally undervalued, and PayPal is trading well below its fair multiple. Our valuation assumes Strong Buy status at current prices.

Justin Sullivan

PayPal (NASDAQ:PYPL) is a significant player in the digital payments industry. Despite the advancement of competitors and the likely emergence of new companies, PayPal has its target audience, and we do not expect major erosion of market share in future. The company will maintain its healthy organic growth rate and will be able to significantly improve its financial results amid improved customer LTV and lower operating costs. PayPal continues to be trading significantly below its fair multiple, which is a good opportunity for long-term investors and reinforces the effect of stock buybacks (the management plans to allocate ~75% of FCF). Its status at current prices – BUY.

Healthy operations growth despite slowing economy and tight industry competition

Digital payment systems have largely become a defining factor of economic development over the past few decades. In addition to traditional Visa or Mastercard there are many counterparts, offering both regular debit transactions for the purchase of goods and various types of installment payments.

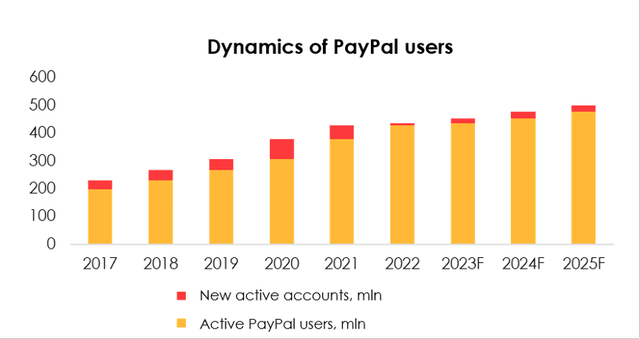

The emergence of new players (Klarna, Affirm, Square, etc.) and increasing competition in the industry could not but affect PayPal. The company faced a slowdown in subscriber growth, increased churn rates, so the management changed its strategy: it abandoned the previous goal of 750 million active users by 2025 and focused on quality customers, increasing turnover per account and, consequently, ARPU.

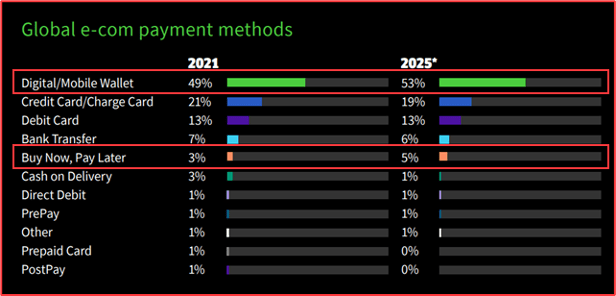

We believe that payment systems remain an investment-attractive industry given the ongoing massive digitalization of the economy, as well as the remaining high potential in emerging markets, where the use of alternative transactional systems remains limited.

Worldpayglobal

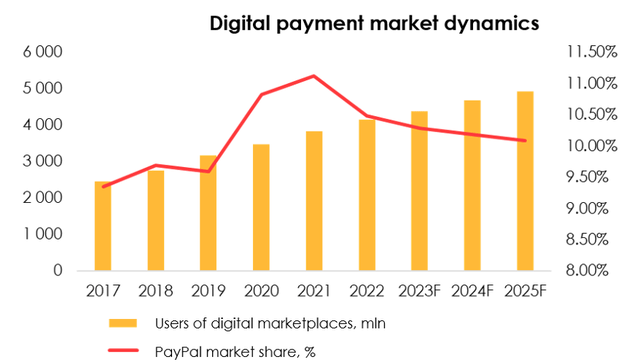

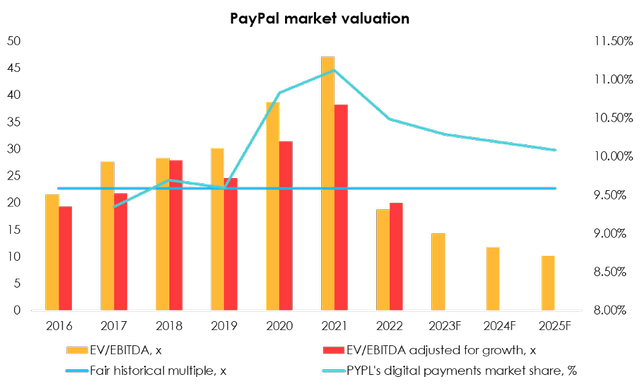

Therefore, it is reasonable to expect active investments from players, as well as the appearance of new companies in the industry, which will lead to increased competition and further erosion of PayPal’s share. Nevertheless, we believe that the company’s target audience is already formed, so we do not anticipate a strong erosion of market share in future. We use Statista data on the number of users of digital transaction systems as a forecast of active users and erosion of market share by 0.40% (to 10.09%) by 2025.

We thus expect the company to reach 496 million active accounts by 2025 (+61 million in 2023-2025). Despite a significant slowdown versus 2016-2021, we believe that it can be described as a healthy organic growth given PayPal’s updated strategy.

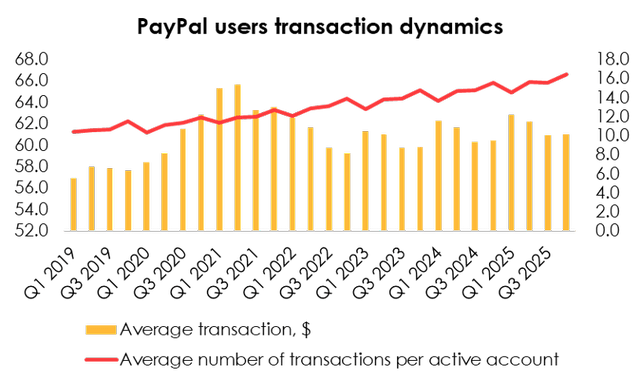

Meanwhile, the focus on high-income customers will also positively change the average volume and number of transactions. Although in the short term the dynamics of the average ticket will still be influenced by the high USD exchange rate, we believe that the peak of DXY has passed, and the effect will wane by the end of 2023.

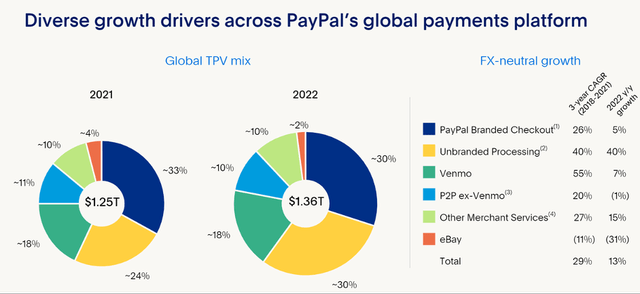

However, PayPal continues to develop not only through the main transaction service, but also via smaller fintech sectors like Braintree or decentralized small platforms, which will provide additional support amid growing competition and will expand revenue streams.

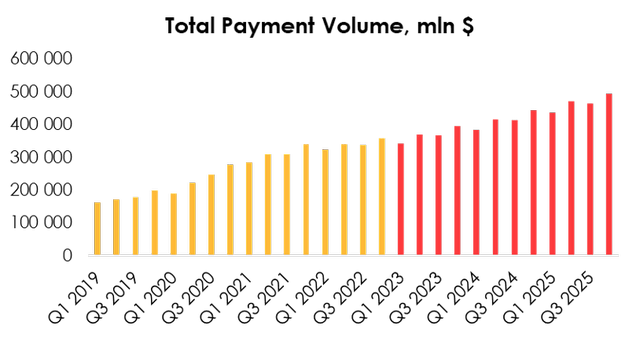

Therefore, we expect PayPal revenue to reach $30 073 million (+9.3% YoY) in 2023, $33 855 million (+12.6% YoY) in 2024, and $38 013 million (+12.3% YoY) in 2025. As a result, despite increasing competition, PayPal’s mid-term outlook remains clear.

Profitability bridge is sustainable

The company’s cost-cutting policy deserves special attention. Already in 2022, the reduction in operating costs, the transfer of the loan portfolio to counterparties and the effect of investments in transactional infrastructure began to bear fruit – the Q4 operating margin was 16.8% compared to 15.2% YoY and the lowest of 11.0% in Q1 2022.

Moreover, the management announced additional layoffs (7% of staff) in Q4. According to managers’ estimates it could save the company an additional $600 million per year on both transactional and other operating costs.

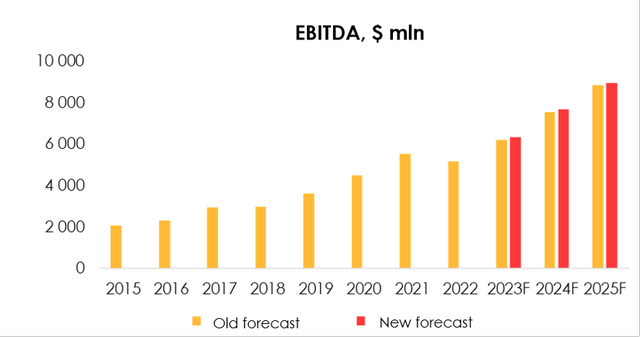

Due to lower labor costs, we have revised PayPal’s forecast for transaction costs from 43.99% to 43.70% of revenue in 2023 and from 43.49% to 43.20% of revenue in 2024. We have also revised the forecast for other operating costs downwards from 39.90% to 39.76% of revenue in 2023 and from 38.49% to 38.35% of revenue in 2024.

We thus estimate that the company’s operating margin will be 16.5% (+2.6 p.p. YoY) in 2023, and 18.4% (+1.9 p.p. YoY) in 2024.

Therefore, we expect EBITDA in 2023 to amount to $6 347 million (+23.2% YoY) and to $7 679 million (+21.0% YoY) in 2024.

Maturing business & market valuation volatility

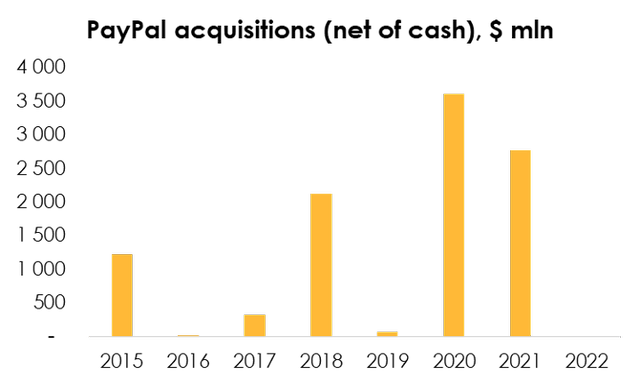

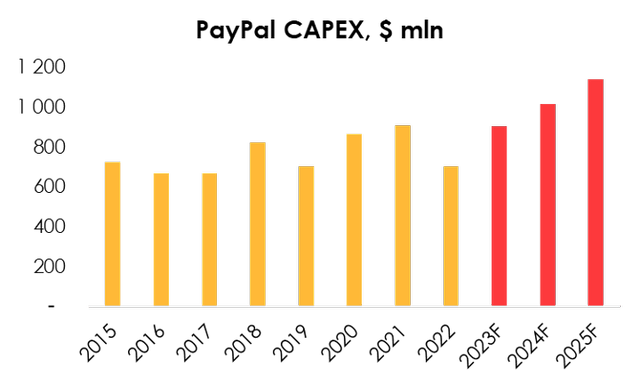

PayPal has already launched the transformation from a small growing company to a mature business: the company has no need for large capital investments or constant aggressive M&A, it has completed all the necessary acquisitions in 2018-2021.

PayPal’s capital expenditures both historically and in the forecast period will remain modest. The management expects them to reach 3% of revenue in 2023, and we believe that a similar trend will persist in the forecast period.

Given PayPal’s growing profit margin and net income, as well as its lack of need for large investments, the company is becoming a real cash machine. Starting from 2023, the company will allocate ~75% of FCF to stock buybacks, which at current valuations of 13.3x EV/EBITDA FWD looks like a reasonable way to make payouts to shareholders.

Many investors are disappointed with the stock’s performance over the last year, but even relying on historical data, the company is now significantly undervalued. The multiple has been very sensitive to the dynamics of the company’s operating results and market share, but given that the main share erosion is behind, we believe that the multiple should return to its historical values.

Valuation

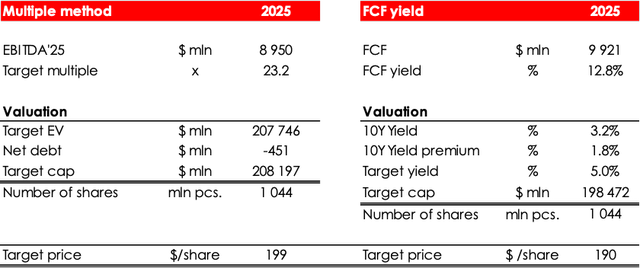

We are evaluating PYPL target price based on discounted at 13% 2025 EV/EBITDA multiples & FCF Yield. For the valuation purposes we also include assumed buyback effect on the number of shares outstanding. Prices in tables depicted below are not discounted. Fair value price of shares is $153.

Conclusion

PayPal – is one of those companies that we find attractive even in the face of expectations of an economic slowdown. The market’s overreaction to the slowdown last year led to a significant undervaluation of the company, even despite healthy growth in financial results and a clear development strategy. We believe that the company is now one of the best long-term portfolio choices for investors.

To manage the position, we recommend keeping an eye on financial statements of PayPal and its competitors (Visa, MasterCard, Affirm, Square) industry research (McKinsey, Capgemini, Worldpayglobal)

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.