Summary:

- Google stock was hit with extreme fear.

- A revitalized Bing threatens to take market share from Google Search.

- Google remains a cash cow with a net cash position.

- The stock looks cheap on a sum of the parts basis.

Sean Gallup/Getty Images News

Unlike its tech peer Meta Platforms (META), Alphabet (NASDAQ:GOOGL) stock did not soar following its fourth quarter earnings report. It seems that the company’s goal of using artificial intelligence to streamline costs was not well received by the market, which may have preferred more direct commentary on controlling costs. There was also the company’s stumble in unveiling Bard, its answer to ChatGPT. Yet the market is ignoring the deep undervaluation present in the stock price, as Google Cloud continues to grow rapidly in spite of negatively impacting the bottom line. The market may be underestimating the company’s ability to offset macro headwinds with margin expansion. GOOGL remains a top pick in the market, as the robust cash flows and net cash balance sheet round out potential for multiple expansion.

GOOGL Stock Price

Like many stocks in the tech sector, GOOGL has struggled over the past year.

I last covered GOOGL in January where I called it my best risk reward opportunity. The stock has since returned 14% but I continue to see strong upside ahead as the company’s resilient fundamentals are not being adequately appreciated by the market.

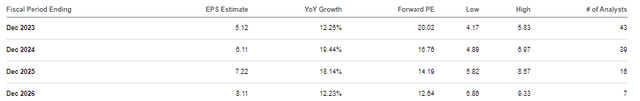

GOOGL Stock Key Metrics

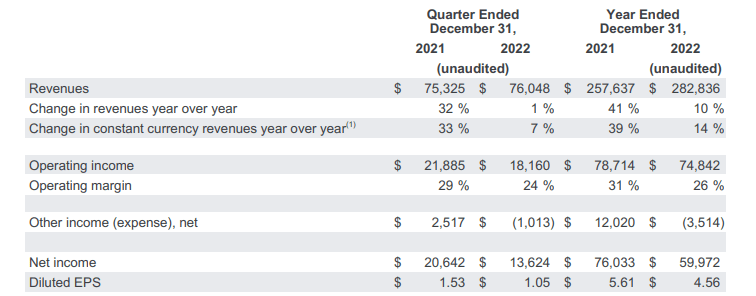

The positive thing about nasty stock price crashes is that sentiment and expectations are reset. In its most recent quarter, GOOGL generated just 1% YOY revenue growth (7% constant currency). GAAP earnings per share declined by 31.3%.

2022 Q4 Release

GAAP earnings include non-cash gains and losses from investments. Excluding that, earnings per share of $1.18 declined a more modest 12.6% from $1.35 per share in the prior year.

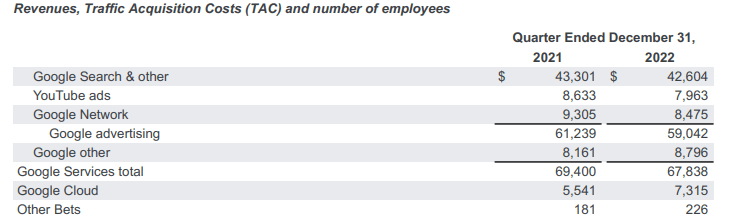

As a dominant online advertising platform, the secular trend toward online advertising proved insufficient to offset the weakening demand amidst a tough macro backdrop. GOOGL saw its advertising segments decline YOY all across the board. Google Cloud was the lone bright spot at 32% growth.

2022 Q4 Release

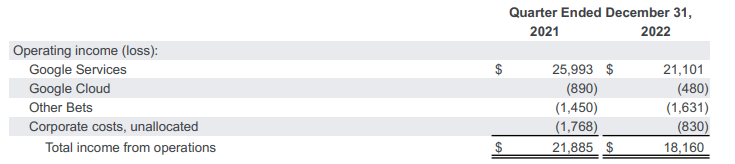

Given the strong results in cloud, I would have expected the stock to rally strongly following this report especially considering the strength relative to Amazon Web Services (AMZN). But that did not happen, likely due to the still-unprofitable nature of the business. Google Cloud did see some improvement in operating losses but remained unprofitable in the quarter.

2022 Q4 Release

On the conference call, management stated the following with regard to Google Cloud:

We’ve really been investing ahead of our revenues, given the growth and the opportunity overall and the desire to ensure that we’re equipped, able to support customers across segments around the globe. And so there’s been meaningful investment to position ourselves to really have the momentum that the team has continued to deliver.

And we’re at a position now where we’ve meaningfully closed the gap to profitability but still are working through as we continue to invest for growth while narrowing what this is on our march to profitability.

The problem is that this is a market highly focused on near term profitability and mere words are not enough to convince a skeptical market. I am of the view that Google Cloud will be able to sustain hefty profit margins over the long term, but the market is unwilling to give even the likes of GOOGL the benefit of the doubt.

GOOGL announced a layoff of 12,000 employees in January and expects to incur up to $2.3 billion in severance charges, with the majority recognized in the next quarter. GOOGL ended the quarter with $113.8 billion of cash and $30.5 billion in non-marketable securities versus $14.7 billion in debt. I was happy to see a commitment to the share repurchase program. The company repurchased $15.4 billion of stock in the quarter (up from $13.5 billion a year prior) out of $16 billion in free cash flow. For the year, GOOGL generated $60 billion in free cash flow and repurchased $59.3 billion in stock. This is not the same company from just several years ago which was more content to hoard cash than return cash to shareholders. Over time, I see share repurchases as being the most important lever for multiple expansion.

The biggest negative in the report in my view was that the company would be changing the financial reporting of its AI division DeepMind. DeepMind had previously been reported under Other Bets but would now be reported as part of general corporate costs. I view this development negatively not only due to the likely deterioration in ex-Other Bets margin but also the realization that a “sum of the parts” valuation methodology might not be totally accurate due to the inter-segment relationships. That said, my fears may admittedly be overblown considering that total Other Bets losses remains very modest at less than 10% of overall operating income and DeepMind may eventually lead to profit generation. If anything, this may prove to be a bullish signal as it may be signaling the unveiling of new AI products.

The company has been more vocal about its investment in artificial intelligence (‘AI’). That may have to do with the rise of Microsoft-backed (MSFT) ChatGPT. This has culminated in the company launching its Bard chatbot, joining a growing list of companies with similar offerings. It may not just be for shock and awe, though. Management notes that AI may help the company improve operational efficiency, ranging from improving Shorts monetization (at the very least by improving recommendation of content to users), managing the efficiency of their technical infrastructure, optimizing their workplace, and more. Management stated that investors might see “more of an impact on 2024 than in 2023” from such efforts. While that is indeed one year away, I was still surprised that the market did not give GOOGL the same reaction as it gave for META’s “Year of Efficiency.” While the general public seems to have come under the assumption that ChatGPT is a runaway winner in artificial intelligence, it is important not to ignore the fact that GOOGL has been working on AI for many years and can be considered a clear leader in the field. That said, I wouldn’t be surprised if ChatGPT keeps the stock price valuation tempered over the several quarters until the company can show that the financial impact from the competition is not as much as feared.

Is GOOGL Stock A Buy, Sell, or Hold?

After the slide, the stock is now trading at around 20x forward earnings estimates.

The stock is even cheaper than it looks. When valuing the stock on a P/E basis, that is implicitly assigning negative value to any segment which is generating operating losses. The Other Bets division generates $1.6 billion in operating losses in the latest quarter but arguably should be worth at least $0 per share (remember that the self-driving unit Waymo is here). Google Cloud lost $480 million in the latest quarter but generated $7.3 billion in revenues. Based on my projections for 30% long term net margins, 25% forward growth, and a 1.5x price to earnings growth ratio (‘PEG ratio’), Google Cloud might be worth 11.3x sales or $330 billion. That’s $25.40 per share in value. I think that “core Google” is worth more than 20x earnings but even at that multiple we arrive at $105 per share in value for that segment alone (based on $86.6 billion in trailing twelve months operating income and a 21% corporate tax rate). Finally, net cash and investments are worth around $10 per share. Adding it up, we arrive at $145 per share in value. I’d argue that this valuation is conservative because GOOGL deserves a higher multiple as well as the likelihood that the company is still over-investing in headcount.

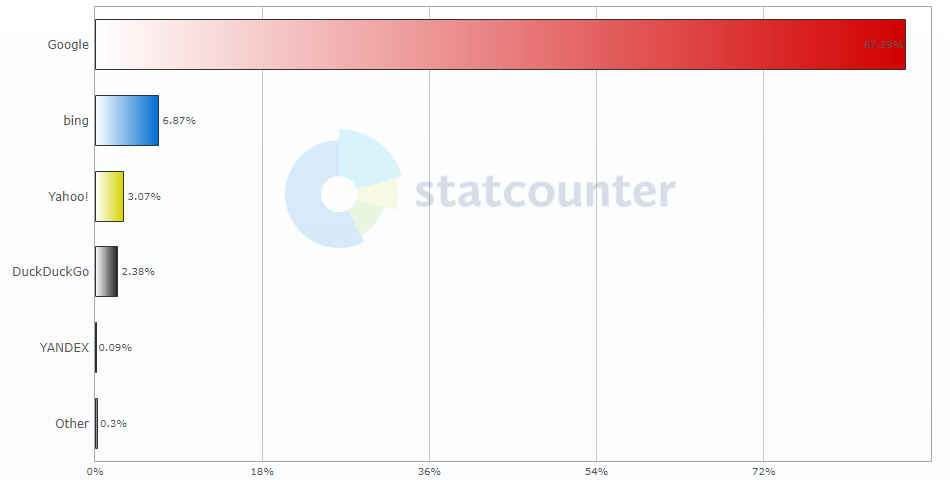

What are the risks? Given MSFT’s push into integrating OpenAI with Bing search, the greatest risk is that of disruption. GOOGL has dominated search for a long time with nearly 90% market share in the United States.

gs.statcounter.com

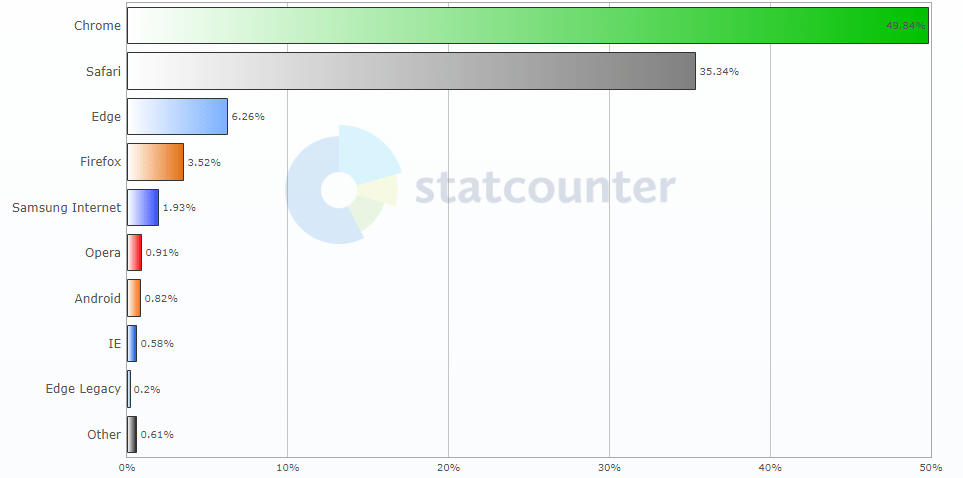

It is possible that MSFT is able to win market share on account of the revitalized platform – GOOGL would have the most to lose in such a scenario. But I am a skeptic. I’d first point out that Bing has offered users rewards for using its service for many years without so much success. Second, it is important to note that Google Chrome remains the dominant internet browser globally including nearly 50% market share in the United States.

gs.statcounter.com

While fears of competition from MSFT are likely to dominate headlines and sentiment in the near term, I expect those fears to ease over coming quarters as the financial results tell the full truth.

Instead, I see the long term risk not coming from MSFT but instead from Apple (AAPL). To date, AAPL has not yet officially launched a search service, but I have a hunch that they may unveil such a service in the future. Unlike MSFT, AAPL has significant if not dominant market share across internet browsers, computers, and smartphones. I would find such a threat more significant due to the greater potential for increased adoption. It is possible that GOOGL’s multiple remains compressed until that overhang is removed – that is, until the market can see the actual impact to the fundamentals. The company may be able to repurchase cheap stock in the meantime, but the fear of disruption can make the bulk of returns back-end weighted.

Another risk is that of a weak economy. Unlike enterprise tech names which may see greater financial stability, GOOGL’s reliance on online advertising may make revenues more volatile in a recession. The company’s strong cash flows and balance sheet make financial solvency an insignificant risk, but the next several quarters may be more disappointing than optimistic. On a closing thought, I point out that with tech peer META announcing a new round of layoffs, one mustn’t ignore the possibility (or even likelihood) that GOOGL will announce another round of layoffs of its own, as I continue to be of the view that there is a lot of “fat” available to cut if management wishes. That may help the company offset any top-line headwinds as the market comes to appreciate the company’s ability to drive margin expansion amidst a tough macro backdrop. GOOGL remains one of my top picks in the market today and one of the largest holdings in my portfolio.

Disclosure: I/we have a beneficial long position in the shares of GOOGL, META, AMZN, AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am long all positions in the Best of Breed Growth Stocks Portfolio.

Growth stocks have crashed. Want my top picks in the market today? I have provided for Best of Breed Growth Stocks subscribers the Tech Stock Crash List Parts 1 & 2, the list of names I am buying amidst the tech crash.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best 6-8 investment reports monthly.

- My top picks in the beaten down tech sector.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks today!