Summary:

- As treasury yields collapse, a flight to safety trade is boosting mega-cap tech stocks like Apple.

- In this note, we will discuss five things all smart investors must know about Apple before rushing into the stock here.

- Despite having great faith in Apple as a business, I do not like AAPL stock as an investment at current levels.

- I rate Apple “Avoid/Neutral/Hold” at $155.

Andrii Yalanskyi

Amidst fears of a full-blown banking crisis in the aftermath of multiple bank failures, treasury yields have declined sharply, and Apple’s (NASDAQ:AAPL) stock has caught a bid in recent weeks as investors flock to treasury bonds and mega-cap tech for shelter.

In the past, I have opined that big tech giants like Apple and Microsoft (MSFT) are broadly (and wrongly) viewed as “safe haven” stocks after nearly fifteen years of easy money policy [QE & ZIRP].

And despite moving into a radically different macroeconomic [high inflation & rising interest rate] environment over the last year or so, most investors are still flocking to these big tech giants for perceived safety.

In today’s note, I would like to share five things that you must know about Apple right now:

1. Apple Offers Little To No Margin Of Safety

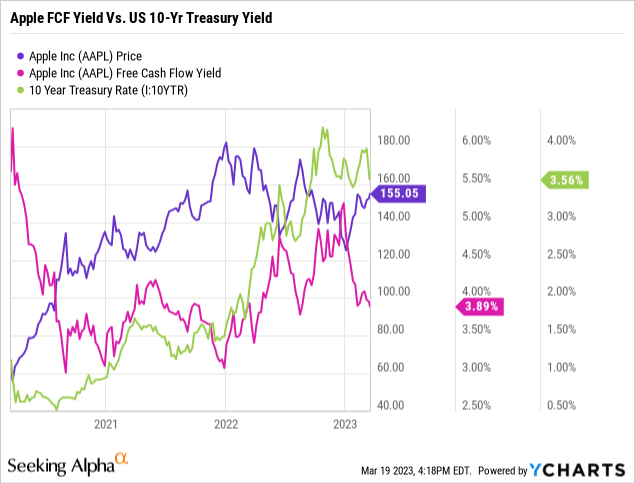

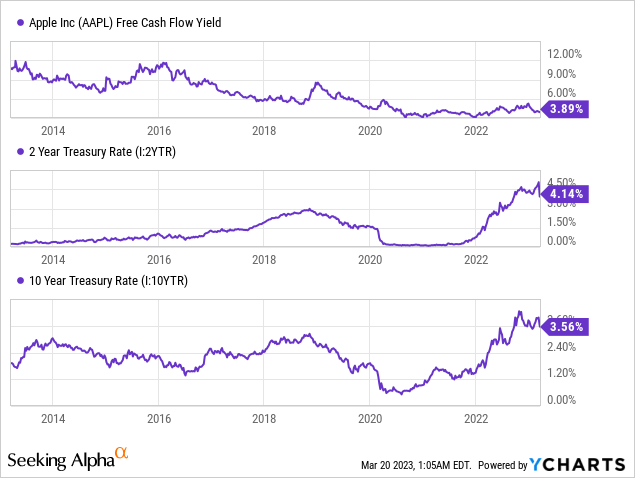

Historically, Apple has offered investors a significant margin of safety, which can be viewed through a positive spread between free cash flow yield and (risk-free) treasury bond yield. However, this spread narrowed significantly in the ZIRP-powered liquidity boom of 2020-21. And despite a sizeable upswing in treasury yields, Apple’s free cash flow yields have remained suppressed!

On the back of the ongoing year-to-date rally in its stock, Apple’s free cash flow yield has declined to ~3.9% (from around 5.4% in late December 2022). Now, despite a sharp drop in treasury yields in March, short-term treasury yields are still higher than Apple’s free cash flow yield, and the spread with long-duration rates is nearly non-existent.

In summary, Apple’s stock has little to no margin of safety.

Now here’s some pushback I have received on my stance about Apple’s margin of safety (or lack thereof):

But Ahan, Apple’s credit ratings of “AA+” from S&P Global and “AAA” from Moody’s are on par with US Government bonds. Furthermore, Apple is a growth company and a free cash flow generating machine. Then why should Apple offer any margin of safety over and above government bonds?

I’ll answer this question in the next couple of sections.

2. Apple Is Not The US Government, And It Is Not Immune To The Macroeconomic Environment

Over the years, Apple has built up a strong reputation as a reliable free cash flow-generating machine! However, Apple is not the US Government, which can print money out of thin air and tax its millions of citizens to pay its bills during an economic downturn. In fact, Apple is primarily a hardware business that will struggle to maintain sales and profit margins during tough times.

With the Fed’s aggressive monetary policy tightening, aggregate demand is likely to decline. Despite being one of the most robust businesses on this planet, Apple is not immune to the macroeconomic environment, and a drop in consumer demand will hurt Apple! The evidence is showing up in Apple’s financials already:

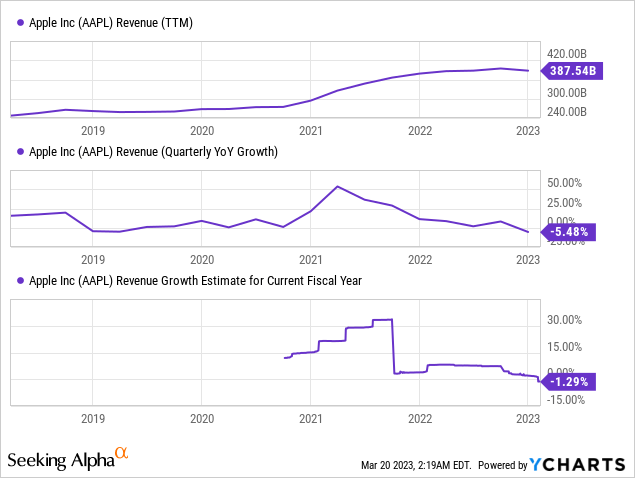

As you can see above, Apple’s revenues are in decline, with the company reporting -5.5% y/y revenue growth in Q1 FY2023, with the forecasted growth for FY2023 also being negative!

While I expect to get a lot of flak for this statement, I would like to highlight that Apple is primarily a hardware business, with more than 82% of Apple’s revenue coming from device sales, i.e., iPhone, Mac, iPad, wearables, and other accessories.

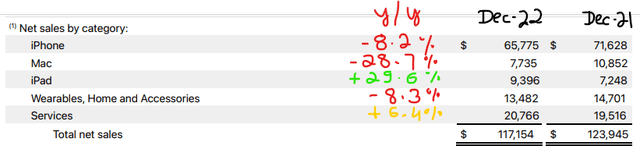

As of Q1 FY2023, Apple’s iPhone and Mac sales were showing significant declines, which were offset partially by strong growth in iPad sales. However, as an investor in Apple, I am more concerned about the slowdown in Apple’s twin growth engines – the Wearables and Services segments.

Apple Q1 FY2023 Results

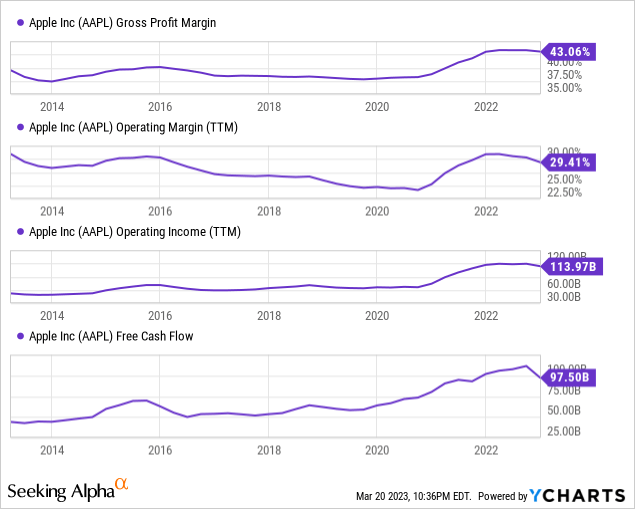

In addition to negative revenue growth, Apple’s gross margins have been flattening out and moving slightly lower in the last few quarters, which in turn has led to negative operating leverage, i.e., lower operating margins.

With both revenues and margins coming down, Apple’s operating income and free cash flows are in decline! In my view, Apple is still a free cash flow-producing machine; however, we must understand that the output of this machine will always be variable depending on the economy.

If the macroeconomic environment worsens further in the coming months, Apple’s financial performance is likely to get worse, and investors must be compensated for this risk. Hence, a margin of safety over bonds is absolutely necessary for investors buying Apple’s stock.

3. Apple’s Balance Sheet Is Not What It Used To Be

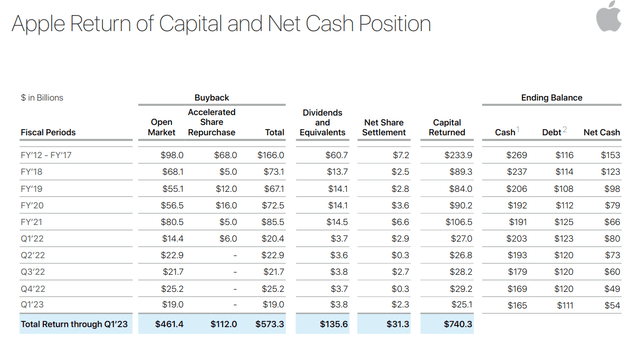

In the past decade or so, Apple’s management has significantly boosted shareholder value through a humongous capital return program, and I am a big fan of such applied financial engineering. Heck, we run an entire strategy based on capital return programs at our investing group – The Quantamental Investor. Apple is a part of this portfolio at TQI; however, I don’t like it as much as I used to in the past because I see Apple’s capital return program getting far less aggressive in the coming years.

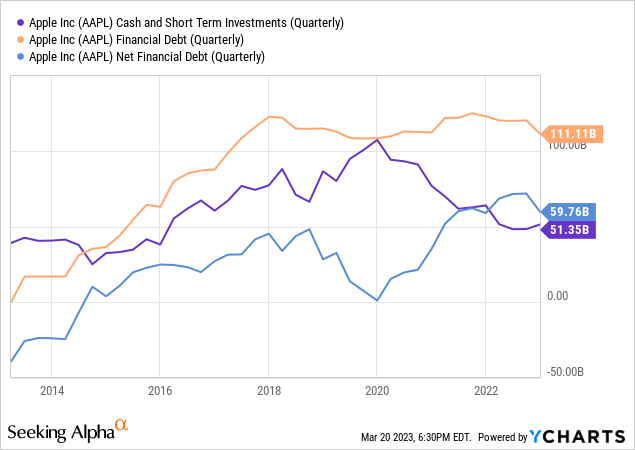

With an aim of becoming net cash neutral, Apple has been executing leveraged buybacks for the past few years, i.e., taking on debt to repurchase its stock. As you can see below, Apple’s net cash has gone from $153B in FY2017 to $54B in Q1 FY2023.

Apple Capital Return Program

Now, a $54B net cash figure may seem to indicate that Apple’s aggressive capital return program can be supported for years to come; however, I believe that Apple will need to taper off its buybacks in the not-too-distant future, and here’s why:

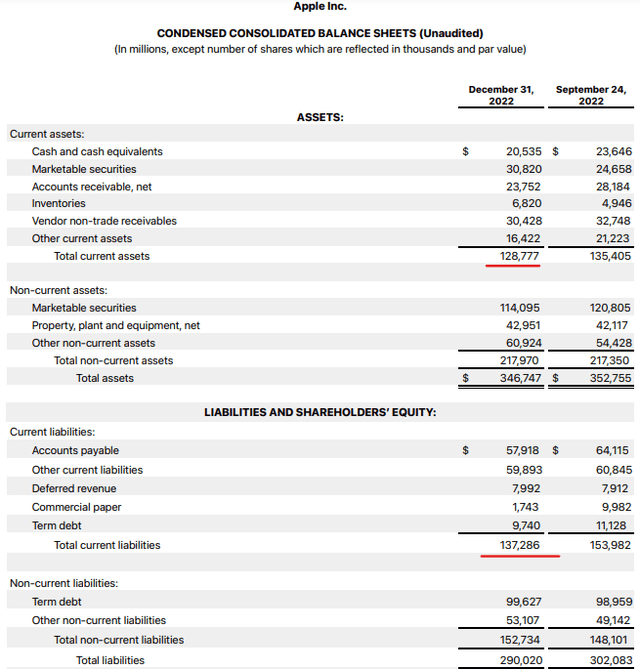

With nearly ~$114B tied up in non-current marketable securities, Apple only has ~$51B in cash and short-term investments.

Yes, Apple can choose to take on more long-term debt to spend more money on buybacks than it makes from its business. However, with interest rates rising to 4-5%+, doing so may not be prudent. And it’ll be interesting to see what management chooses to do. With a liquidity ratio of less than 1.0 (Apple’s current assets < current liabilities), Apple’s balance sheet isn’t as robust as it used to be in the past.

Apple Q1 FY2023 Results

Now, please note that Apple is still going to make tens of billions of dollars in free cash flow in the future, and it will most likely continue to keep its shareholder-friendly capital return program in place for years to come. And this means Apple will continue to buy back shares, albeit with lesser intensity.

4. AAPL’s Tryst With Precarious Technicals And Quant Factor Grades

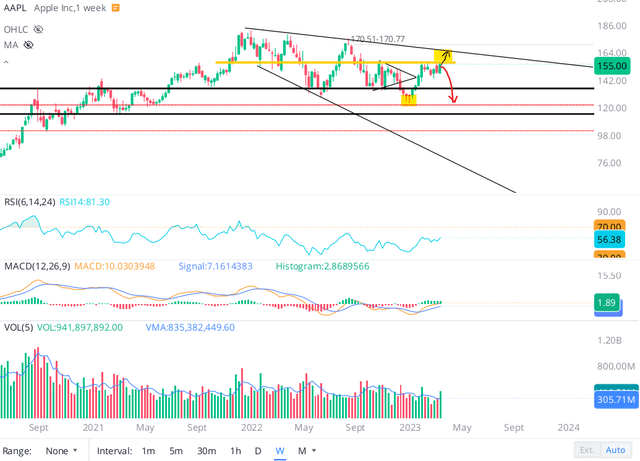

In a recent article – Apple Stock: A Troublesome Tryst With Technicals, we discussed the symmetrical triangle formed on the AAPL chart, and the potential moves we could see in the stock. After initially breaking downwards as per my expectation, Apple hit the low $120s, but we did not hit my target range of $80-$110.

After quite a scintillating move this year, Apple’s stock is now trading at a key level marked in a yellow line on the chart. If AAPL can break above this line, we could hit the upside trendline of the megaphone pattern at $160-$165.

WeBull Desktop

On the flip side, Apple could turn back lower and re-test the low $120s if it fails to clear the $155 level convincingly. Until AAPL confirms an upside breakout from the megaphone pattern, I think the risk/reward is skewed to the downside. From a technical perspective, I wouldn’t want to start a new long position here.

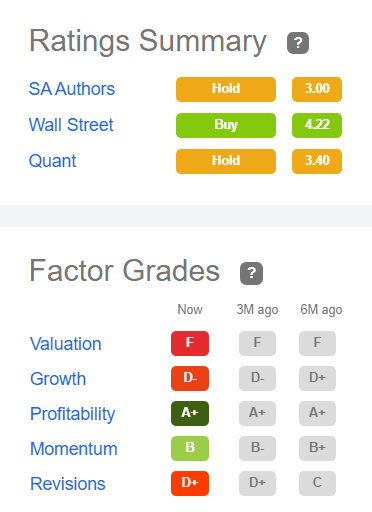

And Apple’s quant factor grades are in agreement with my stance:

SeekingAlpha

According to SA’s Quant Rating system, Apple is a “Hold” with an overall score of 3.4/5. As we have seen in this note, Apple’s revenue growth is deteriorating and its valuation looks stretched. Hence, AAPL’s Valuation and Growth grades of “F” and “D-” make complete sense. Also, a Profitability grade of “A+” is obvious. Interestingly, Apple’s Momentum and Revision grades have moved lower in the last six months from “B+ to B” and “C to D+”, which is a clear sign of weakness in the stock and the business.

5. Apple Is Overvalued

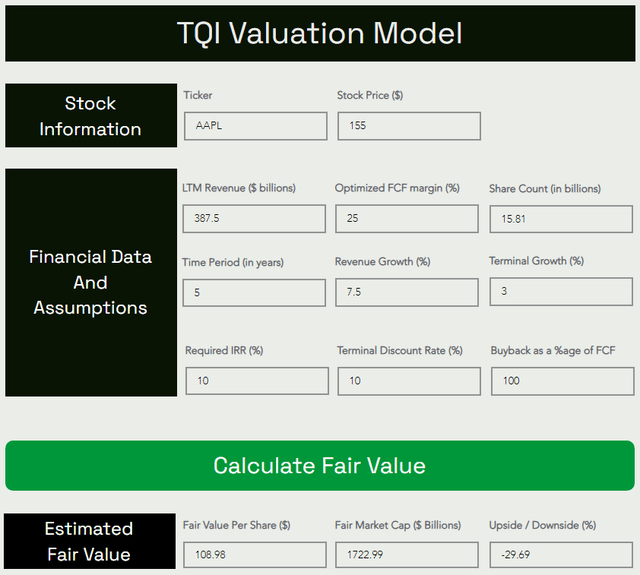

After a sharp rebound off of its December lows, Apple’s stock is looking quite stretched based on TQI’s valuation model (using fairly optimistic assumptions for long-term growth and free cash flow margins).

Here’s my updated valuation for AAPL:

TQI Valuation Model (TQIG.org)

As you can see above, AAPL’s fair value is $1.723T (~$109 per share), i.e., 30% lower than its current market price. Since my assumptions do not bake in a deep recession, I view Apple’s current valuation as frothy!

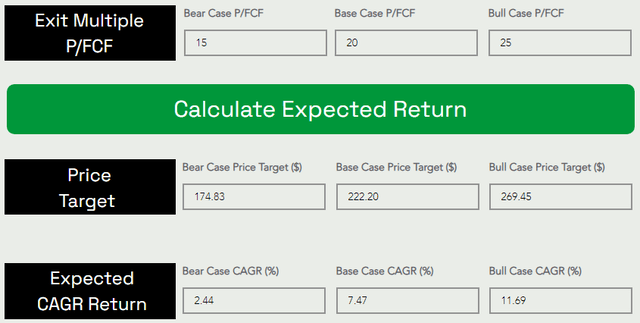

However, what sort of returns could one expect in the future by buying Apple at current levels?

TQI Valuation Model (TQIG.org)

Assuming a base case P/FCF exit multiple of ~20x, I see AAPL’s stock trading at ~$222 per share at the end of 2027, which implies a ~7.47% CAGR return over the next five years.

Concluding Thoughts

Apple remains a fundamentally sound business; however, it is not immune to the macroeconomic environment. Since Apple’s expected return fails to beat my required IRR of 10% for a “safe haven” stock, I don’t like Apple as a long-term investment at these elevated levels. From a technical perspective, Apple’s stock is in a “no trade” zone. Hence, I don’t like a short-term trade here either. In my view, the sheer lack of a margin of safety in AAPL stock is ample reason for investors to stay away from it right now.

Key Takeaway: I rate Apple stock a “Avoid/Neutral/Hold” at $155.

As always, thank you for reading, and happy investing. If you have any thoughts, questions, and/or concerns, please share them below.

Disclosure: I/we have a beneficial long position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Are you looking to upgrade your investing operations?

Your investing journey is unique, and so are your investment goals and risk tolerance levels. This is precisely why we designed our marketplace service – “The Quantamental Investor” – to help you build a robust investing operation that can fulfill (and exceed) your long-term financial goals.

We have recently reduced our subscription prices to make our community more accessible. TQI’s annual membership now costs only $480 (or $50 per month). New users can also avail of a special introductory pricing deal!