Summary:

- It is rare in this market for us to get excited about ideas on the long side with any real expectation of holding for duration.

- We’ve found that in this environment, you have to move in and out of ideas pretty quickly. There are simply too many moving parts for long-duration theses in this market.

- Or at least so we thought. While we feel that broadly holds true, PYPL could prove to be an exception. We see an asymmetric r/r opportunity in the stock.

- We think there are a number of potential catalysts for the stock over the next 6-12 months. Growth in the unbranded checkout business, discretionary spend strength (more on that later), surprising strength in branded checkout & Venmo, continued cost discipline, conservative guidance/low estimates, and management working for shareholders via capital returns, and even possibly the CEO change into ’24 and beyond.

- In terms of quantifying upside and downside of R/R profile: We see a downside case to ~$55 (-25%) and an upside case to ~$111 (+51%) by the beginning of C’24.

Justin Sullivan

Premise – PayPal Is A Sleepy Tech Story, Wake Up Before The Street Does

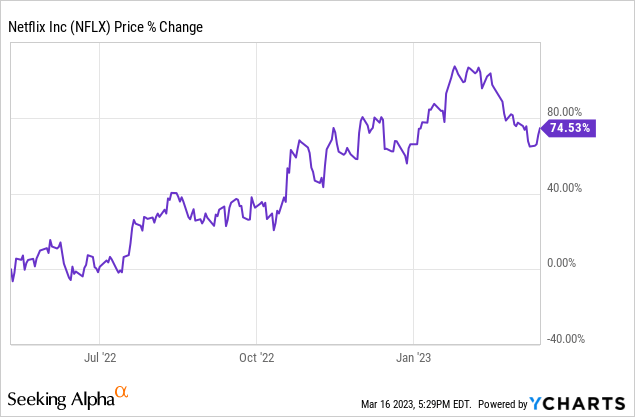

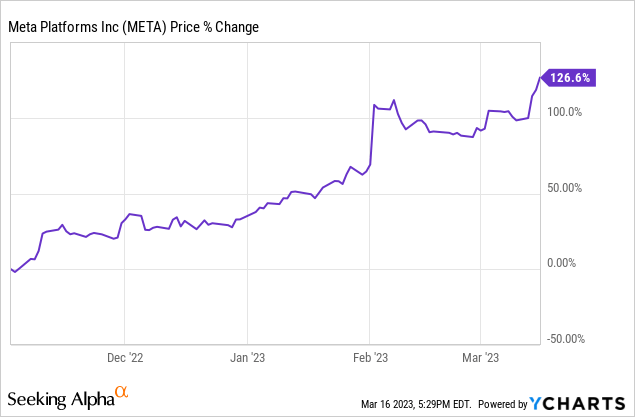

During much of last year, investors sold big tech stocks, especially the primarily-consumer facing ones that have worked for the last decade. These dramatic selloffs presented opportunities in the back half of the year to trade for rallies. We think PayPal (NASDAQ:PYPL) could parallel a couple of these setups. The two specific examples we want to highlight are: Netflix (NFLX) and Meta (META). For much of last year, these stocks were among the worst-performing ones in an already-poor performing tech basket.

For 1H’22 and a little into 2H’22 (in META’s case), investors had a compelling bear case to make on both the businesses and the stocks.

On the business side, bears could point to: slowing growth from broader market saturation and lapping high-bar Covid comps. You could look at increasing competition eating at market share down the road. You could also point out tech companies in general having ridiculously high and wasteful overhead spend. The bottom line is there was a good case to be short tech for much of 2022. There was a blend of a broader macro bear case on the economy and Covid trends resetting in the tech world, as well as a perception on the Street that META and NFLX had some element of idiosyncratic existential risks. At peak fear, there was a real debate going on about what terminal value looked like at the businesses.

On top of this, for much of last year we noticed that both META and NFLX traded at relatively inexpensive valuations. What you have to understand however, is that when the story is broken, stocks generally won’t bottom when multiples are inexpensive. Inexpensive isn’t enough. They have to get to the capitulatory point, where they’re beyond dirt cheap. NFLX traded down to a historically low mid-teens multiple, while META traded down to a low-double digit/high single-digit multiple. This basement/floor valuation didn’t come until the bulls had almost no conviction and Wall Street’s base case estimates was the old bear case. When the bear case becomes the base case, generally that’s a sign sentiment is bearish enough for opportunistic traders to start getting long.

With PayPal, we’re not quite there yet. The base case, if we had to estimate it is relatively in-line to slightly bearish on what we think the FY’23 reality looks like. We think that the bear case on the macro-environment is being largely offset by the bull case idiosyncratically, but that no major disconnect has presented itself yet. We’re not in the basement yet valuation wise, or estimate wise, even though the multiple is inexpensive. This is why waking up to the story now would make you early, and possibly wrong over a short time horizon, even if right over time. For these reasons (current sentiment, valuation, and estimates) we can easily pencil in a scenario where the stock trades as low as the $50s before a META/NFLX-esque rerate would occur.

But back to META and NFLX.

What caused the massive outperformance into the end of last year? Here’s what happened: Management forcefully took control of the narrative on the stock and killed off the bear case one point at time (as best as they could). Simply put, why would you continue selling because of the existential risk narrative when it had already become Wall Street’s base case?

When management crushed the existential and terminal value question, the stocks rerated… massively.

Now, obviously, environment is key, and the environment was just right for those re-rates to take place. At the time of writing, the macro and market environment is incredibly turbulent and uncertain. With those rallies, the Street was already bearish on the macro picture (both industry and economy), everyone knew (and more importantly, believed) the idiosyncratic bear case and terminal value question, and there were specific areas where management could turn the corner to prove the bears wrong. And so they did.

In the case of META: they cut costs, authorized massive stock buybacks, invested in their targeting/attribution solutions, leaned into Reels and more broadly competing head on with TikTok. Basically management grabbed the ‘bear’ by the horns at almost every point of the bear case and the Street rewarded them for the fruits of their labor with a double in the stock. And that’s not hard to do when the expectations are another year of massive declines in EPS/FCF because spend is out of control. Management’s focus on reigning in costs was the biggest catalyst for the rerate.

In the case of NFLX: they cut costs, stabilized and promised to stabilize the content budget on the go-forward, leaned into an ad tier/pw sharing (changed Street perception of terminal value especially regarding rev. growth trajectory and FCF margins), dip their toes in theatrical (see Glass Onion success), and pumped out new great content (see Wednesday) that topped streaming charts. The stock got rewarded. Why? Management took the narrative, to the best of their ability, into their own hands.

Enter PayPal.

We’re Not At Doomsday Yet, Which Means Bulls Are Probably Early, But The Terminal Value Debate Is Here, As Are The Bears

On paper, you have a pretty clear bull case. Management is saying (and starting to do) all the right things: cutting costs, buying back stock, growing revenue above expectations, being clear and transparent on the terminal value proposition etc.

So why isn’t the stock getting a bid? Something I’ve seen bears/neutral investors talk about is how PayPal seems to be doing all the right things at the corporate level, and yet nobody likes the stock – at least not enough to sustain a bid. So what is it that we don’t know that the Street does?

If I had to guess, the two things holding PayPal back from the META/NFLX returns are: (a.) an incredibly uncertain macro backdrop that PayPal is highly correlated with (more on that later) and (b.) a lack of truly capitulatory price action/valuation.

It’s a lukewarm long. A good story with maybe a little bit of upside to estimates, but nothing that warrants sinking money and conviction into.

The big questions we see on the stock are: (a.) what does competition in unbranded look like over time (re. Stripe and Adyen), (b.) are estimates too high for out-years (2024+), (c.) what is the terminal value of a payments middle man (w/attachments like Venmo), and ultimately (d.) is the stock a value trap?

That’s the question. Either this is a stagnant value trap with terminal value questions, or it’s a rare potential compounder in a tech space that feels already saturated. And the fact that we aren’t quite at that point, where the debate is being had at a much greater level, shows us sentiment (and the stock price, mostly likely) hasn’t bottomed. So, yes we’ve bought up good exposure, but we’re not at max exposure yet.

In terms of how we’d answer the terminal value question, which we’ve gotten from bears, we think that the terminal value lies (at least in the branded checkout side of the biz) in the brand and active installed base. Accounts continue to grow, and spend per account continues to grow. We think this can grow in-line w/broader eCom growth rates as eCom growth normalizes. The moat is the brand and the scale. ~400m+ active user accounts and ~30m+ active merchants with an incredibly high ranked brand. The middleman’s advantage, regardless of the space, is the trust-bond that is created with both merchant and buyer.

The way we look at it, online fraud is ridiculously high, and so having a trusted third party mediate transactions isn’t something that is going to go away soon.

Bear Case – Terminal Value in Question, Rev. Growth Below Expectations For 2H, Earnings +LDD

Our bear case is that as the year progresses the economy and consumer spending actually deteriorate. Basically, the Fed’s monetary tightening starts to take effect in the real economy, and we get a consumer spending recession as soon as this summer and into 2H. We think in this scenario PYPL is down low-mid 20s (%) on the year, retreating to a low double-digit earnings multiple. We think the market is also down low 20s in this scenario, so even in that bear case, you’re not doing worse than the market in a PYPL long. This is important because there are pockets of tech where we think if this scenario plays out, you will be doing materially worse than PYPL.

The way we work through our bear case is an expectation of ~10% EPS growth against low to mid single-digit revenue growth for the year. We think 12x earnings is an appropriate multiple to reflect a bear case of: terminal value risk (for being a payments middleman in general & competition in unbranded), higher rates, and below trend growth which puts us at ~$55/share. Relative to current share price, that’s downside of ~25%.

While that’s a pretty aggressive downside case, we think there’s a relatively low probability it happens. We’d put a ~25% probability on that bear case coming to fruition.

Why? In the macro environment, PYPL called out an acceleration in early 1Q in their core branded checkout. Whether that continued to play out through the end of the quarter or not is hard to say. We’ve seen some data that credit card spend weakened into the end of the quarter, so if you use that as a proxy for broader online consumer spend, that might not bode well for PYPL.

Even still, in spite of the ongoing liquidity pressures in pockets of the banking system, we don’t think the economy as hit the cliff yet. Consumption will be strong until it isn’t, so pinpointing a cliff for consumer spend and PYPL’s business more broadly will be difficult.

Bull Case – ‘No Landing’, Wage Inflation, Path To Low 20s EPS Growth And A New Narrative Into ’24 And Beyond

The bull case, which is ultimately what we’re betting on being long the stock is relatively simple. Our bull case assumes the macro environment doesn’t change much. Inflation remains well above target as the labor market (especially in the blue collar part of the economy) remains tight, boosting wages. While this is negative for the strength of the economy long-term, stocks are traded in dollars, and PYPL does business in real dollars, so inflation does have a positive impact on TPV levels and the business as a whole. Essentially, the bull case is that the strong consumer spending paradigm continues throughout this year, and that PYPL is able to leverage a more efficient cost structure to boost earnings power.

For revenues, in this scenario we can see high single-digit/low double-digit top-line growth against low 20s EPS growth. We’re penciling in 22% non-GAAP EPS growth, and applying a 22x earnings multiple to that. That brings us to a bull case of ~$111/share, upside of ~51%.

The thing that needs to be justified here most is the multiple. The estimates themselves are not out of the realm of possibility. Management has said that their guide for 18% NG EPS growth is conservative in its own right, so coming out to our estimate isn’t too aggressive. The question is, what multiple do you put on it?

This is where narrative becomes important. In this bull case, we actually presume a higher rate environment with duration end of the yield curve delivering ~4% returns. So if that’s the risk-free rate, which equates to ~25x ‘earnings’, why the 22x multiple?

Well, because we anticipate a shift in investor perception in the bull case. Remember the talk about bulls probably being early? Well, when the story gets more saturated, we think there’s a case to be made that the multiple can expand to this level. Why?

By 2024, we think the focus will be on growth in both top-line and bottom-line. Bulls will be able to point to a more disciplined cost profile, continued growth in unbranded checkout, the resilience of the core branded checkout business, and the continued optionality (wink-wink at the multiple) of an asset like Venmo. Not to mention, they’re buying back stock still.

And most importantly, Dan Schulman is probably out at CEO by 2024. If they can hire someone young with a growth focus at CEO, with a growth first strategy that in-and-of-itself can rejuvenate the story and rerate the multiple. Never underestimate a new management teams power in changing the Street narrative on a business.

Conclusion – Risk/Reward Skews Bullish, And While We’re Probably Early, All It Takes Is Management Changing Investor Perception

At its core, we view this purely as an asymmetric risk/reward opportunity on the long end, with good odds of paying out if (a.) macro doesn’t crater on PYPL (b.) and management can follow the META/NFLX playbook and take the narrative back into their hands.

Right now, we think we’re probably early on the story, so we aren’t sitting on a full position. That being said, we think PYPL is a very capable compounding candidate if management simply takes the story into their hands to the best of their ability.

Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: We are not financial advisors. This is not financial advice. Please do not interpret this as financial advice. Do your own due diligence before initiating a position in any of the aforementioned securities.