Rafmaster/iStock via Getty Images

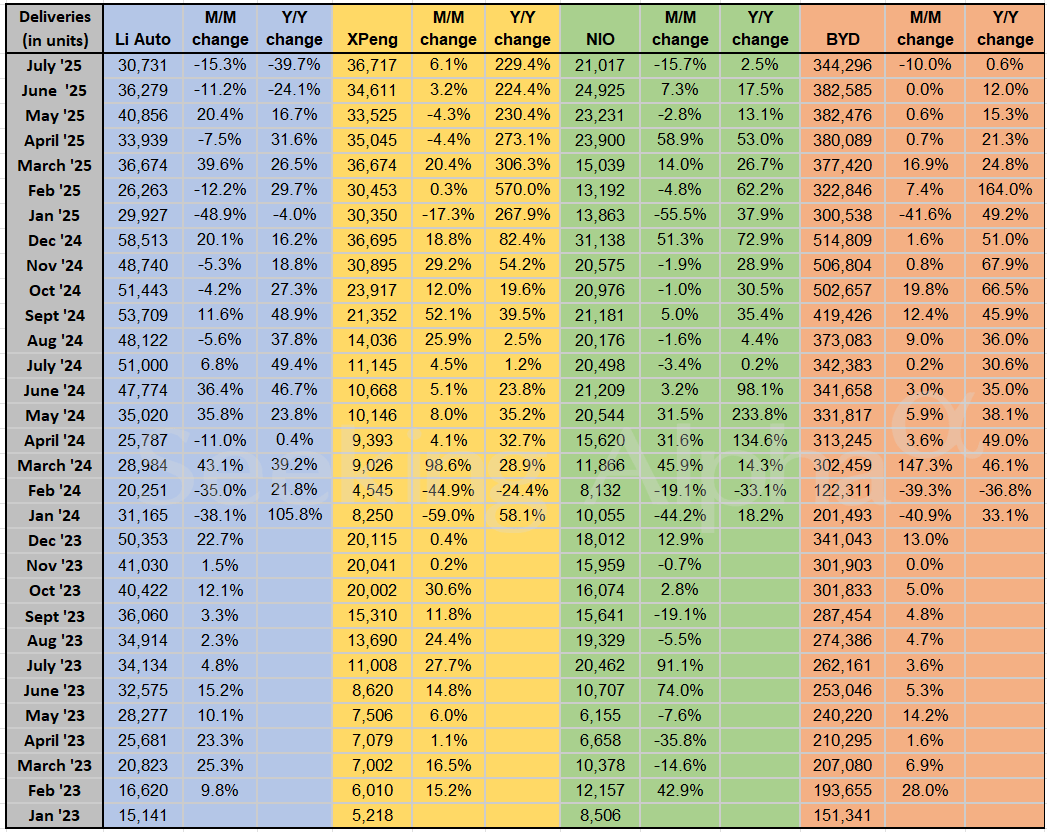

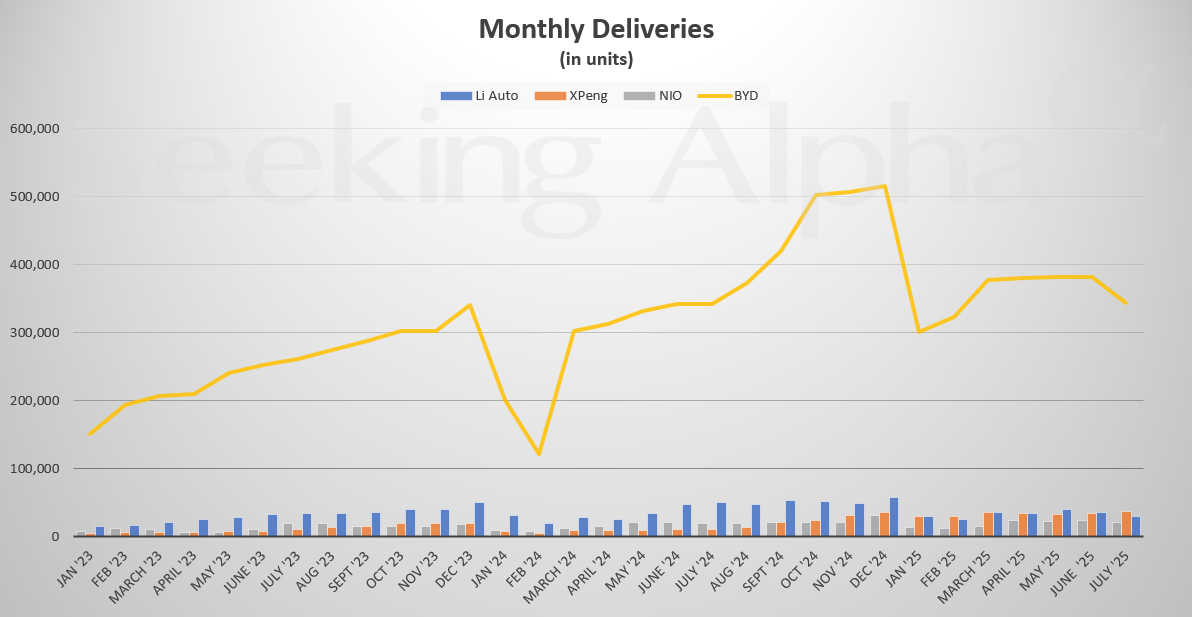

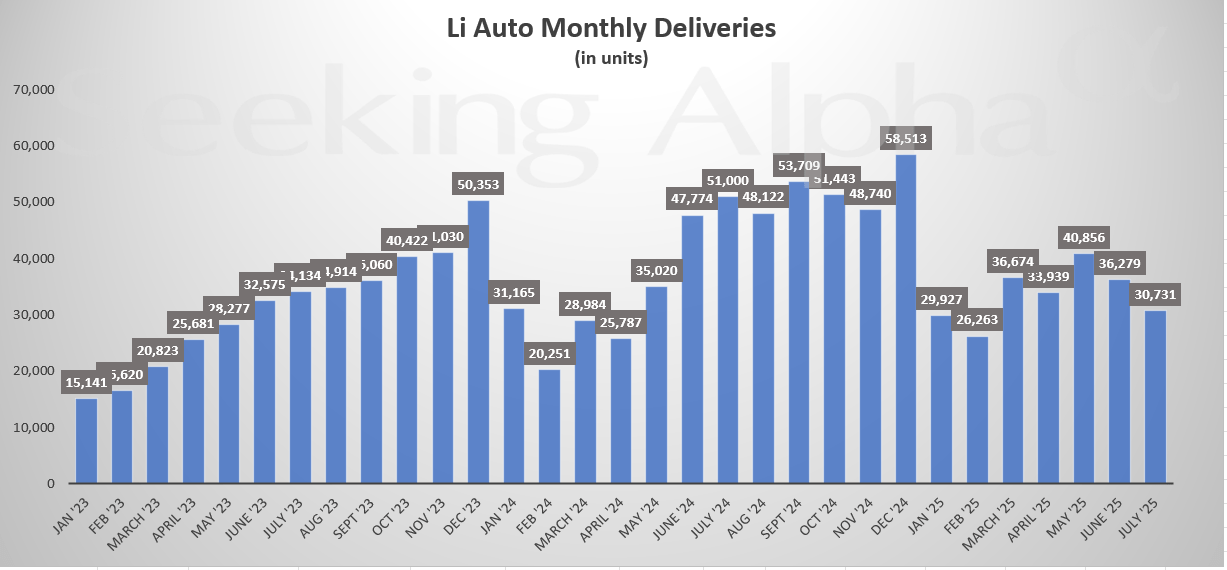

Li Auto (NASDAQ:LI)

- Deliveries: 30,731

- M/M Change: -15.3%

- Y/Y Change: -39.7%

Li Auto’s July numbers mark a second straight month of contraction, with volumes falling to their lowest level since early 2024. The Y/Y drop of nearly 40% also reflects a stark reversal from its strong growth streak last year, suggesting mounting pressure from competition and model fatigue.

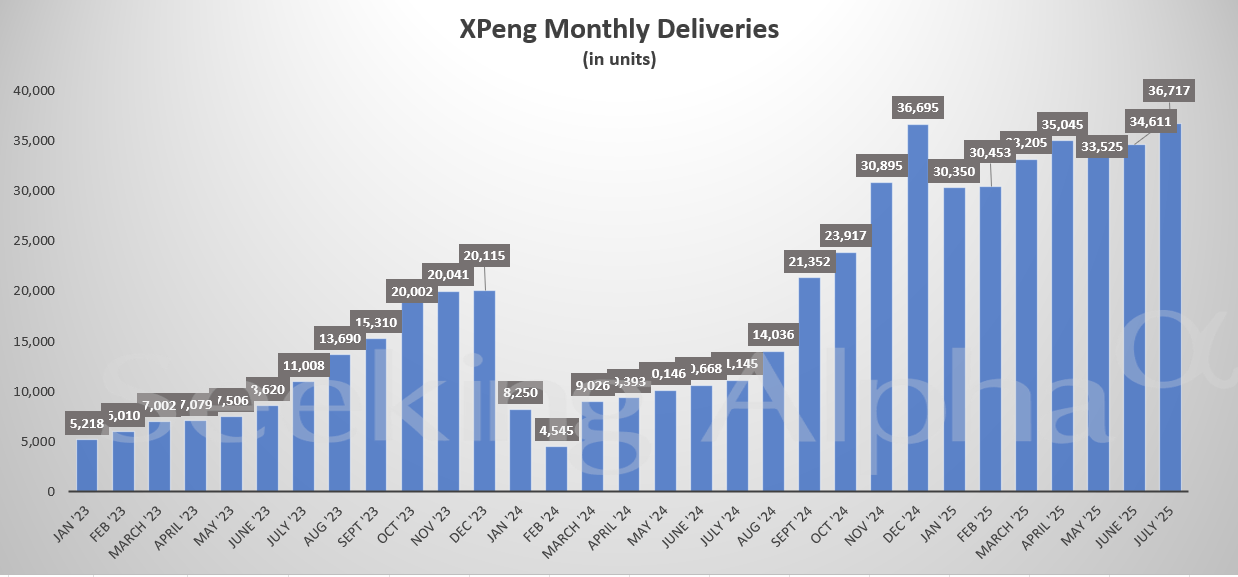

XPeng (NYSE:XPEV)

- Deliveries: 36,717

- M/M Change: +6.1%

- Y/Y Change: +229.4%

XPeng defied the sector’s overall softness with continued growth in July, posting a 6.1% monthly gain and maintaining its triple-digit Y/Y momentum. The company appears to be benefiting from its new models and expanding partnerships, especially in the autonomous and smart driving space.

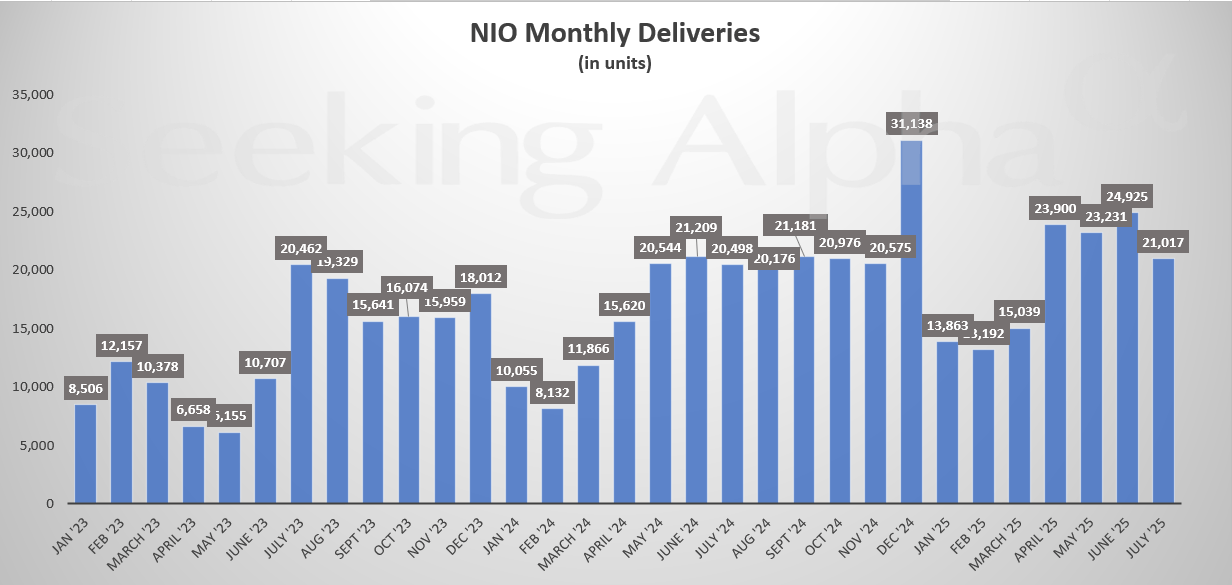

NIO (NYSE:NIO)

- Deliveries: 21,017

- M/M Change: -15.7%

- Y/Y Change: +2.5%

NIO’s July figures fell 15.7% M/M, with Y/Y growth nearly flattening out. The company has struggled to build on the momentum it gained earlier in the year, and the latest delivery dip may reflect growing competition in the premium EV segment.

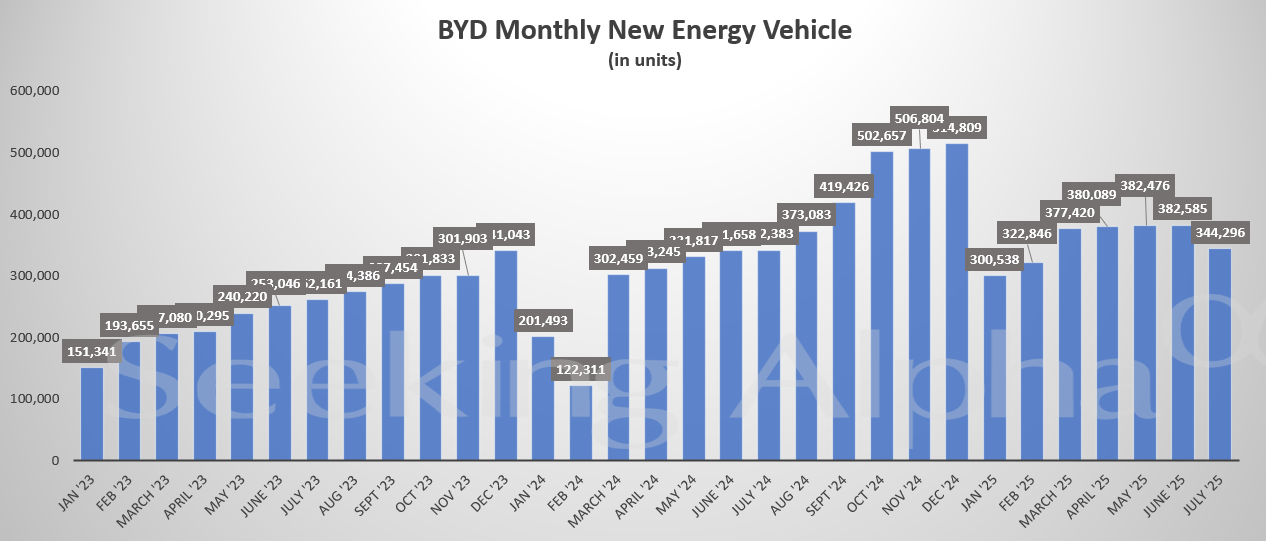

BYD Company (OTCPK:BYDDF)

- Deliveries: 344,296

- M/M Change: -10.0%

- Y/Y Change: +0.6%

Despite remaining the volume leader by a wide margin, BYD saw deliveries fall to a 6-month low. The modest 0.6% annual growth rate is its slowest since early 2023, a sign that the company could be reaching a saturation point in its domestic market, even as it expands globally.