Short interest, which could be an indicator of pessimism, calculates the number of shares sold against the company float. (Short Interest % = Number of Shares Sold Short ÷ Stock Float).

Most shorted stocks:

Franklin Resources (BEN) – 7.30% vs 7.36% last month.

Apollo Global Management (APO) – 7.11% vs 6.97%.

Erie Indemnity Company (ERIE) – 6.96% vs. 6.56%.

Huntington Bancshares (HBAN) – 6.05% vs 4.11%.

Coinbase Global (COIN) – 4.95% vs 6.94%.

Least shorted stocks:

Mastercard (MA) – 0.63% vs 0.61% last month.

Chubb (CB) – 0.76% vs 0.79% last month.

JPMorgan (JPM) – 0.83% vs 0.90%.

Berkshire Hathaway (BRK.B) – 0.87% vs 1.02%.

Moody’s (MCO) – 0.91% vs 1.19%.

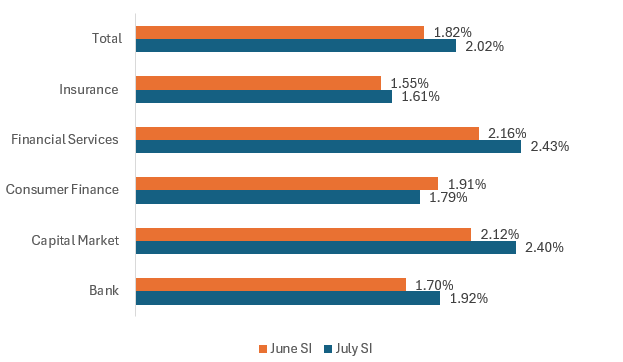

Short Interest as per industry:

Source: Seeking Alpha

Financial Services was the most shorted industry with short interest of 2.43% followed by Capital Market short interest of 2.40%.

Insurance was the least shorted industry at 1.61% against 1.55% in the prior month.