Summary:

- Demand for fast food is growing amid economic slowdown and falling real incomes.

- McDonald’s Corporation is set to open ~1 500 new restaurants next year, which will drive additional revenue.

- The recovery in profitability will be challenged by rising floor wages and initiatives to support franchisees.

- McDonald’s Corporation’s capex will be inflated next year due to opening of new locations. Free cash flow generation is challenged but is still sufficient for dividend payments’ growth.

- Given all the pros and cons, we believe McDonald’s Corporation’s market price is fair, so we give it HOLD status with a conservative downside from current prices.

Justin Sullivan

Investment thesis

McDonald’s Corporation (NYSE:MCD), as the market leader among fast-food restaurants worldwide, should be the beneficiary of the observed trend for consumer preference shifting towards cheaper products, and that would provide the company with steady growth in LFL-sales. Nevertheless, rising wages will continue to squeeze margin. We don’t think the company is attractive at current prices, so it’s reasonable to look for more promising investments. HOLD.

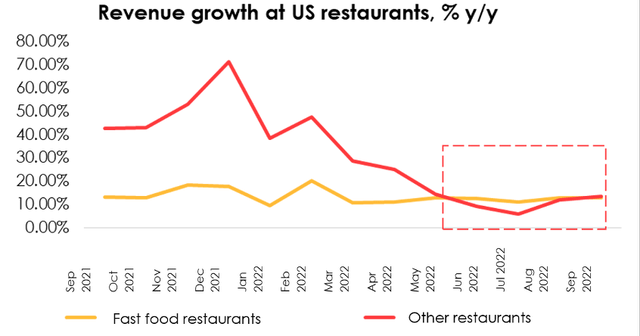

Organic growth should continue, supported by consumer shift, inflation & restaurants openings

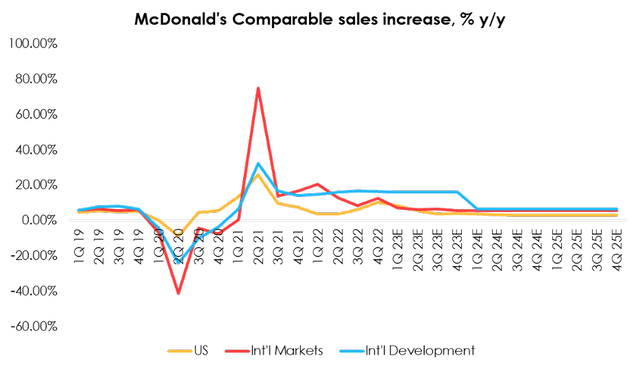

In Q4 2022 (FY 2023), McDonald’s LFL sales amounted to 10.3% YoY in the U.S. and 12.6% YoY internationally excluding FX, and 16.5% YoY excluding FX in emerging markets. This impressive growth was linked to the average ticket growth and high consumer demand for fast food restaurants (QSRs). This trend became noticeable in Q3 2022 due to declining real incomes and a shift in consumer preferences towards cheaper products. In general, the situation in the market is similar to grocery retail – Walmart indicates that consumers prefer cheaper products, but in larger quantities, the same situation is observed with restaurants.

US Census Bureau Monthly Trade Report

We believe this trend will persist in 2023 as the economy slows down further. In 2023, we expect average growth at 5.48% YoY in the U.S., driven by persistent inflation and QSR share growth effect of ~1.3% YoY in international markets, 6.34% YoY in emerging markets, and ~15.88% in China due to economic and consumer activity recovery. Nevertheless, the persistent high USD exchange rate against global currencies will have negative impact on revenue.

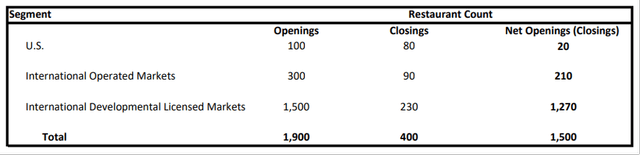

The management reported significant expansion of the restaurant chain – the company plans to open ~1 900 cafes next year and close 400 locations. Given the current trend of growing demand for fast food restaurants, the expansion looks reasonable and will create a good base for further organic growth and will help offset the withdrawal of more than 700 restaurants in Russia in Q2 2022.

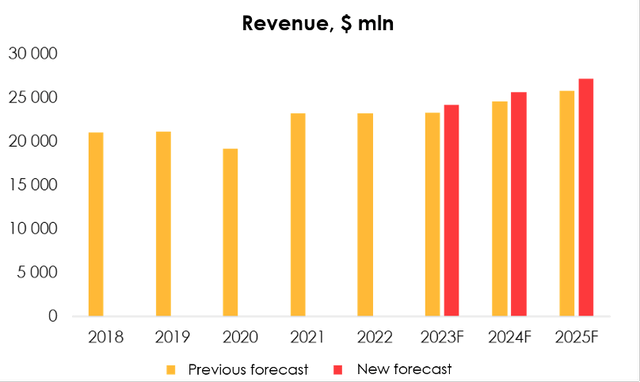

According to our estimate, McDonald’s revenue growth potential amounts to $24 149 mln in 2023 (+4.2% YoY) and $25 593 mln (+6.0% YoY) in 2024).

Wages inflation will continue to impact profitability

Despite surging average tickets and the company’s adaptation to inflationary pressure, we see some difficulty in expanding margin next year.

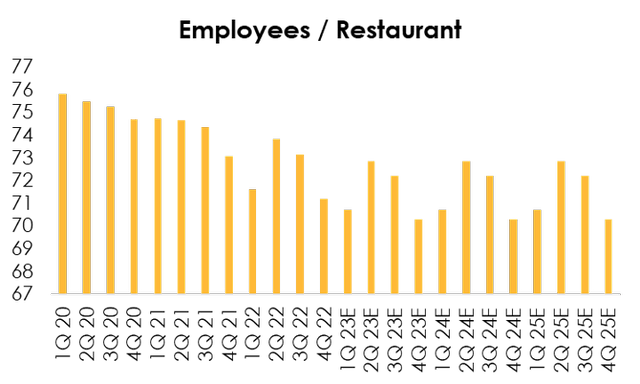

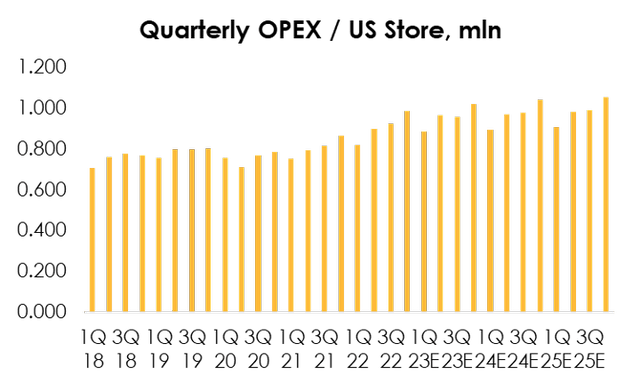

The main challenge is rising minimum wages in the USA and global inflationary pressures. While we see McDonald’s gradually reducing its average number of employees per open location as part of the restructuring of some divisions, another cycle of wage increases will continue to put pressure on the company’s profitability.

The company also reports that franchisees are now facing a more challenging macroeconomic environment and are having difficulty generating free cash flow. The management thus plans to assist franchisees in the near future to maintain long-term relationships. According to the corporate estimates, this support will amount to $100-150 mln next year – it is included in our operating costs forecast as an additional $35 mln per quarter.

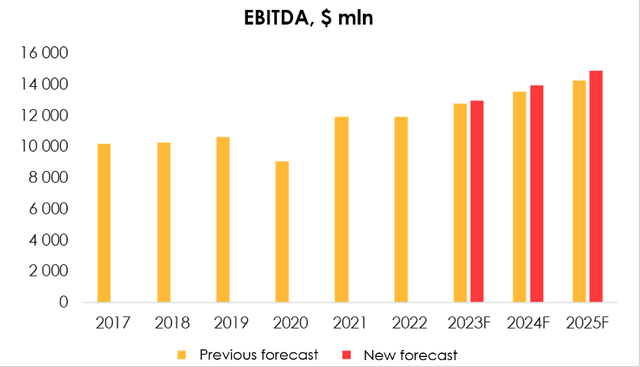

All things considered, we have revised McDonald’s operating margin forecast downwards from 46.7% to 45.4% in 2023 and from 47.0% to 46.4% in 2024. Management is targeting an operating margin of 45% in 2023, which is broadly in line with our forecast. Given that higher revenue had a more pronounced effect than lower operating margins, we have revised our EBITDA forecast from $12 774 mln (+8.9% YoY) to $12 943 mln (+8.6% YoY) in 2023 and from $13 526 mln (+5.9% YoY) to $13 953 mln (+7.8% YoY) in 2024.

FCF is sustainable to cover dividends, but yields are low

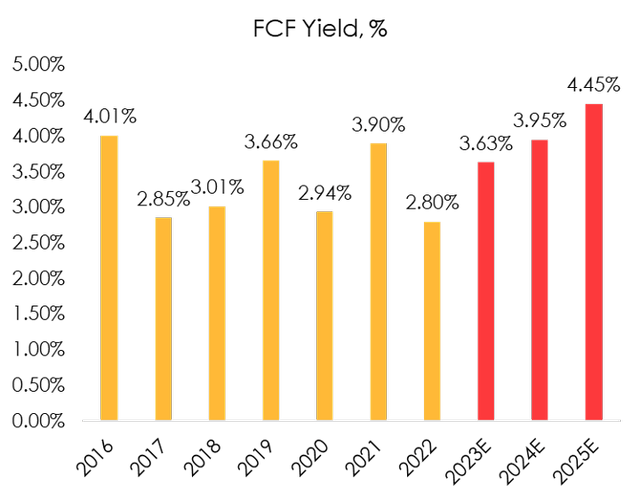

In Q4, MCD raised its quarterly dividends up to $1.52/share, which offers a relatively good yield at current prices (~2.3% FTM with a Q4 dividend hike next year up to $1.63/share). Nevertheless, we see some problems with free cash flow (“FCF”) generation and McDonald’s valuation:

- Corporate income tax increase from 21% to 28% starting in 2024.

- High 2023 capex due to the opening of new restaurants. The company estimates their volume at $2.4 bn (~25% CFO).

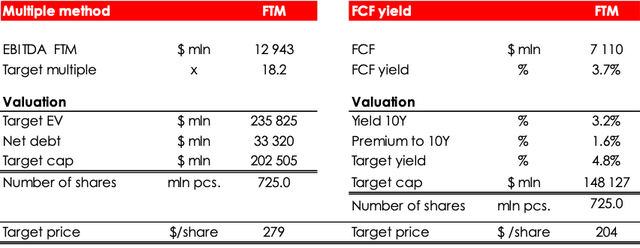

According to our estimate, FCF is at $7 110 mln in 2023 and at $7 736 mln in 2024. Given the dividend hike, the payout will be $4 495 mln and $4 713 mln, respectively, which means that the company still has room for a buyback. Nevertheless, FCF yields are relatively low at MCD’s current cap of ~3.63% in 2023 and 3.95% in 2024.

Valuation

We have revised our McDonald’s Corporation fair value stock price upwards from $236 to $242 due to:

- Upward revision of 2023-2024 EBITDA forecast;

- A shift in FTM estimate (previously we included EBITDA forecast for the next 12 months (Q4 2022-Q3 2023), now the forecast period is shifted to Q1 2023 – Q4 2023).

Fair value stock price is the average between two methods of valuation.

Conclusion

While we see an upward trend in QSR share of the food market along with the potential for further growth in McDonald’s Corporation LFL sales, and the company plans significant restaurant expansion next year, rising floor wages and franchisee support costs will continue to put pressure on the company’s profitability. Generating FCF is complicated by higher capex, so the company is starting to look overvalued in terms of FCF. We maintain neutral view on McDonald’s Corporation stock.

To manage the position, we suggest keeping an eye on McDonald’s Corporation financial statements and industry reports (Census Bureau, QSR magazine, etc.)

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.