Summary:

- As a low-cost leader, WMT should regain market share with any economic softness.

- Food inflation is also benefiting the company, given it is the country’s largest grocer.

- The company also has an opportunity to expand its Walmart Plus memberships to drive growth.

Iryna Tolmachova

Walmart (NYSE:WMT) looks poised to continue to benefit from high food inflation and potential economic weakness.

Company Profile

WMT is a mass-merchant retailer that operates throughout the U.S., as well as Canada, Chile, China, Africa, India, Mexico, and Central America. It sells a variety of goods including groceries, apparel, housewares, health & wellness, electronics, hardline goods, and much more.

In the U.S., its namesake stores come in three different formats, Supercenters, Discount Stores, and Neighborhood markets. It also sells items through its e-commerce website. Internationally, in addition to its stores, it also owns a majority stake in e-commerce site Flipkart in India and has partnerships with JD.com (JD) in China. It also owns a majority stake in the digital payments platform PhonePe in India as well.

The company also operates warehouse store Sam’s Club in the U.S. It charges between $50-110 for memberships, with add-on memberships costing $45.

Q4 Overview

For fiscal Q4, WMT saw revenue rise 7.3%, or 7.9% in constant currencies, to $164.1 billion. That beat analyst estimates calling for sales of $158.7 billion.

U.S. Walmart same-store sales climbed 8.3%, while e-commerce revenue grew 17%. Transactions rose 1.8%, while average ticket was up 6.3%. Grocery sales led the way, with comp sales up in the mid-teens.

Sam’s Club comparable-store sales (ex-fuel) jumped 12.2%, while membership income rose 7.1%. Transactions climbed 6.7%, while the average ticket rose 5.2%. Grocery led the way with comps up in the high teens.

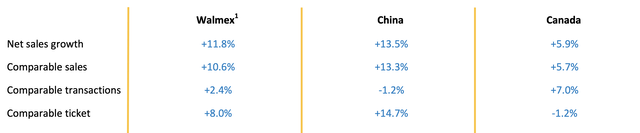

Walmart International sales increased 2.1%, or 5.5% in constant currencies, to $27.6 billion. Results were hurt by a shift in Flipkart’s Big Billion Days event into Q3 versus Q4 last year.

Gross margins fell -83 basis points to 22.9%, while it was able to leverage SG&A by 89 basis points.

Adjusted EPS came in a $1.71, easily ahead of the $1.51 consensus.

Inventory was flat year over year, and down -2.6% at Walmart U.S. locations.

Overall, WMT’s results were solid across the board, as inflation help bolstered the top-line, while it was able to keep gross margins healthy at the same time. It was also able to keep inventory in good shape, despite a lot of destocking issues seen throughout the retail sector in Q4.

FY2024 Guidance

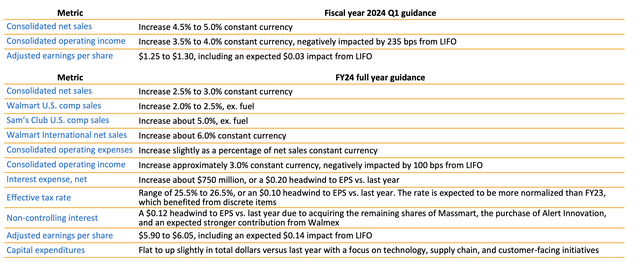

Looking ahead, WMT guided for 2.5-3.0% revenue growth in constant currencies, with operating income growth of 3%. It’s forecasting U.S. Walmart SSS growth of 2.0-2.5%, and Sam’s Club comp growth of 5%, excluding fuel. International sales are expected to rise 6% in constant currencies.

For Q1, the company is projecting sales growth of 4.5%-5%, powered by inflation. Operating income is projected to increase 3.5%-4%, which includes a -235 basis point negative impact of a LIFO charge. It guided for adjusted EPS of between $1.25-$1.30.

Management is expecting the first half of the year to show stronger growth than the second half due to an expected weaker macro environment and tougher comparisons.

On its Q4 call, CFO John Rainey said:

“As we sit here today, we find ourselves in a similar position to each of the last 3 years, where there is a great deal of uncertainty looking out over the balance of the year. While the supply chain issues have largely abated, prices are still high and there is considerable pressure on the consumer. Attempting to predict with precision these swings in macroeconomic conditions and their effect on consumer behavior is challenging.

“As such, our guidance reflects a cautious outlook on the macro environment, but at the same time, our excitement about our recent results, momentum in all segments and progress on our strategy both for this year and the years that follow. We are positioned well and convicted about our plan. …. Our multiyear sales and operating income targets are just that, multiyear. In some years, our performance will be higher; and in some years, lower. We are confident, however, that we’re building a business that allows us to grow our top and bottom line throughout an economic cycle.”

WMT’s overall sales guidance came in a bit light, but given the macro environment, the retail giant appears to be taking a prudent approach, setting the bar appropriately low. The fact that the full-year guidance is more front-end loaded is a good sign, as back-end loaded guidance is generally tougher to hit given that it is further out. Given the WMT tends to perform well in weak economic environments and that guidance is front-end loaded, I think the company is set up to surpass it for the year.

Opportunities and Risks

While WMT faces some macro risks, the company generally does pretty well during periods of macro weakness. The company has the reputation as a low-cost leader, and thus often will benefit from a trade-down effect. It also sells a lot of necessities, being the largest grocer in the U.S. by far.

The company has so much buying power, given its size and scale, that it is generally able to deliver the best prices to its customers. As such, it is often able to take share during a period of economic weakness away from traditional grocery stores, as well as other mass merchants like Target (TGT).

WMT has been benefiting from inflation, especially food inflation, which has been boosting sales and profits. That should eventually normalize as the Fed continues to push rates higher, but it will still at least boost its 1H results. The company could also benefit from a shift to eating in versus eating out if inflation remains high and/or there is economic softness.

WMT is also benefiting from its Walmart Plus service. The company’s answer to Amazon (AMZN) Prime, the paid subscription service offers perks such as unlimited free delivery, discounts on gas, early access to sales, and free streaming through Paramount+ Essentials. The subscription costs $98 a year upfront after the first month free, and then $13 a month.

Morgan Stanley estimates the Walmart Plus has 18.4 million members and has been adding about 250K members a month on average. The firm thinks that WMT could grow Plus to 30 million members. I think Morgan Stanley’s number could be low, given that Amazon has over 200 million Prime members. WMT Plus was only launched in September 2020 and has not been heavily advertised, so there should be a lot of growth ahead of it.

Internationally, WMT should also benefit from the re-opening of China. On its Q4 call, CEO of Walmart International Judith McKenna said:

“Clearly, the big news in China was the opening of China. As I look though into last year, we saw continued strength in hypermarkets, which is the higher-end offering that we have within China, slightly different positioning to Sam’s Clubs in the U.S. and in Mexico. They continued very strongly. But also, people shopped back into hypermarkets again, and we saw some of our best performance in hypermarket than we have for some time. But the real consumer trend, and it’s probably one that is worth taking note of globally is what’s happening in e-commerce in China. So you’ll have seen in the results that we talked about, 70% growth in Q4, which was 163% 2-year stack for China on e-commerce growth and a penetration now reaching 48%. That is undoubtedly helped by the buildup into Chinese New Year. That buildup fell into Q4. But we continue to see that as part of economic behavior.”

China is still small when looking at WMT as a whole, but it has a huge population, so there is plenty of opportunity to grow. I like how it has teamed up with JD.com, as partnering with established companies in China can help U.S. companies better navigate the ins and out of operating in China and appealing to its consumers.

Valuation

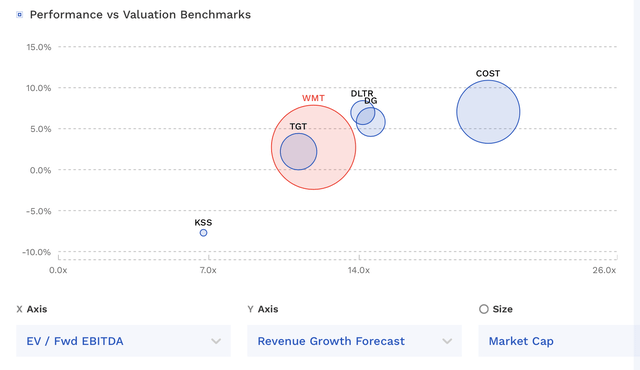

WMT currently trades around 12x the FY2024 (ending January) consensus EBITDA of $36.9 billion and 11.2x the FY2025 consensus of $39.2 billion.

It trades at a forward PE of nearly 24x the FY24 consensus of $6.11, and 21.4x the FY25 analyst estimate of $6.79.

Revenue growth is expected to be nearly 3% this year, and then grow around 3-4% a year over the next few years.

WMT trades at a similar multiple to TGT and well below the faster-growing Costco (COST). Given WMT’s mix is more toward necessities, especially groceries, compared to TGT, I think the multiple gap between the two should widen during a softer economic period. COST has always demanded a very healthy multiple, and it does offer some more growth opportunities through potential membership fee hikes and more potential expansion. I don’t know when the COST premium will eventually go away, but it is unlikely soon.

WMT Valuation Vs Peers (FinBox)

Conclusion

WMT is a solid defensive stock in the event of a recession. The retailer should be poised to regain some share in a tougher environment given its scale and buying power, which it then can pass on to its customers.

At the same time, it is riding the wave of inflation to generate higher sales and profits. It also shouldn’t have to deal with a number of issues that retailers dealt with in 2022, such as too much inventory and lapping additional costs related to COVID.

At this point, I think WMT gave pretty cautious guidance that it should be able to surpass in 2023. As such, I think the stock is a “Buy” for more conservative investors.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.