Summary:

- Investors who bet against Intel were stunned by INTC’s recent relative strength, outperforming the S&P 500 and the iShares Semiconductor ETF.

- In February, the company’s decision to slash dividends was a game-changer, triggering an exodus of income investors at its March lows.

- Intel unveiled strategies to compete against AMD and Nvidia in the AI logic market. However, Intel’s execution will likely be the focus.

- With INTC’s valuation normalized, the buying opportunity is less compelling. Accordingly, income investors who want to bail out should consider selling its recent strength.

JasonDoiy

Intel Corporation’s (NASDAQ:INTC) bears were likely stunned recently, as it outperformed the S&P 500 (SPX) (SPY) significantly since staging its post-dividend cut low.

We highlighted to investors in our previous article that market operators sent INTC income holders fleeing at the lows, which could allow dip buyers to pick up the pieces. As such, INTC surged since then, notching a return of nearly 27%, relative to the SPX’s 2.7% uptick.

Accordingly, bottom-fishers returned to pick up INTC’s undervalued shares in March, as it also outperformed its peers represented in iShares Semiconductor ETF (SOXX) over the past month.

Hence, we urge investors to remind themselves that price action is a leading indicator. Therefore, it’s important not to get caught up selling in capitulation downdraft (panic selling) or buying on momentum surges (greed buying). Instead, investors should carefully assess INTC’s valuation and price action before clicking the Buy/Sell button.

In late March, Intel discussed its updated data center roadmap at its AI Investor Conference. The company shared its strategies and TAM to capture the opportunities afforded by AI over the next five years.

Notably, the company believes it retains the initiative to dominate the market with its hardware and software stack.

Accordingly, Intel projected a TAM of $110B for its data center and AI or DCAI business through 2027. Intel’s confidence is driven by “high-growth workloads such as AI, networking, security, analytics, and HPC.” As such, the company aims to leverage its “range of silicon, software, and fleet-level services to serve diverse customer needs and offer total cost of ownership advantages.”

While Intel is expected to continue losing data center market share to AMD (AMD) in 2023, do you think the market doesn’t know? INTC’s price action, which saw it take out lows last seen in August 2015, likely reflects the market’s dissatisfaction with CEO Pat Gelsinger & his team.

Also, note that Intel is still expected to remain the data center market leader by a wide margin in 2023. Hence, if the company could stem and reverse the slide moving forward, it could lift buying sentiments further and put pressure on AMD’s more expensive valuation.

Therefore, the focus for investors is not just on how much share it could lose in 2023 but on whether it’s on track to regain process leadership over the next two years.

Therefore, the company’s updated DCAI roadmap suggests that bears could have been overly pessimistic, as Intel telegraphed, “over 200 designs are currently shipping from all major OEMs and ODMs.” It also includes wins with the “top 10 global cloud service providers,” further corroborating Intel’s market leadership.

The company highlighted that it’s on track to “achieve product leadership with Clearwater Forest in 2025.” However, we think it’s too early to tell. With AMD executing well as Intel stumbled, the market will likely remain in a “show-me” phase, parsing Intel’s ability to close the gap before a further upward re-rating is justified.

Notwithstanding, Intel believes it has the complete portfolio to compete in the $40B AI logic silicon market. As such, the company believes its portfolio of “CPUs, GPUs, deep learning accelerators, FPGAs, and software” should it a pivotal edge against its peers.

While NVIDIA (NVDA) is the market leader in AI training, Intel believes its open ecosystem approach should help “enable broader access and more cost-effective AI deployments.”

Hence, it’s too early to rule Intel out of the race. The more pessimistic the market and analysts get, it could help INTC outperform these downgraded expectations, as the market is forward-looking.

The critical question is whether INTC’s remarkable surge in March has likely reached a line in the sand?

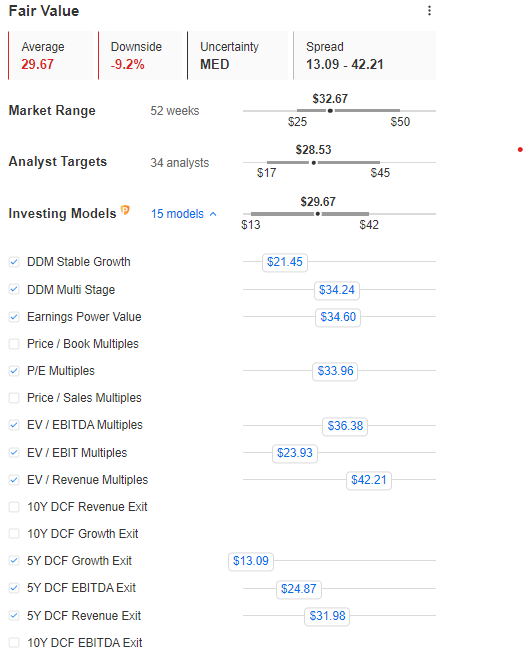

INTC blended fair value estimates (InvestingPro)

INTC’s valuation has normalized with the recovery over the past month. As such, investors shouldn’t chase the surge, as its valuation is much less compelling.

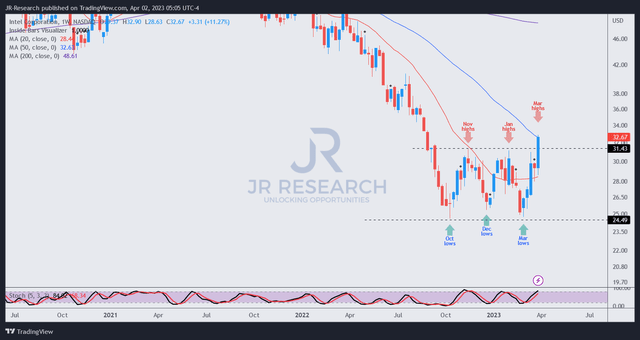

INTC price chart (weekly) (TradingView)

INTC re-tested its critical resistance zone that bounded its past advances from its October lows. As such, we did not glean a lower-risk entry point for investors who missed its bottom in March.

Income investors looking to cut exposure should consider using the recent rally to get out. Those who fled at INTC’s March lows are reminded not to fall into the capitulation “trap” set by market operators in the future.

As a reminder: Buy weakness, sell strength at the appropriate support/resistance levels.

Rating: Hold (Revised from Buy).

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have you spotted a critical gap in our thesis? Saw something important that we didn’t? Agree or disagree? Comment and let us know why and help everyone to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC, AMD, NVIDIA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!