Summary:

- Chevron has built up an impressive portfolio of assets, especially with its continued natural gas investments.

- The company can generate reliable cash flow at prices well below current prices, although it’s still at risk from a changing environment.

- The company’s upside cash flow simply isn’t high enough to generate the returns to justify its valuation, making the company a poor investment.

JHVEPhoto

Chevron (NYSE:CVX) is an American multinational energy company with a market capitalization of more than $300 billion. The company’s size, scale, and intelligent historical capital spending have made it one of the most popular and successful large oil companies. However, as we’ll see throughout this article, given the macroeconomic risks, the company is overvalued at this time.

Chevron Asset Portfolio

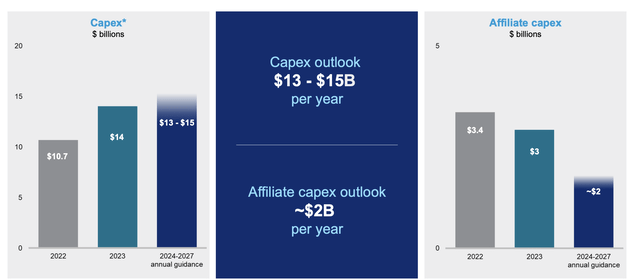

Chevron is anticipating $14 billion in 2023 capital spending and it expects to keep capital spending in roughly this range through 2027.

Chevron Asset Portfolio – Chevron Investor Presentation

At the same time, the company expects its affiliate capex to drop to roughly $2 billion annualized for the next 4-years. As a result of this investment, the company has had a 10-year reserve replacement ratio of 99%. 10-years ago it had 11.3 billion barrels in assets. Since then, it’s sold 1.1 billion barrels and produced 10.2 billion barrels.

The result after investing? 11.2 billion barrels or roughly exactly where it started. The company’s 6P BBOE has grown from 64.7 billion barrels to 77.9 billion barrels.

Chevron Production Growth Targets

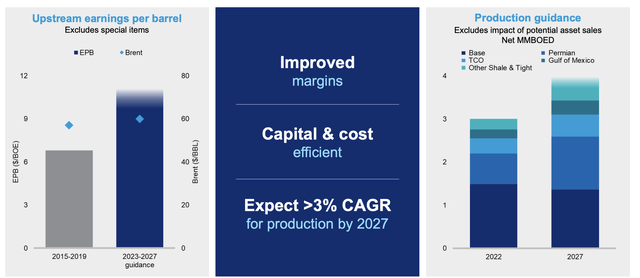

There is a benefit of the company’s continued capital spending, with some promising growth targets.

Chevron Production Growth – Chevron Investor Presentation

The company expects to grow production from 3 million barrels / day in the prior year to almost 4 million barrels / day in 2027. The majority of that growth is expected to come from the company’s ambitious growth plans in the Permian Basin where it expects production to almost double to 1.25 million barrels / day.

As a result, the company expects Permian Basin FCF to grow from $2 billion to more than $4 billion. It’s a lofty production growth target for the company with >3% annualized growth and improved margins that will help the company to increase shareholder returns. The company also has large natural gas reserves (175 TCF vs. 868 for Qatar) that it’s working to connect to the market.

Chevron Low Carbon Business

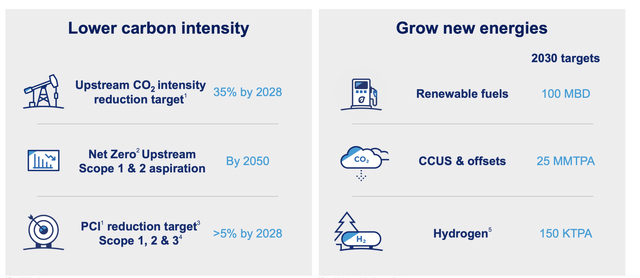

U.S. companies are behind European companies but the company is focused on expanding its low carbon business.

Chevron Low Carbon – Chevron Investor Presentation

Chevron is working to decrease upstream CO2 intensity by 35% although it’s worth noting that reduced intensity doesn’t account for the company’s continued production growth. The company is targeting net zero for Scope 1 & 2 by 2050, a relatively weak goal and expects to grow new energies into 2030 targets for 100 thousand barrels / day.

The company’s low carbon business clearly isn’t a focus and at the company’s few billion in capital spending it won’t generate sufficient returns.

Chevron Shareholder Return Potential

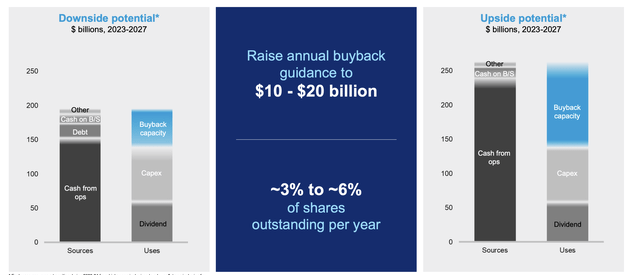

Chevron is dedicated to providing the returns to justify a $310 billion valuation, however, it’ll require substantial effort.

Chevron Returns – Chevron Investor Presentation

The company’s downside assumption is for $60 / barrel average Brent from 2023-2027. The company’s upside assumption is $85 / barrel for the same time period. Versus just under $80 / barrel Brent right now, the company sits somewhere between the two assumptions. In both cases the company pays its dividend and 3.7% in annual dividends.

However, the differences between the two is share buybacks. The company’s downside assumes $10 billion / year in buyback capacity, but with $15 billion (5%) in new debt. The total shareholder returns in that case are 6%. In the upside, where dividends hit $20 billion annualized, the company’s shareholder returns become 9% as additional debug isn’t needed.

Our View

Here the highlights of the company’s risk and overvalued nature. Even in the company’s optimistic $85 Brent scenario, investors have given it such a high valuation that it can only generate 9% returns, which historically lines up with the long-term returns of the S&P 500. That’s in the company’s optimistic scenario.

It’s also worth noting that that’s with the assumption that higher share prices don’t come as a result of the company’s plan to drive returns through aggressive share repurchases. As a result, overall, we think Chevron is overvalued and a poor investment.

Thesis Risk

The risk to our thesis is that Chevron is growing production. The company has a top-tier business, and a history of strong execution. The company is looking for new discoveries to take advantage of the market and it has a strong reserve replacement. Should oil prices extend past $100 / barrel, which is possible in different circumstances, the company could generate strong shareholder returns.

Conclusion

Chevron has a unique portfolio of assets. The company is continuing to generate substantial cash flow while comfortably affording its dividend. The company has a dividend of more than 3% and depending on crude oil prices it can generate 3-6% in annualized returns from share repurchases. There’s no guarantee oil prices remain high.

The company has an incredible management team and it’s performed well. Unfortunately, the company is a victim of its own success. Its valuation makes it much more expensive which means it’ll struggle to generate the double-digit shareholder returns that we look for. As a result, we recommend against investing in Chevron.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.