Summary:

- Disney’s proxy battle has turned out to be a non-issue.

- Management is planning for the recovery from 2020 to continue while addressing market concerns.

- Cost cutting without a long-term goal structure can be very dangerous.

- DTC’s operating income improved unexpectedly. Management guided to further improvement and profits in 2024.

- The current CEO plans to get Disney back on the growth track.

Drew Angerer

Disney (NYSE:DIS) managed to disarm the coming proxy battle adversaries very easily. It actually justified my position that the proxy battle centered on short-term issues that may not have been to the benefit of shareholders. So many times, mindless cost cutting without a long-term plan would send a stock price up only to have long-term problems rear up afterwards. This management clearly has a long-term plan to get Disney back on track.

Disney has begun the layoffs and corporate reorganization needed to right-size the company and gain efficiencies for the current situation. The annual meeting and the first quarter report should provide still more guidance.

Disney stock actually popped when the company beat expectations for the strong fourth quarter. But it is going to take more than a quarter of results to sustain the stock price action that Disney shareholders are used to. Management for some time has been considered well above average. For at least a minute, management succession considerations have been pushed down the priority list until Disney “gets back to normal”.

Large companies like Disney take some time to recover from something like the shutdowns caused by the coronavirus demand destruction and other related challenges. Mr. Market has little appetite for that amount of time. So, the key is to keep the market directed at positive things while the recovery continues.

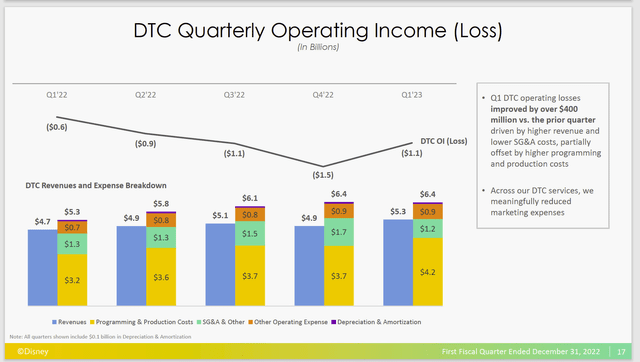

Disney History Of Direct To Consumer Streaming Results (Disney First Quarter 2023, Earnings Conference Call Slides)

Sometimes, the way the market responds, an observer would think that streaming is the only thing that matters to this company. Probably the most visible part of the earnings beat had to be the unexpected improvement in the losses reported for this segment. Clearly, for that improvement to happen, management had been working on this issue for some time.

During the conference call, management stated that improvements happened faster than expected. However, management has different strategies in place in other parts of the world to serve as a reference point for changing strategies when needed. Therefore, the improvement shown above was a possible outcome before the market ever considered that result.

Management guided to another $200 million improvement in the second quarter. Probably the hard (and slowest part) will occur as the company gets near breakeven. Still management is reiterating that they intend to see profits from this division in 2024.

But then again, it is typical for large companies to first go after market share and then make that market share profitable. Probably a reference for this would be Michael Porter’s book “Competitive Strategies”. So, what is happening now should not be unexpected by anyone who has ever studied management strategies.

The fact is that in terms of revenue, this part of the business is really not that material. Should Disney abandon the streaming business, there is always an option later to acquire the business once it becomes “generic” as so many of these new things typically become. They are often far less expensive at that point than is the case when they are new. So, there is still a lot of strategy flexibility available.

What is far more material is to get movies back to a regular production and release schedule and have parks (and other business lines) back to normal after the coronavirus demand destruction caused shutdowns and other issues on the restart of operations. Large companies like Disney will take some years to get back to normal. So, each year after 2020 should show improvement as that process continues.

More importantly, direct to consumer largely continues to grow, even if at a reduced pace. Now that competition has arrived, it is very likely that the days of 30% growth are over. It is far more likely that single digit to maybe 10% growth will be the norm in the future.

More importantly, Disney really competes based upon its franchises. Properly run, those franchises will be a competitive moat for a long time to come. Streaming, movies and television, for example are just channels to properly communicate the franchises to consumers. One thing that the current CEO has made clear time and again is that he wants differentiated competition so that the streaming has in effect a competitive moat.

Disney can monetize its franchises in several different businesses. That gives it a tremendous advantage over the competition. So, if streaming turns out to not be an avenue, there are likely to be other ways to go until streaming has to be the way to go (if that ever happens).

Some competitors like Warner Bros. Discovery (WBD) management have mentioned that streaming is just “one more way to go”. It is not the begin-all and end-all that so many competitors make it to be.

The major question is whether streaming has to show a profit to increase corporate profitability or whether it will increase corporate profitability through incremental accounting without showing a profit itself. This can happen when an asset (or assets) is already paid for elsewhere but used in streaming to provide more revenue. Using an already paid for asset costs nothing. But GAAP generally requires the costs to be spread across every use of that asset. The result is that the lines paying for the asset become more profitable when the cost is spread. That increases corporate profitability when the increase in profit is higher than the loss reported by the new line. The net result is using paid for assets (like movies for example) to increase revenue yet another way.

The Future

Disney management discussed cost cutting which will take some time. Evidently there are ways to rationalize the “process” to reduce costs. This happened because technology keeps advancing. So many corporations have to periodically review the cost structure to make sure that new lost cost ways of doing things are included in the production process.

But the big deal is probably monetizing the assets acquired from Fox just before the coronavirus challenges hit. That interrupted what would have been a normal assimilation process. Now, the later Avatar film appears to be the first major visible attempt to take advantage of the acquired film (and television) assets. Probably there will be more major ideas on the way.

In the meantime, Disney has to come to terms with the CEO transition mess. You cannot forever call back old CEO’s to bail out the company. I think management realizes this and will figure out how to do a lot better in the future. The company from Michael Eisner, to the current CEO had the rare luck to have (mostly) two very strong and good leaders in a row. Now we are going for three exceptional leaders.

Management and the board need to realize what it takes to find an exceptional leader as they “do not grow on trees”. Chances are very good that the next one needs time to be acclimated to the job even if it is an inside pick. It would not be unusual for a new CEO to be mentored for a couple of years when a large company like Disney is involved. Let us hope they do not make another mistake as this is far more important than anything else covered in the conference call.

The Disney recovery story probably makes this stock a strong buy based upon the recovery. Longer-term, the CEO succession issue makes this somewhat riskier as CEO’s are a vital part of any company. Disney messed this up once. So, there will be more pressure to “do it right” this time.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIS, WBD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor, and this article is not meant to be a recommendation of the purchase or sale of stock. Investors are advised to review all company documents and press releases to see if the company fits their own investment qualifications.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

I analyze oil and gas companies, related companies and Disney in my service, Oil & Gas Value Research, where I look for undervalued names in the oil and gas space. I break down everything you need to know about these companies — the balance sheet, competitive position and development prospects. This article is an example of what I do. But for Oil & Gas Value Research members, they get it first and they get analysis on some companies that are not published on the free site. Interested? Sign up here for a free two-week trial.