The ongoing boom in the artificial intelligence (AI) industry was sparked by the launch of OpenAI’s ChatGPT in November 2022, and since then, Nvidia (NASDAQ:NVDA) has emerged as the leader of the pack. The firm takes center stage on Wednesday ahead of its quarterly earnings after the closing bell.

The company is currently the number one maker of the high-processing chips that power many AI processes. Its stock has also swelled into the world’s largest in terms of market capitalization and, in the process, has become a market-moving entity, especially after its earnings reports.

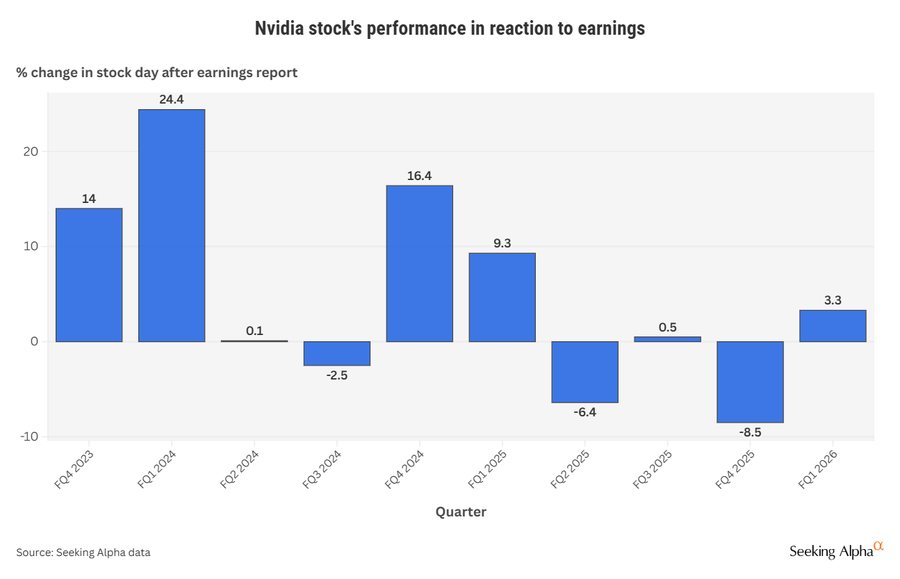

Nvidia (NASDAQ:NVDA) has issued ten quarterly reports since the AI boom of November 2022. In that time, the stock’s valuation has gone from $418.22B to a staggering $4.44T. In terms of reaction to earnings, the stock has seen an average move of 8.5% higher or lower on the day immediately after a quarterly report.

See the chart below:

Seeking Alpha data

Another big stock reaction could be in store for Nvidia (NASDAQ:NVDA) on Thursday. Reuters reported that option traders are expecting moves north of $260B in the company’s market cap in either direction.

For investors looking to gain exposure to NVDA, here are the 10 exchange-traded funds with the largest weightings towards the chipmaker’s stock: (NYSEARCA:USD), (NASDAQ:NVDU), (NASDAQ:NVDL), (NYSE:SHOC), (NYSEARCA:GXPT), (NASDAQ:SMH), (NASDAQ:SMHX), (NYSEARCA:SOXY), (BATS:NVDW), and (NVW).