Summary:

- Deep down, Google’s competitive advantage is a database of our intentions: our needs, wants, and fears.

- The value of such a database is both massive and scary depending on your perspective.

- It is also better shielded from changes from other platforms such as Apple’s iOS 14 update.

- It only depends on users’ search terms to reveal their intent and identify monetization opportunities.

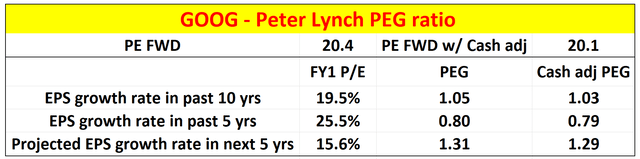

- Such an overpowering database is now priced at about 1.2x PEG, close to the 1x Peter Lynch threshold for rapid growers.

Alena Kravchenko

Thesis

The title was inspired by John Battelle, a critical thinker who saw the true power of Google (NASDAQ:GOOG) (NASDAQ:GOOGL) about two decades ago, a time when most people thought (myself included) Google only as a more powerful and digital catalog. The following is quoted directly from Battelle’s 2003 comments and the emphases were added by me:

The Database of Intentions It live in many places, but three or four places in particular hold a massive amount of this data (i.e., MSN, Google, and Yahoo). This information represents, in aggregate form, a placeholder for the intentions of humankind – a massive database of desires, needs, wants, and likes that can be discovered, subpoenaed, archived, tracked, and exploited to all sorts of ends. Such a beast has never before existed in the history of culture but is almost guaranteed to grow exponentially from this day forward.

These insightful comments accurately captured the growth curve for GOOG – its massive database and also its monetization potential has indeed grown exponentially.

And the thesis of this article is to argue that exponential growth is not over yet and will continue. Despite some current challenges, which are largely temporary in my view (more on this later), GOOG’s primary moat, its powerful database and search engine, remains as valid as when Battelle made his farsighted comments in 2003. Finally, it’s worth noting that despite such exponential growth prospect potential, the company’s current PEG (P/E growth rate ratio) is only around 1.2x, surprisingly close to the 1x Peter Lynch threshold for rapid growers as detailed next.

PEG close to the Lynch threshold

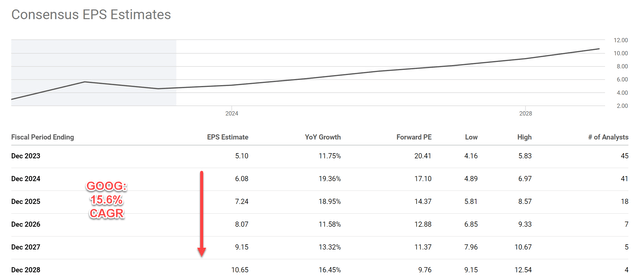

According to the following consensus estimates data from Seeking Alpha, the current FWD P/E ratio for GOOG is 20.4x. And its EPS is projected to grow at a CAGR of 15.6%. To put things under a broader context, over the past 10 years, its EPS has grown at a CAGR of 19.5%. And over the past 5 years, it has grown at a CAGR of 25.5%.

Source: Author based on Seeking Alpha data

As a result, depending on which growth rate you assume, the PEG ratios are in a range between 0.80 and 1.31 as shown in the next chart below. And these PEG ratios are either below or close to the 1x PEG ratio that Lynch prefers for growth stocks. It is also worth noting that GOOG has a significant net cash position ($113B or $1.70 per share), which reduces its P/E ratio a bit to approximately 20.1x. Consequently, the PEG ratio would also be a bit lower when the cash position is adjusted as shown in the last column.

Looking ahead, consensus estimates predict that GOOG’s EPS will increase from $5.1 in 2023 to $10.65 in the next five years. And I will argue next why I am optimistic about the growth and even think such consensus estimates to be conservative.

Source: Author based on Seeking Alpha data

Growth potential and Growth CAPEX

I am optimistic about the EPS growth basically for two reasons: A) GOOG has plenty of growth areas, and B) GOOG has the resources to pursue these areas aggressively. And next, I will elaborate on both of them one by one.

Despite some near terms challenges (such as ChatGPT, more on this later), GOOG is in a sweet spot combining existing cash cows and new growth areas. The former includes its search segment and its digital ad segments. I expect both to keep making significant contributions to the cash flow and keep a healthy growth rate at the same time. New areas include its Google Cloud segment and also Artificial Intelligence (“AI”), and especially their combination. To wit, Google Cloud is launching four AI-powered tools specifically designed to assist retailers with inventory management and the personalized shopping experience on e-commerce websites. The potential of the database of intentions combined with AI probably would even escape John Battelle’s farsighted forecast.

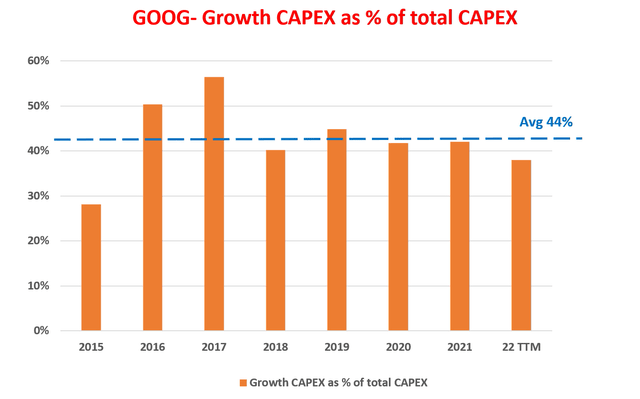

Thanks to its combination of cash-cow segments and new growth areas, GOOG certainly has the resources to purpose high-risk and high-payoff initiatives aggressively while maintaining a fortress balance sheet as shown in the chart below. The chart below shows the percentage of GOOG’s CAPEX expenditures that are used for growth. The analysis was performed using Bruce Greenwald’s method, detailed in my earlier article or in Greenwald’s book Value Investing. As seen, GOOG has been sustainably affording about 44% of its total CAPEX pursuing growth in recent years.

Author based on Seeking Alpha data.

Risks and final thoughts

Google certainly faces several challenges. In the near term, it is suffering from digital ad slowdown, currency headwinds, and also its overexpansion in the past few years. To wit, it has recently announced cost-cutting plans and also layoff plans to eliminate roughly 12,000 jobs. Other measures to reduce costs include the cancellation of the tech giant’s next-generation Pixelbook laptop, and permanently closing the cloud gaming service Stadia. In the meantime, ChatGPT has attracted much attention lately and is viewed as a threat to Google. My view is that such fear is overblown. The chatbot technology employed by ChatGPT MIGHT have the potential to rival and replace current search engines like Google. However, it is a quite remote scenario. And furthermore, with Google’s prominent position as a search engine and its ongoing AI foothold (quite strong in my view with DeepMind and Google Cloud AI), I anticipate a solid response from Google on the chatbot front too. Google already has chatbot technology (e.g., one called LaMDA).

With the layoffs and restructuring efforts, I expect to see GOOG reallocating resources to business areas that support its advancement in AI. And as mentioned already, the combination of AI with its massive database of intention is a truly unique advantage that ChatGPT (or other chatbot players) does not have.

To conclude, the thesis here is that John Battelle’s forecast made in 2003 is still valid today and possibly even more so with the possibility that the database of intentions can be combined with AI. GOOG of course faces some challenges as just mentioned. But I view these challenges to be either short-term or overblown. In my view, GOOG’s true moat remains intact due to the nature of its database and its dominant position in the search space, which will keep the database growing.

The database is further shielded from changes from other platforms such as Apple’s iOS14 update. Unlike other social media (such as Facebook) that need user consent for tracking their activities, Google search only depends on users’ search terms to reveal their intent and does not require consent.

Finally, note that its PEG ratio is only about 1.29x, close to the 1x Peter Lynch threshold. Furthermore, because a large fraction of its CAPEX is growth CAPEX, as a result, its owners’ earnings are significantly higher than its accounting earnings (by about 10% to 15% from my analysis). As a result, its PEG ratio is actually below 1.2x if the P/E ratio is based on owners’ earnings.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.