Summary:

- This is a technical analysis article. Bottom fishers swoop in at Netflix’s bottom and keep buying until it gets too pricey.

- They will buy again when prices drop to retest support or the bottom. We expect price to be stopped on this attempt to reach the recent high.

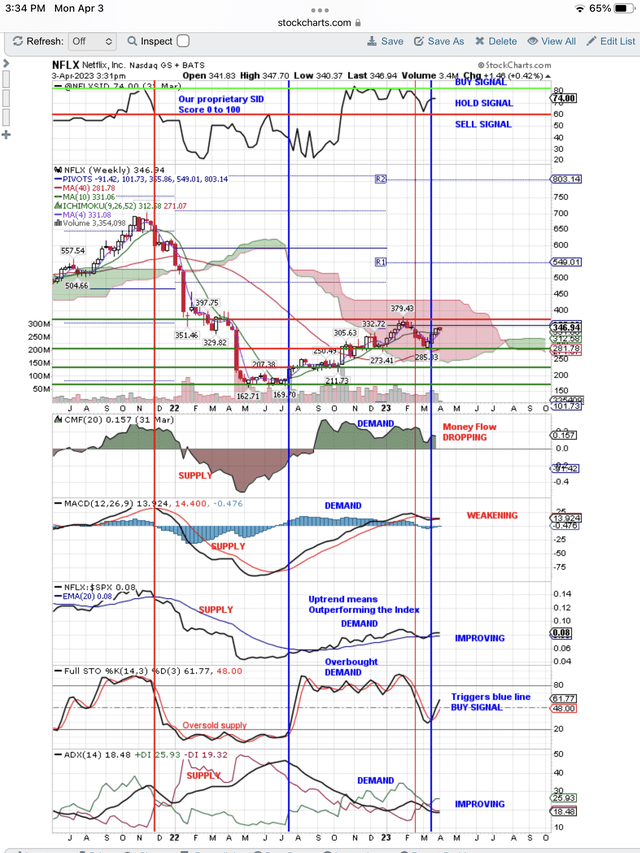

- Our proprietary fundamental and technical rating for Netflix has dropped from a Buy Signal to a Hold Signal and you can see this at the top of the chart below.

- Seeking Alpha gives it top grades for Growth, Profitability, Revisions and Momentum but not Valuation.

- Therein lies the problem because bottom fishers are value players and they stop buying when a stock becomes too pricey.

FedBul/iStock via Getty Images

Once the bottom fishers catch a big one, like Netflix (NASDAQ:NFLX), they stop buying as price moves too high. So it is no surprise that this great bounce NFLX had, off a deeply oversold bottom, is over and is struggling to get back to its recent high. We know the technical resistance that NFLX will face as it tries to get back to the recent high. Seeking Alpha gives us the Valuation breakdown of poor grades that will cause this resistance.

Our proprietary, fundamental and technical SID score is shown at the top of the chart below. You can see how our SID score improved to a Buy Signal as price made a nice bounce off the bottom. To obtain our SID Buy Signal, NFLX had to have both good fundamentals and good technicals. It did when price was at the bottom. However, now you can see that our SID score has dropped from a Buy Signal to a Hold Signal. Since the chart still looks good, we wanted to turn to the Seeking Alpha’s Quant system to do our due diligence and to find out what was wrong with the fundamentals.

Seeking Alpha gives NFLX top ratings for Profitability, Growth, Revisions and Momentum, so our research becomes easy. The only poor grade is Valuation and by hitting that tab we can see all the Valuation metrics have poor grades except PEG Non-GAPP (FWD).

After NFLX’s crash to the bottom, that burned many portfolio managers, the bottom fishers may be the only institutional buyers left. When they stop buying, price stops going up. We can see that happening on the charts below.

Here is our weekly chart with our proprietary Stocks In Demand, SID, signal at the top of the chart. It is color coded to identify the Buy/Hold/Sell levels.

Netflix Stopped By Resistance, Tries Again (StockCharts.com)

On the above chart, you can see that we have drawn a vertical, blue line, Buy Signal indicating that Demand is taking price higher to retest resistance at $379, if it can get back up that high. On the chart below we show the strong resistance at $348, $352, $356 and $360.

Also across prices on the above chart, you can see that we have drawn a price resistance line at $379. We have drawn a horizontal support line at $285. Price is now consolidating its big gain on the bounce up, in this trading range. It will either breakout or breakdown from this trading range. We expect price to drop from $379 and retest $285. We think it has a valuation problem at $379, especially in a bear market.

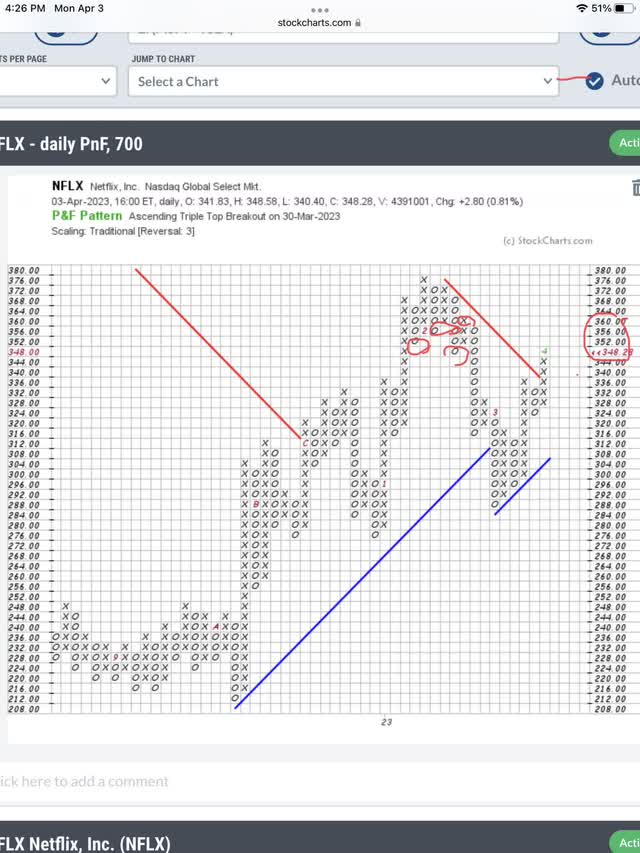

Here is a Point & Figure chart showing the strong resistance levels that NFLX has to overcome if it hopes to reach $379 on this current attempt.

Netflix Resistance Hurdles To $379 (StockCharts.com)

On the above chart we have circled the established resistance levels that this move up has to overcome just to reach $379 again. We think that will exhaust the buyers and we expect a drop to retest $285, especially if the broader market drops in May as we expect.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in NFLX over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: We are not investment advisers and we never recommend stocks or securities. Nothing on this website, in our reports and emails or in our meetings is a recommendation to buy or sell any security. Options are especially risky and most options expire worthless. You need to do your own due diligence and consult with a professional financial advisor before acting on any information provided on this website or at our meetings. Our meetings and website are for educational purposes only. Any content sent to you is sent out as any newspaper or newsletter, is for educational purposes and never should be taken as a recommendation to buy or sell any security. The use of terms buy, sell or hold are not recommendations to buy sell or hold any security. They are used here strictly for educational purposes. Analysts price targets are educated guesses and can be wrong. Computer systems like ours, using analyst targets therefore can be wrong. Chart buy and sell signals can be wrong and are used by our system which can then be wrong. Therefore you must always do your own due diligence before buying or selling any stock discussed here. Past results may never be repeated again and are no indication of how well our SID score Buy signal will do in the future. We assume no liability for erroneous data or opinions you hear at our meetings and see on this website or its emails and reports. You use this website and our meetings at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Use our free, 30 day training program to become a successful trader or investor. Join us on Zoom to discuss your questions.