Summary:

- 3M’s strong R&D capabilities, extensive patent portfolio, and innovative culture contribute to a competitive edge in the market, resulting in a consistent supply of innovative products for customers.

- Market woes. Challenging business environment and eroding competitive position, leading to slowing organic growth, supply chain disruptions, and weakness in some end markets.

- Major litigation risks related to Combat Arms Earplugs and PFAS chemicals could result in billions of dollars in liabilities.

- Mispriced shares. 3M shares trading at a 5% premium.

josefkubes

3M’s (NYSE:MMM) competitive advantage in R&D, driven by its extensive patent portfolio and innovative culture, is overshadowed by the three “Ms” the company faces:

- Market woes due to a challenging business environment with eroding competitive position,

- Major litigation risks associated with Combat Arms Earplugs and PFAS chemicals, and

- Mispriced shares trading at a 5% premium.

In this article, we will examine 3M’s business model and growth drivers, as well as discuss these three critical issues that influence the company’s financial performance and prospects.

Overview and Business Model

3M is a diversified global manufacturer, marketer, and innovator with operations in over 70 countries. Its core strength lies in its ability to apply its technologies – often in combination – to a wide array of customer needs. The company has a vast range of products and solutions, including adhesives, abrasives, laminates, health information systems, and medical dressings. It operates under four business segments: Safety & Industrial, Transportation & Electronics, Health Care, and Consumer. These segments serve various industries, such as automotive, electronics, healthcare, and personal protection equipment (PPE).

Strong Competitive Advantage and Growth Drivers

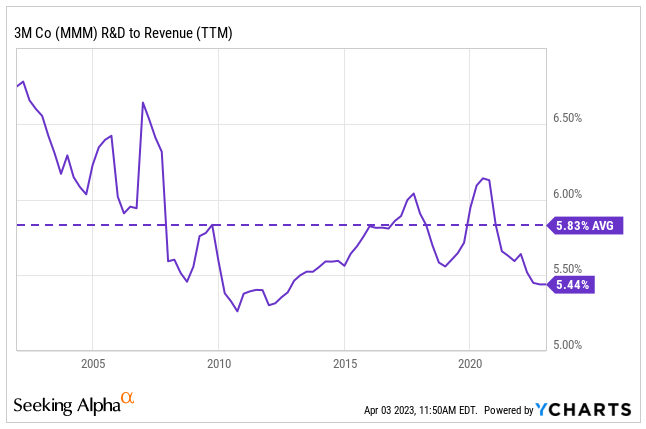

3M’s competitive advantage is derived from its extensive patent portfolio, strong brand, and innovative culture. It holds more than 100,000 patents and invests significantly in R&D. Its commitment to R&D has helped the company create innovative products and solutions that provide a competitive advantage in the market. This investment contributes to the generation of over 3,500 patents annually, leading to a consistent supply of innovative products for customers. The company possesses 51 technology platforms, encompassing areas such as adhesives, abrasives, ceramics, and nanotechnology. Globally, scientists collaborate and leverage these technologies across all business sectors to invent and produce state-of-the-art products.

YCharts

Significant long-term growth drivers for 3M involve the PPE market, global medical dressings, medical software markets, transportation safety, and industrial adhesives and tapes. I anticipate that 3M will progressively allocate more of its R&D and capital expenditures toward these promising divisions.

The PPE market is driven by growing concerns about employee health and safety, met with new regulations. 3M’s material science core competency positions it well in this segment, as it requires innovative products that balance comfort, aesthetics, lighter fabric, and premium quality in protective materials. Rising manufacturing and construction in developing economies should further propel growth.

The medical solutions market is experiencing growing demand due to the increasing global incidence of wound infections, diabetes, and chronic diseases. Age is a significant factor in developing chronic wounds, which strains healthcare systems as populations age. Various factors contribute to wound healing complications, with untreated infections being a major cause. The World Health Organization reports a significant rise in diabetes from 108 million in 1980 to 537 million in 2022, primarily in low- and middle-income countries. By 2045, the global diabetic population is expected to reach approximately 783 million. Diabetes can lead to severe complications and increased mortality rates. 3M’s acquisition of Acelity in 2019 strengthens its position in the negative-pressure wound care market.

Problem #1: Market struggles – Challenging Business Environment and Eroding Competitive Position

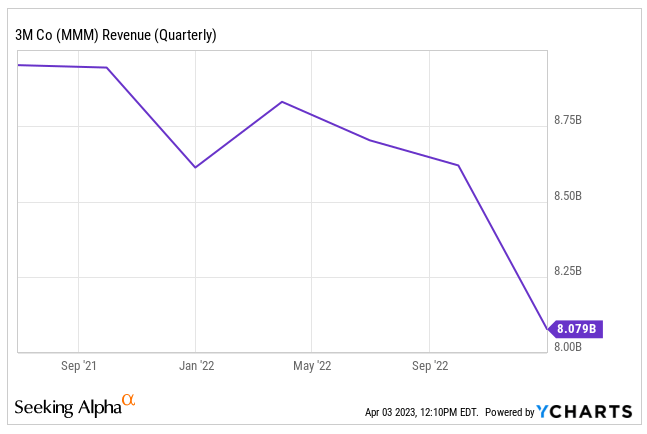

In recent years, 3M has faced a challenging business environment despite its competitive advantages. The company’s financial performance has been impacted by multiple factors, including slowing organic growth, supply chain disruptions, and weakness in some end markets. Since achieving its highest quarterly revenues of $8.9 billion in Q2 of 2021, 3M’s revenues have continuously declined and were $8.1 billion for Q4 of 2022.

YCharts

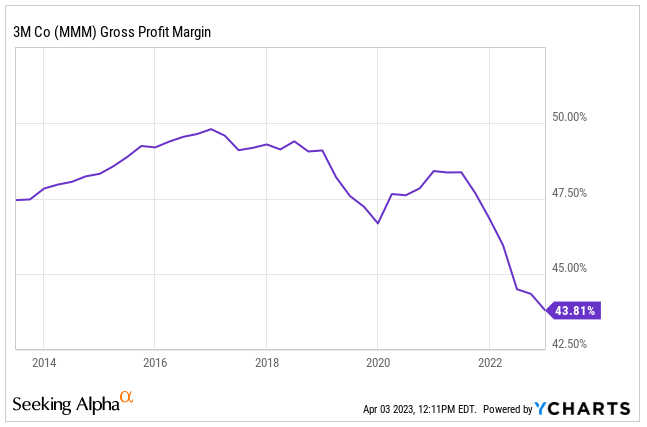

Additionally, although there was a slight improvement in 2020, the company’s margins have been declining from their peak of 49.8% in 2016 to 43.8% in 2022.

YCharts

The decline in revenues and margins can be attributed to 3M’s eroding competitive position in some end markets, especially its healthcare segment, which includes its health information systems and oral care business divisions.

Problem #2: Major Litigation Risks: Combat Arms Earplugs and PFAS

3M is grappling with major litigation risks linked to earplugs and PFAS chemicals, which could result in billions of dollars in liabilities. The company faces two significant court cases: one involving earplugs and another concerning PFAS contamination. 3M has been sued by hundreds of cities, states, and individuals for allegedly polluting rivers, drinking water, groundwater, and soil with PFAS chemicals. By 2020, the company was involved in over 187 PFAS lawsuits.

Additionally, 3M’s subsidiary, Aearo Technologies, is awaiting a review by the 7th U.S. Circuit Court of Appeals of a bankruptcy court’s decision not to block litigation against 3M, despite Aearo’s Chapter 11 bankruptcy. This case includes more than 200,000 combat veterans suing 3M for allegedly selling defective earplugs. A loss, in this case, could lead to billions of dollars in liabilities for 3M. The ruling will also determine if corporations can use subsidiaries’ Chapter 11 filings to avoid mass tort litigation, which could greatly impact future mass tort cases.

3M has pledged to stop producing PFAS by the end of 2025 and to discontinue its use in products. This marks a significant shift away from a class of chemicals in use for over 70 years. PFAS were initially developed during World War II for atomic bomb research and have been used in various products, such as firefighting foams and waterproof and stainproof textiles. However, they have been linked to serious health concerns. As 3M ceases PFAS production, it anticipates pretax charges of $1.3 billion to $2.3 billion and a potential $30 billion liability if it fails to clean up contamination caused by the chemicals.

On March 23, 2023, 3M clarified earnings guidance for 2023 excluded potential litigation costs related to military earplugs and PFAS chemical production. The company’s CFO, Monish Patolawala, said they could not predict the exact litigation expenses, so the adjusted EPS guidance of $8.50 to $9 excludes these matters. 3M is awaiting court decisions in April 2023, which will determine its involvement in Aearo’s bankruptcy and whether Aearo can file for bankruptcy at all. In early May, appeals for two earplug lawsuits will be heard.

Problem #3: Mispriced shares trading at a 5% premium

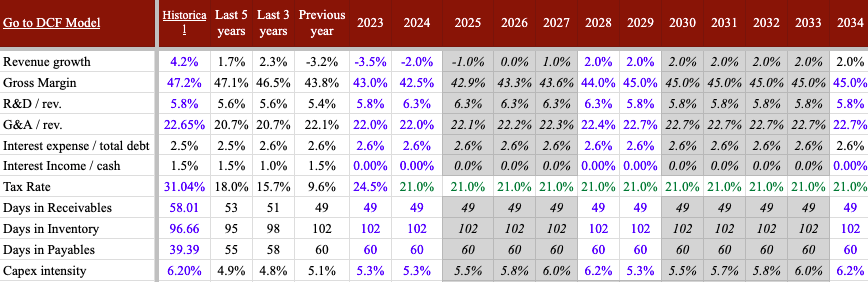

I value MMM stock at $99. This is based on a DCF model using a cost of capital of 7.8%. That cost of capital used an unlevered beta of 1.12 for the industry and an extra premium for the risk from the litigations as I do not count for that risk in the cash flows.

I expect revenues to continue declining in the medium term driven by the discontinuation of PFAS and the trend in the healthcare segment. This will continue to drag margins but I expect margins to recover in the long-term, however, they will still be slightly lower than historical margins by 200bps.

Author estimates & company filings

Conclusion

While 3M boasts a robust competitive advantage in R&D, driven by its extensive patent portfolio and innovative culture, it is currently facing three significant challenges. These include a challenging business environment with an eroding competitive position, substantial litigation risks surrounding Combat Arms Earplugs and PFAS chemicals, and shares trading at a 5% premium. These issues have a considerable impact on the company’s financial performance and prospects. Based on my analysis of these factors, I recommend against purchasing 3M shares at this time. I will closely monitor the company’s progress in addressing these concerns and reassessing the investment opportunity when the risks have been mitigated or resolved.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.