Summary:

- PayPal continues to deliver on margin expansion in spite of a tough macro backdrop.

- The stock price has languished near 2017 levels.

- The company is using most of its free cash flow to repurchase beaten-down stock.

- PayPal offers considerable upside as Wall Street warms up to this cash flow story.

SylvieBouchard

PayPal (NASDAQ:PYPL) seems like a perfect stock for today’s environment. The tech stock has seen its stock price absolutely crushed amidst the tech crash, helping to reset valuations. Management has shown an increased focus on driving profitability, helping to offset slowing top-line growth rates. Yet the stock has not participated in the recent recovery in the tech sector and instead continues to trend lower. Amidst a dramatic transition from high-flying tech stock to cash cow, Wall Street may be sleeping on this multiple expansion story. I reiterate my buy rating.

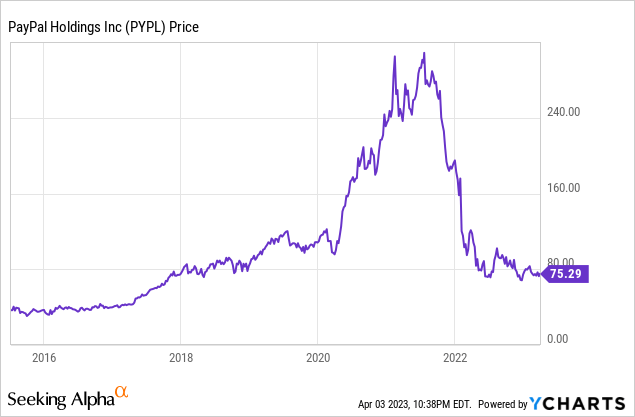

PYPL Stock Price

As one of the top e-commerce beneficiaries from the pandemic, PYPL was a literal “multi-bagger” in just a few years. After the crash, the stock now trades as low as it did in 2017.

I last covered PYPL in November where I rated the stock a buy after third quarter earnings. There, I made the case that Wall Street was failing to appreciate the intentional transition to a cash flow focus. With the company already delivering on promised margin improvements and guiding for more in 2023, the stock is offering a favorable setup for a catalyst-driven investment.

PYPL Stock Key Metrics

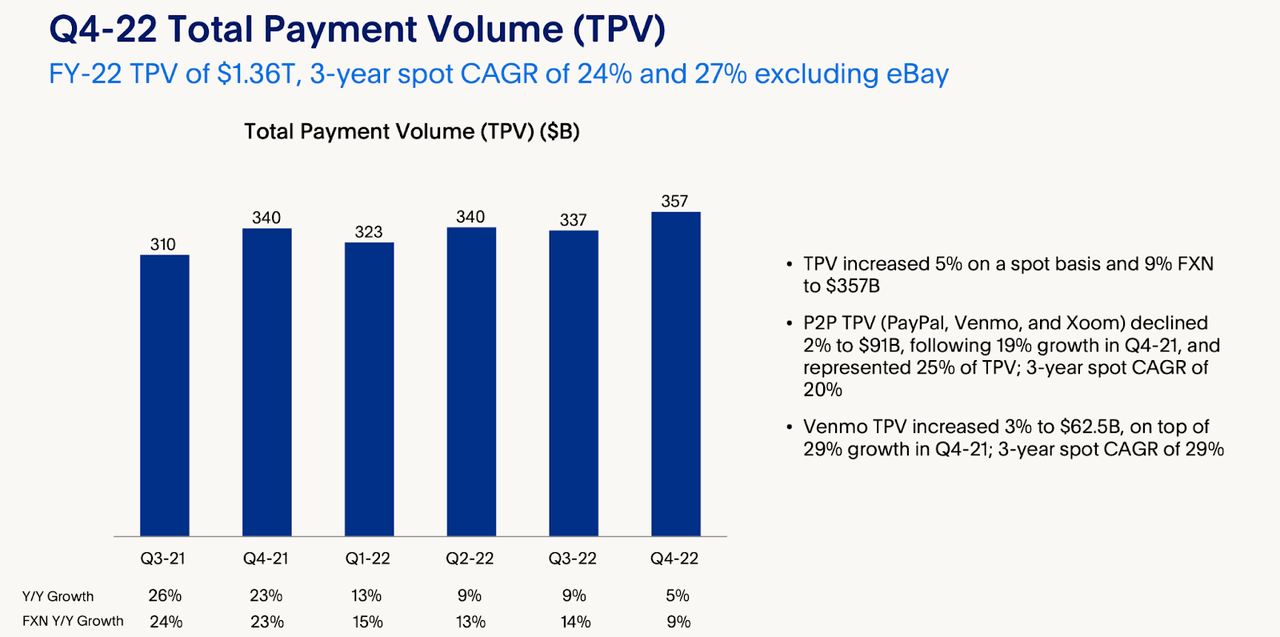

In its most recent quarter, PYPL saw the material effects of the tough macro backdrop as total payment volume (‘TPV’) grew by only 5% (9% constant currency). Many investors, including yours truly, had hopes for accelerating growth as the company moved passed tough comps. However, it is apparent that in place of tough comps there is now a tough macro environment.

2022 Q4 Presentation

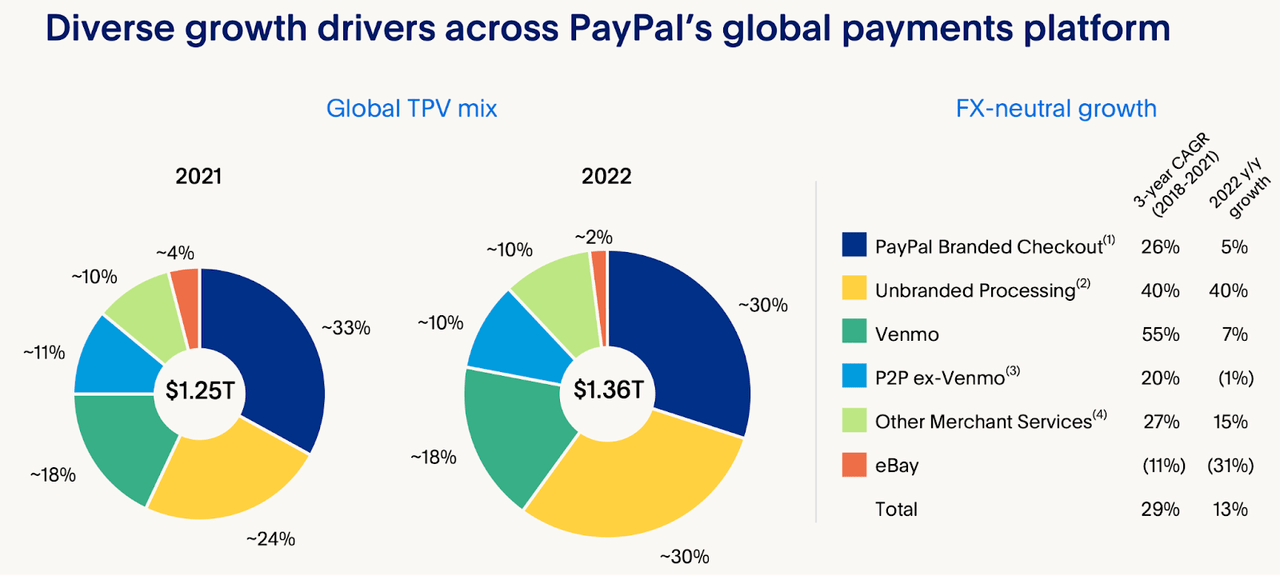

While eBay (EBAY) remained a headwind and represented 31% declines in TPV YOY, PYPL saw strong growth in unbranded processing, which grew 40% YOY.

2022 Q4 Presentation

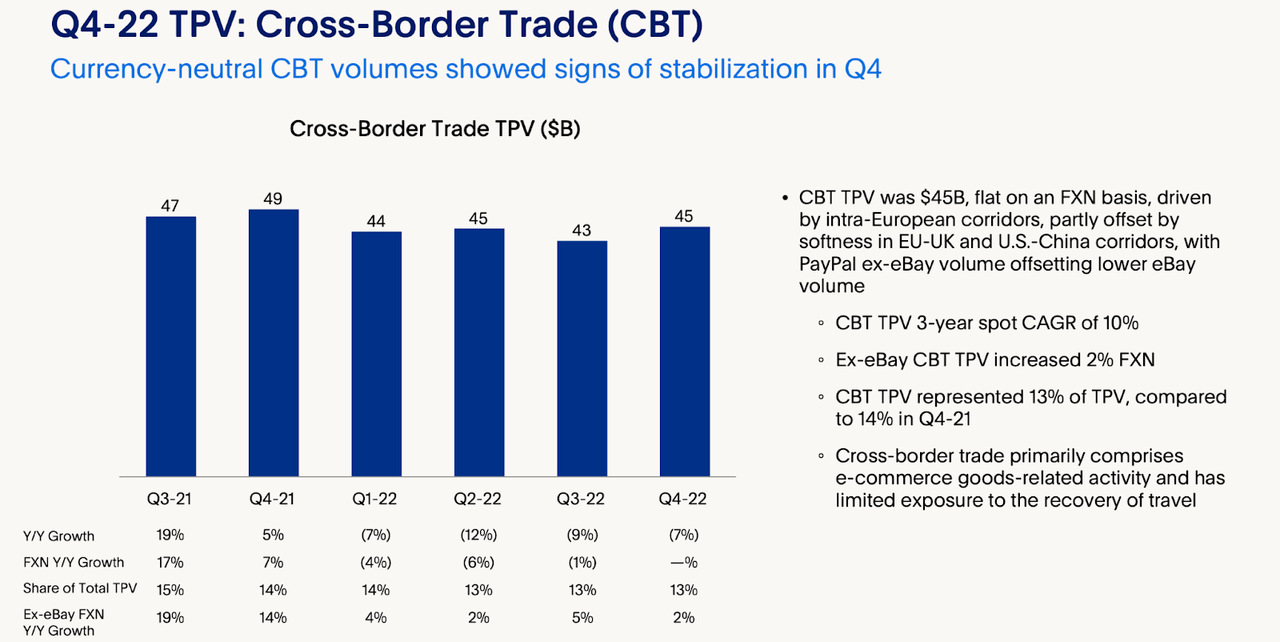

As can be expected, cross-border trade TPV remained a headwind, likely due to both China (the country has since eased pandemic restrictions) and the Russia-Ukraine war.

2022 Q4 Presentation

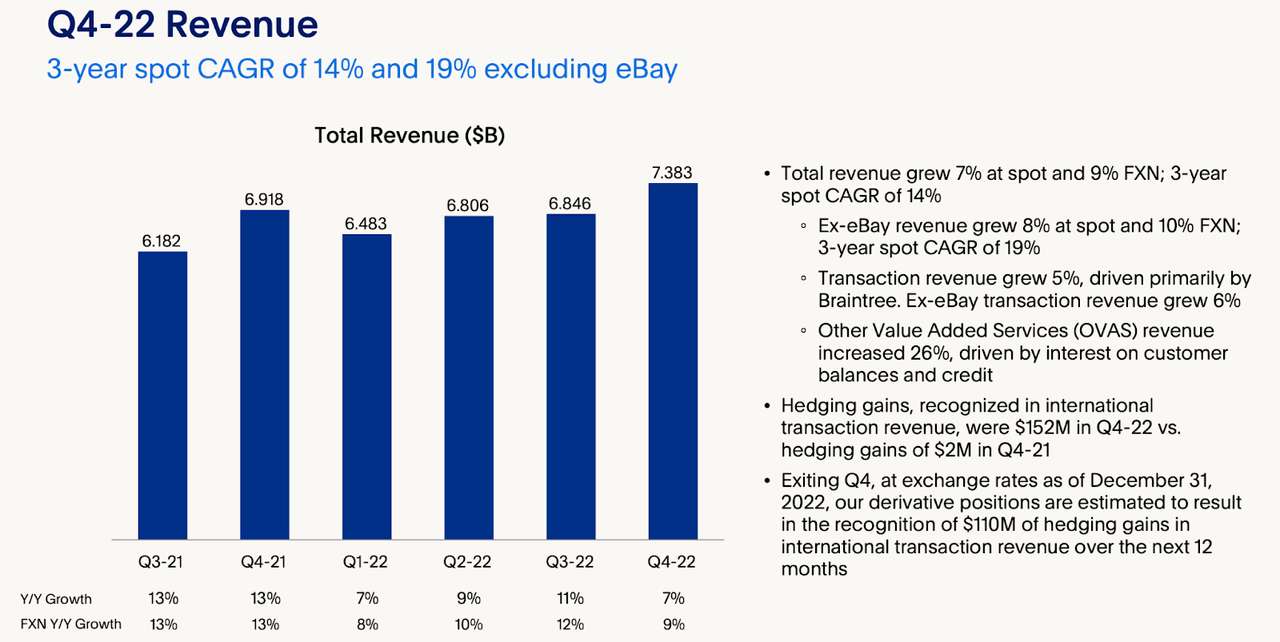

In spite of the mild TPV growth, revenue still grew 7% YOY. The discrepancy was in part driven by higher interest revenues generated from customer deposit balances.

2022 Q4 Presentation

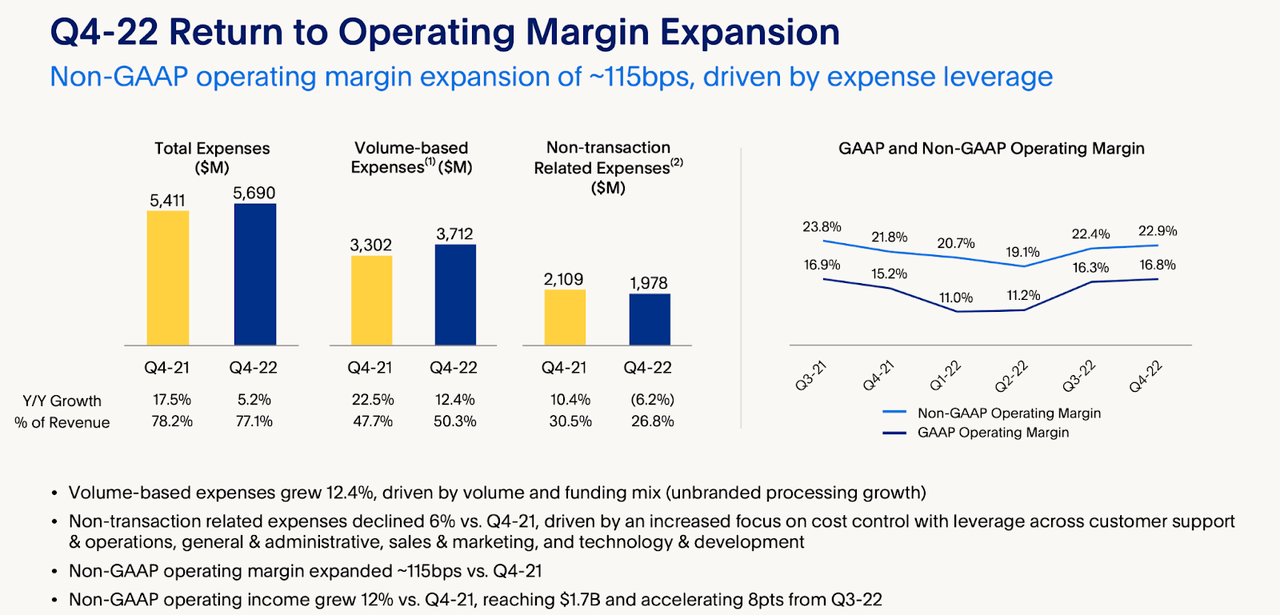

Like many tech stocks in the current environment, PYPL has sought to offset disappointing top-line growth with margin expansion. PYPL delivered yet another quarter of non-GAAP operating margin expansion, finally returning to YOY growth. “Cost control” was highlighted as the main driver.

2022 Q4 Presentation

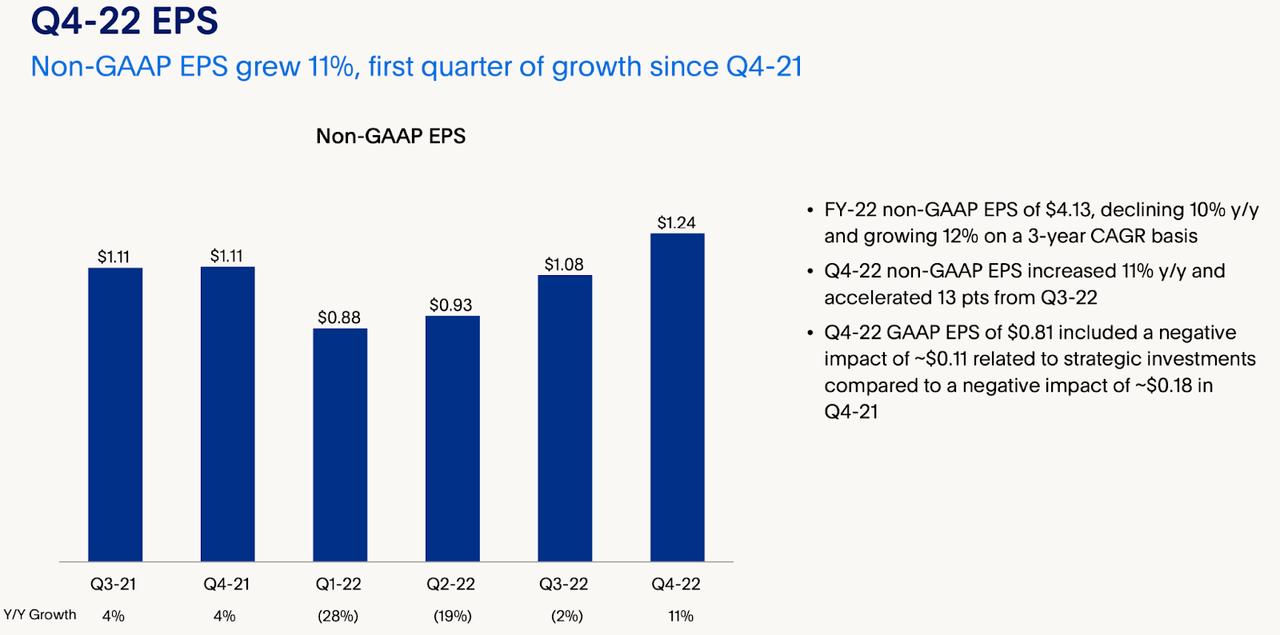

Non-GAAP earnings per share grew by 11% which was the first quarter of growth for a whole year. It appears that the tough macro environment has forced PYPL management to stop making excuses and to start delivering on bottom-line growth.

2022 Q4 Presentation

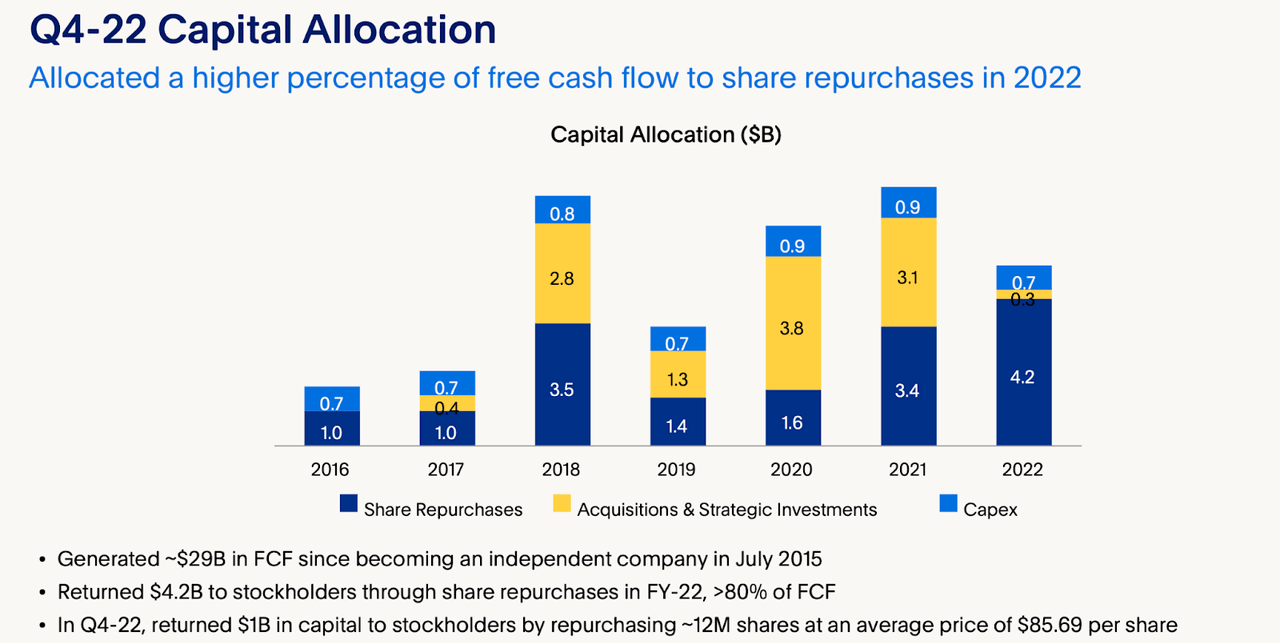

PYPL ended the quarter with $15.9 billion in cash and investments versus $10.8 billion in debt. With such a strong balance sheet, PYPL has been able to return the vast majority of free cash flow to shareholders, spending 80% FY-22 free cash flow on $4.2 billion in share repurchases.

2022 Q4 Presentation

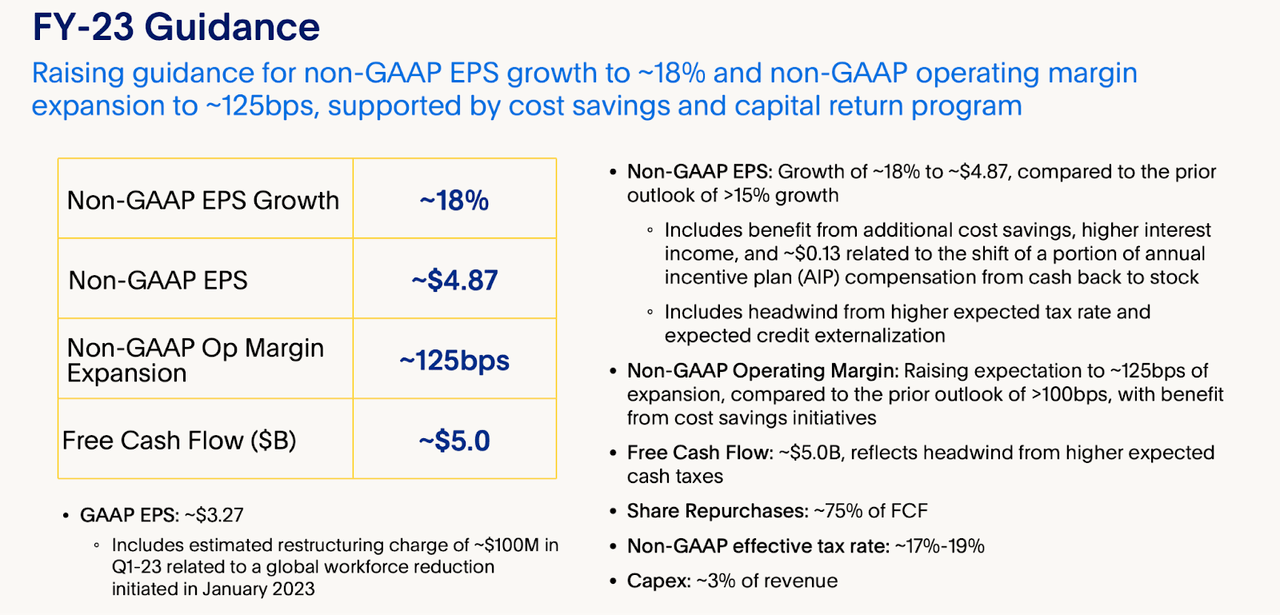

Looking ahead, PYPL has guided for this upcoming year to see around 18% non-GAAP EPS growth – ahead of the prior guidance for 15% growth. PYPL expects to generate around $5 billion in free cash flow and spend 75% of that on share repurchases.

2022 Q4 Presentation

What is driving the uplift in guidance? On the conference call, management noted that they had “identified an incremental $600 million of cost savings on top of the $1.3 billion of cost savings previously identified.” That is expected to drive 125 bps of margin expansion.

For the first quarter, PYPL is guiding for around 9% constant currency revenue growth with up to 25% non-GAAP EPS growth. I suspect that management has left room to raise full-year non-GAAP EPS guidance based on the projection for slower growth in subsequent quarters.

2022 Q4 Presentation

Management noted that they view that revenue growth rate as being “very conservative” and expressed “high confidence” in their EPS guidance target. Management went on to call this quarter a “positive inflection point” and a “direct result of our intense focus and cost discipline and the pursuit of profitable growth.”

Is PYPL Stock A Buy, Sell, or Hold?

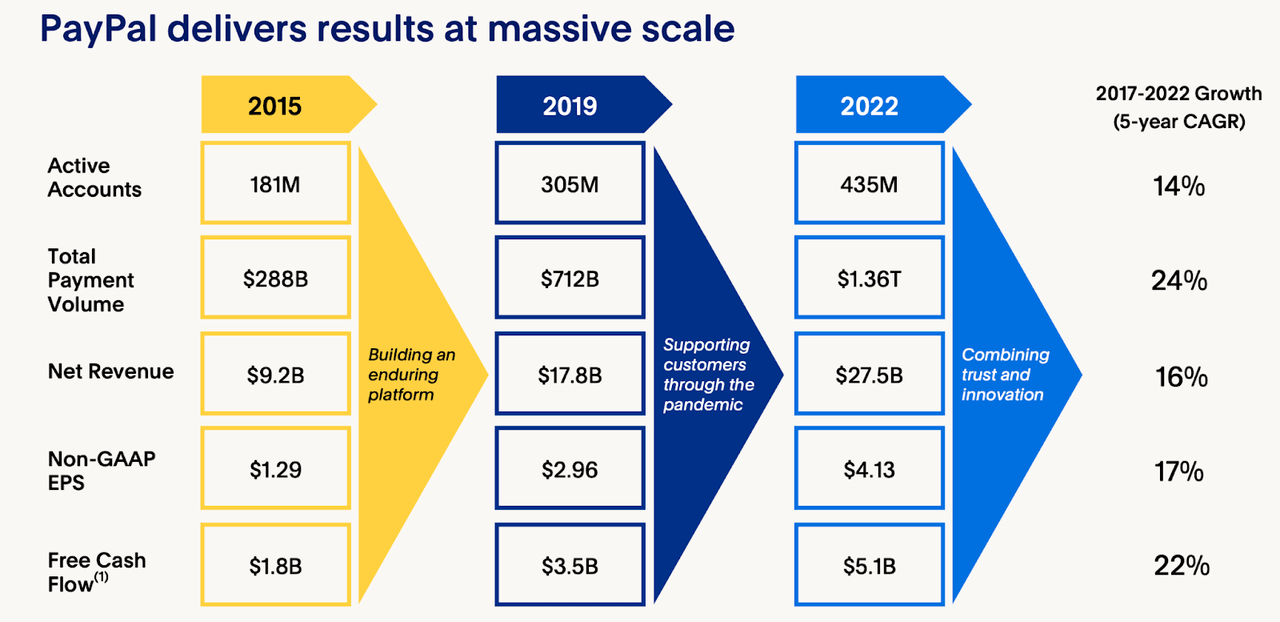

You’d think that those numbers and management commentary would have led to a huge rally in the stock price. That rally has not yet materialized. It seems that Wall Street is still focused on the disappointing top-line growth. It is important to note that on a 5-year basis, PYPL has grown net revenue at a 16% CAGR. The pandemic may have pulled forward significant growth and the company may be still dealing with tough comps.

2022 Q4 Presentation

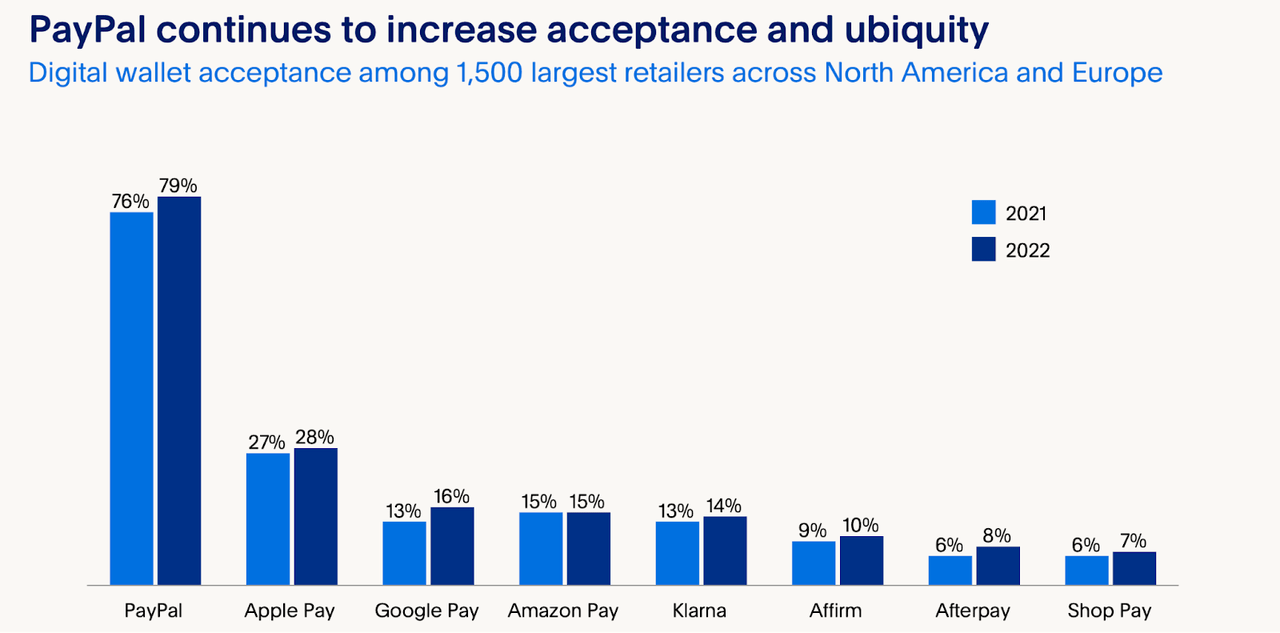

PYPL remains the most broadly accepted digital wallet across North America and Europe.

2022 Q4 Presentation

Some investors might view this negatively, thinking that this means that PYPL has the most to lose. But I view it differently: having a first-mover advantage means that PYPL can drive solid user growth. In short, the value proposition that PYPL delivers is having to avoid the hassle of entering payment information over and over again. PYPL may be able to stave off competition because consumers might not want to use a new payment service for that exact reason.

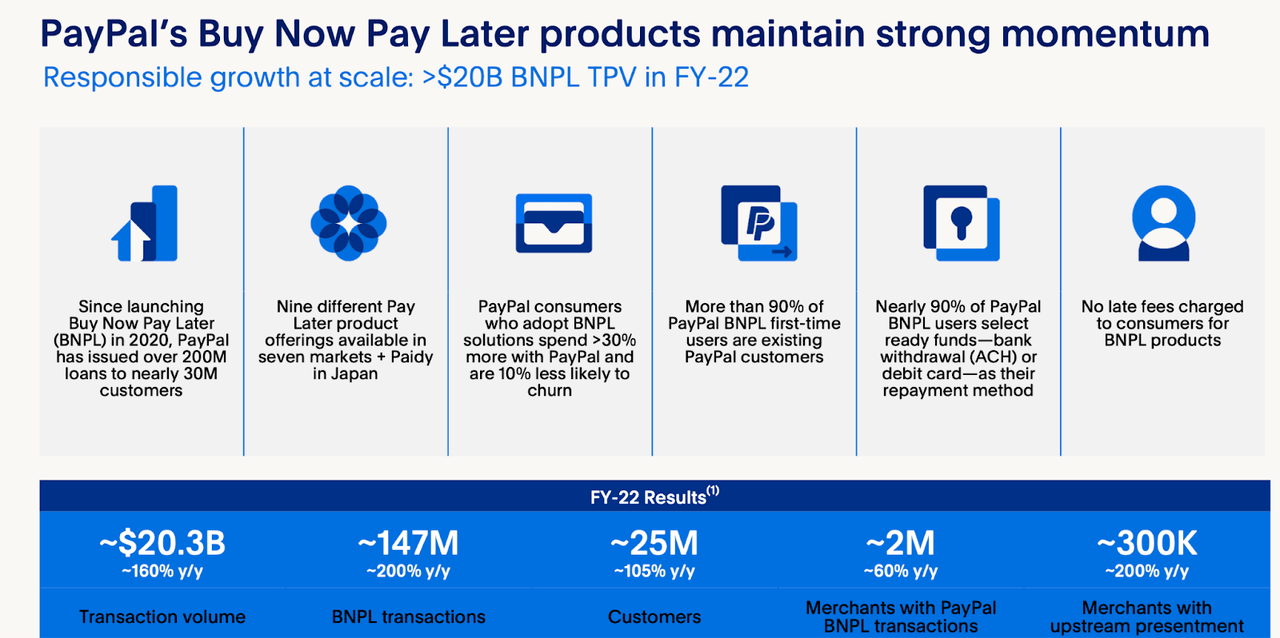

Meanwhile, PYPL has been expanding the breadth of its services, including investing in Buy Now Pay Later. PYPL has seen extraordinary growth in BNPL, with transaction volume growing 180% last year.

2022 Q4 Presentation

PYPL management noted that its layoffs and focus on cost reduction would not get in the way of internal investment, as they continue to invest “towards passwordless, one click native in-app experiences as well as deploying the next generation of advanced checkout using our data and AI capabilities.”

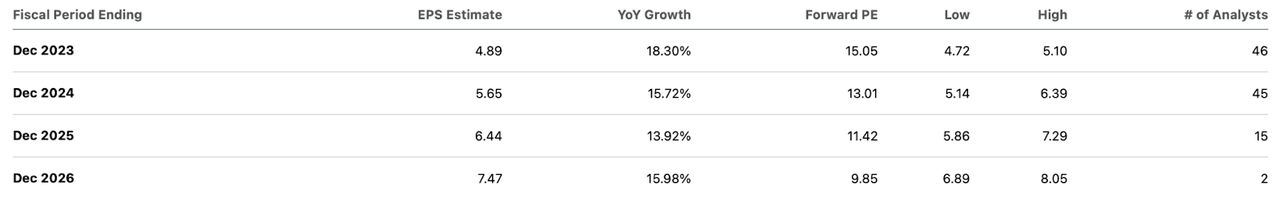

Unlike management, Wall Street does not expect top-line growth to return in earnest.

Seeking Alpha

However, PYPL has quickly become an earnings story, with the stock now trading at just 15x this year’s earnings.

Seeking Alpha

I note that the above chart is using non-GAAP EPS, of which stock-based compensation makes up around 20% of non-GAAP earnings. As PYPL continues to repurchase stock and deliver on growth initiatives, I can see the stock quickly re-valuing to at least 30x earnings, implying triple digit upside.

What are the key risks? With the valuation now more or less “de-risked,” I am not so concerned by the slowing top-line growth rate as I am confident that the company can sustain double-digit bottomline growth even with just mild revenue growth. Competition is arguably the most important one. It is not clear if the first-mover advantage would be enough to help sustain market share, or if competitors would be able to win market share through aggressive promotional activity. Apple Pay (AAPL) may be the most notable threat, as I suspect that Apple users may be more loyal to Apple-branded services. AAPL has rolled out its buy now, pay later offering and only time will tell how this impacts PYPL’s own BNPL growth ambitions. While PYPL has already done a stellar job in delivering margin expansion, this macro environment adds great uncertainty even to management’s conservative guidance.

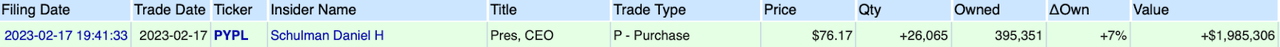

It is worth noting that even as CEO Dan Schulman plans to retire after a year, he nonetheless made a near $2 million purchase of the stock in the open market in mid-February.

Openinsider

I continue to view a basket of undervalued tech stocks as being an optimal way to position ahead of a recovery in tech stocks. PYPL is one of my favorite picks offering a winning combination of undervaluation, solid profitability, and share repurchases.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL, AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For My Premium Service "Best of Breed Growth Stocks"

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best 6-8 investment reports monthly.

- My top picks in the beaten down tech sector.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!