Summary:

- Oil jumped on the OPEC+ decision to cut oil production again.

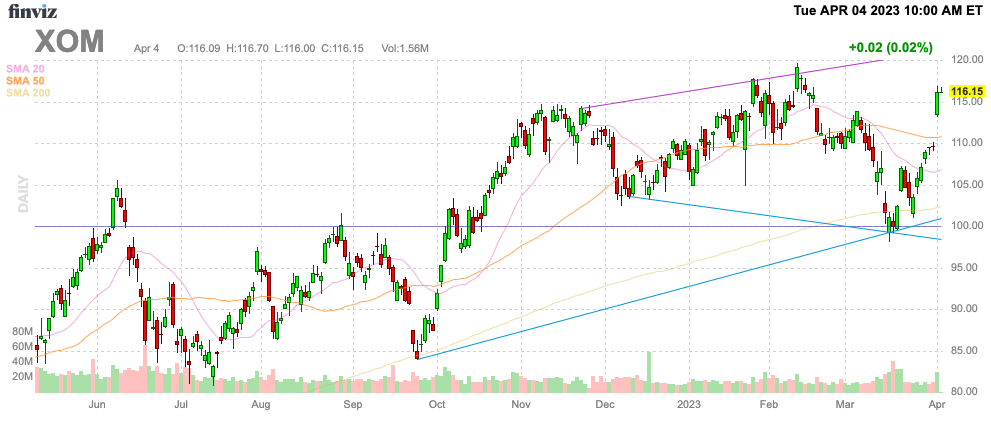

- Exxon Mobil Corporation is back trading near all-time record levels, despite substantially lower energy prices.

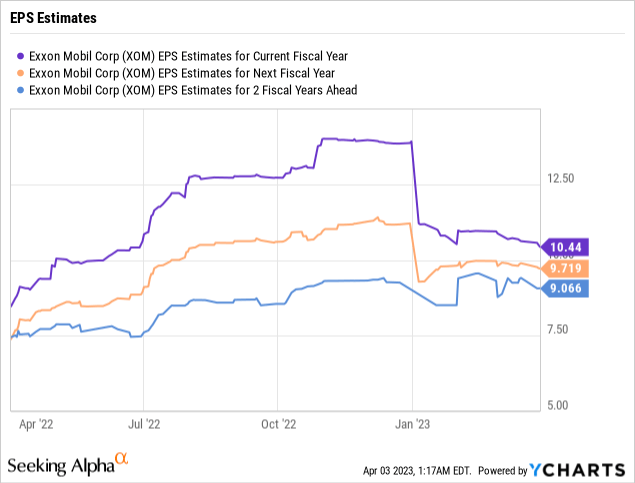

- Exxon Mobil stock trades at 11x ’23 EPS estimates that appear far too high.

William_Potter

In a surprise move over the weekend, OPEC+ decided to cut oil production yet again. In theory, Exxon Mobil Corporation (NYSE:XOM) is set to benefit from large cuts in oil production, but the last few OPEC+ cuts haven’t helped. My investment thesis is Bearish on XOM stock, with the initial post-cut rally sending the stock to recent all-time highs while profits are nowhere close to peak levels.

Finviz

Another OPEC+ Cut

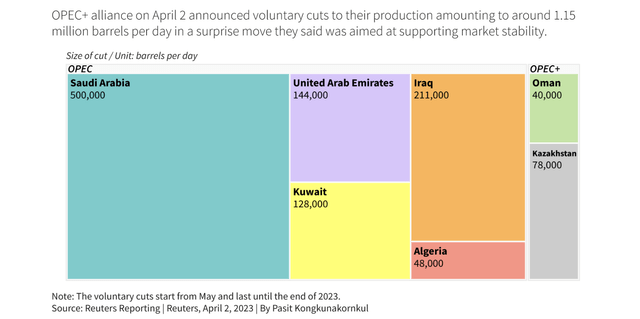

Only last October, OPEC+ agreed to cut oil output by 2 million bpd starting in November. Now, OPEC+ expects to cut production again by 1.16 million bpd for May delivery, with Saudi Arabia leading the way with 500,000 bpd in cuts.

In total, OPEC+ has now cut oil production by an incredible 3.66 million bpd. The interesting part of the move is that oil prices have only fallen since the cuts last October.

The move is shocking in that it both helps Russia collect more profits to fund the war in Ukraine, and it increases the specter of higher inflation.

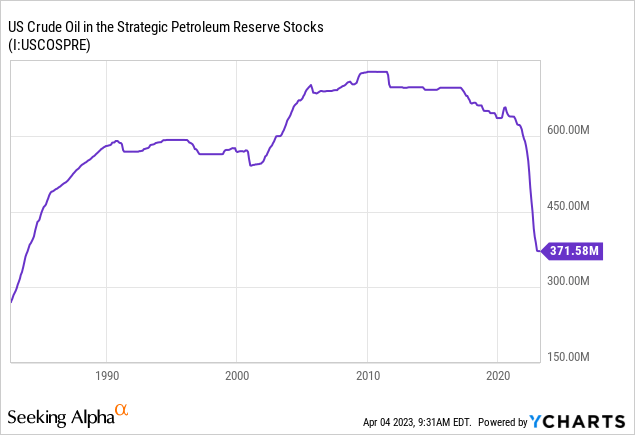

In addition, the U.S. failed to refill the Strategic Petroleum Reserve (“SPR”) when WTI prices fell below $70 in a sign that probably helped lead to Saudi Arabia pushing for these output cuts. The SPR was filled to its then 727 million barrel authorized storage capacity on December 27, 2009, and is now down to its lowest level in decades at 372 million barrels.

With oil prices spiking to over $80 on the initial spike, some analysts see the move as a signal of weak demand. Morgan Stanley cut the Q3’22 Brent price to target to $90/bbl and the 2024 forecast to $85/bbl.

Big Oil Impact

For now, Exxon Mobil has been saved by these big oil production cuts by OPEC+. The slumping oil prices were set to crush profits after a year of record numbers due to surging oil and natural gas prices because of the Russian invasion of Ukraine.

Analysts had already cut Exxon Mobil EPs targets to $10 or below for the next couple of years. In the December quarter alone, the energy giant reported an EPS of $3.40, but the company didn’t produce anything close to these EPS levels in the past.

The 12 months prior to the Russian invasion, Exxon Mobil only earned $6.80 per share. The best quarter in the period was just $2.07, or $8.28 per share annualized rate, and this was during Q1’22 when the invasion started.

The idea that Exxon Mobil is suddenly going to earn $9 to $10 per share now with much lower energy prices isn’t logical. The OPEC+ cuts help boost oil prices, but the move probably only helps crush domestic natural gas prices. Domestic oil producers will only produce more oil, leading to additional natural gas production as a by-product.

As an example of the earrings hits ahead, Exxon Mobil had the following energy price realization in Q1’22 when the company only earned ~$2 per share. Heck, back in 2021 the energy giant only earned $5.39 per share on the following average energy price realizations:

- WTI Oil – ~$65

- Nat gas – ~$3 – U.S.

- Nat gas – $7 – non-U.S.

U.S. natural gas prices are below $2 now while OPEC+ cuts have provided some relief on oil prices. Remember, though, Exxon Mobil realized these average oil prices when WTI prices were on average $3/bbl to $4/bbl higher.

Also, remember that Exxon Mobil agreed to pay much higher wages to employees at the end of 2022 in the form of a 9% pay increase. The energy giant decided to pay the higher profits to employees while energy prices are very volatile.

Takeaway

The key investor takeaway is that investors are far too bullish on Exxon Mobil Corporation now while energy prices are more reflective of 2021 levels, not 2022. The current analyst EPS targets appear to forecast far higher energy prices than the reality of current prices.

Investors should use this rally to unload Exxon Mobil Corporation close to the all-time highs while energy prices are nowhere close to record levels.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market heading into a 2023 Fed pause after several bank closures, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the out sized risk of high flying stocks.