Summary:

- Dividends have remained decent.

- However, the company has greatly lagged the broad S&P index.

- The market appears to show little interest in Big Pharma.

Mario Tama

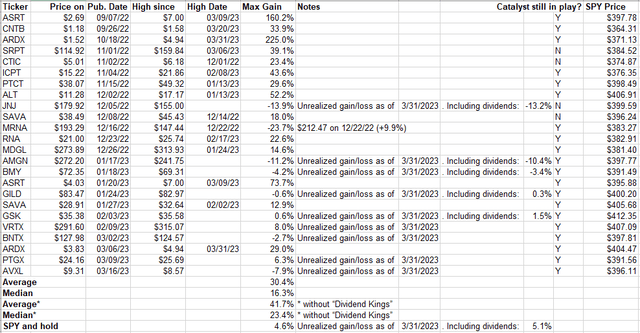

In previous coverage, Johnson & Johnson (NYSE:JNJ), still the world’s largest ($405 billion) healthcare products company, was held up as a Buy for its B+ rated dividend (which increased to 2.92% yield), A+ rated profitability on $23.8 billion revenue in Q3, and as a defensive healthcare stock in this bear market. Since then, it has shed about $60 billion in value. It is one of the five stocks promoted for their dividends that have all underperformed among personal recommendations (Figures 1 and 2), and hasn’t tracked the reference SPDR S&P 500 Trust ETF (SPY) at all until early February. The premises haven’t changed, but investors have to consider mixed Q4 earnings and other factors that may be at play.

Figure 1. Performance of CSI’s Buys and Strong Buys from September 2022 compared to S&P ETF

Seeking Alpha

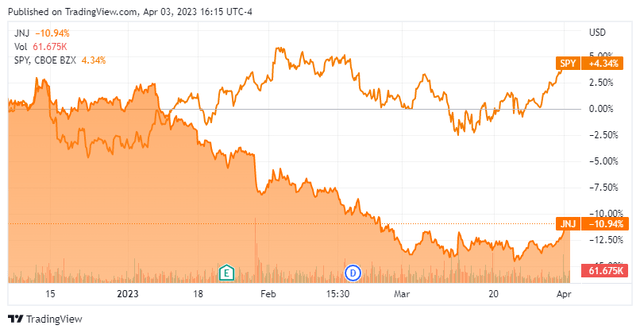

Figure 2. JNJ Price chart compared to S&P ETF from December 2022

Seeking Alpha

On December 16, JNJ withdrew its IMBRUVICA application as a treatment for previously untreated mantle cell lymphoma patients in the European Union, and the stock went down 1.03%. At the 41st Annual J.P. Morgan Healthcare Conference on January 9, JNJ discussed an apparent disconnect with their stated $60 billion goal in pharmaceutical revenues by 2025, pricing challenges in the MedTech segment, and didn’t mention their upcoming Consumer Health unit spinoff. The stock plunged 2.59% that day. On January 27, the Phase 3 CARTITUDE-4 study evaluating CARVYKTI versus salvage treatments known as PVd or DPd for the patients with relapsed and lenalidomide-refractory multiple myeloma was reported to have met its primary endpoint (“PEP”) of progression-free survival (“PFS”) at the first pre-specified interim analysis, but no details. The market reception was bad and led to a 3.7% price drop when the market opened the following Monday. Otherwise, there were no press releases or SEC filings to explain the 7% cratering from the $180.93 January 6 high to the $168.31 close the day before Q4 earnings on January 24. All that happened before the one real piece of bad news. On January 30, the U.S. 3rd Circuit Court of Appeals in Philadelphia denied bankruptcy for JNJ’s LTL subsidiary as a means to escape more than $3 billion worth of legal costs regarding claims that talc in Johnson’s baby powder caused cancer.

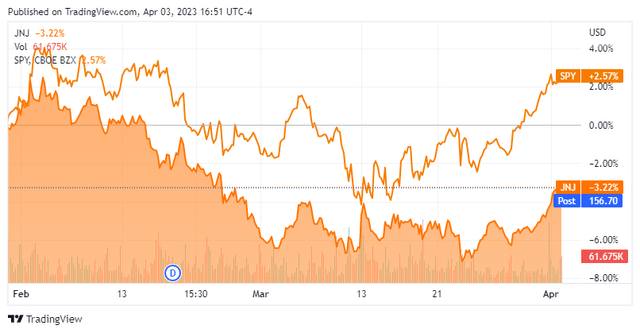

The fact that JNJ tracked SPY better since February wasn’t necessarily a good thing. The dips were steeper and rallies weren’t as high (Figure 3). Next up was the SVB Securities Global Biopharma Conference on February 15. The company debated how to mitigate cytokine release syndrome with DARZALEX as well as other safety issues with their other meds, which they largely blamed on not being able to educate everyone involved in the drugs’ administration. They also provided upcoming data readouts, but declined to give more specifics regarding CARTITUDE-4; again, shares lowered by 1.65%. The two March conferences were mainly about other topics and didn’t move the needle much.

Figure 3. JNJ Price chart compared to S&P ETF from February 2023

Seeking Alpha

To conclude, JNJ has been one of the worst-performing stocks on Table 1’s list (or THE worst depending on one’s Moderna (MRNA) exit strategy) and shared a trend with other Big Pharma companies during that span, perhaps signaling that even a Dividend Aristocrat like JNJ is no longer a preferred healthcare haven in these uncertain times. It does still offer good yields and profits and the Quant grades remain the same, but Q4 revenues of $23.7 billion was 4.4% worse than 2021 and missed estimates. Obviously those metrics haven’t been enough to satisfy the market, but sentiment on Wall Street can’t be blamed for the price malaise. Among the analysts covering JNJ since my previous article, there were 5 neutral stances, 3 Buys and no downgrades among Wall Street analysts. In addition, Ford Equity Research and ISS-EVA both have a 98% StarMine Relative Accuracy Score, based on the firms’ opinions on the stock over the last 24 months; no one else is remotely close to that. Both say Hold, although Ford agrees with the poor Quant Valuation grade.

Investors should keep in mind that issues brought up at J.P. Morgan such as inflation, Covid-19, and austerity in China and Europe all remain in play, as does the specter of talc lawsuits, which could keep JNJ prices suppressed. On the other hand, it doesn’t seem like the above uncertainties warranted a 15% price shave, as most of these headwinds have been in the public consciousness for some time. Overall, no one has had the conviction to give a Sell rating, but the time may be coming.

One important catalyst is the actual reveal of CARTITUDE-4 results, since President of Global Oncology Biljana Naumovic said that moving CARVYKTI into frontline is a huge opportunity. Longs should Hold for that, then sell if there is significant price appreciation (>5%) and they are in the money. Readers looking for positive Alpha but are drawn to companies with consistent earnings such as JNJ may probably do better with similar stocks such as Assertio Holdings (ASRT), a Strong Buy for its deep value, or Vertex Pharmaceuticals (VRTX), a Buy for its strong growth. According to the Quant system, such properties are lacking with JNJ.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.