Summary:

- Meta’s Facebook platform reported a 0.07% quarter-over-quarter decline in its monthly active users (MAUs) in Q2,22 and its user growth has been slowing down.

- Instagram has ~2 billion MAUs and was ranked No. 5 by iOS app downloads in the U.S. for March 2023, whereas Facebook didn’t even make the top 10.

- I believe if Meta spun off Instagram, it would unlock shareholder value through faster decision-making, more accountability, faster innovation, and external capital raise benefits.

- My valuation model estimates an intrinsic value of ~$280/share (no split), but a ~37% higher value per share of $383 (if the company split).

Kira-Yan

Meta Platforms (NASDAQ:META), formerly known as “Facebook,” changed its name in June 2022 as the company aimed to restructure and “resignal” to the market its differentiated brand, after poor financial results and slowing user growth were reported. In March 2023, Meta announced a “year of efficiency” which included the layoff of 10,000 people including many in middle management, with Zuckerberg stating “every layer of a hierarchy adds latency and risk aversion in information flow and decision-making.” Therefore it’s clear Zuckerberg (and investors) have noticed issues with the existing company structure both financially and culturally. I now believe Meta should take things one step further and spin off its “crown jewel” segment Instagram, which is its best business (in my opinion) due to its demographics, download trends, etc. I believe this will result in faster decision-making, more accountability, and ultimately unlock greater shareholder value. In this post I’m going to break down my detailed reasons for this thesis before revealing my valuation of the company.

Problems with Facebook

Slowing User Growth

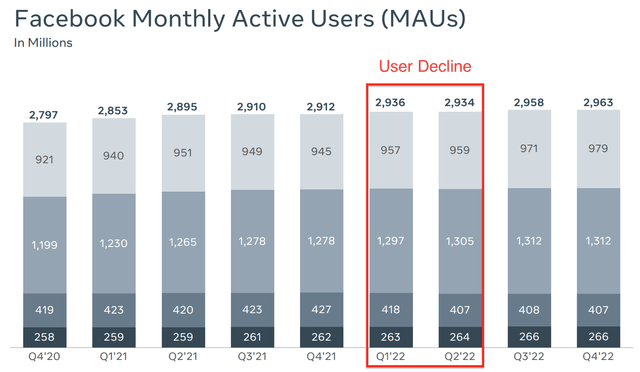

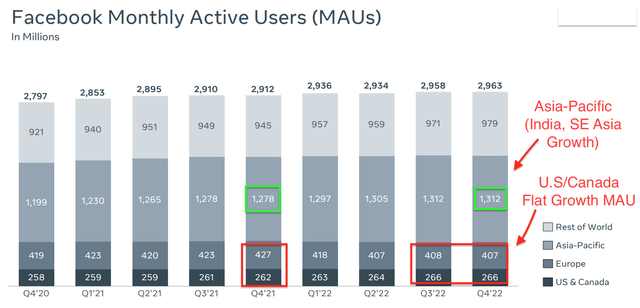

Meta’s core platform “Facebook” has many issues both tangible and intangible. Firstly, its Monthly Active Users (MAUs) declined from 2.936 billion in Q1,22 to 2.934 billion by Q2,22. This may seem like a small amount, but in my mind, this is the first signal of a declining platform. Interestingly enough Meta’s name change was during this period. At the time, I compared this to a restaurant changing its name after a food poisoning report… it’s never usually a good sign.

Facebook MAU (Meta Q4,22 report)

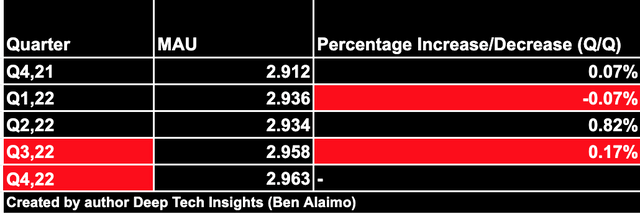

Meta recognized this as an issue, and enacted a series of changes, which credit to them caused a rebound in monthly active users, from -0.07% q/q growth in Q2,22 to a solid 0.82% growth rate by Q3,22 to 2.958 billion MAUs (ignore the offset on the table). However, this celebration was short lived between Q3,22 and Q4,22, and the sequential growth rate slowed down again to a snail’s pace at just 0.17%.

Slowing Growth Rate Facebook (created by author Ben at Deep Tech Insights)

As someone who works in the digital marketing industry (agency director), I’m aware that applications such as Facebook and other apps can effectively be “gamed” to increase user re-engagement. Now there’s nothing nefarious about this, for example, if an application wishes to reignite “dormant” users it could do a push notification, email blast or even make changes inside the platform. However, this doesn’t remove the fact that the user drop-off happened and usually that is for a reason. I believe there is a systematic shift in the social media landscape and the Facebook platform is a prehistoric relic. I will discuss more on this in the next section.

Demographic Shifts

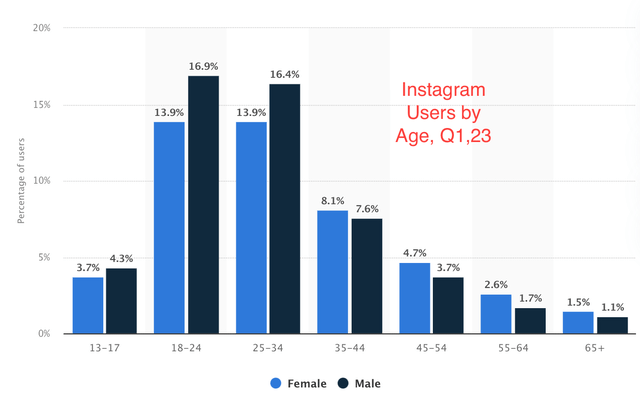

The Facebook platform was founded in 2004 on the Stanford campus and gained its initial traction as a college-based social networking tool for the younger demographic. However, close to a decade later (~2012-2014) a shift already had begun toward alternative platforms such as Instagram. Luckily Meta adopted a “fast follow” or acquire strategy and purchased Instagram for $1 billion in 2012. I believe this was the smartest acquisition Zuckerberg ever did and this effectively saved Meta Platforms. From my experience as a Digital Marketing agency director, Facebook is still popular with the “Baby Boomer” population those born between 1946 to 1964 and Generation X (born between 1965 and 1980). However, platforms such as Instagram are more favored by millennials (those born between 1981 and 1996) and the most valuable cohort Gen Z (those born between 1997 and 2012). The data backs up this experience, Statista indicates, 69.1% of Instagram’s users are between 13 and 34, with the vast majority in the 18 to 24 and 25 to 34 bracket. If I compare this Facebook the figure is closer to 56.2%, for the “younger demographic.”

Instagram Users by Age and Gender (Statista data)

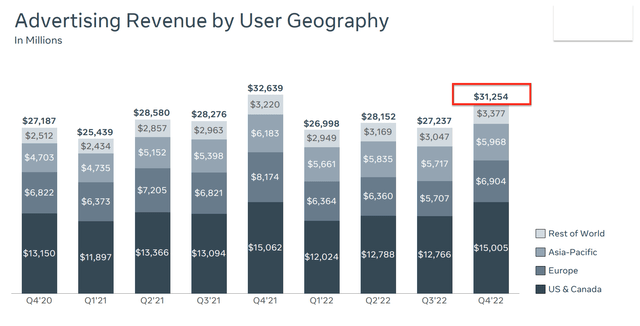

Also keep in mind these are global figures and it doesn’t take into account cultural and localization differences in places such as India. My experience is more relevant to the western demographic and thus I believe this “younger demographic” figure for Instagram would actually be much higher in the west at ~70% to 80% for Instagram and less than 40% for Facebook. This is important because western “users” in well-developed nations such as the U.S, Canada, U.K and Europe, are generally the most highly valued by advertisers. This is not based on the “people” but just income levels, etc. For example, the average salary in India is reported to be just $428 per month (INR 31,900). Whereas the average U.S salary is closer to $4,585 USD in Jan 2023, or a ~10x difference. Therefore advertisers love to target those in the U.S and developed nations with more products etc. Given Meta generates 97% of its revenue or $31.25 billion from advertising these trends are vital to take note of. It also should be noted that its overall advertising revenue has declined by 4.32% year over year, although this has mainly been derived from the cyclical pull back in the advertising market.

Meta Advertising Revenue (Q4,22 report)

Cycling back to the user demographics for the “Facebook” platform only, I found some interesting patterns. Firstly, U.S/Canada MAU growth has been flat between Q3,22 and Q4,22 at 266 million, despite a measly increase of 1.5% year over year. This is not great for what I established as the “most valuable” cohort based on advertising rates, income levels etc. Next we move to Europe, which also is a valuable cohort and reported a substantial 4.7% decline in MAUs to 407 million from the 427 million in Q4,21. That’s 20 million people which stopped visiting Facebook at least once a month.

The growth of Meta has been driven primarily by the Asia Pacific with a 2.66% increase year over year to 1.312 billion MAUs. Keep in mind Facebook doesn’t operate in China, and thus I expect the majority of this growth to be from India and Southeast Asian countries (Thailand, Philippines etc). As someone who traveled around SE Asia and have many friends there, I was surprised to see the popularity of the Facebook platform. But again, these are not countries that have the best advertising rates due to income levels. For example, the average salary in Thailand is ~$450 per month, although these countries are getting more expensive (due to foreign tourists etc), thus I do expect this to rise in long term.

Facebook MAU’s by Region (Author annotations, Meta data)

Next, you may say, Ben, aren’t you forgetting Japan? The fourth-largest economy in the world by GDP, which also would fall under Asia Pacific. Yes this is correct, however, according to one study by a digital agency, Twitter is the most popular social media platform in the country and Facebook is used mostly for business networking like LinkedIn. There also are only ~26 million MAUs on Facebook in Japan and a platform called LINE messages is used more than Meta’s WhatsApp. Therefore I agree there’s potential in Japan, but it doesn’t look as though Meta is dominating so far.

Competition (TikTok)

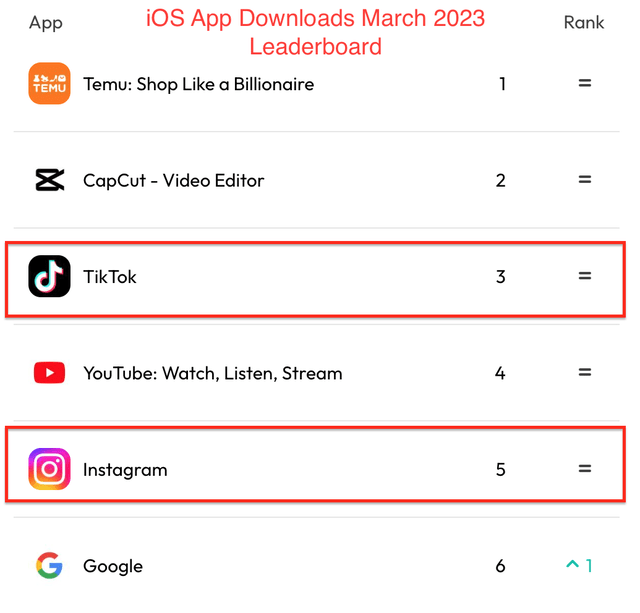

As I’ve established so far in this post, Meta platforms is facing a number of headwinds, and its legacy platform Facebook looks to be pretty stagnant. There’s also aggressive competition as platforms such as TikTok rapidly grow to over 1 billion monthly active users – MAUs. The majority of TikTok’s users are estimated to be the younger demographic which is highly valued by advertisers due to their adoption of new trends and more eagerness to try new products/services etc. For instance, it’s estimated that 67% of 18 to 19 years use TikTok, and 56% of 20- to 29-year-olds use the platform in the U.S. The platform also was ranked third in the U.S. by App downloads (iOS) for March 2023 and it was number one for the full year of 2022. You will notice number one on the list is an app called, Temu, which I covered in my previous post on Pinduoduo (PDD). This is an e-commerce player and not social media related.

iOS App Downloads (App Annie author annotations)

You will notice Instagram was number 5 on the list of app downloads and is thus still a major player in the industry. Whereas the Facebook platform didn’t even make the top 10 app downloads…Snapchat (SNAP) was number 10.

Therefore I believe Instagram is the crown jewel of Meta and has the potential to keep its lead above TikTok if it can continually innovate rapidly. There already have been signs of this after Instagram launched its popular “Reel” format, in order to compete with TikTok short-form videos. In addition, Meta has taken inspiration from Twitter and launched a paid-for blue tick service for $14.99 per month. Although this service is available on both Facebook and Instagram, it’s pretty clear that Instagram is where adoption is likely to be seen.

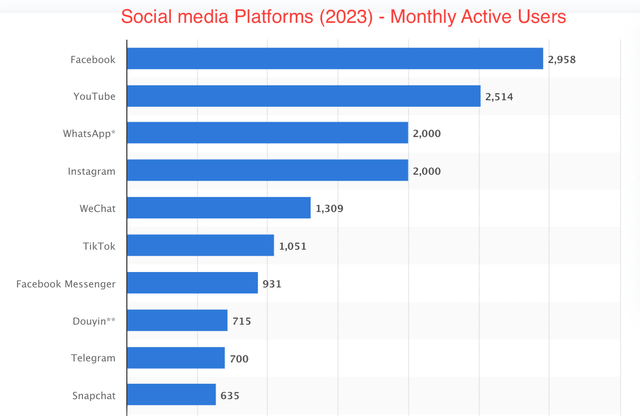

This is because Instagram is the home to “influencers” with millions of followers and the blue tick is already seen as a badge of recognition. This is especially vital given scammers can often make duplicate accounts to try and scam users. The social hierarchy is just not the same on the Facebook platform as the general connection type is via a “friend request” which creates a mutual connection, as opposed to an aspirational (follow/unfollow). Therefore I believe Instagram will benefit from this initiative more than Facebook and thus this should help to diversify its revenue. For completeness, I have added a chart with the social media platforms by global monthly active users (MAUs) as of January 2023. Facebook is still the most popular platform in the world by MAUs, but as I’ve discussed in this post the trends are not as positive as they once were.

Social Media Platforms (Statista data, Jan 23, author annotations)

What would Meta look like if it split?

From the post so far, I hope you can see how I have touted the positives of Instagram as the “crown jewel” and thus I believe a spin-off would benefit shareholders. Now of course, I don’t believe the core Facebook platform is completely terrible and Meta has made strides in adding features such as Facebook Shops, Marketplace, and even Reels. However, I believe a split could enable each platform to set its own strategy, make faster decisions and get better results. Both Facebook and Instagram are at different stages with different goals. I believe the core Facebook platform is going through a period of stagnation and thus either requires reinvention or maintaining with its current demographic. Whereas Instagram is more in the “scale up” phase and must rapidly innovate to stay ahead of its competitors such as TikTok.

Meta also has products such as WhatsApp with has ~2 billion monthly active users. I also believe this platform has major potential as it has not been extensively monetized yet. Despite being acquired in 2014, for $22 billion WhatsApp is still in the “scale-up” phase in my mind and should act as such, with rapid innovation, defining product-market fit, etc.

Then there is Meta’s Reality Labs segment, which includes the number one virtual reality platform Oculus and its various AR innovations which are under development. This segment reported revenue of $727 million in Q4,22, but produced an operating loss of ~$4.3 billion. Therefore it’s clear that this is more of an R&D segment and should be treated as an early-stage startup from a strategic point of view.

Valuation?

Now if you have read my previous posts on Amazon (AMZN) (regarding a spin-off of AWS) and Alibaba (BABA) (six-segment split), you will know I’m a fan of using a “sum of parts” valuation in order to quantify the value of each segment. However, in this case, Meta doesn’t provide a breakdown of its Instagram-generated revenue which makes this modeling not possible. However, as an extremely rough estimate, I can the aggregate the users of Facebook at 2.9 billion MAUs and Instagram at ~2 billion MAUs and split the revenue in equivalent proportions. This gives a total of 4.9 billion MAUs, with 59% of users are from Facebook and 41% from Instagram. Given Meta reported revenue of $32.17 billion in Q4,22, I can say $18.98 billion (59%) of revenue is from Facebook and $13.2 billion (41%) from Instagram. Now, this does not include WhatsApp or Reality Labs which are not earning substantial revenue or generating losses. However, it’s clear to see Instagram is a substantial business and thus could have a monster IPO, raising capital easily.

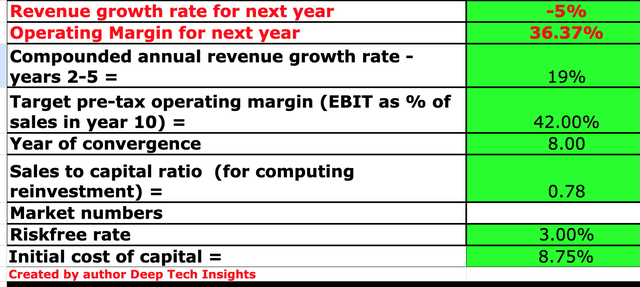

In my previous post on Meta I created a valuation model for the stock, which assumed a negative 5% growth rate for “next year” and 11% growth rate in years 2 to 5. I can assume a split business would be more agile with faster decisions, faster feature iteration, and thus this would likely improve its growth rate. My extremely rough estimate would be approximately a 9% improvement (to a total of 18%) in years 2 to 5, based on my intangible factors outlined. This may seem overly exuberant but keep in mind, Meta grew its revenue by a rapid 37% in 2021, 22% in 2020, and ~27% in 2019. Therefore this really would be a return to prior growth rates.

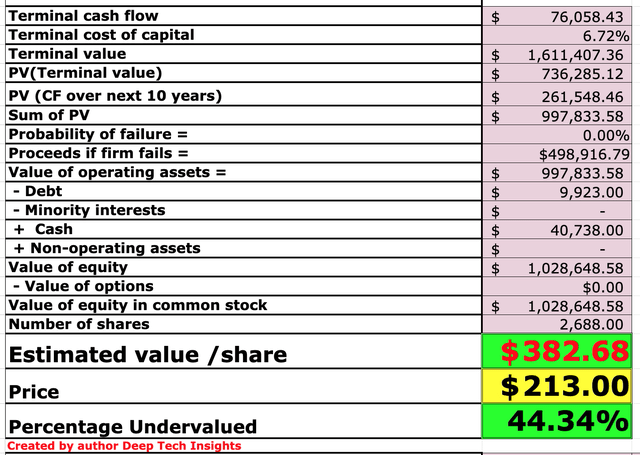

Meta stock valuation 1 with split synergies (created by author Ben at Deep Tech Insights)

I also kept my margin increase estimates the same as in my prior post, 42% in year 8, this includes R&D capitalization.

Meta stock valuation 2 (created by author Deep Tech Insights)

Given these factors I get a fair value of $383 per share, the stock is trading at ~$213 per share at the time of writing and thus it’s 44% undervalued. With my original growth estimates (without a split), I get a fair value of $279.83 per share and thus the net benefit is ~37% higher with a split, according to my estimates which is substantial.

Final Thoughts

Meta Platforms is still the most dominant social media company in the world and is in a strong position. However, advertising headwinds have highlighted its focused business model and user growth trends indicate stagnation in its core Facebook platform. I believe if Meta spun off Instagram it would have a net benefit on shareholders overall due to improved agility, innovation, and accountability. Either way, my valuation model and forecasts indicate the stock is undervalued if it keeps the same structure or decides to split.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.