Summary:

- Mastercard maintains one of the best business models in the market.

- The company lags V in size and margins, but has grown faster recently.

- The stock is fairly valued today, and management continues to make the right moves to keep the company relevant. It’s a buy.

jbk_photography

There are few businesses that are as attractive as Mastercard (NYSE:MA) has been over the long run. The company boasts incredible scalability on a relatively fixed expense framework due to its asset-light business model and an effective oligopoly with a robust global payments network.

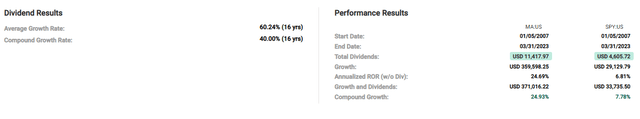

This has delivered outsized returns to shareholders. An investment in 2007 in MA would have compounded away at around 25% compared to the less than 8% in the SPY.

Based on the company’s strong positioning as a tollbooth of overall international economic activity, strong margins and shareholder-friendly management, I believe MA is set to continue compounding away at market-beating returns.

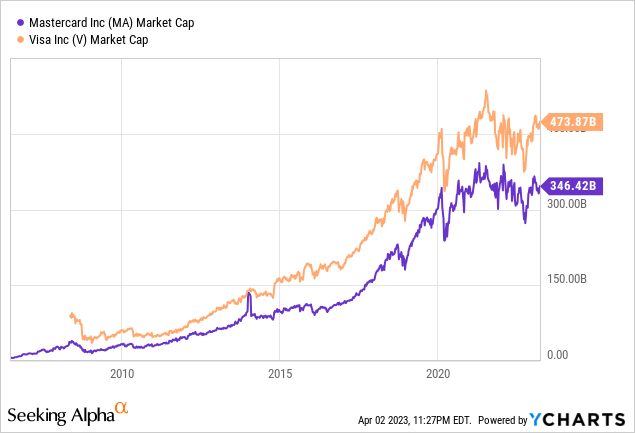

In comparing MA and Visa (V), both have significantly scaled their market capitalizations in the past 15 years or so. MA remains slightly smaller than V, and that gap has maintained pretty consistent over time.

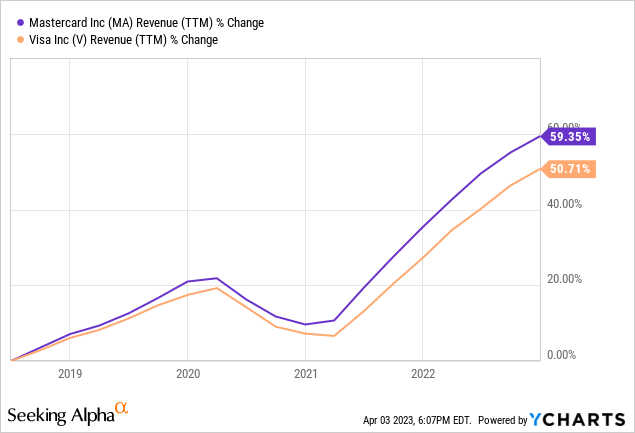

Revenue growth for both has been tremendous. Although management of both companies has made intelligent decisions to propel the companies forward, both are riding a massive macro tailwind favoring digital payments. Like the old Buffett quote, the best investments are those where management is barely needed for the company to continue winning. However, there is a clear deviation between MA and V on the long-term revenue trajectory.

However, looking at the more recent past, MA has actually grown revenues somewhat more quickly than V. The company shares similar scale internationally, but generally lags V in almost every market. With MA growing somewhat faster and from a slightly smaller market cap, there’s a chance for a touch of outperformance from here compared to V in my view.

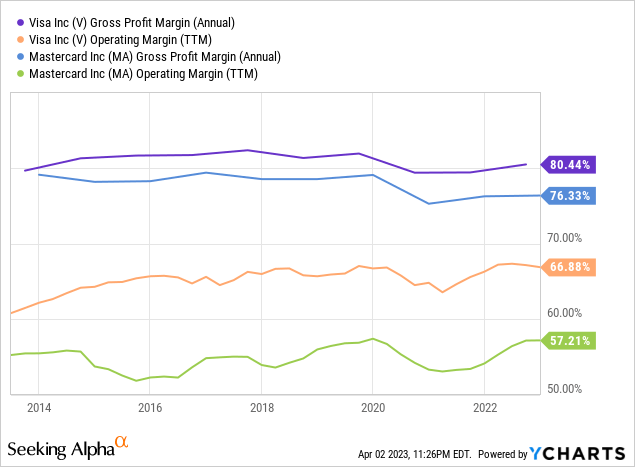

Looking at the margin picture, the operating margin gap is stark, and V maintains slightly higher gross margins as well. As I discussed above, both of these companies are able to scale business with relatively little operating expense growth. Given the firms’ massive scale, more of each incremental dollar in revenue can go straight to the bottom line. Since V is larger and drives more revenue, it makes sense margins are somewhat better. Additionally, MA continues to focus on winning new customers and digital innovation.

Some examples from the most recent quarter paint the picture of a company continuing to push new payment ideas to maintain market leadership. The company launched Mastercard Installments with SoFi (SOFI) as the first banking partner to onboard. The company processed 2B tokenized transactions, up 38%, and launched Consumer Clarity which signed on over 50 financial institutions. This allows cardholders the ability to see merchant details with card transactions to minimize disputes. Additionally, the company continues to build out open banking capabilities with notable partners including JPMorgan Chase (JPM) where customers can pay bills directly from bank accounts. Some discussion on this from the call:

This is focused on existing ACH payments, which are not bringing the value to the biller or the consumer that they are looking for. Frankly, though, very specifically, what we’re doing here, the issue with some of these account-to-account payments is you never really know what balance is on the account. And our open banking capabilities are really providing a payment success factor here that tells the biller this is a good time to debit this particular account, so true value brought that somebody is willing to pay for, in this case, the biller/the merchant. So, a good example of where there can be value created an alternative payment tools while this doesn’t take away from the power the cards are bringing to consumers and merchants.

The key takeaway here for me is MA continues to innovate to maintain their massive lead over the field in payment infrastructure internationally. Risks still remain in certain geographies of local state-sponsored payment networks and other disruptive digital innovation. However, with neither MA or V asleep at the wheel, I assess it doesn’t take much investment to ward off competition and maintain significant value creation for shareholders.

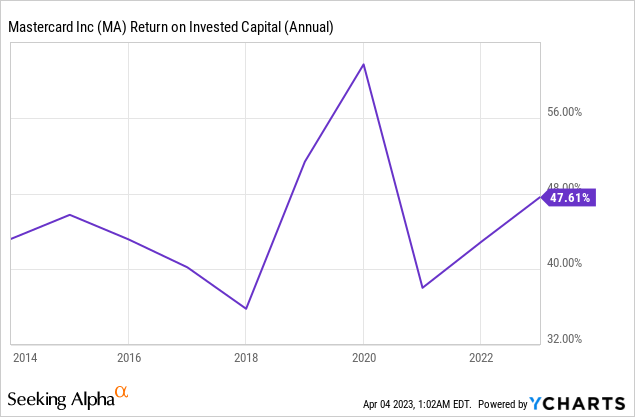

With that, returns on invested capital prove out the compelling business model. Incremental returns on each invested dollar drive significant shareholder value creation, well above the weighted average cost of capital.

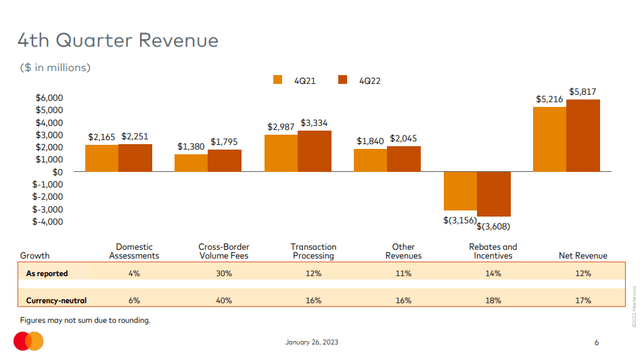

Looking at recent results, revenues were up 17% and EPS grew 19% YOY. Cross-border transaction flows were back above 2019 levels outside of some pockets of SE Asia. China was back to 20% of inbound transactions and 50% of outbound, which should continue to recover into this year. Operating expenses grew 13%, below revenue growth, and management repurchased $2.4B in stock. Overall, payment volumes look healthy despite a murky economic backdrop, and investors should look to recovery in economic conditions as a strong tailwind for MA and V.

Management projects for the high end of low double digit revenue growth with a 1.5% impact from Russia which should roll off this quarter, and operating expense growth of high single digit growth in 2023. This seems easily achievable.

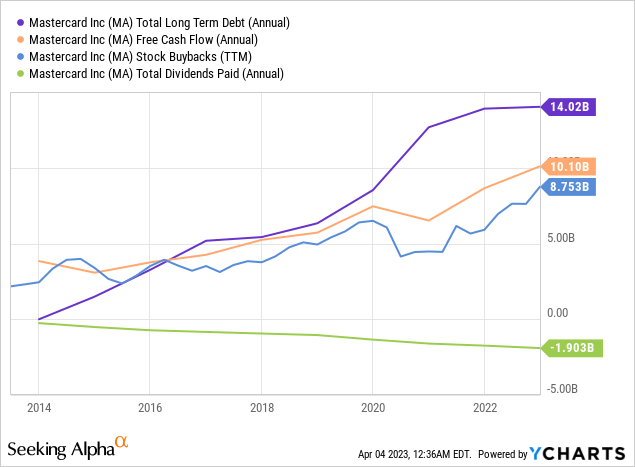

MA has grown the dividend for 11 consecutive years, and both MA and V are among the best dividend growth stocks in the market in my view. Free cash flow generation remains robust, at $10B last year, easily covering the dividend. Dividend growth rates average 35.7% over the past 10 years and most recently 11%, according to DRIP Investing.

Looking at shareholder capital returns, stock buybacks and the dividend have accounted for nearly all of free cash flow over the past decade. Based on some leveraging in long-term debt growth, I’d anticipate at some point a pullback in buybacks. However, for now, the balance sheet remains in a good spot and I don’t foresee any issues with the company continuing to maintain strong free cash flow generation.

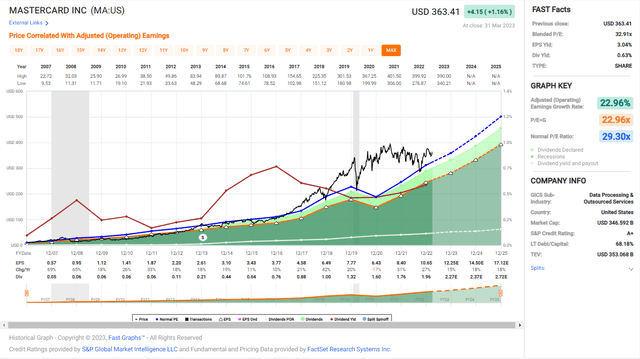

Earnings growth has been a model for consistency, with a notable dip from the pandemic. The company has compounded earnings at 23% per year since 2006, and maintains a considerable premium to the market averages.

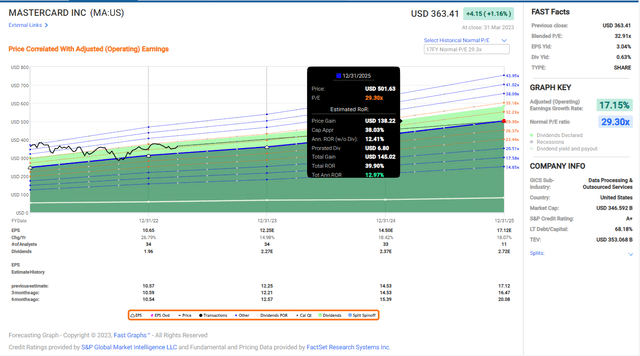

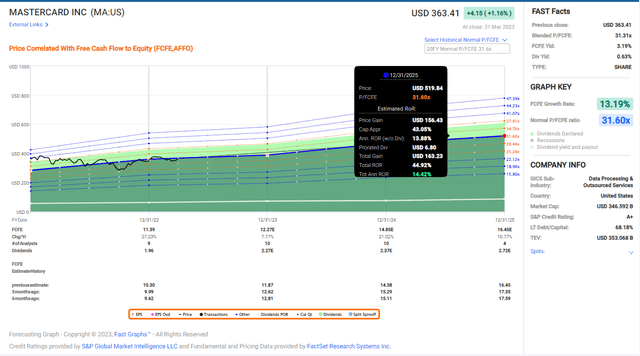

Based on a return to the long-term average multiple around 29X earnings and analyst estimates for earnings growth, an investment today could yield around 13% annualized total returns. I think the valuation premium to the SPY is justified considering the durability of the business model and long-term growth history.

Based on free cash flow growth projections and a ~30X FCF multiple, an investment today could yield around 14.4% annualized.

I am continually impressed by both MA and V’s business model. The companies likely deserve a place in any long-term growth portfolio, and I think both companies are making the right moves to continue compounding away at above-market returns. I don’t see a significantly compelling case to buy one over the other, though V does maintain higher margins and overall market leadership. I don’t think there are really any true set it and forget it stocks, but these both come close and are among an elite group I’d be willing to put in the coffee can. I think Mastercard is fairly valued today, and is a buy with a long-term time horizon.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of V, MA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.