Summary:

- Acuity Brands’ stock has corrected after mixed Q2 2023 results.

- The near-term revenue outlook is mixed, but the company should do well in the long term.

- Valuation is below historical average.

Kameleon007

Acuity Brands (NYSE:AYI) recently reported mixed results, with revenue of $943.6 million missing the consensus estimates by $14.86 million while adjusted diluted EPS of $3.06 (up 19% Y/Y) beating the estimate by 33 cents. Management maintained its annual net sales guidance range of between $4.1 billion and $4.3 billion and adjusted diluted EPS guidance of between $13.00 and $14.50. The stock corrected after the report as investors are worried about the near-term slowdown in sales. While I understand investor concerns, the company’s medium to long-term prospects are good, with it benefiting from the demand from Infrastructure Investment and Jobs Act (IIJA) related projects next year and the company’s product vitality focus driving above-market growth in the long term. The valuation has also corrected with the recent drop in the stock price, and AYI stock is trading at a meaningful discount to its historical levels. Hence, I believe the recent correction is a good buying opportunity for the stock.

Revenue Analysis and Outlook

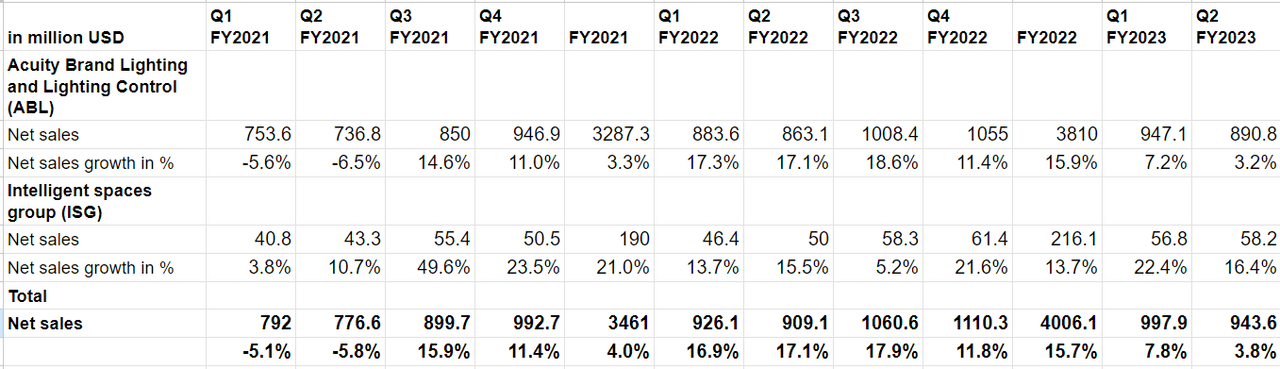

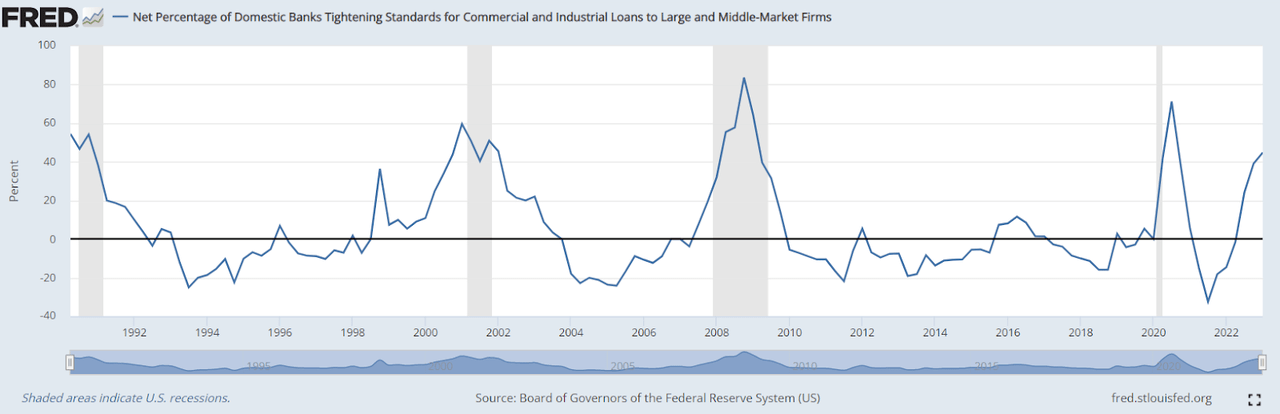

AYI posted 3.8% Y/Y revenue growth in the quarter, with the Acuity Brands’ lighting and lighting control (ABL) segment posting 3.2% Y/Y growth, while the Intelligent Space Group (ISG) segment posting 16.4% Y/Y growth. While both segments posted a year-over-year increase in revenue, the company’s total net sales growth was lower than the ~7.8% Y/Y growth that the company saw in Q1 2023. There are a couple of factors that impacted the company’s growth rate. First, as the supply chain constraints are easing, the lead times are normalizing. So, the excess inventory, which distributors/retailers as well as end customers were ordering earlier than usual to minimize the impact of disruption/uncertainty, is no longer needed, and inventory levels are correcting. Second, with the broader economy weakening and interest rates increasing significantly in a short time, banks are tightening standards for commercial and industrial (C&I) loans, which is negatively impacting project-related demand.

AYI Revenue Growth (Company Data, GS Analytics Research)

Looking forward, the near-term outlook is mixed. The project-related demand from the C&I end market is expected to continue slowing as banks continue to tighten lending standards, but a higher-than-usual project backlog is expected to provide some support. The company’s “Contractor Select” portfolio, which is primarily targeted at distributors and retailers, has continued to do well thanks to product vitality initiatives and the launching of innovative products. However, there is some risk of inventory destocking for it as well in the near term.

Net Percentage of Domestic Banks Tightening Lending Standards for C&I Loans to Large and Middle Markets (FRED)

Overall, I am expecting flattish Y/Y revenue in the back half of the fiscal year. But the Y/Y growth for the full fiscal year 2023 should still be up low single digits thanks to the good growth in the first half of the year.

In the medium to long term, the funding from IIJA should help the demand as infrastructure projects start ramping up. The U.S. Infrastructure Investments and Jobs Act envisage ~$1.2 trillion in funding for infrastructure projects over the next couple of years, and as mentioned in my previous article, AYI is working with its direct sales force to better position its Holophane brand to take advantage of this upcoming infrastructure spend.

The company’s product vitality initiatives should also help. AYI’s “Contractor Select” portfolio has grown at a higher pace than end markets in recent years thanks to its product innovation and differentiation. Talking about the success of the company’s product innovation on its recent earnings call, management commented:

We compete every day on everyday products with our Contractor select portfolio. We think that’s working. Obviously, It’s growing in the face of a couple of things. One is Asian imports — census data suggests that Asian imports are down over 30%. Obviously, we’re growing. And our portfolio is a portion of those numbers. So it’s obviously differentiating. So that relationship is working. We’re delivering higher value at the same — kind of a competitive price for both the customers and margin for us.”

I expect product innovation and differentiation should be a good driver for AYI’s outperformance in the future as well. So, my medium to long-term outlook on the company’s revenue is still positive, and I am willing to bear some near-term pain for long-term gains.

Margin Analysis and Outlook

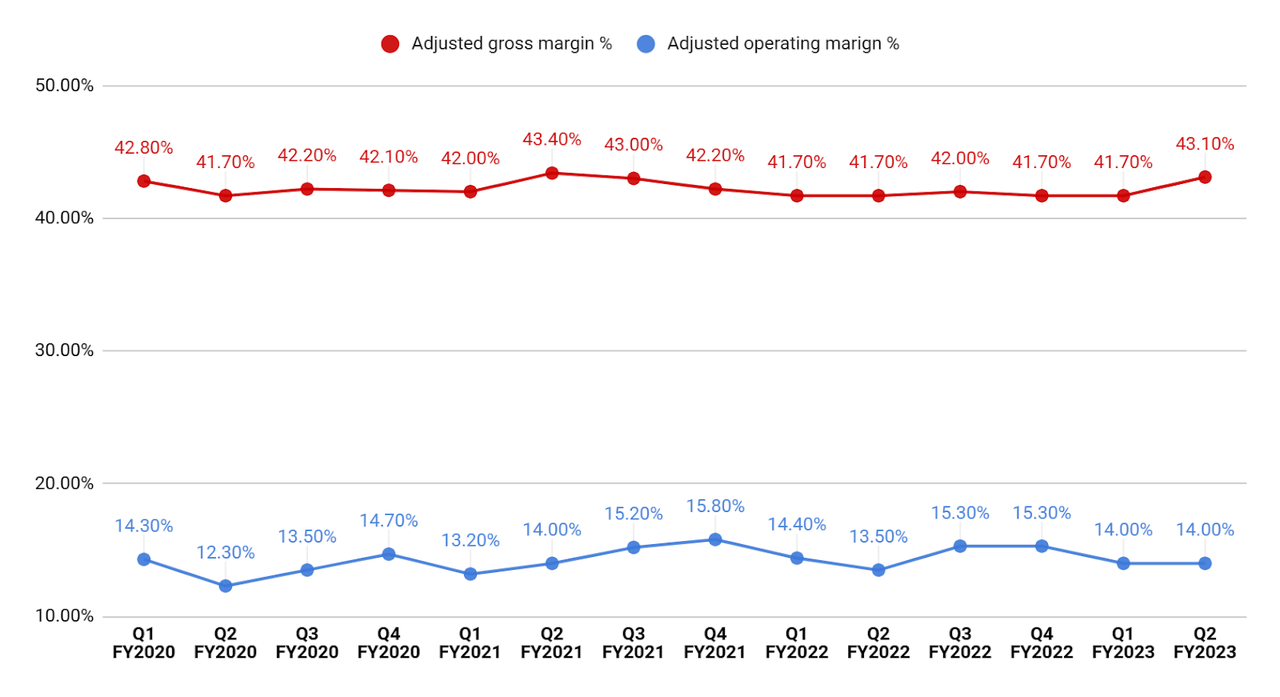

The company’s operating margins usually decrease sequentially from Q1 to Q2 and then increase in Q3 and Q4. The reason behind this pattern is seasonality in revenues, which are lowest in the company’s second quarter due to lower construction work in the winter season. However, for Q2 FY2023, the adjusted operating margin was flat versus the first quarter. The company’s adjusted gross margin expanded 140 bps sequentially as well as year-over-year as AYI increased prices while input cost inflation eased. This helped the company offset the impact of sequential volume decrease versus the first quarter. The company’s adjusted operating margins were also up 50 bps Y/Y versus a 40 bps Y/Y decline in Q1 2023.

AYI Adjusted Gross and Operating Margins (Company Data, GS Analytics Research)

As supply chain disruptions continue to ease and input cost inflation comes down, I expect margins to continue improving. In the long term, the company’s product vitality initiatives should also help AYI charge a premium for its differentiated offering, helping margins. So, I am optimistic about the margin outlook, both from a near as well as longer-term perspective.

Valuation and Conclusion

AYI Stock is currently trading at a P/E of 11.66x FY23 EPS, which is a significant discount to its 5-year average forward P/E of 14.48x. While I understand that there are near-term headwinds, the stock seems to be already pricing them to a good extent, and the company’s medium to long-term prospects are attractive. The upcoming demand from IIJA funding, product vitality initiatives, and good growth prospects in the ISG segment – all bode well for the stock. Even for the near-term issues around rising interest rates, macroeconomic slowdown, and tightening lending standards, I see the light at the end of the tunnel as I expect the Federal Reserve to become less hawkish after the recent banking fiasco. While the near-term concerns may result in the stock trading sideways over the next couple of quarters, I believe it is an opportunity for medium to long-term investors with an investment horizon of a couple of years or more to buy the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is written by Ashish S.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.