Summary:

- Netflix excels at creating both content and revenue in local markets while having a direct relationship with customers.

- Many Netflix subscribers have been in place for years such that the company’s overall churn rate is lower than what we see from the competition.

- The valuation seems reasonable if management can get back to their financial objectives of double digit revenue growth and operating margin expansion.

Justin Sullivan

Introduction

My thesis is that there is significance in Netflix (NASDAQ:NFLX) making it to the other side of the lake in a world where streaming is the preferred form of home entertainment. Warner Bros. Discovery (WBD) CEO David Zaslav talked about this at the November 2022 RBC Capital Markets conference saying that when he talked to AT&T’s (T) John Stankey about a deal 2 years ago, Netflix had made it to the other side with what appeared to be a brick house and Disney (DIS) had made it with a tent. Despite the fact that growth has slowed down for Netflix, the magnitude of them being the first to the other side should not be underestimated. They have been early in terms of figuring out how to generate content and revenue in local markets without heavy reliance on distribution partners. In addition, they have streaming customers who have been in place for years such that their overall churn rate is lower than what we see from competitors who are newer to streaming.

The Numbers

I like to look at competitors who are focused on streaming entertainment as one of their highest long-term priorities. YouTube (GOOG) (GOOGL) is enormous in this space but their Google parent is more focused on search engine advertising than streaming. Prime Video (AMZN) is a substantial part of this space but Amazon is largely focused on retailing and AWS. Apple (AAPL) is centered on selling phones.

Headlines talk about subscribers when discussing the competitive landscape but this can be a facile way of looking at things. Subscriber numbers matter but I like to look at operating income and revenue first. True DTC streaming operating income is obfuscated with adjustments by some companies but revenue is more straightforward. Netflix is in an enviable position; they have more DTC streaming revenue than legacy companies who have been around for decades:

Netflix: $31,616 million

Disney: $19,558 million

Warner Bros. Discovery: $9,693 million

Paramount (PARA): $4,904 million

Unlike the companies above, Netflix is known for having a direct relationship with customers in international markets. In 2022, Netflix received 31% of their streaming revenue from the Europe, Middle East, and Africa (“EMEA”) market [$9,745 million/$31,470 million], 13% from Latin America (“LATAM”) [$4,070 million/$31,470 million] and 11% from Asia-Pacific (“APAC”) [$3,570 million/$31,470 million]. This is in stark contrast from WBD where we can extrapolate from the 4Q22 release that only about 21% of their streaming revenue for the quarter came from international markets [(41.5 million*$3.71*3)/(96.1 million*$7.58*3)].

I believe much of the potential for Netflix is in the APAC market where they only have 38 million subs relative to 42 million in LATAM, 74 million in the United States and Canada (“UCAN”) and 77 million in EMEA. Headlines talk about the potential in India where the ARPU is dramatically lower than UCAN but I think there is ample opportunity in Japan and Korea where the ARPU is only somewhat lower than UCAN. Citing Media Partners Asia, Deadline says Netflix continues to add content at a healthy rate in Japan and Korea:

According to a recent Enders Analysis report, Netflix nearly doubled its number of Japanese shows last year from 60 to 109. Meanwhile in Korea, a recent event in the nation saw Netflix unveil a 34-strong TV and film slate including six new movies, one of which, Kill Boksoon, premiered at the Berlin Film Festival.

The ARPU in Japan and Korea is lower than what we see in UCAN but the production costs are also lower such that the economics work out. It is especially powerful when a local Netflix show from APAC goes global such as Squid Game from Korea which came out in September 2021. A December 2022 xfire article reports that the second season of Netflix’s Japanese show, Alice in Borderland, brought in over 60 million hours of global views within just 4 days!

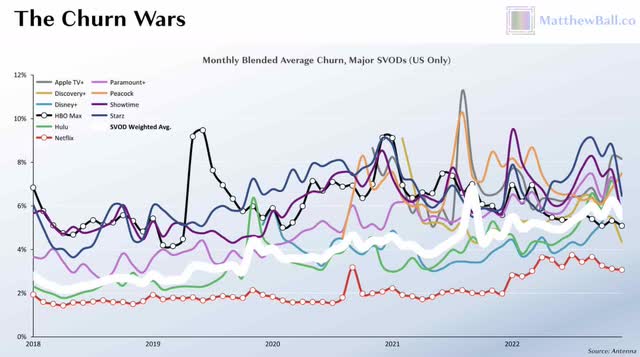

Having been in the DTC streaming business years before competitors, Netflix has loyal subscribers who have been in place for long periods of time such that the overall churn level is low. Citing Antenna, Matthew Ball shows this churn advantage from 2018 to present:

Netflix Churn Advantage (TheStreamingBook.com)

This relatively low level of churn is one of the reasons why Netflix has had positive operating income for years while others have operating losses with DTC streaming.

Per the 2022 10-K from Netflix, they had operating income of $6,195 million on revenue of $29,698 million in 2021. In 2022 they had operating income of $5,633 million on revenue on revenue of $31,616 million.

Disney’s 2022 10-K shows that the fiscal year ended October 1, 2022. In 2021, they had a DTC operating loss of $(1,679) million on revenue of $16,319 million. In fiscal 2022, the operating loss spiraled out of control to $(4,015) million on revenue of $19,558 million such that CEO Bob Iger had to come back to the company. Disney shareholders haven’t seen a dividend since fiscal 2020 and I think this will change as CEO Iger rights the ship.

The 2022 10-K from Warner Bros. Discovery shows 2021 DTC pro forma operating loss, adjusted EBITDA and revenue of $(4,213) million, $(1,865) million and $9,265 million, respectively. These numbers for 2022 were $(5,736) million, $(2,063) million and $9,693 million, respectively. Per the WBD’s 10-K, they have no present intention to pay dividends. Hopefully this will change in the years ahead once they get their debt level lower.

We see from the 2022 Paramount 10-K that they had 2021 DTC adjusted operating income excluding depreciation and amortization, stock-based compensation, costs for restructuring and other corporate matters, programming charges and net gain on dispositions (“OIBDA”) of $(992) million on revenue of $3,327 million. These figures for 2022 were $(1,819) million and $4,904 million, respectively. Paramount issues an annual dividend of a little over $600 million each year and this is one of the reasons why they are starting to rightsize their streaming content spend. 2023 will be the year of peak investment for them and then they will be more profit oriented in the DTC space in 2024 and beyond.

Valuation

At the March 2023 Morgan Stanley (MS) conference, Paramount CEO Bob Bakish continually stressed the importance of the path to profitability on the DTC side. These 4 companies will all perform better for their shareholders if they can concentrate on profit while being rational about market share like companies who sell breakfast cereals. Netflix has always been focused on free cash flow (“FCF”) per share and I think they should start issuing a small dividend. The dividend could start out as being mainly symbolic in nature – 5% of FCF or so.

Netflix’s 4Q22 letter mollifies shareholders by pointing out that the 2% year over year revenue growth would have been 10% in a neutral F/X environment. It guides for 1Q23 revenue growth to be 4% on a reported basis and 8% on a neutral F/X basis. The 2022 operating income of $5,633 million was held down by F/X issues and I believe Netflix is worth up to 30 to 35x this amount which is $170 to $195 billion when rounding to the nearest $5 billion. This range assumes management can get back to the stated financial objectives of double digit revenue growth and operating margin expansion. Per the 2022 10-K, there were 445,346,776 shares outstanding as of December 31st. This means the market cap is $152.5 billion based on the April 5th share price of $342.35. The enterprise value is $160.8 billion which is $8.3 billion above the market cap because of $14,353 million in long-term debt which is partially offset by cash and equivalents of $5,147 million and short-term investments of $911 million.

I also like to think about the market cap and enterprise value for the other companies in this space. Disney’s 1Q23 10-Q through December 31st shows 1,826,807,227 shares such that the market cap is $182.5 billion based on the April 5th share price of $99.91. The enterprise value is $235.1 billion which is $52,636 million more than the market cap due to $45,128 million in long-term debt + $3,249 million in short-term debt + $8,743 million in redeemable non-controlling interests + $3,986 million in other non-controlling interests – $8,470 million in cash and equivalents.

Per the WBD 2022 10-K, there are 2,430,029,982 shares outstanding so the market cap is $35.9 billion based on the April 5th share price of $14.79. The enterprise value is $83.1 billion which is $47,186 million more than the market cap due to $45,614 million in net debt from the 4Q22 Non-GAAP Reconciliations + $318 million in redeemable non-controlling interests + $1,254 million in other non-controlling interests.

The market cap for Paramount is $13.7 billion based on the 650,516,853 shares in the 2022 10-K from 40,704,560 A shares and 609,812,293 B shares along with the April 5th share price of $21. Their enterprise value is $30.1 billion which is $16,417 million greater than the market cap due to $15,607 million in long-term debt + $1,428 million in long-term leases + $239 million in short-term debt + $570 million in non-controlling interests + $1,458 million in retirement liabilities – $2,885 million in cash and equivalents.

In summary, the market cap and enterprise value of each of these companies is as follows:

Netflix: Mkt Cap: $152.5 billion; Enterprise Value: $160.8 billion

Disney: Mkt Cap: $182.5 billion; Enterprise Value: $235.1 billion

Warner Bros. Discovery: Mkt Cap: $35.9 billion; Enterprise Value: $83.1 billion

Paramount: Mkt Cap: $13.7 billion; Enterprise Value: $30.1 billion

20 years ago there were early signs that the internet would eventually be the main way people would enjoy home entertainment but I would have been shocked if someone said Netflix would be the leader in DTC streaming in 2023. It’s impressive that Netflix reached the top without having to rely on mergers and acquisitions. The fact that they are ahead of a combined Disney + Pixar + Marvel + Lucasfilm is remarkable.

The enterprise value for Netflix is below my valuation range and I think the stock is attractive for investors willing to hold it for at least 3 years.

Forward-looking investors should keep an eye out for the April 12th details on WBD’s combined product offering. If WBD can stay rational and remain focused on keeping streaming losses under control such that their overall FCF is high then I believe it is good for all the companies in this space including Netflix.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NFLX, AAPL, AMZN, DIS, GOOG, GOOGL, PARA, WBD, VOO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: Any material in this article should not be relied on as a formal investment recommendation. Never buy a stock without doing your own thorough research.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.